Through the pandemic, @ScotGov has been helpfully publishing data to help understand what’s going on in the economy. Data comes with caveats, but broad trends show what is going on. New data came out just before Xmas – here’s a summary of some interesting aspects…

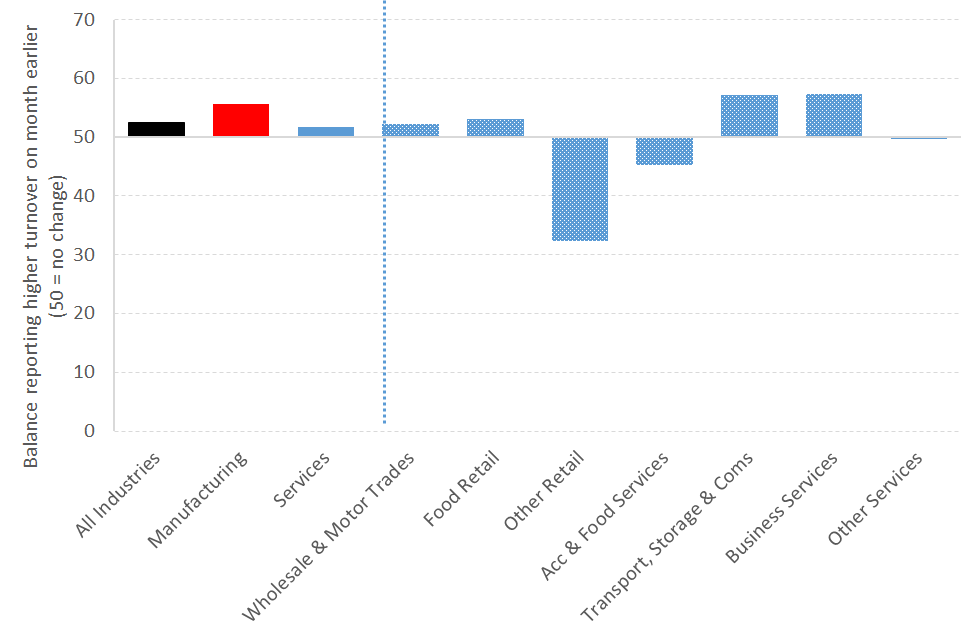

The latest monthly turnover from SG showing ‘other retail’ and ‘accommodation & food services’ (i.e. tourism and eating out etc) seeing lower turnover in Nov compared to one month ago – a sign of things to come as restrictions increased…

This comes after the worst year on record for our tourism sector. In November the economy-wide balance of turnover was 40.7 (recall 50 means no change relative to year ago). It was 48.4 for manufacturing. For accomodation & food it was 15.8….compared to 2016-19 average of 52.1.

We’ve also got monthly GDP data from @scotgov for October. Take a look at this chart! Can anyone recall ever seeing such volatility in a sectors performance?? Shows the scale of the challenge for the sector, not just in terms of cut backs but the stop-start nature of recovery.

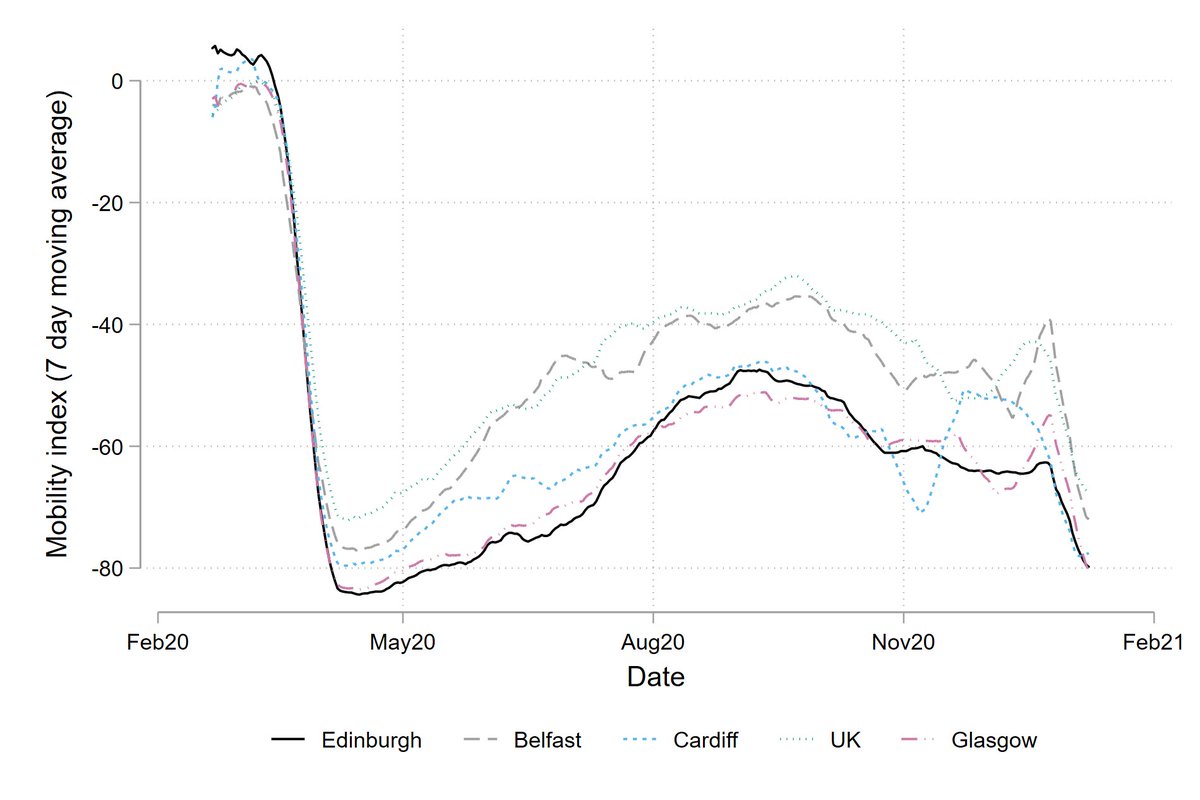

Picking up on this point, some of the mobility data coming in from Google is worth a look. Here’s the data on transit mobility – underlines reversal of increased mobility that occurred while restrictions were eased but also that people are following rules.

A very similar picture comes through when we look at mobility related to workplaces - interestingly (if not surprisingly) these series have tended to move in similar ways across these cities but the November ‘firebreak’ lockdown in Wales stands out a bit.

The latest data and surveys, including the @ScotChambers / @Strath_FAI economic indicator report out today underline how exceptionally challenging it is for businesses right now, with many struggling to survive.

But it is also clear that we need to see progress on the public health to protect the economy. Businesses have done a lot to support the fight against the virus, and if we’re to see them re-emerge from this crisis, we are going to have to do more to help them.

Read on Twitter

Read on Twitter