1/

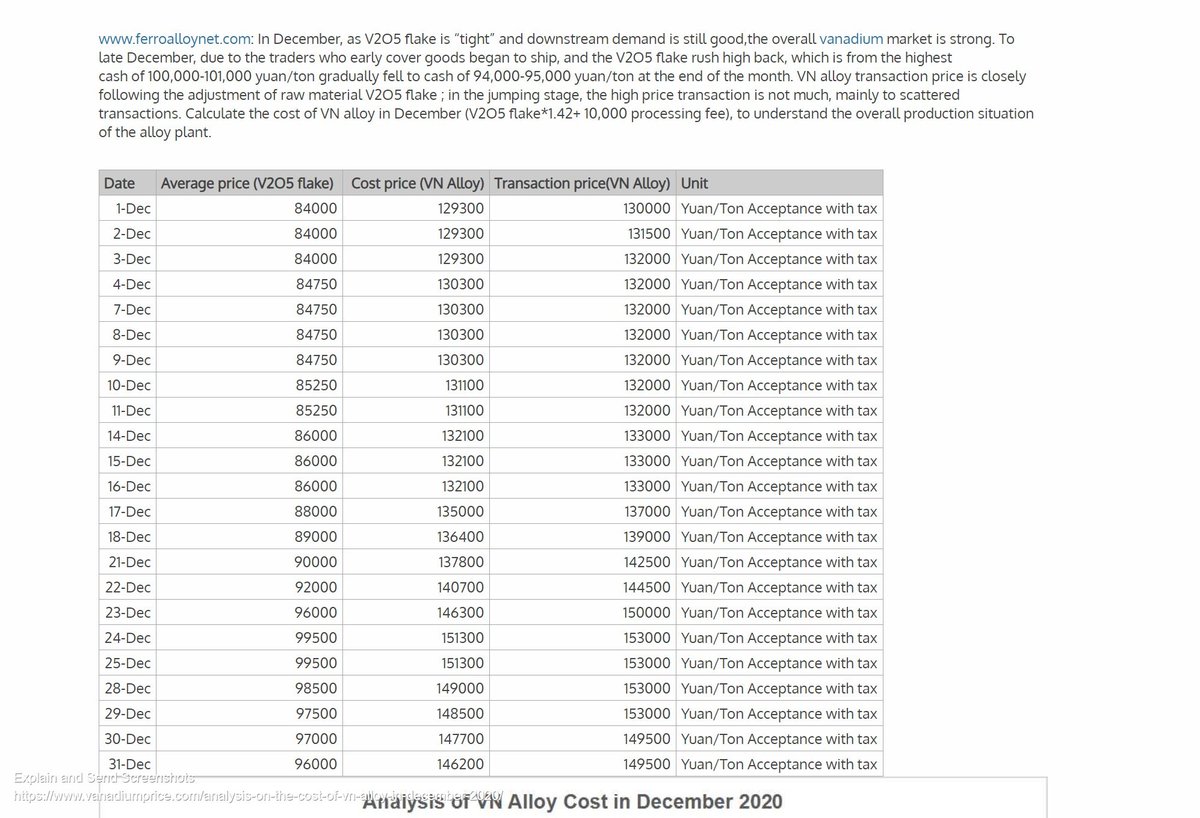

In support of my thoughts on vanadium price pressures, here's a really interesting table showing the affect that front end V205 prices, have on VN alloy downstream costs/prices.

That's why those V205 prices, of which #BMN had significantly upped its production through...

In support of my thoughts on vanadium price pressures, here's a really interesting table showing the affect that front end V205 prices, have on VN alloy downstream costs/prices.

That's why those V205 prices, of which #BMN had significantly upped its production through...

2/

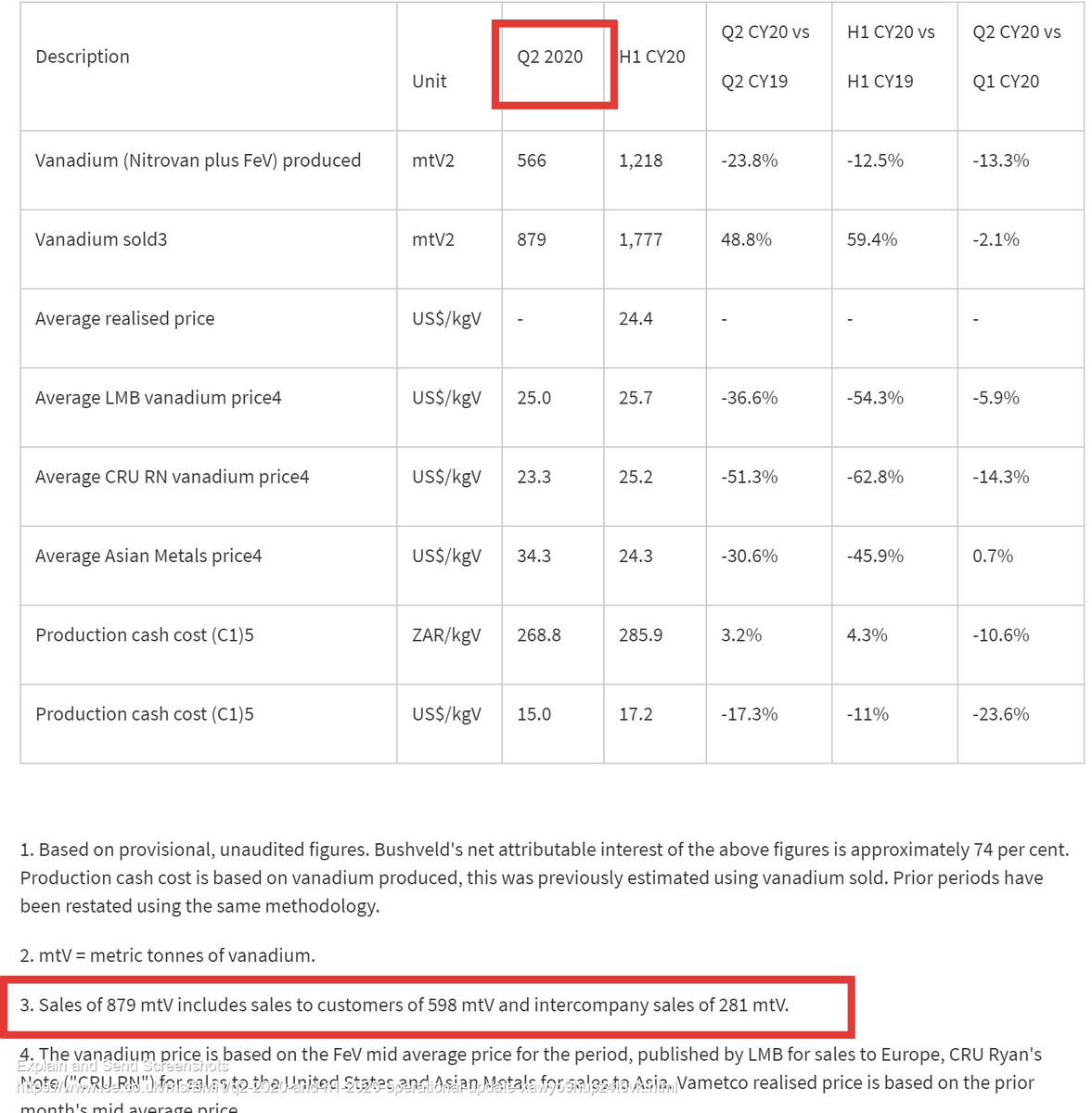

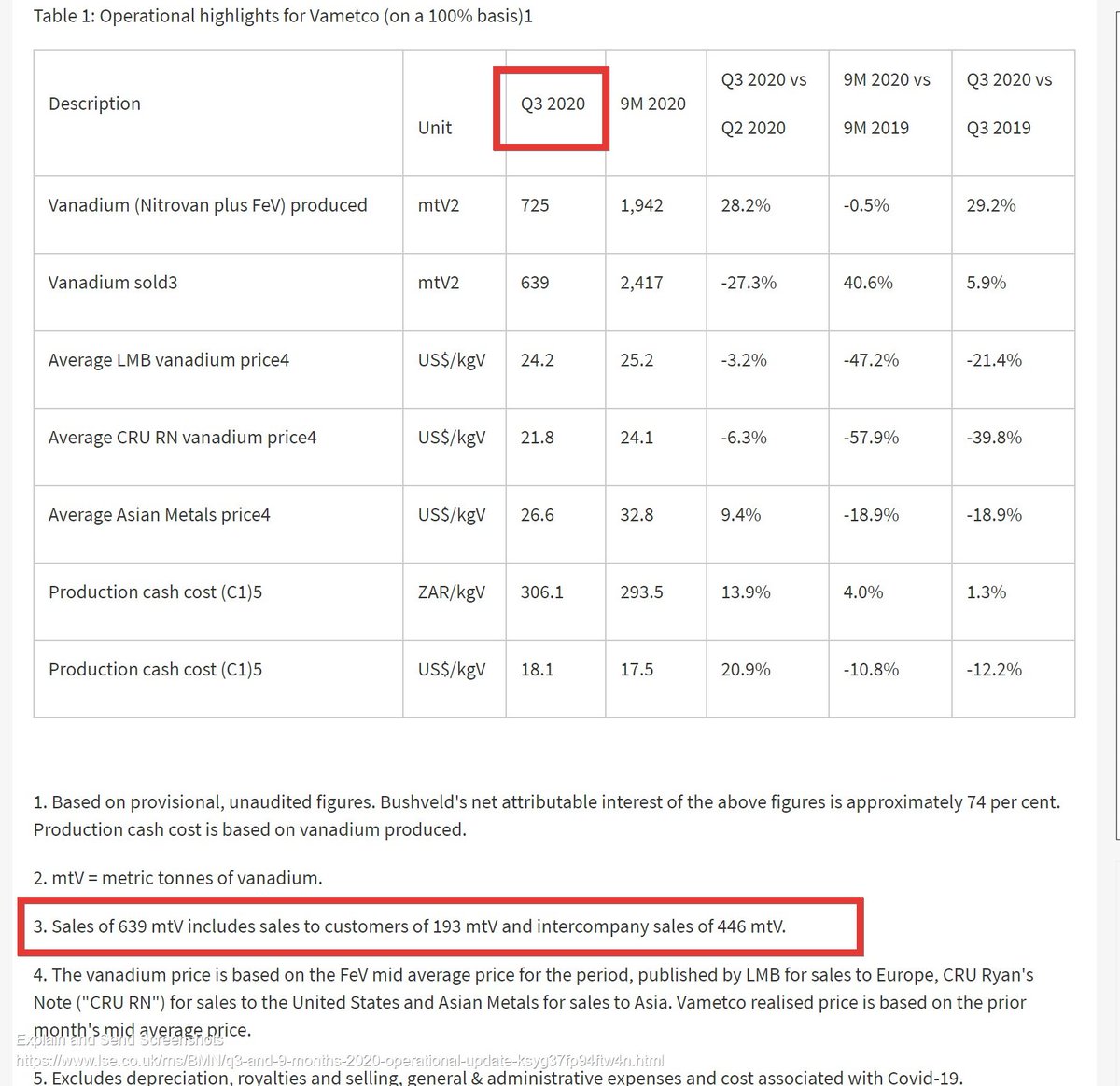

Vanchem in Q3, are so important in all of this V market analysis.

https://twitter.com/BigBiteNow/status/1335863596492976128?s=20

A trend that for me will clearly continue in Q4. Why? See below comparison between Q3 and Q4 inter company sales.

A 59% increase, which should show itself in those Q4 figs.

Vanchem in Q3, are so important in all of this V market analysis.

https://twitter.com/BigBiteNow/status/1335863596492976128?s=20

A trend that for me will clearly continue in Q4. Why? See below comparison between Q3 and Q4 inter company sales.

A 59% increase, which should show itself in those Q4 figs.

3/

As I keep repeating, ownership of Vanchem really opens up other profitable avenues for BMN as a whole, allowing product to be moved around in order to take advantage of V products that are most profitable.

That in my view is not yet fully respected in the valuation.

As I keep repeating, ownership of Vanchem really opens up other profitable avenues for BMN as a whole, allowing product to be moved around in order to take advantage of V products that are most profitable.

That in my view is not yet fully respected in the valuation.

4/

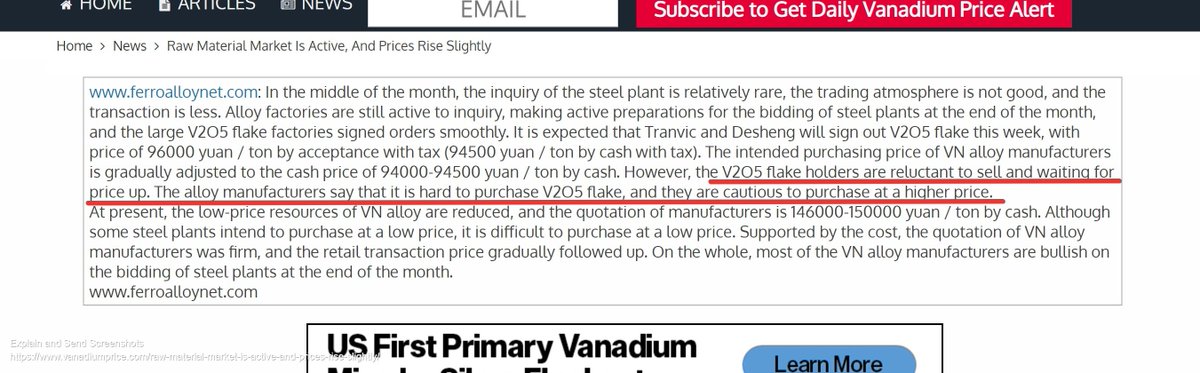

Back to the current situation. Here's the latest reported pricing from 13th Jan. There we see that VN alloy prices are still averaging 148,000 yuan, so only minimally below the Dec high of c. 153,000..

but... "VN manufacturers are bullish on the bidding of the steel plants,"

Back to the current situation. Here's the latest reported pricing from 13th Jan. There we see that VN alloy prices are still averaging 148,000 yuan, so only minimally below the Dec high of c. 153,000..

but... "VN manufacturers are bullish on the bidding of the steel plants,"

5/

which are due at the end of the month and lead directly up to China New Year, which is normally a re-stocking period anyway.

So bullish signals there alone but its coupled with those front end V205 pressures once more. Back to that report.

which are due at the end of the month and lead directly up to China New Year, which is normally a re-stocking period anyway.

So bullish signals there alone but its coupled with those front end V205 pressures once more. Back to that report.

6/

"V2O5 flake holders are reluctant to sell and waiting for price up."

This sort of message on V205 flake keeps repeating otself across these reports and BMN have a solid outlet for supplying the gap, rather than concentrating on their traditional downstream products.

"V2O5 flake holders are reluctant to sell and waiting for price up."

This sort of message on V205 flake keeps repeating otself across these reports and BMN have a solid outlet for supplying the gap, rather than concentrating on their traditional downstream products.

7/

Of course since these Dec figures, European and US prices have begun to rise, which adds a further interesting ingredient to the mix.

The more that prices reach parity the less incentive producers have to ship into China, thus placing a re-stocking Chinese market under...

Of course since these Dec figures, European and US prices have begun to rise, which adds a further interesting ingredient to the mix.

The more that prices reach parity the less incentive producers have to ship into China, thus placing a re-stocking Chinese market under...

8/

added pressure.

All of which points to a supply pinch, which I personally didn't expect quite soon into the European/US recovery.

Risks remain with Covid, particularly in China but without that headwind, any recovering market really looks short on vanadium.

added pressure.

All of which points to a supply pinch, which I personally didn't expect quite soon into the European/US recovery.

Risks remain with Covid, particularly in China but without that headwind, any recovering market really looks short on vanadium.

Read on Twitter

Read on Twitter