1. Institutional Interest

Bitcoin has gained an enormous levels of institutional interest in recent months.

Most notably, MicroStrategy adopted Bitcoin as their primary treasury reserve asset by investing $475 million into the asset.

Bitcoin has gained an enormous levels of institutional interest in recent months.

Most notably, MicroStrategy adopted Bitcoin as their primary treasury reserve asset by investing $475 million into the asset.

Additionally, MicroStrategy recently issued debt to purchase another $675 million in Bitcoin.

Square, who is led by Jack Dorsey purchased $50 million in Bitcoin, which is about 1% of their total assets.

Square, who is led by Jack Dorsey purchased $50 million in Bitcoin, which is about 1% of their total assets.

The Grayscale fund has seen enormous institutional interest in their Bitcoin fund as well. Today, their fund holds a total of roughly $20 billion in Bitcoin.

Grayscale’s ability to buy and store Bitcoin has been far outstripped by the demand for their fund.

Grayscale’s ability to buy and store Bitcoin has been far outstripped by the demand for their fund.

Big US Banks have also taken an interest in Bitcoin.

A CitiBank analyst recently projected a Bitcoin price of $318k by the end of 2021, calling it “21st century gold”.

JP Morgan projects a Bitcoin price of $146,000 as it fights to capture gold's market share.

A CitiBank analyst recently projected a Bitcoin price of $318k by the end of 2021, calling it “21st century gold”.

JP Morgan projects a Bitcoin price of $146,000 as it fights to capture gold's market share.

Guggenheim, a firm who has $270 billion in assets under management also has high expectations for Bitcoin.

They believe that Bitcoin will reach a price of $400k based on the asset’s scarcity and relative value to gold.

They believe that Bitcoin will reach a price of $400k based on the asset’s scarcity and relative value to gold.

2. Notable Investors

A number of notable investors have spoken positively about Bitcoin and own the asset.

- Alan Howard (NW of $1.6B)

- Howard Marks (NW of $2.1B)

- Paul Tudor Jones (NW of $5.3B)

- Stanley Drunkenmiller (NW of $4.6B)

A number of notable investors have spoken positively about Bitcoin and own the asset.

- Alan Howard (NW of $1.6B)

- Howard Marks (NW of $2.1B)

- Paul Tudor Jones (NW of $5.3B)

- Stanley Drunkenmiller (NW of $4.6B)

3. Regulatory Environment

Bitcoin has also seen positive advancements in the regulatory space.

Wyoming recently elected Sen. Cynthia Lummis, who is an advocate for Bitcoin.

Kentucky law makers proposed a new bill that would give tax breaks to Bitcoin miners in their state.

Bitcoin has also seen positive advancements in the regulatory space.

Wyoming recently elected Sen. Cynthia Lummis, who is an advocate for Bitcoin.

Kentucky law makers proposed a new bill that would give tax breaks to Bitcoin miners in their state.

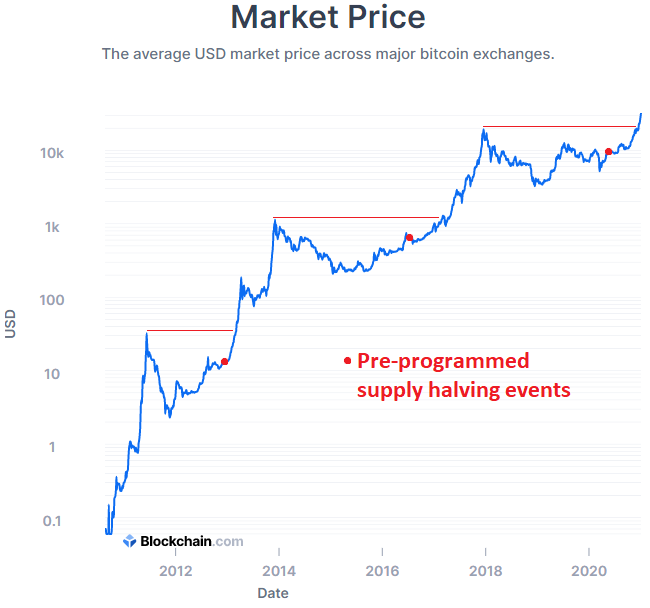

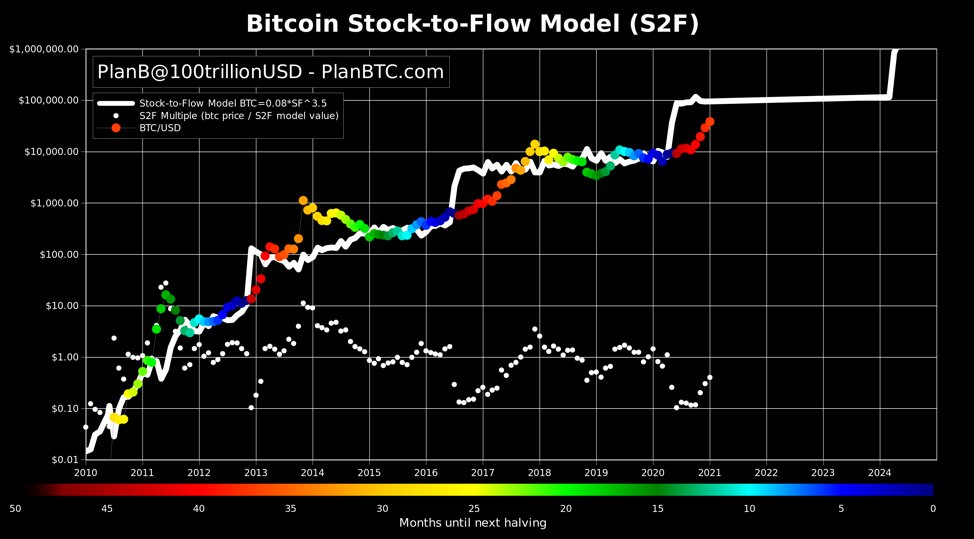

4. The Four-Year Halving Cycle

In 2020, the Bitcoin mining reward was cut in half, which greatly reduces the sell pressure on Bitcoin.

Historically, Bitcoin has performed extraordinarily well in the year following a halving cycle, which is where we are today.

In 2020, the Bitcoin mining reward was cut in half, which greatly reduces the sell pressure on Bitcoin.

Historically, Bitcoin has performed extraordinarily well in the year following a halving cycle, which is where we are today.

In 2017, Bitcoin had a return of nearly 1,200%. This was largely driven by the supply halving that occurred in the first half of 2016.

This is a BIG reason why many have high expectations 2021.

: @100trillionusd

: @100trillionusd

This is a BIG reason why many have high expectations 2021.

: @100trillionusd

: @100trillionusd

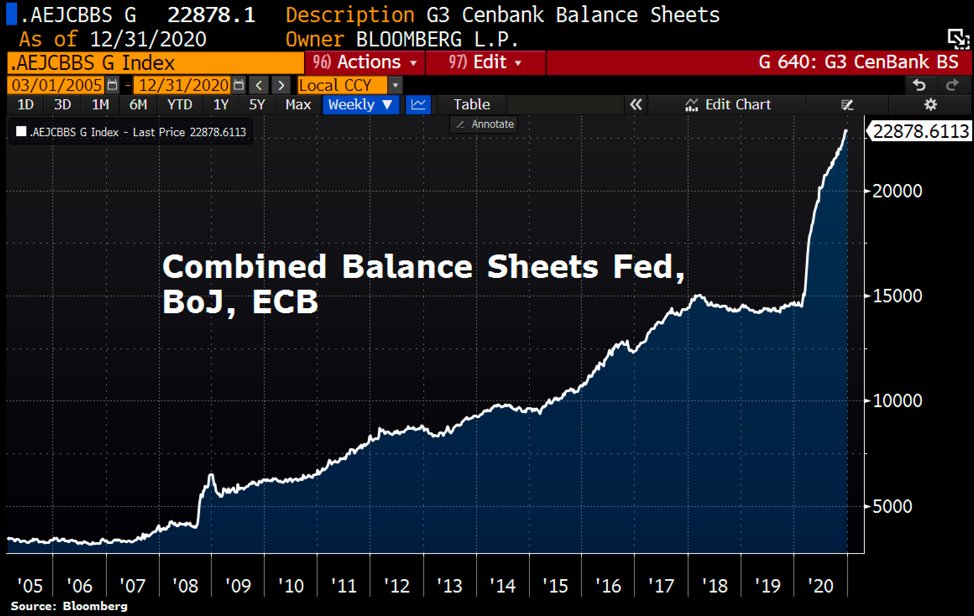

5. The Macro Environment

“There is an infinite amount of cash in the Federal Reserve.” – Pres of the Minn. Federal Reserve Bank

The coronavirus pandemic has forced central bankers to print unprecedented levels of cash to keep the economy functioning.

“There is an infinite amount of cash in the Federal Reserve.” – Pres of the Minn. Federal Reserve Bank

The coronavirus pandemic has forced central bankers to print unprecedented levels of cash to keep the economy functioning.

In a period of unlimited money printing, I believe the scarcest assets will perform the best as investors look to avoid the potential effects of inflation.

Since there will only be 21 million Bitcoin to ever exist, this makes it the scarcest of all assets.

Since there will only be 21 million Bitcoin to ever exist, this makes it the scarcest of all assets.

More stocks can be issued…

More gold can be mined…

More dollars can be printed…

But no more than 21 million Bitcoin will ever exist. Ever.

More gold can be mined…

More dollars can be printed…

But no more than 21 million Bitcoin will ever exist. Ever.

We’re still very early in #Bitcoin  .

.

If you’d like to learn more, then you need to check out the Beginner’s Guide to Bitcoin.

This guide teaches you:

- What Bitcoin is

- How to Buy it

- How to Store it

- And much more...

Start here http://gum.co/QQmry

http://gum.co/QQmry

.

. If you’d like to learn more, then you need to check out the Beginner’s Guide to Bitcoin.

This guide teaches you:

- What Bitcoin is

- How to Buy it

- How to Store it

- And much more...

Start here

http://gum.co/QQmry

http://gum.co/QQmry

Read on Twitter

Read on Twitter