NEW: Double taxation of corporate income in the U.S. and the OECD: https://buff.ly/3qjjzDU @ElkeAsen

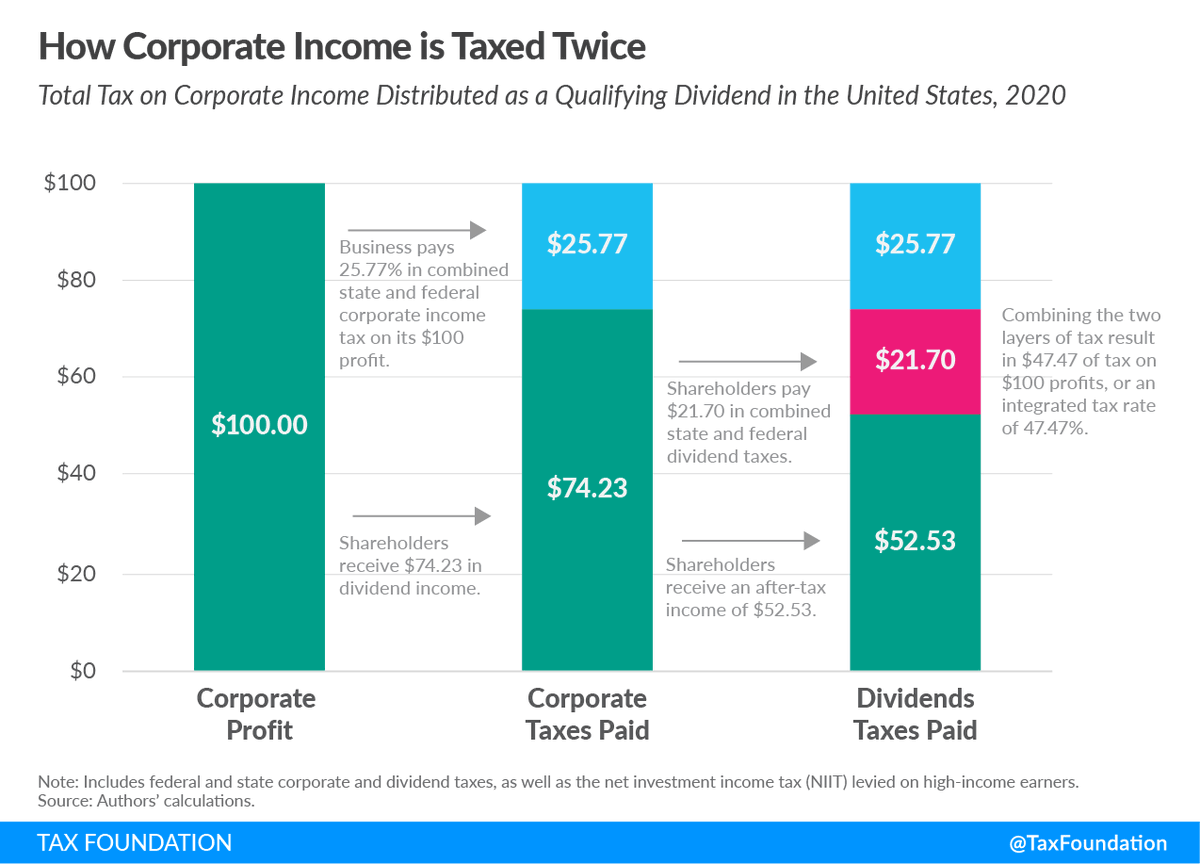

The U.S. tax code—as with many OECD countries’ tax systems—double-taxes corporate income: once at the corporate level and then again at the shareholder level.

This creates a significant tax burden on corporate income, which increases the cost of investment, encourages a shift from the traditional C corporate form, and incentivizes debt financing.

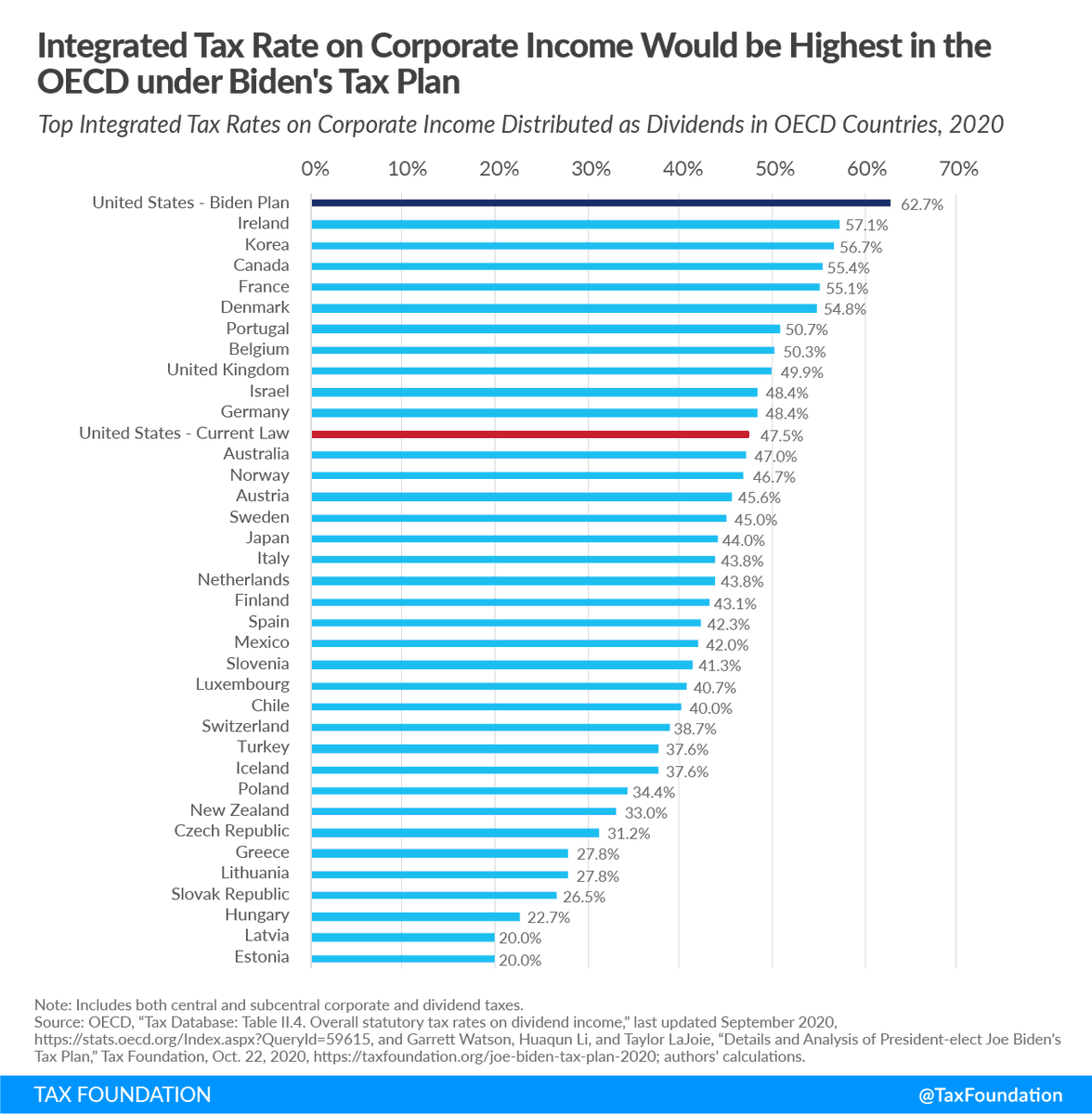

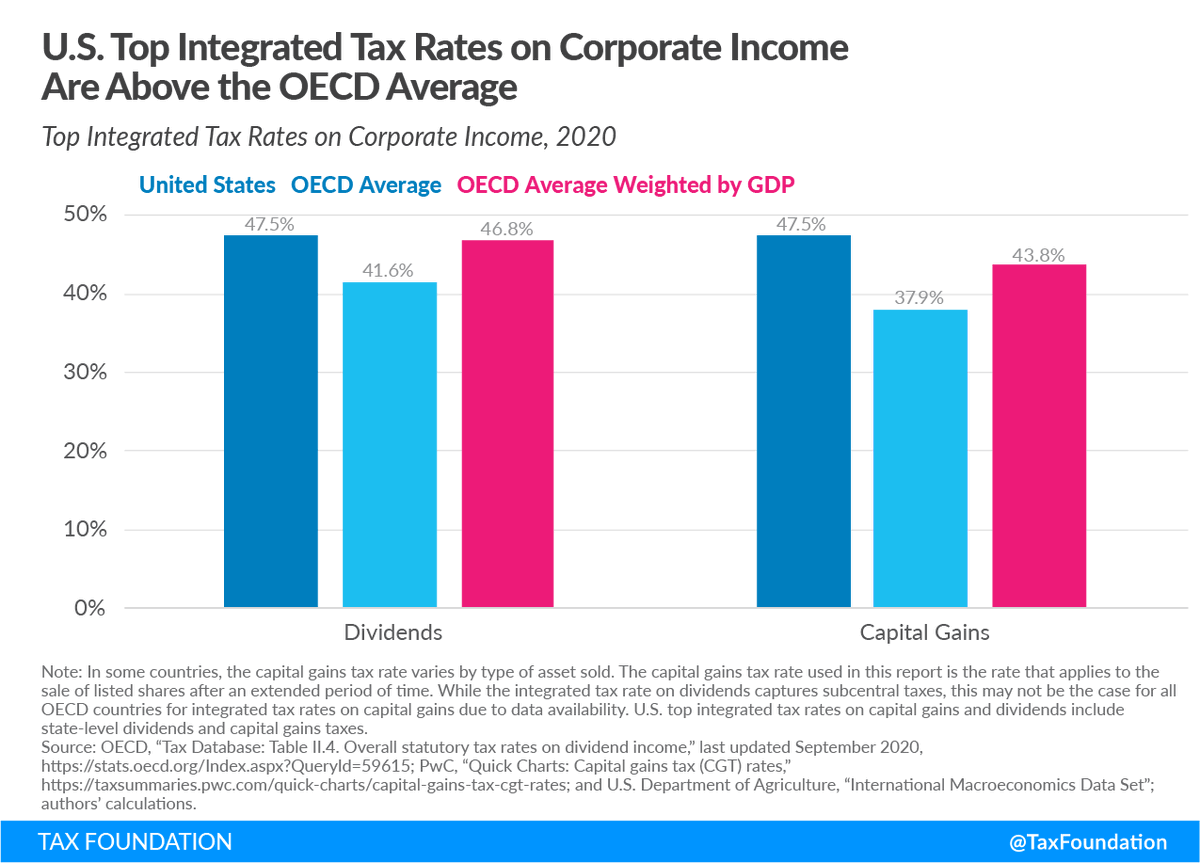

Biden’s proposal to increase the corporate income tax rate and to tax long-term capital gains and qualified dividends at ordinary income tax rates would increase the top integrated tax rate above pre-TCJA levels, making it the highest in the OECD.

Read on Twitter

Read on Twitter