Took the afternoon to understand the prescription drug market a little better.

Here are some ramblings on the value chain...

[THREAD]

Here are some ramblings on the value chain...

[THREAD]

1/ It starts with the manufacturer of the drug. These are the pharmaceutical companies like Pfizer, Abbott Labs, AbbVie, Merck, GSK, etc.

Top 5 by revenue (in billions):

Johnson & Johnson – $56.1

Pfizer – $51.8

Roche – $49.2

Novartis – $47.5

Merck & Co. – $46.8

Top 5 by revenue (in billions):

Johnson & Johnson – $56.1

Pfizer – $51.8

Roche – $49.2

Novartis – $47.5

Merck & Co. – $46.8

2/ As an aside, we're talking prescriptions which are usually chemical-based rather than organism-based. The latter are often researched by biotechs instead of pharma.

But pharma companies sometimes don't even manufacture the drugs themselves...

But pharma companies sometimes don't even manufacture the drugs themselves...

3/ They can outsource the actual development to CDMO's (contract development and manufacturing organizations)

Some bigger CDMO's are Cambrex, Pantheon & Pfizer's CentreOne.

But then you can break that down further into CROs and CMOs as CDMOs are usually full-service operations.

Some bigger CDMO's are Cambrex, Pantheon & Pfizer's CentreOne.

But then you can break that down further into CROs and CMOs as CDMOs are usually full-service operations.

4/ CROs (contract research orgs) deal with discovery services, like testing and formulating drugs.

Some notable examples: IQVIA, Charles River, Covance, PRA Health.

CMOs (contract manufacturing orgs) allow pharma co's to scale quickly.

Some notable examples: IQVIA, Charles River, Covance, PRA Health.

CMOs (contract manufacturing orgs) allow pharma co's to scale quickly.

5/ Ok, once the drug companies have an actual drug and have passed it through the FDA (don't have time to go through the approval process right now), they need to distribute and sell it.

Here's where things start to get tricky.

Here's where things start to get tricky.

6/ It might make more sense if we start with the opposite end of the spectrum, where you actually buy drugs:

Pharmacies

Some examples:

1. Walgreens: 48,986 pharmacists

2. CVS Health: 31,235 pharmacists

3. Walmart: 15,369 pharmacists

4. Rite Aid: 10,869 pharmacists

Pharmacies

Some examples:

1. Walgreens: 48,986 pharmacists

2. CVS Health: 31,235 pharmacists

3. Walmart: 15,369 pharmacists

4. Rite Aid: 10,869 pharmacists

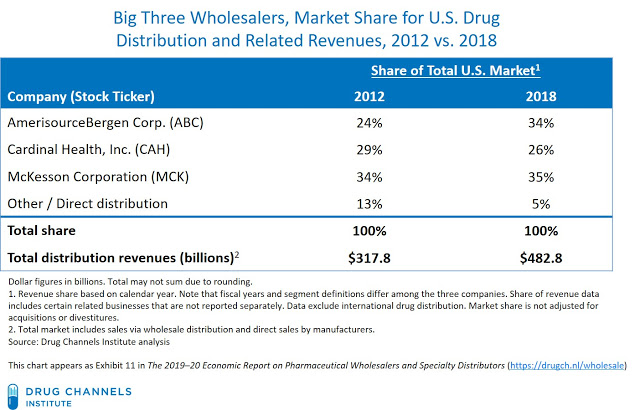

7/ These pharmacies buy drugs through wholesalers, who distribute the drugs from the manufacturers.

In fact, 3 wholesalers own 95% of the market:

- McKesson

- AmerisourceBergen

- Cardinal Health

In fact, 3 wholesalers own 95% of the market:

- McKesson

- AmerisourceBergen

- Cardinal Health

8/ And here's where it gets really tricky.

Let's start with you, the person ultimately using the drug. You buy it at the pharmacy, but do you pay for it?

Without insurance, YOU do! But with insurance, you might pay a co-pay that your insurance company outlines.

Let's start with you, the person ultimately using the drug. You buy it at the pharmacy, but do you pay for it?

Without insurance, YOU do! But with insurance, you might pay a co-pay that your insurance company outlines.

9/ But who pays your health insurance?

Oftentimes, an employer will pay the premiums as a part of your compensation package.

So when you go to the pharmacy, you don't have to pay full-price because your employer pays your insurance premiums.

Out of sight, out of mind.

Oftentimes, an employer will pay the premiums as a part of your compensation package.

So when you go to the pharmacy, you don't have to pay full-price because your employer pays your insurance premiums.

Out of sight, out of mind.

10/ Some people argue that this is one problem. Since most health insurance is covered by employers (some sources say 82%!), the incentives aren't aligned by the core user (you!).

You're not incentivized to spend less since your employer is footing the bill.

You're not incentivized to spend less since your employer is footing the bill.

11/ Ok, back to the value chain.

Let's talk about health insurance companies. I don't think I have to explain the business model but here are some of the biggest examples:

Top 5 by membership (mils)

UnitedHealthcare: 70

Anthem: 39.9

Aetna: 22.1

Cigna Health: 20.4

Humana: 16.6

Let's talk about health insurance companies. I don't think I have to explain the business model but here are some of the biggest examples:

Top 5 by membership (mils)

UnitedHealthcare: 70

Anthem: 39.9

Aetna: 22.1

Cigna Health: 20.4

Humana: 16.6

12/ In the 1960's, when health insurance companies started including prescription drugs in their plans, they started contracting with PBMs (pharmacy benefit managers) to make sure that drug manufacturers weren't screwing them over with frequent price increases.

13/ PBMs make money in a confusing way.

Essentially they play a middleman role on behalf of insurance companies in between drug manufacturers & pharmacies.

Top 5 by market share %

Caremark (CVS)/Aetna: 30

Express Scripts: 23

OptumRx (UNH): 23

Humana Solutions: 7

MedImpact: 6

Essentially they play a middleman role on behalf of insurance companies in between drug manufacturers & pharmacies.

Top 5 by market share %

Caremark (CVS)/Aetna: 30

Express Scripts: 23

OptumRx (UNH): 23

Humana Solutions: 7

MedImpact: 6

14/ PBMs are basically professional drug negotiators.

In return for preferred placement in a health plan, manufacturers will give PBMs rebates, which they can keep a piece of while sending the remaining on to the insurance company (their client).

In return for preferred placement in a health plan, manufacturers will give PBMs rebates, which they can keep a piece of while sending the remaining on to the insurance company (their client).

15/ From the manufacturer's point of view, it makes sense to give these rebates because UnitedHealth, for example, has 70 million potential members that they can reach.

Talk about distribution!

And the insurance company saves money, win-win, right?

Talk about distribution!

And the insurance company saves money, win-win, right?

16/ Before coming to conclusions, we need to talk about this from the pharmacy's point of view.

It's sort of the same thing.

Pharmacies want access to the 70 million UnitedHealth consumers.

But in return, the PBM negotiates reimbursement fees.

It's sort of the same thing.

Pharmacies want access to the 70 million UnitedHealth consumers.

But in return, the PBM negotiates reimbursement fees.

17/ Another problem is that a PBM will never reimburse a pharmacy for more than they charge.

So there is no incentive for a pharmacy to lower prices because they risk not getting the highest willingness-to-pay from consumers and losing out on extra reimbursement dollars.

So there is no incentive for a pharmacy to lower prices because they risk not getting the highest willingness-to-pay from consumers and losing out on extra reimbursement dollars.

18/ Meanwhile, the pharmacies are also negotiating with the drug manufacturers to get volume discounts and preferred treatment.

Because of this triangle of negotiation (between manufacturers, pharmacies, and PBMs), things can become extremely opaque.

Because of this triangle of negotiation (between manufacturers, pharmacies, and PBMs), things can become extremely opaque.

19/ The intention of PBMs was good = save insurance companies money.

But employees don't pay for insurance anyway, so there is no incentive to decrease healthcare usage.

And now the incentive structure of PBMs actually forces pharmacies to continually raise prices.

But employees don't pay for insurance anyway, so there is no incentive to decrease healthcare usage.

And now the incentive structure of PBMs actually forces pharmacies to continually raise prices.

20/ No wonder healthcare is so messed up! The lack of aligned incentives is crazy.

And we haven't even talked about the monopoly power of hospitals yet! Oh my word!

And we haven't even talked about the monopoly power of hospitals yet! Oh my word!

End/ I'll end it right there, but I may pick it up again at some point :)

I haven't even touched on how GoodRx fits into the PBM ecosystem yet!

I haven't even touched on how GoodRx fits into the PBM ecosystem yet!

Read on Twitter

Read on Twitter