Weekly Fundamental Analysis: Goodfood Market Corp $FOOD

267% Organic growth over 5YRS! - It is one of the fastest-growing public companies in Canada

267% Organic growth over 5YRS! - It is one of the fastest-growing public companies in Canada

A young Amazon fresh benefiting from the trend towards eCommerce online grocery shopping.

Thread and Earnings Review!

267% Organic growth over 5YRS! - It is one of the fastest-growing public companies in Canada

267% Organic growth over 5YRS! - It is one of the fastest-growing public companies in Canada

A young Amazon fresh benefiting from the trend towards eCommerce online grocery shopping.

Thread and Earnings Review!

1/ Overview:

Goodfood Market Corp is an online grocery/ eCommerce company that delivers fresh meals, ingredients, meal-kit, breakfast and grocery products in Canada. They offer "Ready-to-eat" and "Ready-to-cook" breakfast meals both fresh and hot meals.

company that delivers fresh meals, ingredients, meal-kit, breakfast and grocery products in Canada. They offer "Ready-to-eat" and "Ready-to-cook" breakfast meals both fresh and hot meals.

Goodfood Market Corp is an online grocery/ eCommerce

company that delivers fresh meals, ingredients, meal-kit, breakfast and grocery products in Canada. They offer "Ready-to-eat" and "Ready-to-cook" breakfast meals both fresh and hot meals.

company that delivers fresh meals, ingredients, meal-kit, breakfast and grocery products in Canada. They offer "Ready-to-eat" and "Ready-to-cook" breakfast meals both fresh and hot meals.

2/ Customer process:

Customers select their ingredients on http://www.makegoodfood.ca and it arrives at home in 24-hours. The value proposition is to take the hassle out of cooking, save time, offering competitive pricing and make it easy for consumers to prepare meals at home.

Customers select their ingredients on http://www.makegoodfood.ca and it arrives at home in 24-hours. The value proposition is to take the hassle out of cooking, save time, offering competitive pricing and make it easy for consumers to prepare meals at home.

3/ New Product  :

:

Launched “Goodfood WOW” a new unlimited same-day grocery delivery service in its pursuit of a larger share of the food-at-home market.

Same-day delivery is consistent with the quick turnarounds consumers expect for grocery shopping and leads to stickiness

:

:Launched “Goodfood WOW” a new unlimited same-day grocery delivery service in its pursuit of a larger share of the food-at-home market.

Same-day delivery is consistent with the quick turnarounds consumers expect for grocery shopping and leads to stickiness

4/ Industry Trends:

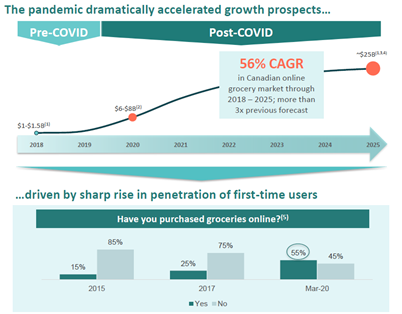

The pandemic has caused a reluctance to go shopping in stores (especially with lockdowns in Canadian cities ). This led to a sharp acceleration in first-time users. In 2015, 15% of Canadians had purchased groceries online, but that reached 55% in 2020.

). This led to a sharp acceleration in first-time users. In 2015, 15% of Canadians had purchased groceries online, but that reached 55% in 2020.

The pandemic has caused a reluctance to go shopping in stores (especially with lockdowns in Canadian cities

). This led to a sharp acceleration in first-time users. In 2015, 15% of Canadians had purchased groceries online, but that reached 55% in 2020.

). This led to a sharp acceleration in first-time users. In 2015, 15% of Canadians had purchased groceries online, but that reached 55% in 2020.

5/ Industry Trends

- B (Optional)

- B (Optional)

Significant % of traditional grocery shopping has shifted online. A large portion of food consumption has

moved 4rm restaurants to grocery/home meal kits

According to this BoA Report, Online Grocery and Food Delivery growth remains strong.

- B (Optional)

- B (Optional)Significant % of traditional grocery shopping has shifted online. A large portion of food consumption has

moved 4rm restaurants to grocery/home meal kits

According to this BoA Report, Online Grocery and Food Delivery growth remains strong.

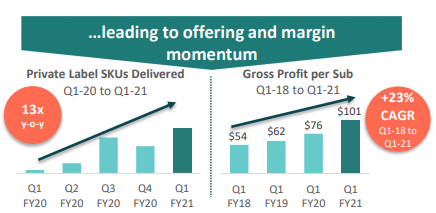

6/ Subscriber Customer Growth:

100% YoY

•2018 - 89K Subs+

•2019 - 111K+

•Jan 2020 - 200k+

•Dec 2020 - 306k+

They have consistently achieved 20%/monthly growth prior to the pandemic. Importantly, they been increasing Gross profit per subsriber at 23% CAGR

100% YoY

•2018 - 89K Subs+

•2019 - 111K+

•Jan 2020 - 200k+

•Dec 2020 - 306k+

They have consistently achieved 20%/monthly growth prior to the pandemic. Importantly, they been increasing Gross profit per subsriber at 23% CAGR

7/ Financial Review -

- A:

- A:

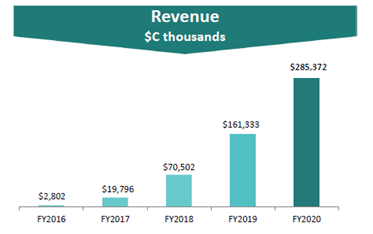

The customer growth has translated to YoY Financial growth –

FY Annual Growth Rate :

:

2017- 606%

2018 - 256%

2019 - 128%

2020 - 77%

CAGR (266%)

--

FY 2020 – Quarterly Revenue Growth:

Q1 (90%+, 61%+, 73%+, 85%+)

Q1-2021 (62%) (Recent)

- A:

- A:The customer growth has translated to YoY Financial growth –

FY Annual Growth Rate

:

: 2017- 606%

2018 - 256%

2019 - 128%

2020 - 77%

CAGR (266%)

--

FY 2020 – Quarterly Revenue Growth:

Q1 (90%+, 61%+, 73%+, 85%+)

Q1-2021 (62%) (Recent)

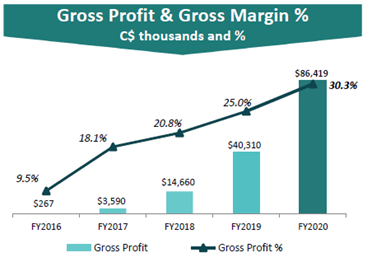

8/Financials - B:

Gross margins: Lower at around 30% due to the high-cost of their food/production.

Gross margins: Lower at around 30% due to the high-cost of their food/production.

But the company has been growing their recent Gross profit over 114%

Overtime, with the significant top-line growth, this figure will improve! Recent Q1-2020 showed 32.3%

Gross margins: Lower at around 30% due to the high-cost of their food/production.

Gross margins: Lower at around 30% due to the high-cost of their food/production. But the company has been growing their recent Gross profit over 114%

Overtime, with the significant top-line growth, this figure will improve! Recent Q1-2020 showed 32.3%

9/ Founder-Led Leadership:

Jonathan Ferrari and Neil Cuggy were Co-founders in 2014. Both were past Investment bankers and awarded as EY Young Entrepreneurs of the year.

in 2014. Both were past Investment bankers and awarded as EY Young Entrepreneurs of the year.

They own over 30% of the company and the rest management of 10% giving a strong 40% ownership stake!

Jonathan Ferrari and Neil Cuggy were Co-founders

in 2014. Both were past Investment bankers and awarded as EY Young Entrepreneurs of the year.

in 2014. Both were past Investment bankers and awarded as EY Young Entrepreneurs of the year.They own over 30% of the company and the rest management of 10% giving a strong 40% ownership stake!

10/ Key Risks to Observe:

• Cyclicality of the business - Winter/Fall are strongest seasons, while Summer months are much slower as people are on holidays

• Competitors from international companies like HelloFresh, Sobeys. Indirectly with $WMT $DASH.

• Better Margins

• Cyclicality of the business - Winter/Fall are strongest seasons, while Summer months are much slower as people are on holidays

• Competitors from international companies like HelloFresh, Sobeys. Indirectly with $WMT $DASH.

• Better Margins

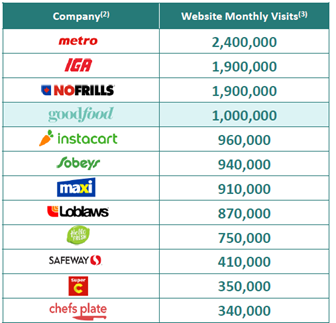

11/ Some notes

- Vertically integrated with operational fulfilment centres with capacity to reach all Canada

- The company has won the “Most Trusted Meal Kit Delivery Service”

-Well-recognized brand in Canada, owning over 40-45% market share with high monthly web-traffic

- Vertically integrated with operational fulfilment centres with capacity to reach all Canada

- The company has won the “Most Trusted Meal Kit Delivery Service”

-Well-recognized brand in Canada, owning over 40-45% market share with high monthly web-traffic

12/ Q1-2021 – Earnings Report Review:

• Revenue Growth – 62% YoY

• Revenue ($91.4M) vs Expectation ($87M)

• EPS: (-0.04) vs Exp. (-0.07)

• Gross margin is improving at 32% | G.Profit 82% YoY

Stock is down because of elevated expectations, but this is all temporal

• Revenue Growth – 62% YoY

• Revenue ($91.4M) vs Expectation ($87M)

• EPS: (-0.04) vs Exp. (-0.07)

• Gross margin is improving at 32% | G.Profit 82% YoY

Stock is down because of elevated expectations, but this is all temporal

13/ Bottom line:

This is a gradual “Amazon fresh” for food delivery building a moat with solid execution and a strong brand with opportunities for intn'l expansion. Margins will improve overtime.

The future is bright for food delivery as seen below.

I have a position.

This is a gradual “Amazon fresh” for food delivery building a moat with solid execution and a strong brand with opportunities for intn'l expansion. Margins will improve overtime.

The future is bright for food delivery as seen below.

I have a position.

I write on growing and disruptive innovative companies in North America, with a slight emphasis on uncovering gems in Canada

Follow and subscribe to our newsletter where I share weekly analysis.

Share if you enjoy & I look forward to your feedback https://investianalystnewsletter.substack.com/

https://investianalystnewsletter.substack.com/

Follow and subscribe to our newsletter where I share weekly analysis.

Share if you enjoy & I look forward to your feedback

https://investianalystnewsletter.substack.com/

https://investianalystnewsletter.substack.com/

@trevmuchedzi Heyy Trev! I know this a favourite of yours! Are you still bullish based on the current earnings report today!

Read on Twitter

Read on Twitter