Starting a thread on the $MCAC soon to be $PLBY spac... This is no longer the creepy Heff & money burning magazine business of the early 2000s. In 2020 Playboy saw revenue & EBITDA grow 80% & 100% respectively. (1/N)

The new CEO Ben Kohn has 20+ years working in private equity and going off recent interviews seems ecstatic about the opportunity $PLBY has in addressing market needs in Sexual Wellness, Style & Apparel, Gaming & Lifestyle, and Grooming & Beauty...

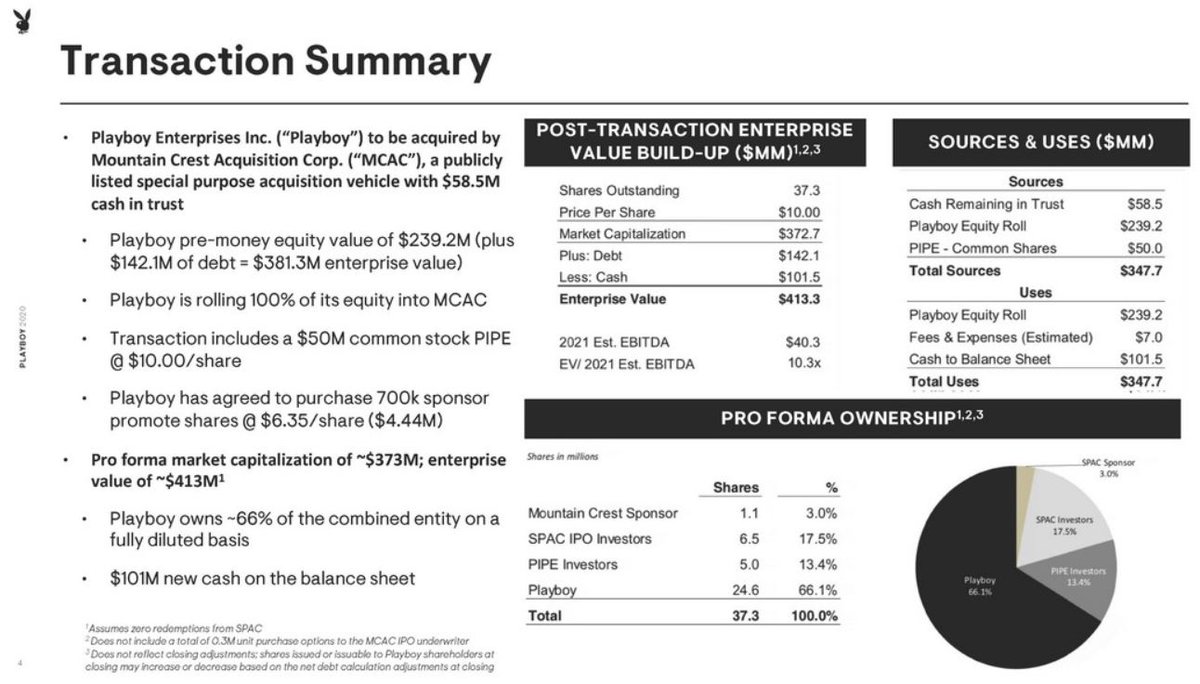

There seems to be a lot of confusion on FinTwit regarding the spac deal specifics but on its face it's actually quite accretive. Playboy is adding 101m in new cash to its balance sheet and rolling 100% of its equity into $MCAC WITHOUT any BS warrants!

Additionally, management's insider ownership is high (>20%) and they have even agreed to a 1 year lockup period to increase the optics of this deal. Who else besides Ben Kohn is leading this effort?

Well, recently they hired Tittu Nellimoottil as SVP of Data who previously worked as a principal engineer at Bird and PayPal. They also hired AJ Saltzman who was a senior director at GOAT, the high-profile sneaker resale company. https://www.linkedin.com/in/tittu-thomas-n-71703746/

As for the underlying business, the CEO simply gets it. License out the brand for 80% gross margin sales in foreign markets and develop internal products for domestic DTC and market to their 50m+ social media followers.

They recently announced a new partnership in India with Jay Jay Iconic Brands with a planned rollout mid-2021. This should further increase the already 40% of revenue they derive from sales in the quickly growing Asia Pacific region (already a huge clothing brand China).

Read on Twitter

Read on Twitter