Yes QE is helping the government fund huge (and necessary) increases in public spending.

But it was never designed for this, and there are better ways of going about it

An attempt at a thread... https://twitter.com/PositiveMoneyUK/status/1349408658849992705

But it was never designed for this, and there are better ways of going about it

An attempt at a thread... https://twitter.com/PositiveMoneyUK/status/1349408658849992705

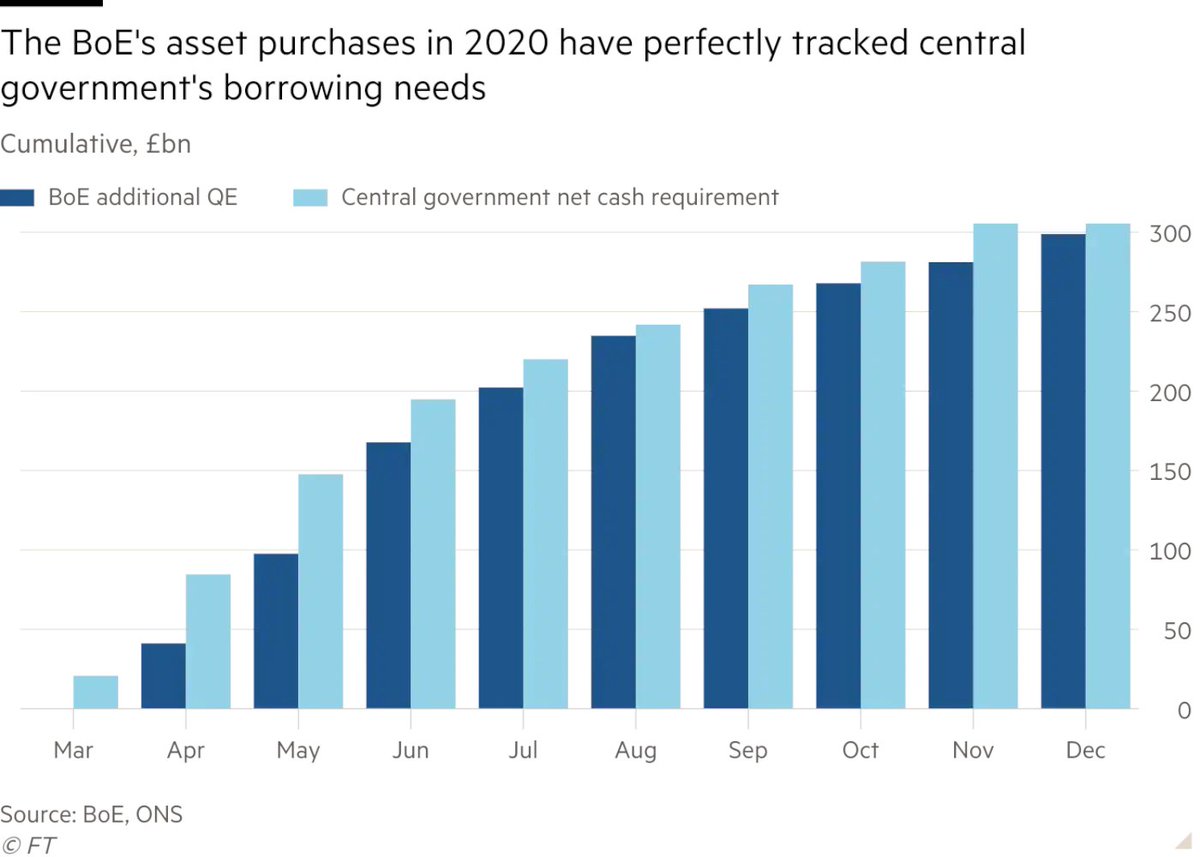

The purchase of gilts through QE has neatly matched the expansion in government borrowing since the Covid pandemic reached UK shores, enabling yields on government debt to stay at record lows despite a huge and necessary increase in public spending

https://www.ft.com/content/f92b6c67-15ef-460f-8655-e458f2fe2487

https://www.ft.com/content/f92b6c67-15ef-460f-8655-e458f2fe2487

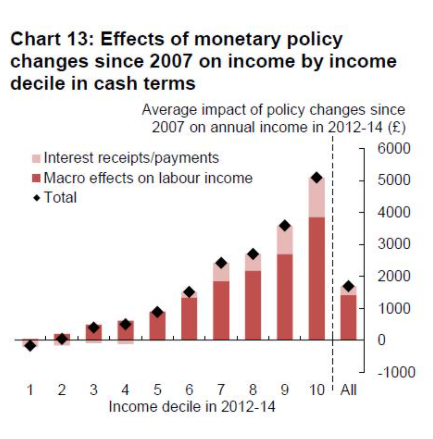

QE has served a useful role in keeping yields low and mitigating immediate financial instability during the Covid crisis. But unprecedentedly loose monetary policy is stoking up another wave of huge increases in inequality, as well as sowing the seeds of instability

This is perhaps most starkly illustrated by the meteoric rises in the price of questionable assets such as Bitcoin, as well as surging stock markets on both sides of the Atlantic, despite the damage the pandemic has done to economic fundamentals https://www.gmo.com/europe/research-library/waiting-for-the-last-dance/

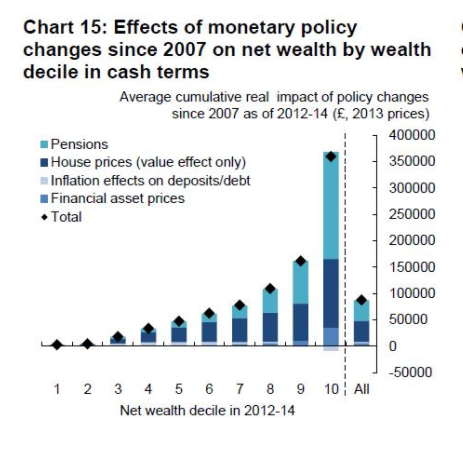

The £445bn of QE between 2009 and 2016, which was not accompanied by a commensurate increase in public spending, has driven a huge increase in wealth inequality https://positivemoney.org/2018/04/bank-england-working-paper-considers-monetary-policys-effect-inequality/

The Bank of England's own analysis suggests that the first rounds of QE enriched the wealthiest 10% of households by £350,000 each - around 100 times the impact it had for the poorest decile

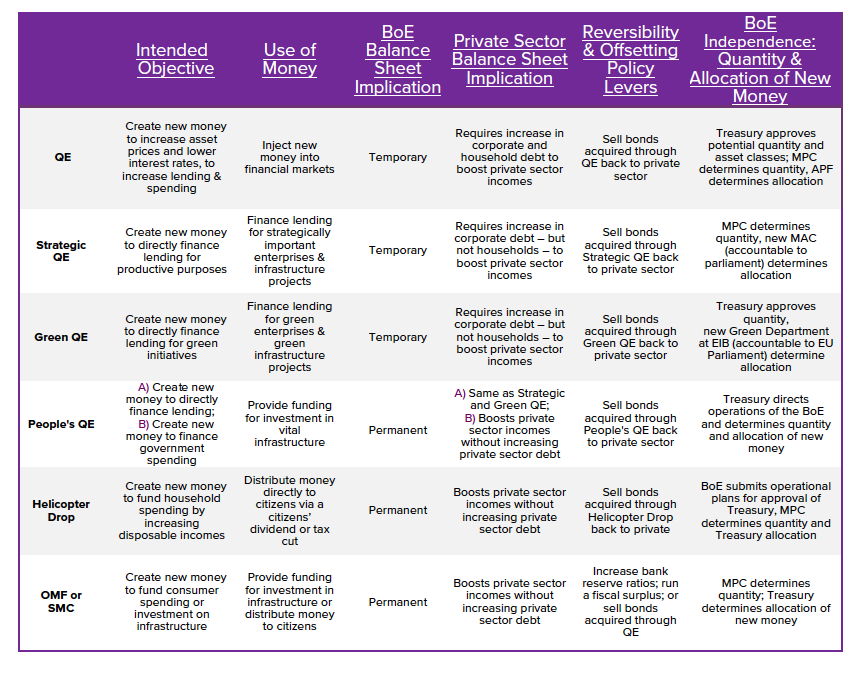

This inequality and long-term instability is a design feature of the Bank of England’s QE programme. The creation of new central bank money, which QE entails, can take a variety of different forms and fulfil a range of different objectives - see https://positivemoney.org/publications/guide-public-money-creation/

In the BoE's own words, a key objective of QE “is to stimulate the economy by boosting a wide range of financial asset prices" https://www.bankofengland.co.uk/monetary-policy/quantitative-easing

As the BoE has made clear over the years, the mechanism through which it believed QE would stimulate the economy was primarily through the so-called 'portfolio rebalancing' channel.

See for instance explanation of QE here: https://www.bankofengland.co.uk/-/media/boe/files/quarterly-bulletin/2014/money-creation-in-the-modern-economy.pdf

See for instance explanation of QE here: https://www.bankofengland.co.uk/-/media/boe/files/quarterly-bulletin/2014/money-creation-in-the-modern-economy.pdf

This idea is that the new money injected into financial markets will see bondholders investing funds into bonds and shares issued by companies, which should lead eventually to higher spending in the economy. A 'trickle down' effect, if you will

A decade of QE has shown the BoE’s approach to be successful in the goal of boosting asset prices (and by extension inequality), but a failure in igniting a sustainable economic recovery. See: turbocharged house prices while real wages failed to recover to pre-crisis levels

Rather than reallocating funds towards more productive investment in the ‘real economy’, money has predominantly been channeled towards non-productive assets, such as property. Surprise surprise...

If the task of monetary stimulus is to help stimulate aggregate demand, far more could be achieved for far less, and without the unwanted side-effects, with alternative tools. Here are some ideas...

Rather than attempting to flood financial markets with a tidal wave of cash through additional bond purchases on the secondary market, or introducing negative interest rates, there are ways in which the BoE could inject money into the non-financial economy more directly

There are various ways in which the BoE could instead directly credit the government with new funds, which it could then invest in infrastructure spending, or distribute equally to all citizens with a so-called ‘helicopter drop’. Here's one menu of options:

Forms of so-called 'direct monetary financing' have been advocated by @PositiveMoneyUK and many others over the years, and even BlackRock put such a proposal forward in 2019, as a means of responding to the next downturn...  https://www.blackrock.com/corporate/insights/blackrock-investment-institute/publications/global-macro-outlook/august-2019#going-direct

https://www.blackrock.com/corporate/insights/blackrock-investment-institute/publications/global-macro-outlook/august-2019#going-direct

https://www.blackrock.com/corporate/insights/blackrock-investment-institute/publications/global-macro-outlook/august-2019#going-direct

https://www.blackrock.com/corporate/insights/blackrock-investment-institute/publications/global-macro-outlook/august-2019#going-direct

The framework outlined by BlackRock involves the central bank financing government spending by activating what it calls a standing emergency fiscal facility (SEFF) when interest rates are at the lower bound (as they currently are in the UK)

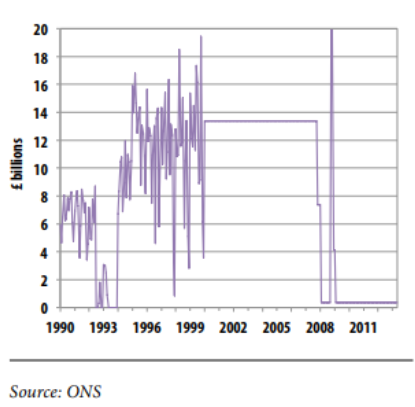

An institutional arrangement for this currently already exists in the UK through the government’s Ways and Means ‘overdraft’ account at the Bank of England, which was frequently used prior to the new millennium.

The Bank has already extended the Ways and Means facility in response to the Covid crisis, but this has not yet been taken advantage of by the Treasury. https://www.ft.com/content/664c575b-0f54-44e5-ab78-2fd30ef213cb

Crediting funds into the Ways & Means account for the gov to spend would be a fairer and more sustainable means of raising aggregate demand and bringing inflation up to the BoE target than further inflating asset prices with additional rounds of conventional QE, or -ve rates

Though such proposals may scare those committed to the fiction of Bank of England 'independence', there is a case to be made that ‘overt monetary financing’ may actually be necessary to maintain the credibility of the central bank

Throughout the Covid crisis the Bank of England has attracted criticism for the lengths it has gone to deny that it is effectively undertaking monetary financing https://www.ft.com/content/f5d74a4b-3084-49fa-bb13-8be537945626

The Bank’s original response to such claims is that QE does not constitute monetary financing namely because it is temporary and will be ‘unwound’ https://www.ft.com/content/3a33c7fe-75a6-11ea-95fe-fcd274e920ca

This argument failed to hold water - one could simply look to the fact that not a single pound of the £445bn of QE introduced between 2009 and 2016 has been reversed, and that markets simply do not seem to believe that it ever will be. Yields on even 30 & 50 yr gilts are <1%

This is chiefly because since 2008 there has been no sight of a sustainable recovery in the ‘real economy’ which will allow it to stand on its own two feet in the absence of monetary support which is keeping asset prices artificially high

Monetary stimulus which increases productive investment and raises incomes may therefore be a prerequisite for giving the BoE a path towards being able to unwind QE and thereby credibly exercise independence, if that's what people really want (Labour still does apparently)

In the absence of a change in approach on monetary policy, changes to fiscal policy will be of even greater necessity - namely increased wealth taxes - to address the hugely unequal economic impact of Covid between the wealthier and the poorer - the so-called K-shaped recovery.

Think I'm going to leave it there for now.

There's obviously a lot going on in the world rn but it's important for us to be talking about this

There's obviously a lot going on in the world rn but it's important for us to be talking about this

Read on Twitter

Read on Twitter