1/39: The only way to describe the public markets’ appetite for new Logos is “insatiable”. But why? SPACs vs. IPOs? I’m no public markets expert by any stretch of the imagination but I’m not going to let that stop me from weighing in on what I think is going on. Unpacked:

2/39: Simply put, going public is a financing event. It’s just a choice available to a sub-set of all private companies and is an optional step in a company’s journey of becoming a durable and profitable business.

3/39: There are pluses/minuses to being a public company that I don’t plan on addressing in this thread, but it’s critical to internalize that going public is merely a scenic overlook on a never-ending road trip. It isn’t a final destination because great companies live forever.

4/39: So, to understand any going public “event”, you have to understand a lot about the path that led up to the event and the topography of the journey ahead.

5/39: To abstract the concept, here’s an interesting thought exercise: Would you ever consider purchasing a book one chapter at a time where the cost of each subsequent chapter costs more than the first?

6/39: The benefit of this structure is that if you don’t like how the story is evolving you don’t have to finish it or pay for the entire book. You’ve clearly invested time and money into getting part way to what hopefully will be a satisfying ending.

7/39: But the purity of making a money/time decision throughout your reading experience puts pressure on the author to hook you over time and deliver against a growing set of expectations.

8/39: This is venture capital in a nutshell. Instead of asking a Founder how much money he/she is going to need from the founding of the business to self-sufficiency, a Venture Capitalist breaks the journey into pieces.

9/39: Each step of the journey is equivalent to reading another chapter in a book that’s still being written, and a Venture Capitalist reserves the right to evaluate future investment decisions based on how much they like the story so far and what the author says is coming soon.

10/39: This isn’t an inherently bad setup, but there's a wrinkle that causes problems for companies that require multiple rounds of funding. The issue: What if you specialized in reading the early chapters of a book and didn’t have the money to buy the middle and later chapters?

11/39: Your job as an “early chapter reader” would be to work with the author to summarize the story that was told in the early chapters to a set of potential readers who specialize in reading the middle chapters.

12/39: Nobody will ever find out the ending of a storyline if you can’t excite a “middle chapter reader” with your summary and ultimately have them explain to a “later chapter reader” why they should pay a lot of money to find out the ending to the story.

13/39: And if one story sells well, it becomes the first in a never-ending series with exciting story arcs and new beloved characters being introduced in subsequent books. This is the journey of a durable and profitable company.

14/39: What this means is that when you start a book you have to believe that there are other readers out there that like the same genre and writing style that you do, otherwise you’re just wasting your time and money reading the early chapters.

15/39: The system discourages you from reading something off the beaten path because there’s uncertainty around finding someone downstream who will fall in love with your story. And most importantly, it explains why Founders need to be extraordinary story tellers.

16/39: So now let’s jump back to the public markets and use this framework to explain why they’re so in love with the recent batch of companies that have made the private/public transition.

17/39: First, most alternatives to reading are really boring right now. Fixed Income? Boring! Corporate Bonds? Boring! Savings? Boring! Distressed debt? Maybe some is starting to emerge. Currencies? Less boring, but still boring. But there are exceptions.

18/39: Real estate? Some categories are really scary right now (hotel and office) but others are pretty interesting (SFR). Crypto? There’s no doubt it’s exciting but it might be too wild a ride for the average book reader.

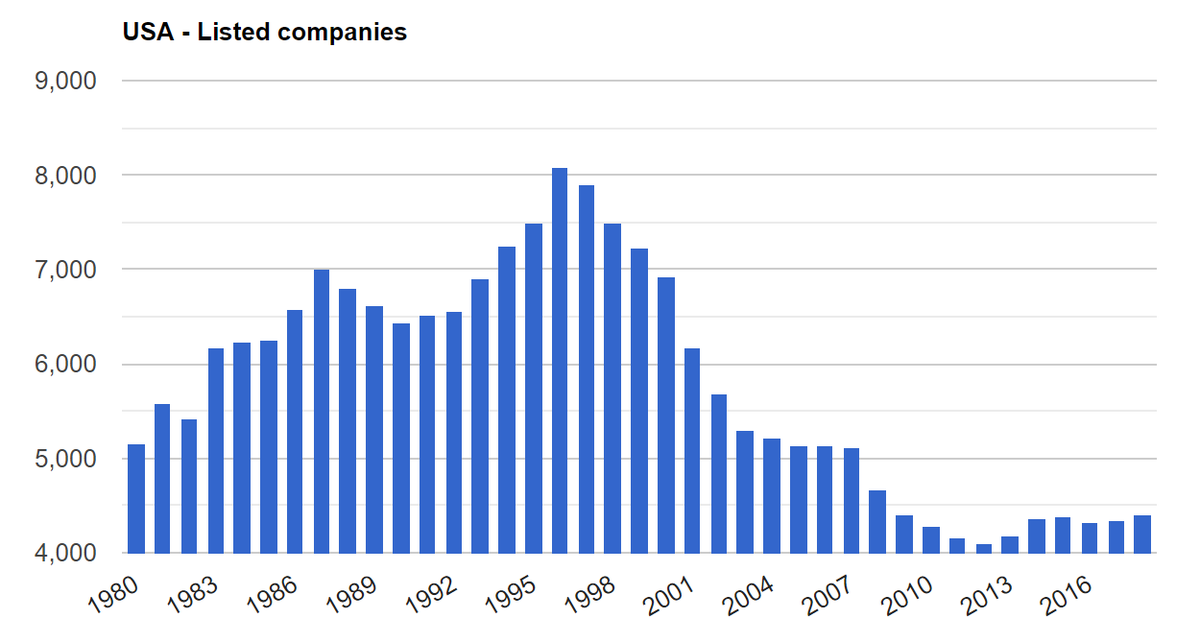

19/39: Second, the number of books in the public markets’ library has been shrinking. The peak was in 1996 at just over 8,000 and this number has been cut in half over the past 2 decades. New books are being welcomed because there just aren’t enough interesting stories to read.

20/39: Third, in a boring world with fewer interesting books, there’s pent up demand for jolts of adrenalin and excitement (i.e. – yield). Investors aren’t that interested in another “slow and steady” book. They don’t want to read about “here and now” businesses.

21/39: What do they want? They want electric cars. They want robots. They want cures. They want digital. They want cloud computing. They want these things not only because they’re interesting, but also because they represent the world we’ll be living in over the next 50+ years.

22/39: But herein lies a major rub with traditional IPOs. The process is designed to constrain the story telling process, especially around any parts of the narrative more than 2 years in the future.

23/39: In a traditional IPO, a company presents its history and a narrative about its future to an underwriter. The underwriter’s equity research team asks questions of management until they feel like they have an in-depth understanding of the business.

24/39: Analysts will build their own forecast models which serve the purpose of validating the company’s projections. For traditional business models and slower growth companies, all forecasts tend to be pretty similar because the business and market conditions are understood.

25/39: But, the IPO process can be crippling if understanding a business requires telling a story about a still evolving and highly uncertain future. These are the most interesting companies (books) being built right now by the most interesting Founders (authors)!

26/39: But why do IPOs cripple future-casting? A major reason is that the company going public isn’t permitted to share its forecast directly with potential Investors! This may sound silly, especially to private investors who typically have direct access to management.

27/39: But the IPO process is designed to abstract the company from the end Investor. The company shares its views of the future with its underwriter and the underwriter’s job is to interpret these conversations as an “agnostic middleman”.

28/39: This “interpretation” is designed to produce reliable short and medium-term views of how the company is going to evolve. It’s not meant to sell a dream. It’s meant to describe a very conservative view of how the next 8 quarters are likely to unfold.

29/39: Why? The truth is that investors are used to an “exceed and raise” environment and they reward consistency. They want a company to beat each quarter by a penny and subsequently raise its forecast for the next few quarters. Do this with consistency and they’ll be fans.

30/39: It’s also true that new logos are subject to the real world issue that investors are likely to sue if a company misses its projections. The great @matt_levine has a view that “everything is securities fraud”, and in the case of new logos missing forecasts investors agree!

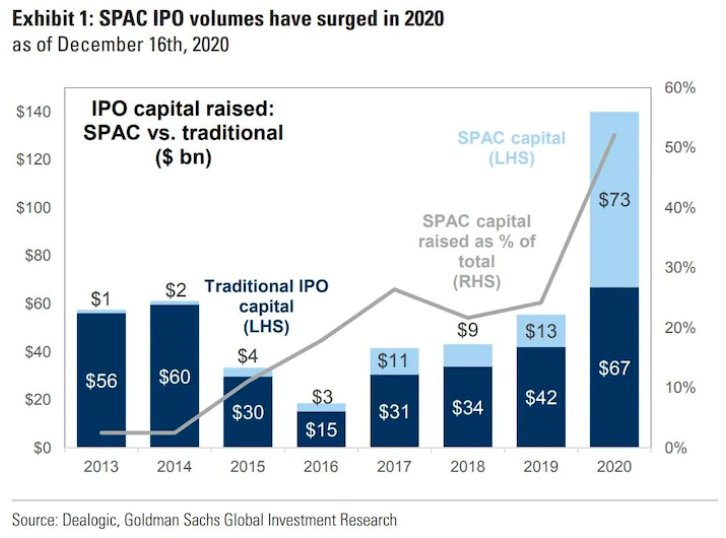

31/39: This is where the SPAC process diverges from a traditional IPO process, especially when raising a PIPE. The SPAC target can include their forecast in their Management presentation to Investors! And they can include a longer-range forecast (3-5 years)! Boom!

32/39: Removing the middleman and being able to tell the story directly to investors is a game changer for some businesses, especially those that require an investor to believe in a high growth forecast that results in market dominance 3-5 years in the future.

33/39: So if you’re a great storyteller and you have a great story to tell then there are clear benefits to a SPAC vs. IPO. Can you imagine constraining @chamath? Can you imagine asking him to tell a conservative story that doesn’t describe the future beyond 8 quarters?

34/39: To be clear, a SPACd company will eventually be public and subject to the same set of expectations (beating estimates on a quarterly basis) as existing public companies. However, investors will have the benefit of hearing the long-term vision directly from Management.

35/39: If a SPACd company delivers against its promise then everyone wins. Investors are paying a premium to get access to a high growth, exciting story. If an author can deliver sequel after sequel of well written stories, investors will believe the price they paid was worth it.

36/39: But it will be interesting to see what happens if (more likely when) some of the SPACd companies miss their forecasts. You can’t sue an author for ruining a story (or @HBO for the @GOT finale), but you can sue a company for mis-representation.

37/39: I fully expect that in the next few years we’ll see more than one securities class action lawsuit pop-up that challenges the historical disclosures and forecasts of a poorly performing SPAC-funded operating company. Investors will look to sue. Lawyers will lawyer.

38/39: There are plenty of SPAC suits out there that you can study (e.g. - China Water, Waitr, etc). What’s clear is that the courts aren’t going to treat this recent batch of SPACs as “buyer beware” investments. If they tell a story they’ll need to live up to it.

39/39: By no means is this thread meant to be a comprehensive view of IPOs and SPACs nor about the pros and cons of going public vs. staying private. But I thought I’d share my simpleton’s view of a few of the drivers of what’s going on out there!

Read on Twitter

Read on Twitter