Tulips, the #Bitcoin  of the 17th century

of the 17th century

How a pandemic, FOMO, and speculation made a flower worth the same as a mansion

/THREAD/

of the 17th century

of the 17th centuryHow a pandemic, FOMO, and speculation made a flower worth the same as a mansion

/THREAD/

1/ During the beginning of the 1630s in the Netherlands, tulips were difficult to cultivate and preserve.

This made them a luxury good reserved for the rich and affluent of the upper class living in mansions with big gardens.

This made them a luxury good reserved for the rich and affluent of the upper class living in mansions with big gardens.

2/ The tulip market was not organized nor regulated, as other trades, which made it easy for professional growers to enter it.

Due to the international trade expansion, the growers starting cultivating rare varieties, to achieve higher prices.

Due to the international trade expansion, the growers starting cultivating rare varieties, to achieve higher prices.

3/ The biggest change occurred when florists used tulip bulbs as speculative assets.

The market expansion led to forward bulb-purchase contracts, thus enabling trading during the entire year, and not just during the summer months when tulips bloom.

The market expansion led to forward bulb-purchase contracts, thus enabling trading during the entire year, and not just during the summer months when tulips bloom.

4/ Easy loans and credit for forward contract purchases led many to enter the market since not much capital was required.

People from the lower economic class (maids, servants, craftsmen) could not resist the temptation for some quick profits and entered the speculative market.

People from the lower economic class (maids, servants, craftsmen) could not resist the temptation for some quick profits and entered the speculative market.

5/ Many sold or remortgaged their houses, which led to a decline in the price of real estate.

The influx of new investors and capital led to a surge in the tulip bulb prices.

The influx of new investors and capital led to a surge in the tulip bulb prices.

6/ Ordinary bulbs saw their prices rise by 20 times, while the rare ones skyrocketed to 4-6,000 fiorins, equivalent today to $750,000.

More than enough to purchase a luxury mansion in the most expensive neighborhood of Amsterdam at the time.

More than enough to purchase a luxury mansion in the most expensive neighborhood of Amsterdam at the time.

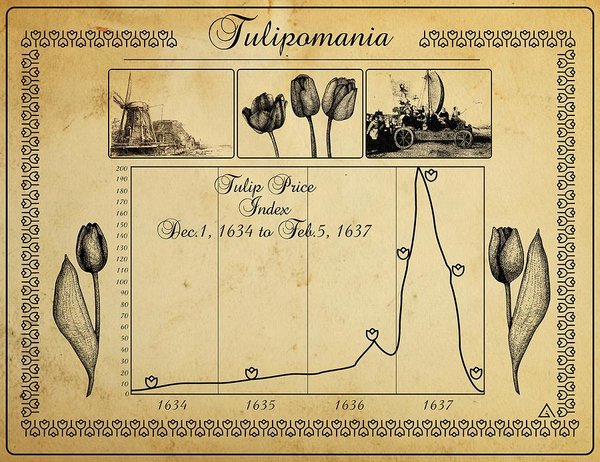

7/ In February 1637, bulbs could not be auctioned even at lower prices.

The news spread like wildfire, with contract holders trying to sell their contracts as soon as possible.

The news spread like wildfire, with contract holders trying to sell their contracts as soon as possible.

8/ This created a chain reaction of lower prices, lower interest, fewer willing buyers, and lower speculation which is what drove the market at the time.

Contract holders refused to pay the agreed price and tried to settle with florists for 10% of the contract price.

Contract holders refused to pay the agreed price and tried to settle with florists for 10% of the contract price.

9/ The government refused to intervene and delegated the issue to the local authorities to mediate the disputed contracts.

Desperate growers sold at low prices to secure a profit.

Desperate growers sold at low prices to secure a profit.

10/ After a court ruling in 1638, the contracts were canceled at only 3.5% of their initial price.

Despite the bubble bursting, the broader economy and most people were unaffected, since it was brief and localized.

Despite the bubble bursting, the broader economy and most people were unaffected, since it was brief and localized.

11/ Most of the debt was personal, and in some cases canceled out between two parties.

Most of the credit was provided by people involved in the tulip trade and not banks, which didn't harm the country's financial system.

Most of the credit was provided by people involved in the tulip trade and not banks, which didn't harm the country's financial system.

12/ The biggest losses were incurred by growers with large quantities of worthless tulip bulbs and those who sold or remortgaged their real estate and got credit to speculate on margin.

The numerous disputes and court litigations for the contracts lead also to a loss of trust.

The numerous disputes and court litigations for the contracts lead also to a loss of trust.

13/ Historians have many theories regarding the origins of the first speculative bubble in history.

The most common was that people were bored from the bubonic plague that was ravaging the country at the time.

The most common was that people were bored from the bubonic plague that was ravaging the country at the time.

14/ All they had left to do was drink in taverns and pubs, play drinking games and speculate the price of the bulbs in their possession.

Sounds familiar?

/END/

Sounds familiar?

/END/

If you liked this thread click below and retweet the first tweet https://twitter.com/itsKostasWithK/status/1349412599696412672?s=20

For more educational threads on financial independence and investing for beginners see below for a collection of threads

https://twitter.com/itsKostasWithK/status/1345790210441928708?s=20

https://twitter.com/itsKostasWithK/status/1345790210441928708?s=20

https://twitter.com/itsKostasWithK/status/1345790210441928708?s=20

https://twitter.com/itsKostasWithK/status/1345790210441928708?s=20

Read on Twitter

Read on Twitter