The PayPal Mafia is at it again raising $1.2B for a "heavily oversubscribed" IPO of #AFFIRM at $15B valuation.

Time for a thread

Time for a thread

1) Consumer Credit.

The backbone of the U.S economy. It’s a glorious invention that makes the world go round. Especially at 2am downing a couple bottles of wine:

“Drunk Americans spend a total of $30B online each year"

The backbone of the U.S economy. It’s a glorious invention that makes the world go round. Especially at 2am downing a couple bottles of wine:

“Drunk Americans spend a total of $30B online each year"

3) Affirm is a financial lender of instalment loans for consumers to use at the point-of-sale.

Huh?

Think of buying a #Peloton. But instead of paying cash (you don’t have) or using credit card (crazy fees) use an Affirm instalment loan and repay over 6 weeks to 48 months.

Huh?

Think of buying a #Peloton. But instead of paying cash (you don’t have) or using credit card (crazy fees) use an Affirm instalment loan and repay over 6 weeks to 48 months.

4) Highlights:

•Launched in 2016

•6.2M customers and 6.5k merchants

•$10.7B purchases funded to date

•Last raise $500MM at $5B-$7B valuation

•Launched in 2016

•6.2M customers and 6.5k merchants

•$10.7B purchases funded to date

•Last raise $500MM at $5B-$7B valuation

5) Business Model.

Affirm should be called the ‘anti-credit card’. Fees are a problem.

“Americans owe a total of $1T in credit card debt today. They have $121B in credit card interest, $11B in overdraft fees, and $3B in late fees.”

Affirm doesn't charge any fees but interest.

Affirm should be called the ‘anti-credit card’. Fees are a problem.

“Americans owe a total of $1T in credit card debt today. They have $121B in credit card interest, $11B in overdraft fees, and $3B in late fees.”

Affirm doesn't charge any fees but interest.

5.1) but they charge a lot of fees to the merchants!

6) COVID.

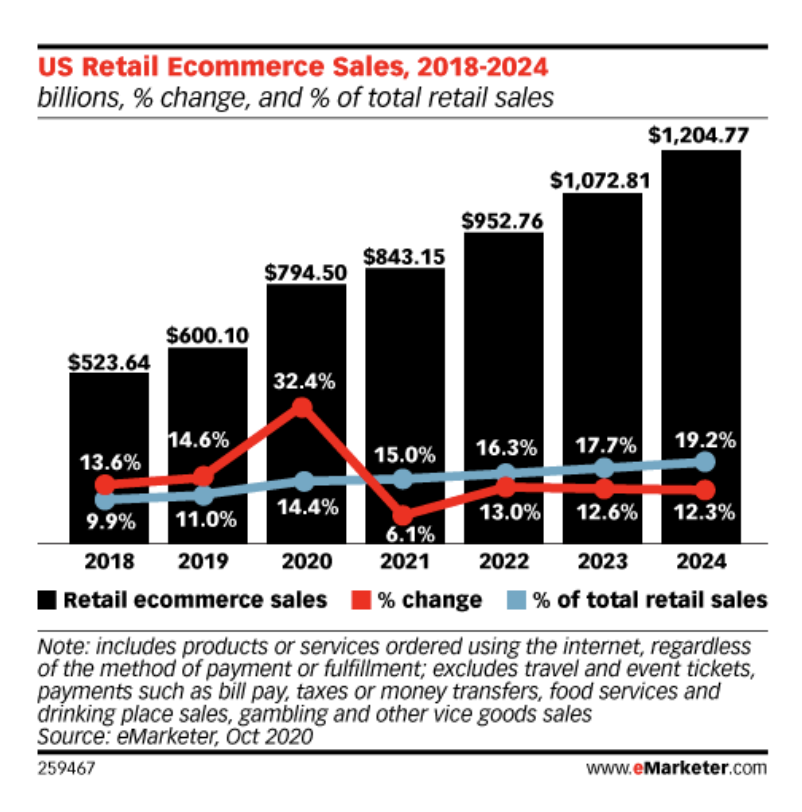

Has been a big win for Affirm. With 10 years of digitization in less than 5 months, Affirm’s revenue 2x to $500MM.

“People are changing their habits very rapidly and the most powerful trend is figuring out what can be purchased online instead of having to go outside.”

Has been a big win for Affirm. With 10 years of digitization in less than 5 months, Affirm’s revenue 2x to $500MM.

“People are changing their habits very rapidly and the most powerful trend is figuring out what can be purchased online instead of having to go outside.”

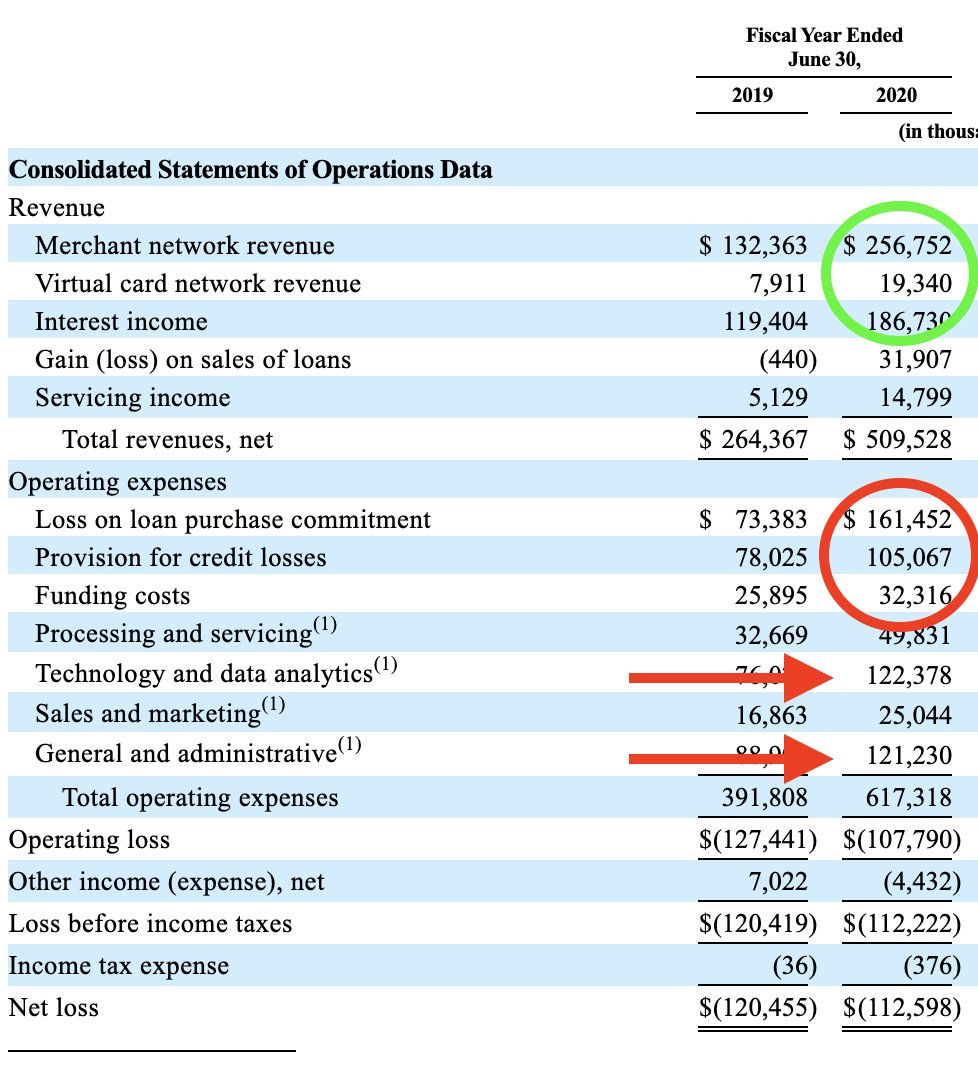

7) Profitability.

But they aren’t profitable yet. Lost over $100MM last year. From their financials I can see they’re generating a nice profit on their loans (green circle minus red circle).

But here’s, the problem the company spends a lot on G&A and Technology (red arrows).

But they aren’t profitable yet. Lost over $100MM last year. From their financials I can see they’re generating a nice profit on their loans (green circle minus red circle).

But here’s, the problem the company spends a lot on G&A and Technology (red arrows).

8) Profitability.

If the bulk of costs can stay fixed as they scale they have a shot at becoming profitable. Plus with all this new IPO capital, they can keep growing unprofitably without worrying about capital for a while.

If the bulk of costs can stay fixed as they scale they have a shot at becoming profitable. Plus with all this new IPO capital, they can keep growing unprofitably without worrying about capital for a while.

9) Lending is Risky.

I learned this first-hand working as a consultant for a consumer lender. One of the companies I analyzed lent people money for breast implants. As you can imagine, if customers didn't pay back you couldn’t just go repossess the asset. Losses were high!

I learned this first-hand working as a consultant for a consumer lender. One of the companies I analyzed lent people money for breast implants. As you can imagine, if customers didn't pay back you couldn’t just go repossess the asset. Losses were high!

10) Competitive Advantage.

Affirm claims to price risk better than the competition. Approving 20% more customers on average and claim their “delinquency rates are at one-fifth of a credit cards”.

Time will tell if this holds true.

Affirm claims to price risk better than the competition. Approving 20% more customers on average and claim their “delinquency rates are at one-fifth of a credit cards”.

Time will tell if this holds true.

11) Market Size.

“it’s estimated that 3% of (eCommerce sales) will be paid via “buy now, pay later.” This means the 2023 North Americans total addressable market (“TAM”) is ~9x larger than Affirm’s $4.6B in transactions today.”- Shelley Olivia

“it’s estimated that 3% of (eCommerce sales) will be paid via “buy now, pay later.” This means the 2023 North Americans total addressable market (“TAM”) is ~9x larger than Affirm’s $4.6B in transactions today.”- Shelley Olivia

12) Risks.

1) Customer Concentration: 30% of their revenue comes from 1 customer: Peloton.

2) Lender Concentration risk: Almost entirely with 1 lender.

1) Customer Concentration: 30% of their revenue comes from 1 customer: Peloton.

2) Lender Concentration risk: Almost entirely with 1 lender.

13) Grits Take.

I know WAY too much about lending to be a fan of this business model. Here are my concerns:

1. ‘Moatless Castle’: Affirm doesn’t have anything proprietary, although, they claim to have better tech to analyze risk. I am not sure I buy it.

I know WAY too much about lending to be a fan of this business model. Here are my concerns:

1. ‘Moatless Castle’: Affirm doesn’t have anything proprietary, although, they claim to have better tech to analyze risk. I am not sure I buy it.

14) Grits Take Cont..

2. Valuation: At $15B and 30x revenue with no profits. I have trouble getting my head around it. $PYPL trades at 13x but it’s profitable. $SHOP trades at +40x but it’s got profits AND innovation.

2. Valuation: At $15B and 30x revenue with no profits. I have trouble getting my head around it. $PYPL trades at 13x but it’s profitable. $SHOP trades at +40x but it’s got profits AND innovation.

15) Grits Take Cont...

3. Failures: In lending, the body count is bigger than the graveyard. Unprofitable, lenders, don’t make great stocks. In October, OnDeck fell victim to a take-under at $90MM valuation, way down from its $1.3B IPO.

3. Failures: In lending, the body count is bigger than the graveyard. Unprofitable, lenders, don’t make great stocks. In October, OnDeck fell victim to a take-under at $90MM valuation, way down from its $1.3B IPO.

16) Grits Take Cont...

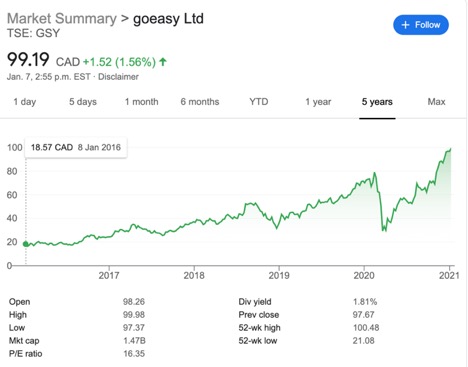

Exception: PROFITABLE lenders can do very well. GoEasy is a great example, they have been profitable for nearly 20 years and their stock has done phenomenally well.

Exception: PROFITABLE lenders can do very well. GoEasy is a great example, they have been profitable for nearly 20 years and their stock has done phenomenally well.

17) Grit Take Cont...

4. Lockups: the CEO owns ~$1B worth of stock (locked up for next few months) and Shopify has warrants that strike at pennies worth +$1B (using IPO price). Quote, feels a bit heavy.

$AFRM is going public soon I am sure it will be overhyped!

4. Lockups: the CEO owns ~$1B worth of stock (locked up for next few months) and Shopify has warrants that strike at pennies worth +$1B (using IPO price). Quote, feels a bit heavy.

$AFRM is going public soon I am sure it will be overhyped!

Read on Twitter

Read on Twitter