1/ We are officially 8 days away from @JoeBiden taking office

Wondering how a Biden presidency could affect your wallet? Let’s talk about some main points within his proposed tax plan.

Let’s talk about some main points within his proposed tax plan.

// THREAD //

Wondering how a Biden presidency could affect your wallet?

Let’s talk about some main points within his proposed tax plan.

Let’s talk about some main points within his proposed tax plan.// THREAD //

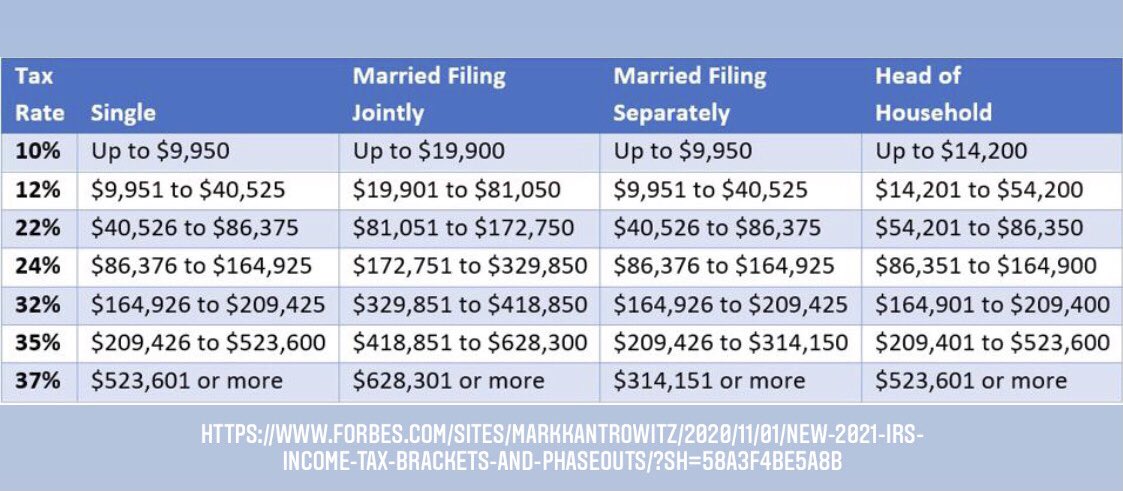

2/ Topic #1: Income Tax

The U.S. uses what's known as a margin tax rate system. Basically, different levels of income are taxed at different rates.

Currently, the 2021 Federal tax rates / brackets look like this:

The U.S. uses what's known as a margin tax rate system. Basically, different levels of income are taxed at different rates.

Currently, the 2021 Federal tax rates / brackets look like this:

3/ Biden's proposal is to raise the highest marginal tax rate (currently 37%) by 2.6% to 39.6%. That means any income made over ~523k will be taxed at 39.6%.

It's a bit unclear what will happen to the other tax brackets, but speculation is that they will remain the same.

It's a bit unclear what will happen to the other tax brackets, but speculation is that they will remain the same.

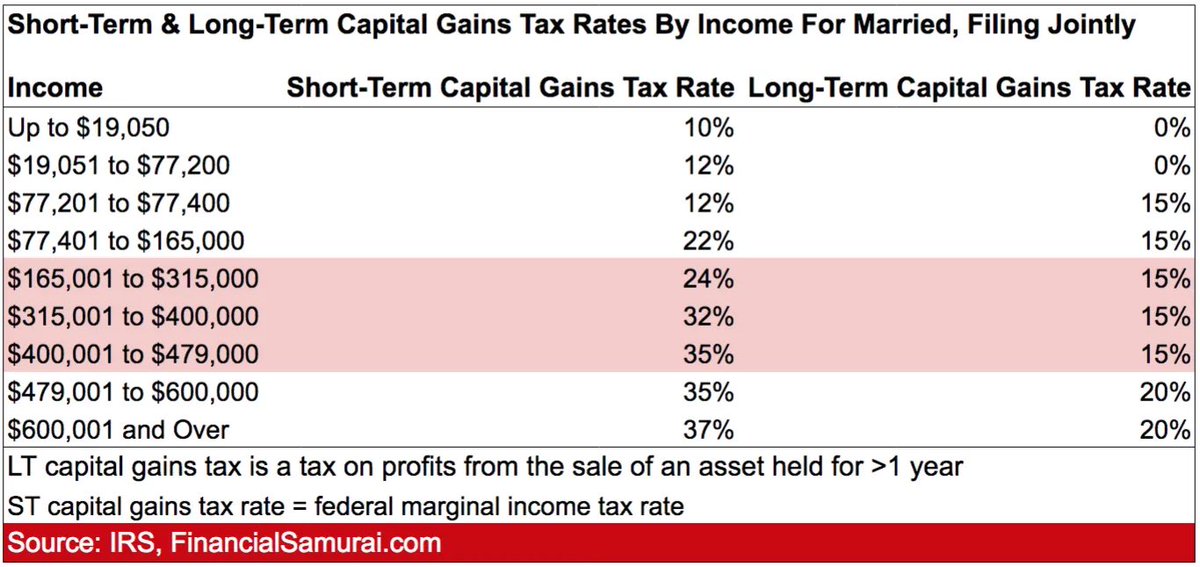

4/ Topic #2: Increased Capital Gains

Capital gains can be defined simply as the money gained on an investment (stock, real estate, etc.). Basically if you buy a stock for $10 and sell it for $20, you have a capital gain of $10.

There are two classes of capital gains:

Capital gains can be defined simply as the money gained on an investment (stock, real estate, etc.). Basically if you buy a stock for $10 and sell it for $20, you have a capital gain of $10.

There are two classes of capital gains:

5/

•Short-Term Capital Gains (STCG):

-Investment held for < 1 year

•Long-Term Capital Gains (LTCG):

- investment held for > 1 year

The two are taxed quite differently. Here's how they are currently taxed (Source: @financialsamura):

•Short-Term Capital Gains (STCG):

-Investment held for < 1 year

•Long-Term Capital Gains (LTCG):

- investment held for > 1 year

The two are taxed quite differently. Here's how they are currently taxed (Source: @financialsamura):

6/ Long-term capital gains are taxed MUCH more favorably: $500 million of LTCG is taxed at a LESSER rate than $100k of STCG.  If you needed a reason to start investing there you go.

If you needed a reason to start investing there you go.

Biden wants to adjust the rates at the top of LTCG, to mitigate this massive tax break.

If you needed a reason to start investing there you go.

If you needed a reason to start investing there you go.Biden wants to adjust the rates at the top of LTCG, to mitigate this massive tax break.

7/ His plan is to raise the tax rate of long-term cap gains over $1 million. The exact numbers are not entirely clear yet, but something like:

20% -> 40%

20% -> 40%

8/ Topic #3: $15k Homebuyer Credit

Millennials have had a tough time buying homes and have had lower home ownership rate compared to prev generations at the same age. Thanks, Boomers.

Biden wants to fix this by providing a $15k credit to FIRST TIME homebuyers.

Millennials have had a tough time buying homes and have had lower home ownership rate compared to prev generations at the same age. Thanks, Boomers.

Biden wants to fix this by providing a $15k credit to FIRST TIME homebuyers.

9/ Obviously sounds great to any first time buyer, but ramifications can be tricky. Will people use 15k to buy homes they can't afford and default in high numbers (aka 2008)? Drive up home prices?

Regardless, if you're a first time buyer, this is something to pay attention to.

Regardless, if you're a first time buyer, this is something to pay attention to.

10/ Topic #4: Corporate Tax

Currently, corps pay a 21% tax. People are frustrated that this isn't enough and Biden wants to address it by raising it to 28%.

Corps paying their fair share is great. But history has shown that upping corp taxes can have some negative results:

Currently, corps pay a 21% tax. People are frustrated that this isn't enough and Biden wants to address it by raising it to 28%.

Corps paying their fair share is great. But history has shown that upping corp taxes can have some negative results:

11/ When biz’s are forced to pay higher taxes, the burden can be thrown onto the consumer:

•Higher priced goods

•Layoffs

•Less jobs

Will these happen again? Or will govt be able to tax big businesses more without the consumer paying for it?

•Higher priced goods

•Layoffs

•Less jobs

Will these happen again? Or will govt be able to tax big businesses more without the consumer paying for it?

12/ Topic #5: Probability

Obviously, all of the above are proposals and passing legislation is hard. But Biden will have a completely blue Congress for at least his first 2 years.

Passing legislation should be easier for him…in theory.

Obviously, all of the above are proposals and passing legislation is hard. But Biden will have a completely blue Congress for at least his first 2 years.

Passing legislation should be easier for him…in theory.

13/ In reality, it will depend largely on how well Biden can bring together the left and the right.

Regardless, it's important to be conscious of what a new govt means for you and your finances.

I hope you all enjoyed this thread and found some value from it.

Regardless, it's important to be conscious of what a new govt means for you and your finances.

I hope you all enjoyed this thread and found some value from it.

14/ Let me know what you think of Biden’s plan in the comments / DM’s!

As always, I am not a financial advisor. Just a dude that has spent way too much time on Money Twitter and wants to share some thoughts!

As always, I am not a financial advisor. Just a dude that has spent way too much time on Money Twitter and wants to share some thoughts!

15/ If you’re interested in learning more, @M2JaspreetSingh and @GrahamStephan do a great job in their videos. Check them out:

•

•

•

•

Read on Twitter

Read on Twitter