A thread on the exuberance we are seeing in Toronto’s real estate market today

I have said that the housing market in the GTA (suburbs in particular) has “bubble-like” symptoms and this tweet from Jake is an example of that – but let me unpack what I mean more specifically 1/ https://twitter.com/mortgagejake/status/1349020706248536078

I have said that the housing market in the GTA (suburbs in particular) has “bubble-like” symptoms and this tweet from Jake is an example of that – but let me unpack what I mean more specifically 1/ https://twitter.com/mortgagejake/status/1349020706248536078

Some of you have noted that economists have been calling Toronto a bubble for years – why is this different?

Firstly, economists often call any housing market that they believe is “overvalued” a bubble

While high prices are important, they’re not the most important factor 2/

Firstly, economists often call any housing market that they believe is “overvalued” a bubble

While high prices are important, they’re not the most important factor 2/

The other, and arguably more important factor is when house prices are driven by “behavioural factors” vs fundamental factors.

I describe some of these behavioural factors in this post from the summer of 2016 3/ https://www.movesmartly.com/articles/2016/07/first-signs-of-a-real-estate-bubble-in-toronto

I describe some of these behavioural factors in this post from the summer of 2016 3/ https://www.movesmartly.com/articles/2016/07/first-signs-of-a-real-estate-bubble-in-toronto

But in short, “behavioural factors” refers to periods when people’s buying decisions are largely driven by the belief that prices will only be higher tomorrow, and that prices can’t come done.

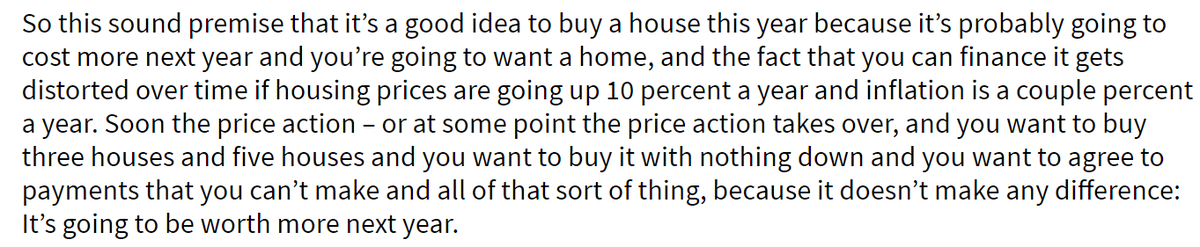

This quote from Warren Buffett describes how housing bubbles develop 4/

This quote from Warren Buffett describes how housing bubbles develop 4/

In 2015/16, the behavioural factors we saw on the ground first were a surge in demand from optimistic investors.

Today things are different.

The exuberance we are seeing appears to be largely led by end users, not investors.

What does this look like on the ground? 5/

Today things are different.

The exuberance we are seeing appears to be largely led by end users, not investors.

What does this look like on the ground? 5/

71 people competing on the same home.

The “winning” buyer paying $140K (or 17%) more than what a similar house 8 doors away sold for 2 months ago.

Why are people doing this? 6/

The “winning” buyer paying $140K (or 17%) more than what a similar house 8 doors away sold for 2 months ago.

Why are people doing this? 6/

Because when buyers see home prices rising by 20+% per year (which is the trend in the suburbs) it leads to a belief that if they don’t buy a home now.....they’ll never be able to afford one 7/

If they don’t buy the $900K house they are bidding on today, in 6 months that same house will be worth $1M

So it doesn’t matter if they over pay by $100K because they would just be losing 6 months appreciation – it will keep going up after that.

That's how some buyers think 8/

So it doesn’t matter if they over pay by $100K because they would just be losing 6 months appreciation – it will keep going up after that.

That's how some buyers think 8/

This urgency and belief is further reinforced by how resilient Toronto’s housing market was in 2020 – a year when homebuyers were told that house prices would fall because of a severe recession.

What message did buyer stake from that? 9/

What message did buyer stake from that? 9/

If home prices didn’t crash:

“with our economy in slow motion, oil being given away, millions of Canadians on income support and a greater % of mortgages not being paid than we’ve seen since the Great Depression”

then nothing can make house prices crash. 10/

“with our economy in slow motion, oil being given away, millions of Canadians on income support and a greater % of mortgages not being paid than we’ve seen since the Great Depression”

then nothing can make house prices crash. 10/

I’m not saying these views that buyers have are correct.

I’m just trying to unpack the psychology that drives housing bubbles in general and the current exuberance in particular. 11/

I’m just trying to unpack the psychology that drives housing bubbles in general and the current exuberance in particular. 11/

Where the market in the GTA goes from here is incredibly hard to predict.

It could fizzle out in a few months due to buyer fatigue.

If enough buyers get frustrated and decide to “take a break” this could take some of the heat out of the market

12/

It could fizzle out in a few months due to buyer fatigue.

If enough buyers get frustrated and decide to “take a break” this could take some of the heat out of the market

12/

But it could also continue to accelerate for some time.

Especially with money being given away and policy makers not showing any concern about these trends – it’s hard to say what’s going to stop this runaway train. 13/

Especially with money being given away and policy makers not showing any concern about these trends – it’s hard to say what’s going to stop this runaway train. 13/

And as concerned as I am by these trends – I’m still looking at buying a property.

I buy defensively & for the long term.

The one thing I’ll never do is compete with 70 other buyers and pay 17% more than the most recent comparable sale.

And neither should you! 14/

I buy defensively & for the long term.

The one thing I’ll never do is compete with 70 other buyers and pay 17% more than the most recent comparable sale.

And neither should you! 14/

If you’re a buyer, you need to proceed cautiously.

This market could turn on a dime and if you end up significantly overpaying you could find yourself in a jam if your bank doesn’t appraise the house for the price you paid for it.

Be Careful! /

This market could turn on a dime and if you end up significantly overpaying you could find yourself in a jam if your bank doesn’t appraise the house for the price you paid for it.

Be Careful! /

Read on Twitter

Read on Twitter