1/ If you're trying to value DeFi assets with traditional valuation ratios, use Price to Book Value (not Price to Earnings)

Why?

Why?

2/ In general, earnings are more volatile and at this stage in particular, they are more complicated to compute and normalize across protocols—both of which make earnings a less useful point of comparison than book value.

3/ Take MKR as an example – earnings would have been negative for much of the last year due solely to events around Black Thursday. You couldn’t compute a PE for MKR during that period, full stop.

4/ But even if MKR’s earnings had been temporarily low instead of negative, does that single event make Maker's balance sheet materially less long-term monetizable?

Maybe? But a PE ratio would reflect a rather extreme opinion.

Maybe? But a PE ratio would reflect a rather extreme opinion.

5/ Moreover, most DeFi protocols aren’t really focused on optimizing earnings yet and differences in business models (which are likely to converge longer term) further complicate earnings as a primary point of comparison.

6/ In other words, using an earnings ratio yields a lot of noise that isn’t actually related to the long-term prospects of a protocol.

7/ Price to Book Value, on the other hand, reflects the market’s perception of the potential for a protocol to monetize its balance sheet in the future. It answers the question “how much is the market willing to pay per unit of balance sheet?”

8/ Book Value = assets - liabilities = TVL (being overly simplistic here but this is roughly how it works)

Book value is a lower level metric than earnings (as earnings are flows produced from a balance sheet) and thus more standardized across protocols.

Book value is a lower level metric than earnings (as earnings are flows produced from a balance sheet) and thus more standardized across protocols.

9/ Given that book value is easier to find and normalize than earnings, you might expect that balance sheet-based ratios are better at grouping similar financial protocols...

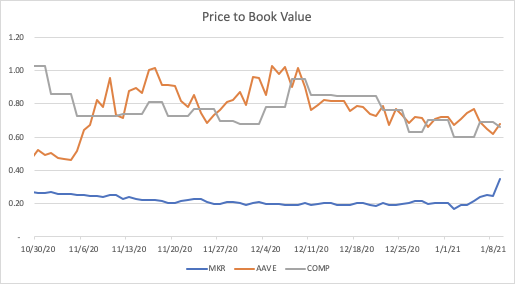

Let’s look at recent pricing data from lending protocols.

Let’s look at recent pricing data from lending protocols.

12/ Predictably, PE ratios exhibit much more volatility and provide a noisier picture.

PB ratios, though, are more stable and interestingly seem to have split the peer set into 2 groups: Aave and Compound in one group, and Maker in the other.

PB ratios, though, are more stable and interestingly seem to have split the peer set into 2 groups: Aave and Compound in one group, and Maker in the other.

13/ Based on the structural differences between these projects, it would make a lot of sense for Aave and Compound to be grouped separately from Maker!

It is easier to explain and is likely more reflective of the metrics that today’s market actually tracks.

It is easier to explain and is likely more reflective of the metrics that today’s market actually tracks.

14/ TVL is on CoinGecko and DeFiPulse, two of the most popular sources for DeFi metrics – whereas earnings are not publicly available free of charge in any robust way yet.

15/ In sum, Price to Book is a more generalizable, more widely accessible, and frankly (at this stage) more logical valuation ratio to compare DeFi assets with.

16/ ps. This is specific to financial crypto protocols. Traditional financial institutions like banks are valued against book value while that wouldn’t make sense for a SaaS business with few tangible assets on its books. In valuation, there’s no one-size-fits-all

Read on Twitter

Read on Twitter