The good, the bad, and the unknowns of owning $FSRV

@rubicon59 @mukund @BluSuitInvest @skaushi @alexkagin @GaedkeMatt @valwithcatalyst @locogekko @GetBenchmarkCo @UnrivaledInvest

A thread

@rubicon59 @mukund @BluSuitInvest @skaushi @alexkagin @GaedkeMatt @valwithcatalyst @locogekko @GetBenchmarkCo @UnrivaledInvest

A thread

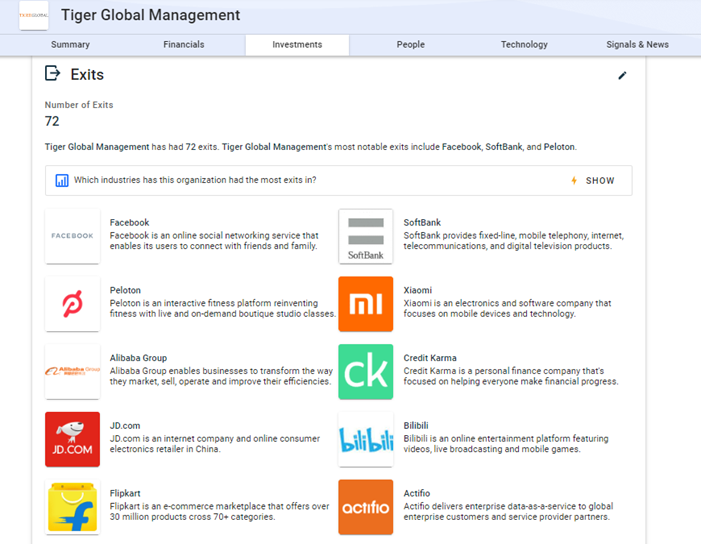

They have a partnership with Affirm. Those folks who $AFRM cannot fix up with credit (non-prime) goes to Katapult.

They have a partnership with Affirm. Those folks who $AFRM cannot fix up with credit (non-prime) goes to Katapult.They have integrated 50 of their merchants on the Affirm Connect waterfall and have identified around 900 merchants for the future.

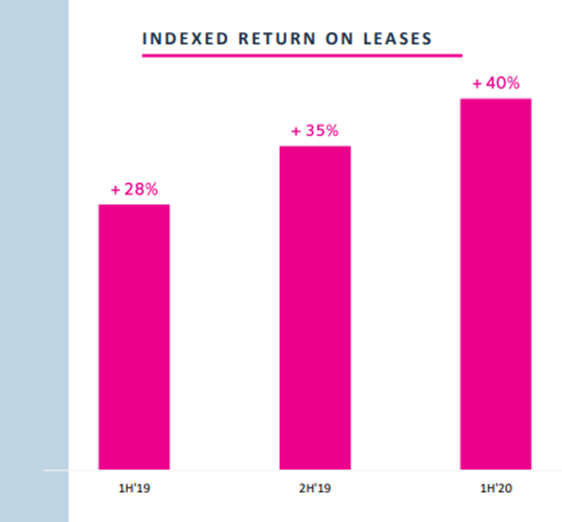

The business might be countercyclical as revenue may grow in recession as non-prime customers are more likely to avail their services for purchases as they can’t afford to make durable purchases during these difficult times.

The business might be countercyclical as revenue may grow in recession as non-prime customers are more likely to avail their services for purchases as they can’t afford to make durable purchases during these difficult times.Their return on lease improved during COVID

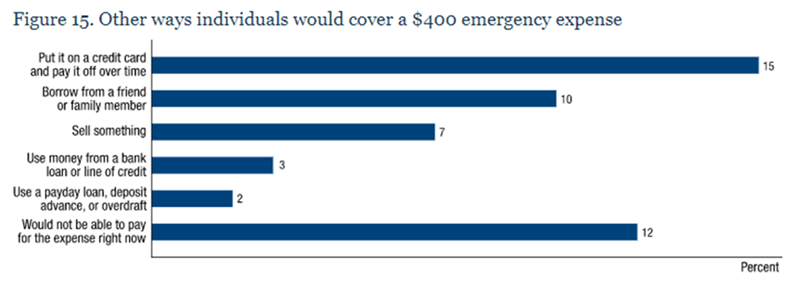

Potential TAM of Non-prime customers is enormous and would proliferate. For example, one study by FED in 2019 found that a large majority of people wouldn’t be able to cover expense it in case of an emergency expense. Those who can most probably use Credit Card. Scary!

Potential TAM of Non-prime customers is enormous and would proliferate. For example, one study by FED in 2019 found that a large majority of people wouldn’t be able to cover expense it in case of an emergency expense. Those who can most probably use Credit Card. Scary!

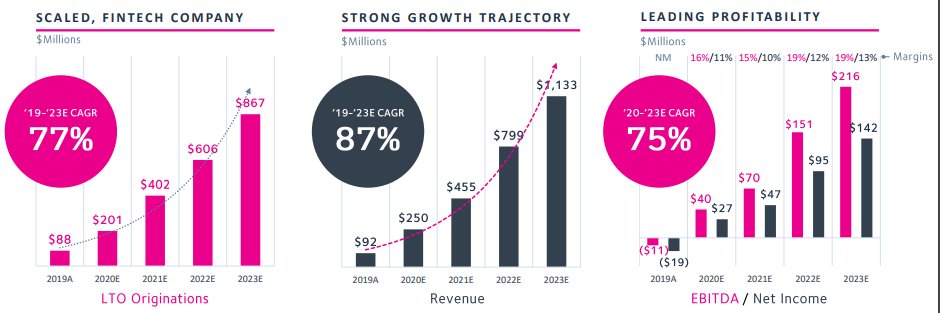

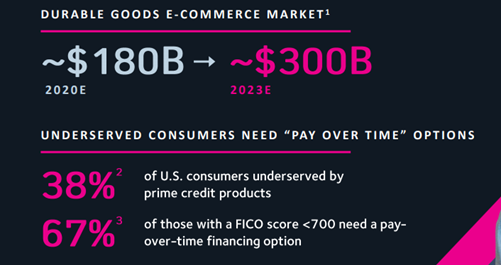

How is revenue recorded? Does it incorporate Gross Merchandise Value, i.e. The fridge a customer buys, is it included within the top line along with transaction fees and commission? If so, the growth expected for 2020 and beyond (shown above) could be inflated

How is revenue recorded? Does it incorporate Gross Merchandise Value, i.e. The fridge a customer buys, is it included within the top line along with transaction fees and commission? If so, the growth expected for 2020 and beyond (shown above) could be inflated

Breakdown of revenue is not given? What if the revenue is stemming from a few big merchants? There is a concentration risk.

Breakdown of revenue is not given? What if the revenue is stemming from a few big merchants? There is a concentration risk.

Are they rising Interest Rates risk? We already are seeing 10 year UST rising. Can the business model be equally effective in a hawkish environment? At the moment they pay off merchants through revolving credit lines before they can recover the lease from the customer.

Are they rising Interest Rates risk? We already are seeing 10 year UST rising. Can the business model be equally effective in a hawkish environment? At the moment they pay off merchants through revolving credit lines before they can recover the lease from the customer.

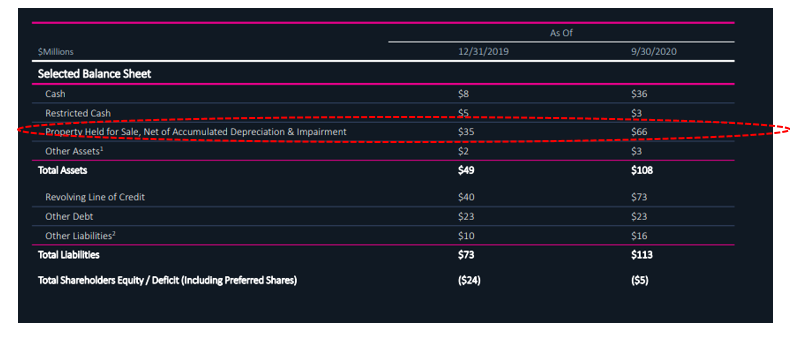

There is an issue of credit risk as we are dealing with non-prime. From their balance sheet, it seems they are offloading their lease by taking a spread cut as assets recorded are lower than the origination amount).

There is an issue of credit risk as we are dealing with non-prime. From their balance sheet, it seems they are offloading their lease by taking a spread cut as assets recorded are lower than the origination amount).Negative equity in the past could be due to bad credit

This company could be a potential multi-bagger, but at the moment we will be seeking more information and details from the complete financials/prospectus once the merger goes through.

This company could be a potential multi-bagger, but at the moment we will be seeking more information and details from the complete financials/prospectus once the merger goes through. Hence we are not adding any position.

If you like this thread, don’t forget to join our Telegram chat group to discuss all things investments and the market: https://t.me/joinchat/J90VAhuJOZsEBhmxJ_26hw

Our Youtube channel: https://www.youtube.com/channel/UCP0BX-hodOY6a84l4beIetQ

Our Youtube channel: https://www.youtube.com/channel/UCP0BX-hodOY6a84l4beIetQ

Read on Twitter

Read on Twitter

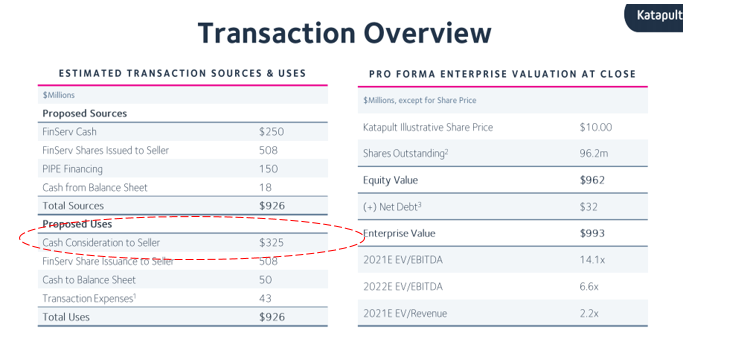

Around 82% of proceeding from the SPAC is being used to fund shareholder sell out

Around 82% of proceeding from the SPAC is being used to fund shareholder sell out