If you purchased $1 of all 1997 IPOs on 12/31/97, $1 of all 1998 IPOs on 12/31/98, and $1 of all 1999 IPOs on 12/31/99 at their respective market weights on those days (then did nothing), how much is that $3 worth as of 9/30/2020?

*$3 invested in the Russell 3000 is worth ~$14.

*$3 invested in the Russell 3000 is worth ~$14.

Before getting into the details... huge thanks to @Jesse_Livermore for helping me answer the "modern day Nifty 50" question that has nagged me. For more details on the remarkable engine he built to tackle these sorts of questions (and much more), see here: https://twitter.com/Jesse_Livermore/status/1339035127700213761?s=20

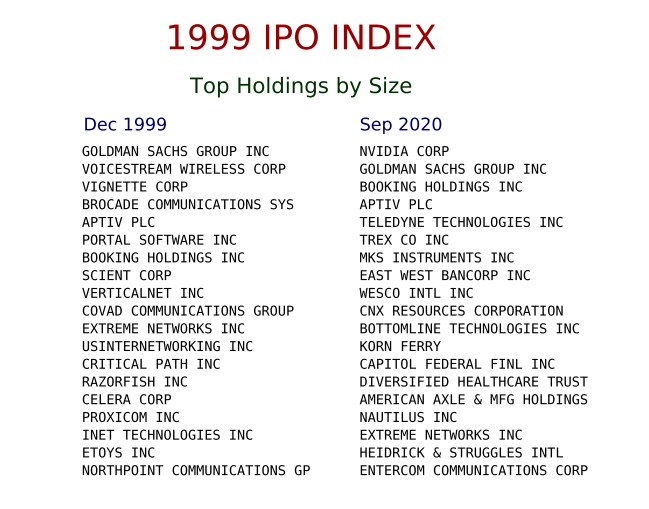

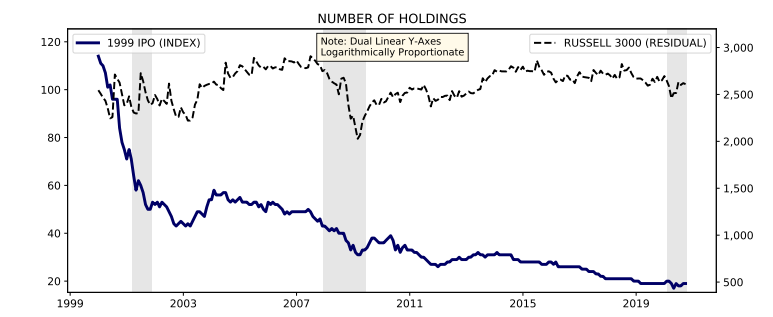

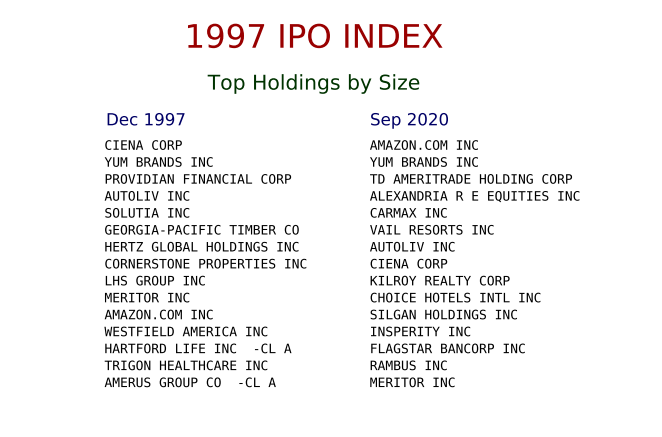

To the details... let's start with 1999 which is the most challenged "vintage" as 12/31/1999 is pretty darn close to the peak of the http://dot.com boom. We can see the largest holdings as of 12/31/99 and 9/30/20.

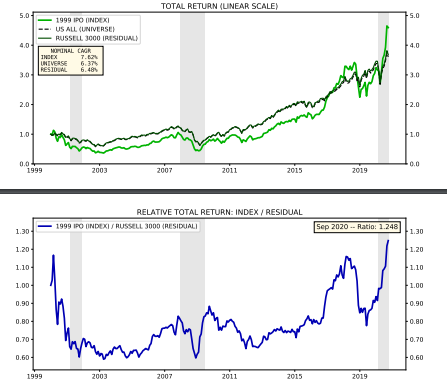

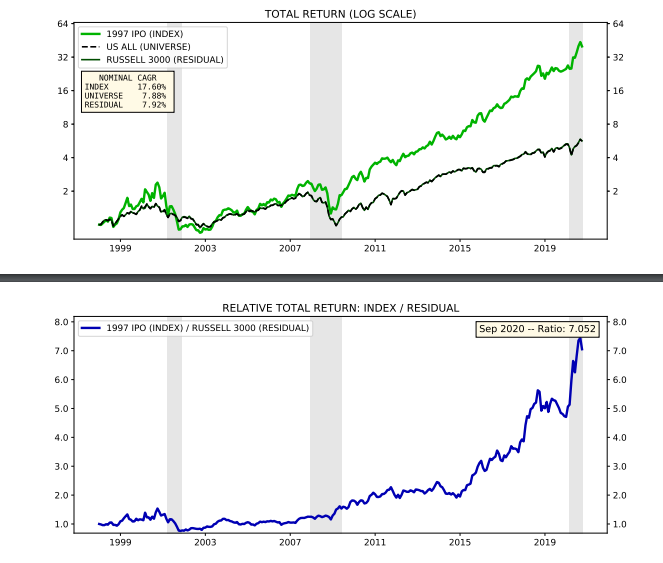

And the returns of the 1999 vintage... despite coming out the gate with underperformance of -26%, -4%, and -14% to the Russell 3000 Index, the 1999 "vintage" has actually now outperformed.

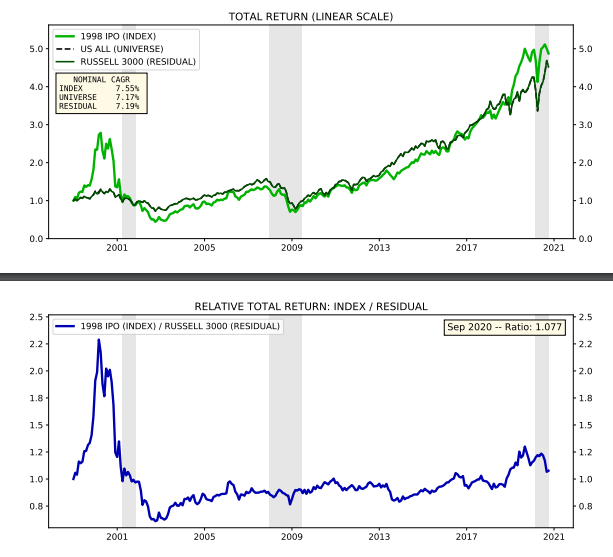

The 1998 IPO vintage fared similarly, despite a lack of a headline name such as the 1999 IPO vintage has with Nvidia. Note American Tower is now the largest weight (which was just written up in a blog post by @lhamtil https://fortunefinancialadvisors.com/blog/breaking-down-the-cell-tower-business-with-morningstars-matthew-dolgin/)

And the 1998 IPO Vintage results.

After a strong start out of the gate and subsequent crash, the index has also slightly outperformed, but largely been in line with the broader market.

After a strong start out of the gate and subsequent crash, the index has also slightly outperformed, but largely been in line with the broader market.

And while performance was challenge during the http://dot.com bust and pretty in-line for most of the following 12 years... it has taken off over the past decade.

The $3 invested in the three "vintages" is worth > $50 today for someone who held.

More interesting (to me) is that all three kept up with the broader market, despite receiving no first day "discount" required to raise capital, and the huge outperformance a decade later.

/fin

More interesting (to me) is that all three kept up with the broader market, despite receiving no first day "discount" required to raise capital, and the huge outperformance a decade later.

/fin

Read on Twitter

Read on Twitter