0/ @SushiSwap's evolution from yield farm to "blue chip" over the past few months has been incredible to watch

With multiple features going live this year, I wanted to lay out how Sushi is differentiating itself from @UniswapProtocol and what this means https://www.delphidigital.io/reports/uniswap-vs-sushiswap-a-tale-of-two-dexes/

With multiple features going live this year, I wanted to lay out how Sushi is differentiating itself from @UniswapProtocol and what this means https://www.delphidigital.io/reports/uniswap-vs-sushiswap-a-tale-of-two-dexes/

1/ First off, it's undeniable that Uniswap has more traction and individual users

But not many realize there are quite a few tokens that enjoy superior liquidity on Sushiswap

Consequently, Sushiswap is the only DEX (barring Curve) whose volumes come close to Uniswap

But not many realize there are quite a few tokens that enjoy superior liquidity on Sushiswap

Consequently, Sushiswap is the only DEX (barring Curve) whose volumes come close to Uniswap

2/ Margin trading, integration incentives, cross-chain swaps, co-building yEarn's Deriswap, and new AMM model are just a few things laid out on Sushiswap's roadmap for 2021

Each of these features improves Sushiswap and $SUSHI value accrual

Each of these features improves Sushiswap and $SUSHI value accrual

3/ There are cultural differences in the way both operate too

Uniswap v3 will likely change the game, but nobody knows what exactly it entails barring the team and perhaps some insiders

Sushiswap on the other hand has a high level of community involvement and transparency

Uniswap v3 will likely change the game, but nobody knows what exactly it entails barring the team and perhaps some insiders

Sushiswap on the other hand has a high level of community involvement and transparency

4/ As a result, Sushiswap has captured the "community-owned" narrative and continues to build on it

Uniswap is also community owned, but the lack of transparency wrt v3 (which is sort of understandable) differs from Sushiswap where the community knows exactly what's up

Uniswap is also community owned, but the lack of transparency wrt v3 (which is sort of understandable) differs from Sushiswap where the community knows exactly what's up

5/ Sushiswap has lots of things going for it in terms of integrations, thanks in part to its place in the yEarn ecosystem

Uniswap's first mover advantage gave it tons of integrations, but if it doesn't counter the integration incentives Sushiswap is setting up, that could change

Uniswap's first mover advantage gave it tons of integrations, but if it doesn't counter the integration incentives Sushiswap is setting up, that could change

6/ The community-centric narrative around Sushiswap is great, but it's important to realize Uniswap is the one that built out this AMM tech that does billions of $ in weekly volume

Uniswap v1 was built on a $100k grant and ingenuity

AMMs are arguably DeFi's biggest innovation

Uniswap v1 was built on a $100k grant and ingenuity

AMMs are arguably DeFi's biggest innovation

7/ For fundamentals:

Sushiswap liquidity has been steadily trending up since Nov 2020, making it the 2nd largest general purpose DEX

Sushiswap liquidity has been steadily trending up since Nov 2020, making it the 2nd largest general purpose DEX

8/ Sushiswap is also the only DEX where volume is comparable to Uniswap, even though there's a sizeable gap between them

Uniswap is still the top DEX by a margin, but if you don't see Sushiswap catching up, you should see an optometrist

Uniswap is still the top DEX by a margin, but if you don't see Sushiswap catching up, you should see an optometrist

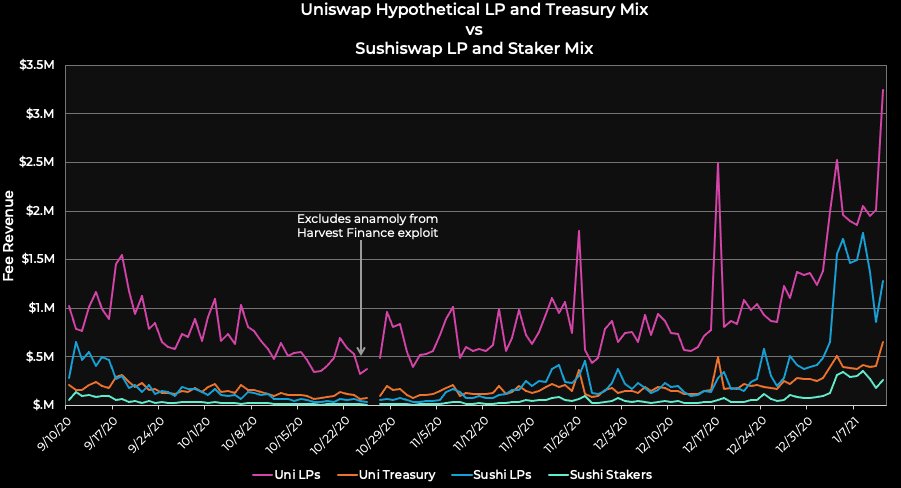

9/ Value accrual is similar but not exactly the same

Both investment theses are rooted in cash flow generation via a 0.05% fee on trading volume

Uniswap's fees go to a community managed treasury

Sushiswap's fees go directly to $SUSHI stakers

Both investment theses are rooted in cash flow generation via a 0.05% fee on trading volume

Uniswap's fees go to a community managed treasury

Sushiswap's fees go directly to $SUSHI stakers

10/ Uniswap's 0.05% can only go live in March 2021 at the earliest while Sushiswap's has been on since Sep 2020

What if Uniswap turned that fee on at the same time as Sushiswap?

This is the result

What if Uniswap turned that fee on at the same time as Sushiswap?

This is the result

11/ $UNI's high market cap IMO is because the prospective cash flows are insane for a protocol that isn't even 3 years old

But $SUSHI value accrual is straightforward, since stakers directly receive fee income, and it's not too far away from $UNI's

Massive potential in both

But $SUSHI value accrual is straightforward, since stakers directly receive fee income, and it's not too far away from $UNI's

Massive potential in both

12/ Long story short: you have to be crazy to think Uniswap v3 isn't going to be mind bending OR to think Sushiswap isn't a real competitor with everything it has achieved and is rolling out this year

13/ The nuance of this argument is tough to capture in a tweet thread, so if this piqued your interest, I recommend you check out the full post: https://www.delphidigital.io/reports/uniswap-vs-sushiswap-a-tale-of-two-dexes/

Read on Twitter

Read on Twitter