When I worked at The Rise Fund, TPG’s $4B impact investing platform, we developed a way to measure & track social impact.

Here's a short thread on how we did it

Here's a short thread on how we did it

1) We called our framework the Impact Multiple of Money (IMM)

You can think of the IMM like you think of the Multiple of Money for financial returns. Just as an investor may earn a 3x financial return on her investment (3x MoM), she may also earn a 3x impact return (3x IMM)

You can think of the IMM like you think of the Multiple of Money for financial returns. Just as an investor may earn a 3x financial return on her investment (3x MoM), she may also earn a 3x impact return (3x IMM)

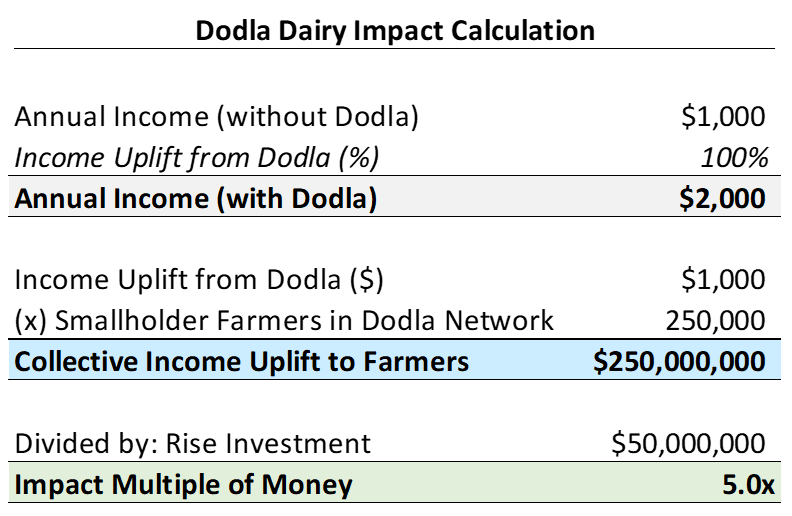

2) Here's an example:

Dodla Dairy is the 3rd-largest dairy producer in India

Working with Dodla, low-income farmers enter long-term contracts that offer reliable daily purchases of milk. This doubles annual income for Dodla’s 250,000 farmers.

Here's how the math might work:

Dodla Dairy is the 3rd-largest dairy producer in India

Working with Dodla, low-income farmers enter long-term contracts that offer reliable daily purchases of milk. This doubles annual income for Dodla’s 250,000 farmers.

Here's how the math might work:

3) The 5x IMM for Dodla Dairy means that for every $1 that Rise invests, we expect to generate $5 of positive social impact.

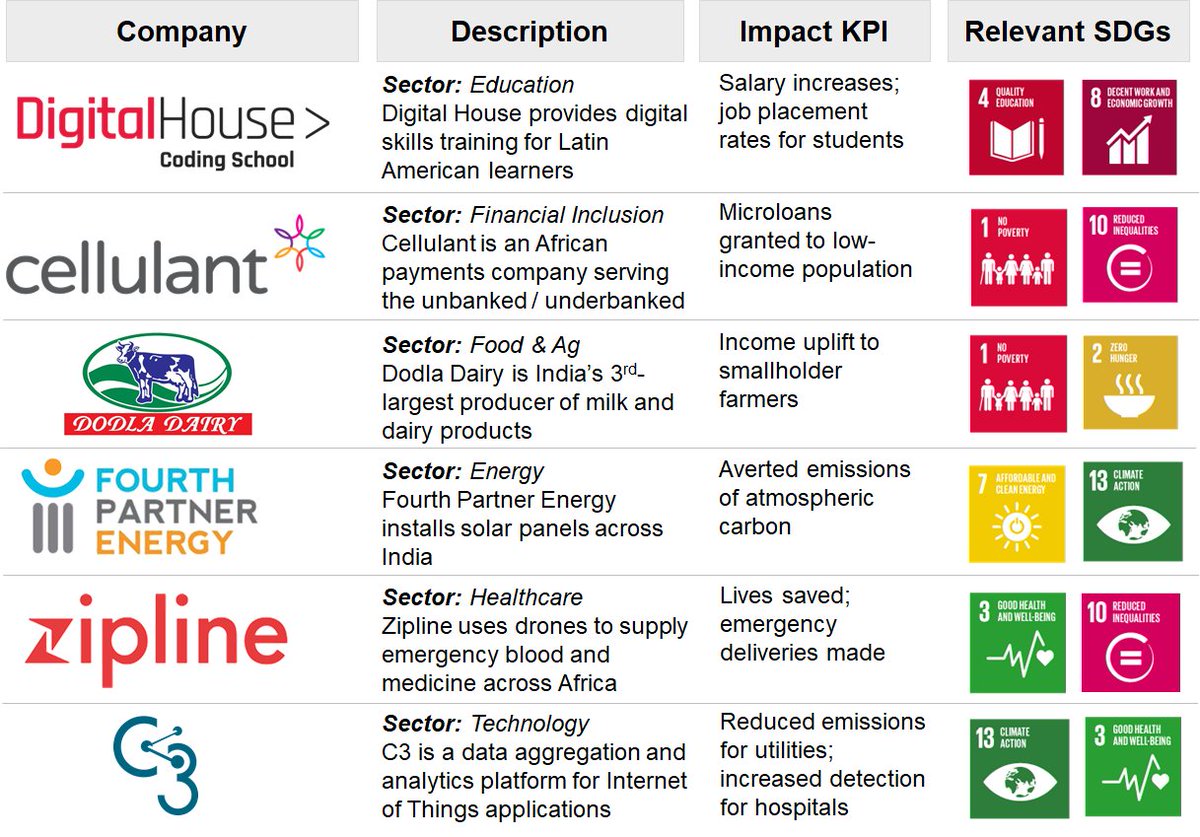

Each IMM calculation is rooted in one or more of the UN's 17 Sustainable Development Goals (SDGs)

Each IMM calculation is rooted in one or more of the UN's 17 Sustainable Development Goals (SDGs)

4) Different sectors typically emphasize different SDGs

Rise invests in six main sectors: Education, Financial Inclusion, Food & Ag, Energy, Healthcare, & Technology

Here are examples of how the impact calculation might work for Rise investments in each sector:

Rise invests in six main sectors: Education, Financial Inclusion, Food & Ag, Energy, Healthcare, & Technology

Here are examples of how the impact calculation might work for Rise investments in each sector:

It’s not a perfect methodology, but I admire how Rise has pushed forward the impact investing field

If you’re interested, here’s a longer piece I wrote about how impact investing translates to venture & why we need a broader definition of impact https://digitalnative.substack.com/p/will-impact-investing-come-to-venture

If you’re interested, here’s a longer piece I wrote about how impact investing translates to venture & why we need a broader definition of impact https://digitalnative.substack.com/p/will-impact-investing-come-to-venture

Read on Twitter

Read on Twitter