http://1.You may not have heard of Polaris. It is a private company making millions out of the care of thousands of vulnerable children in the UK. It is owned by offshore investors based in tax havens (thread).

Polaris owns children’s homes, special residential schools and foster care agencies (including Foster Care Associates), and business is booming in the pandemic. 2/

The company, registered as Nutrius UK Bidco Ltd, has just published its annual accounts showing that it received almost £200 million from local authorities to provide homes for children in the last financial year. It earned an operating profit of £11 million. 3/

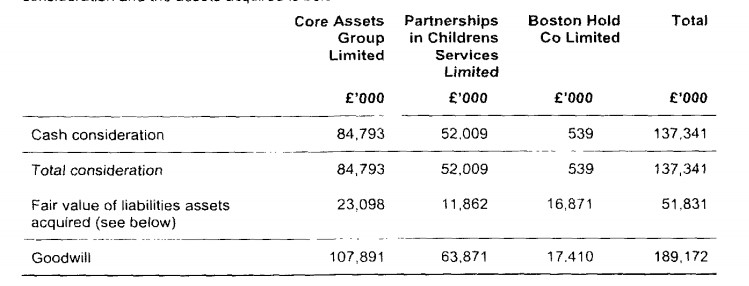

The company has been buying up many of its rivals, including Core Assets and Partnerships in Children’s Services. Competition authorities have shown no interest in reining in their power over local authorities. 4/

As a consequence of this spending spree, the company has borrowings of almost £150 million. It is now paying interest charges of £11 million a year, effectively out of the fees it charges local authorities for care. £11 million that is not spent on children but goes to banks.

Look at these prices being paid for children’s homes and foster care agencies. These companies have limited physical assets, so most of the consideration is goodwill; in effect, the commitment and good name of foster carers, staff in children’s homes and social workers. 6/

That’s £190 million pocketed by the owners of foster care agencies and private children’s homes. Meanwhile, local authorities are having to cut support for the most vulnerable to make ends meet. 7/

Privatisation of children’s services is bad for families, bad for children and bad for the taxpayer. It is a national scandal 8/

The @theNAFP lobby group makes a guest appearance.

Read on Twitter

Read on Twitter