1/ Affirm Holdings, Inc. - $AFRM

Set to IPO on 01/13/2020, Affirm shares are expected to start trading anywhere from $41-$44, a jump from the previously anticipated $33-$38 range.

In this [THREAD ]:

]:

- Overview

- Mgmt

- How It Works

- BNPL Industry

- Financials

Let's go

Set to IPO on 01/13/2020, Affirm shares are expected to start trading anywhere from $41-$44, a jump from the previously anticipated $33-$38 range.

In this [THREAD

]:

]:- Overview

- Mgmt

- How It Works

- BNPL Industry

- Financials

Let's go

2/ Overview:

Affirm is a financial technology services company that offers installment loans to consumers at the point of sale.

Co. Vision: To be as ubiquitous, secure, and convenient as legacy networks, yet far more transparent, honest, and both consumer and merchant centric.

Affirm is a financial technology services company that offers installment loans to consumers at the point of sale.

Co. Vision: To be as ubiquitous, secure, and convenient as legacy networks, yet far more transparent, honest, and both consumer and merchant centric.

3/ Management:

Founded in 2012 by Jeffrey Kaditz, Max Levchin, and Nathan Gettings.

- Jeffery was previously CTO (now gone)

- Nathan was previously CRO (now gone); co-founder of Palantir $PLTR

Founded in 2012 by Jeffrey Kaditz, Max Levchin, and Nathan Gettings.

- Jeffery was previously CTO (now gone)

- Nathan was previously CRO (now gone); co-founder of Palantir $PLTR

4/ Management:

Max Levchin: Founder & Current CEO

- Co-founded Slide, HVF, and PayPal $PYPL (1998)

- Affirm was spun off of HVF in 2012

- Max brings an invaluable amount of knowledge as a software developer. More specifically within FinTech.

Max Levchin: Founder & Current CEO

- Co-founded Slide, HVF, and PayPal $PYPL (1998)

- Affirm was spun off of HVF in 2012

- Max brings an invaluable amount of knowledge as a software developer. More specifically within FinTech.

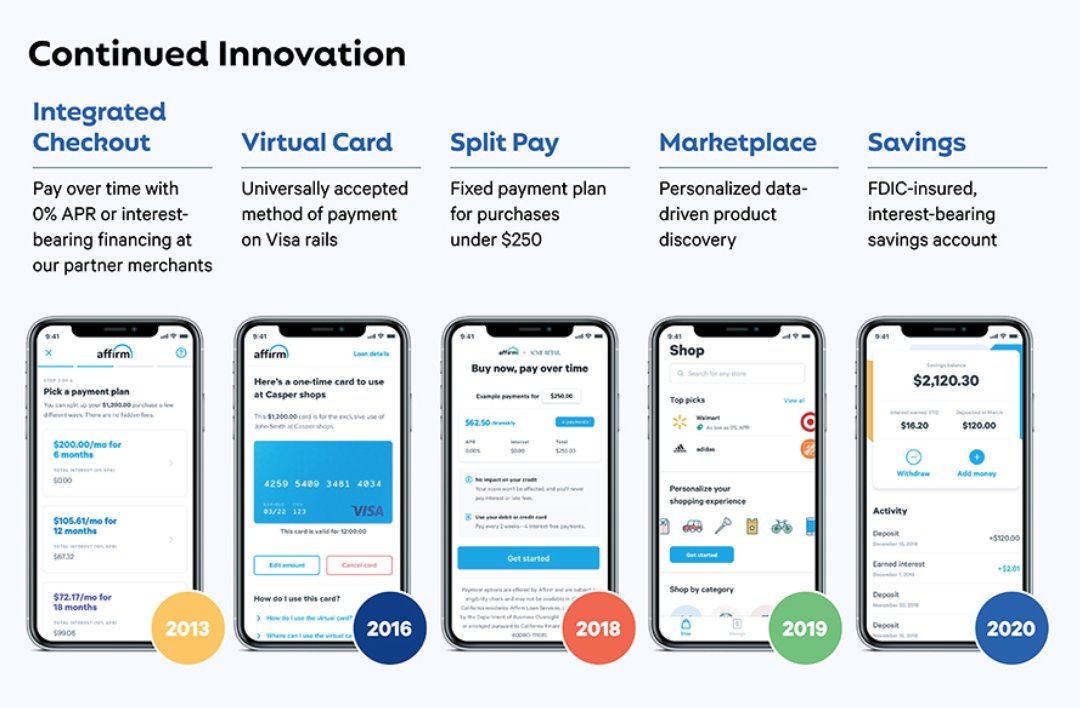

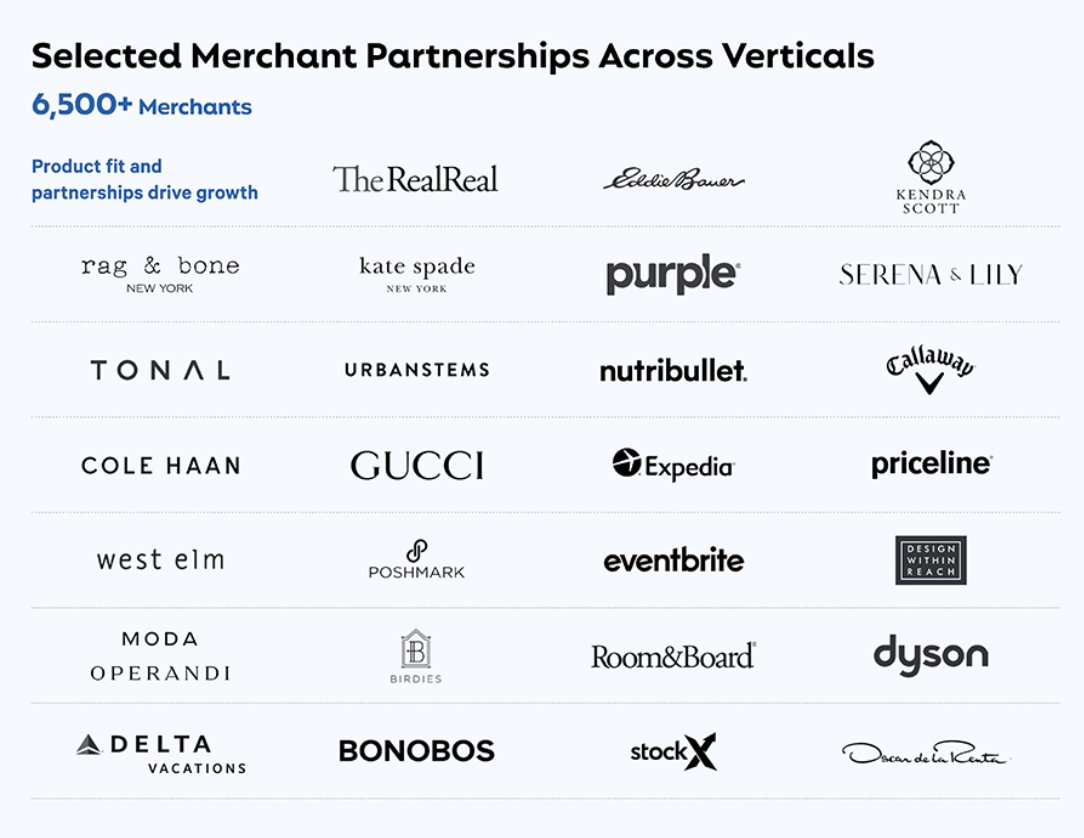

5/ How It Works:

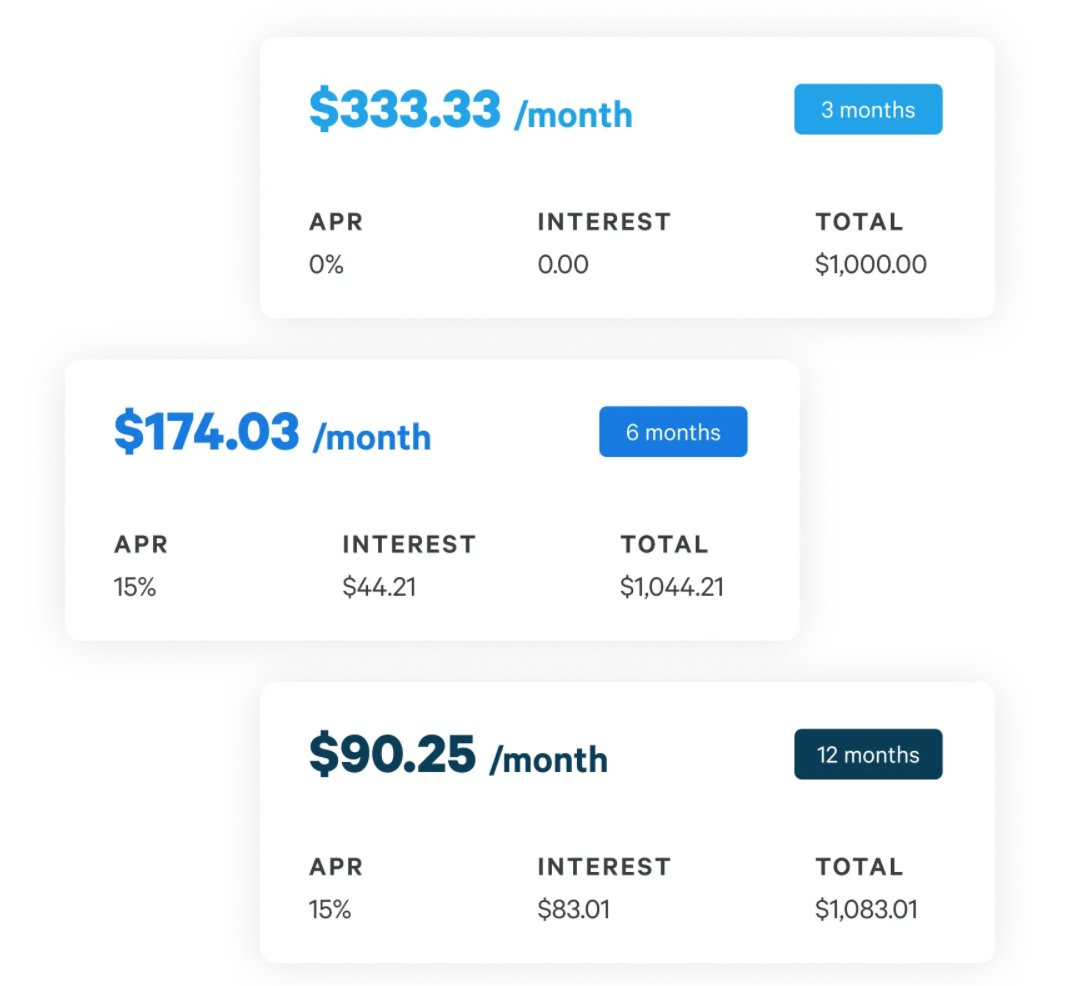

Consumer Side:

1. Fill your cart

- +6,500 Merchants currently offering Affirm services

2. Choose how you pay

- Options usually include 3, 6, or 12-mo. repayment plans

- APR rates range from 0% - 30% based on credit check (does not affect credit score)

Consumer Side:

1. Fill your cart

- +6,500 Merchants currently offering Affirm services

2. Choose how you pay

- Options usually include 3, 6, or 12-mo. repayment plans

- APR rates range from 0% - 30% based on credit check (does not affect credit score)

6/ How It Works:

3. Make easy monthly payments

- Download Affirm App or sign in at http://affirm.com (email and text reminders)

- If Affirm is not offered at your merchant, can get a one-time-use virtual card for online or in-store purchase and pay back over time.

3. Make easy monthly payments

- Download Affirm App or sign in at http://affirm.com (email and text reminders)

- If Affirm is not offered at your merchant, can get a one-time-use virtual card for online or in-store purchase and pay back over time.

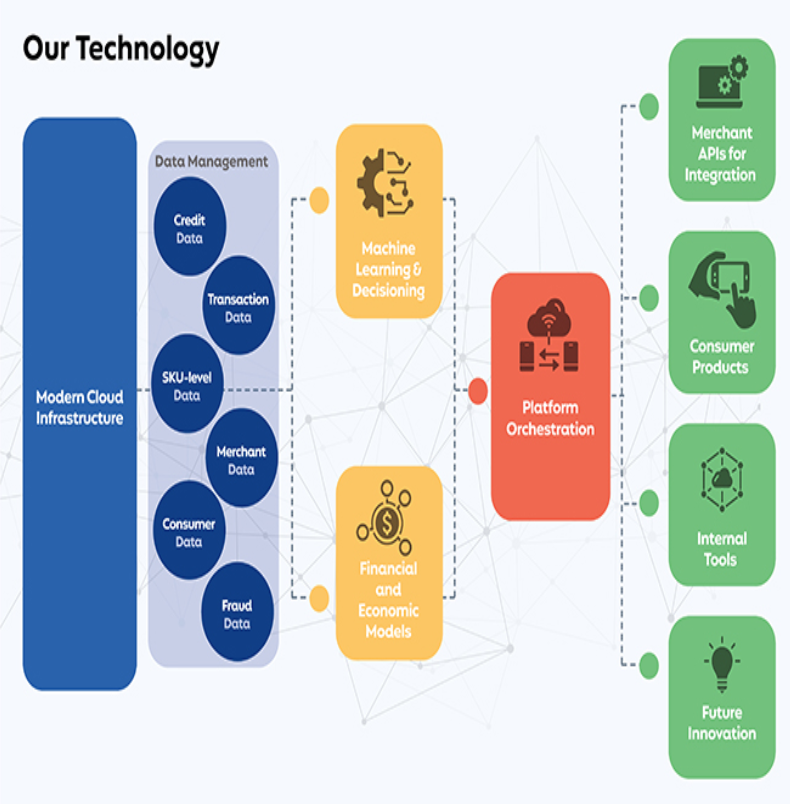

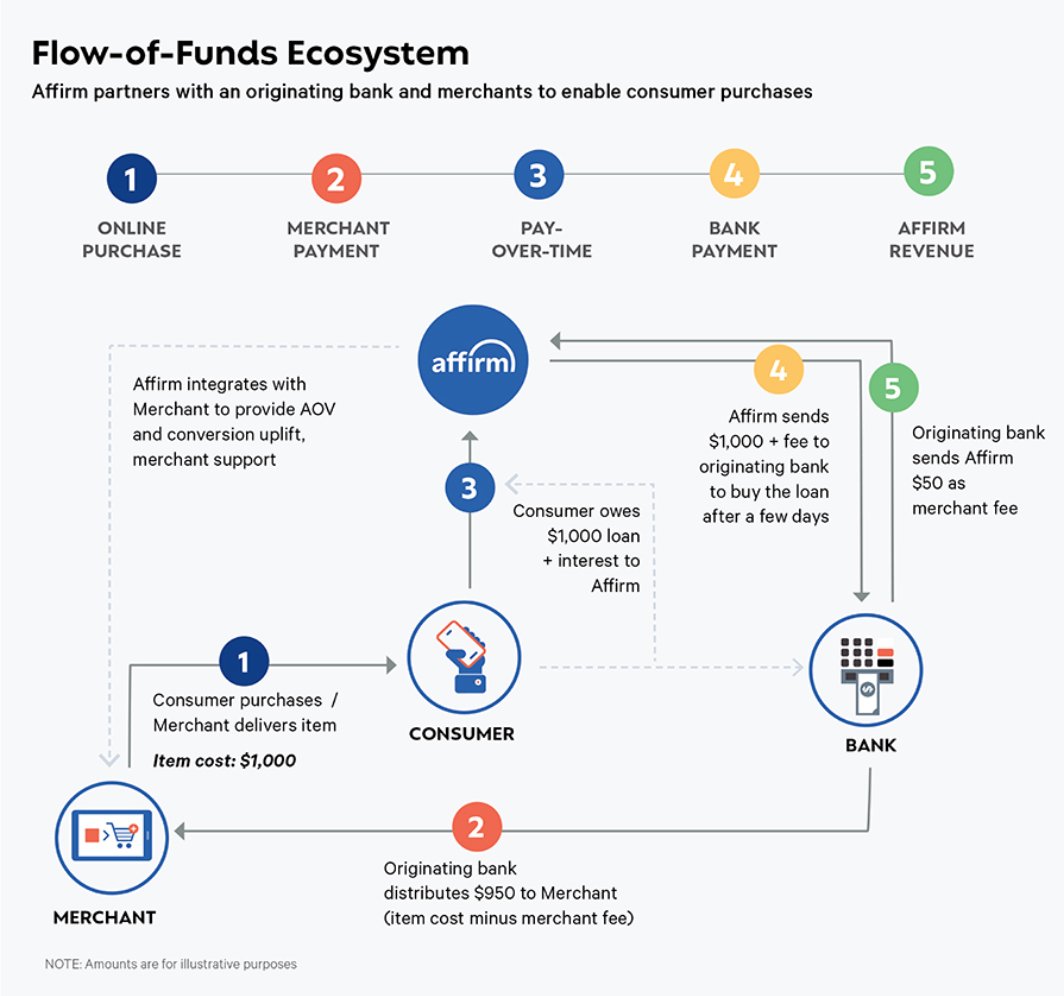

7/ How It Works:

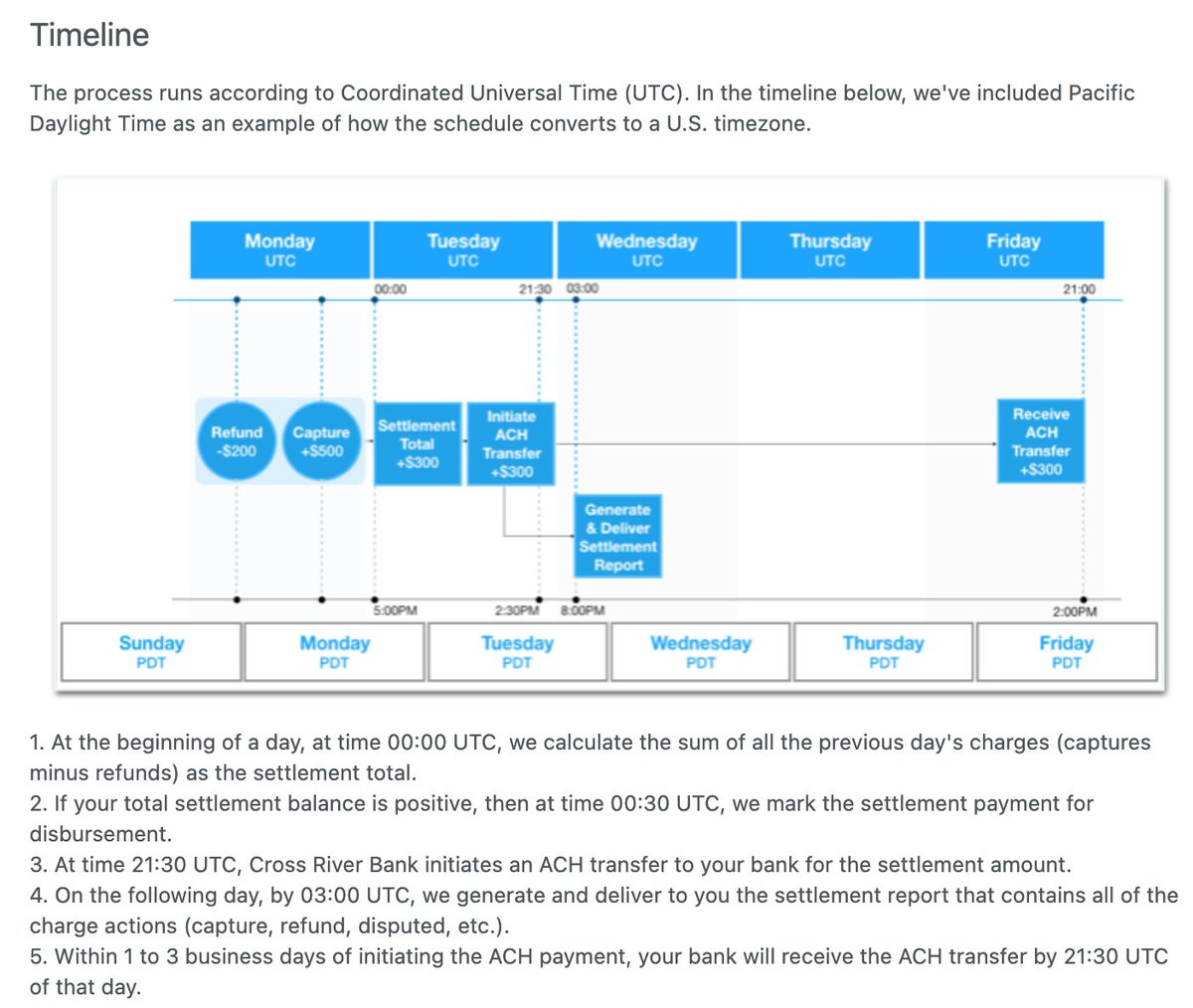

Merchant Side:

- $AFRM is capable of integrating with 31 different e-commerce platforms or directly through their API.

- Receive deposit into your company bank within 1-3 days of the system initiating ACH payment.

Timeline pictured below

Merchant Side:

- $AFRM is capable of integrating with 31 different e-commerce platforms or directly through their API.

- Receive deposit into your company bank within 1-3 days of the system initiating ACH payment.

Timeline pictured below

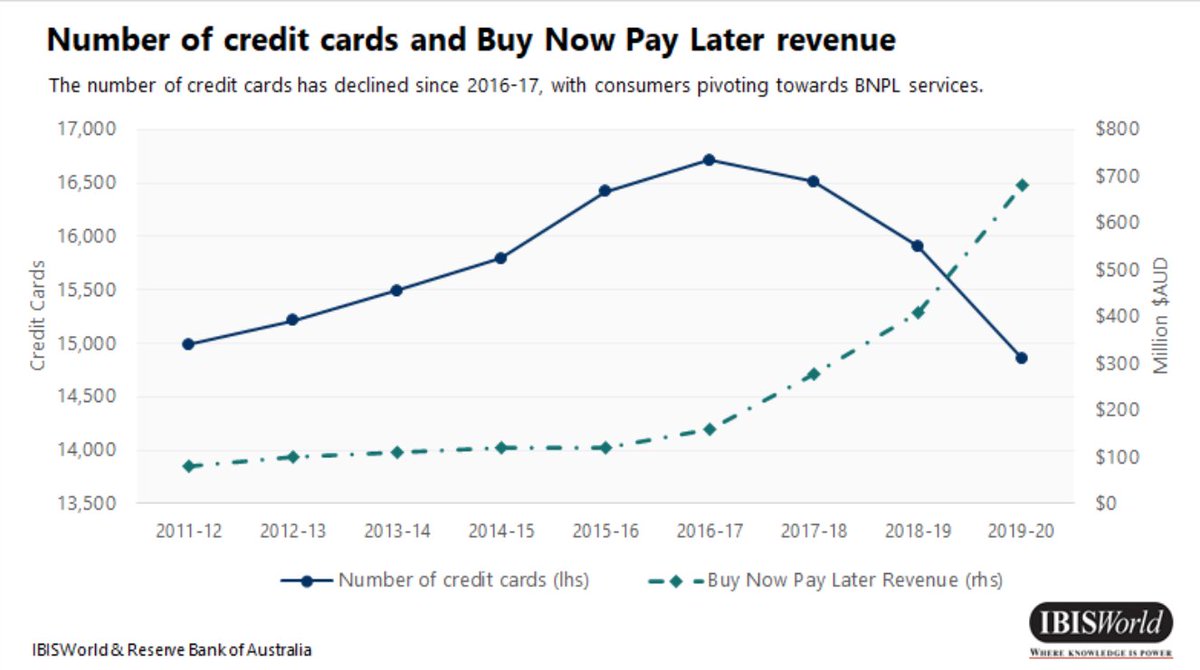

8/ Buy Now Pay Later (BNPL) Industry:

IBISWorld Predicts:

- BNPL will cont. to grow 9.8% annually over the next 5 yrs to $1.1B.

- BNPL will grow 9.1% in 2020-2021, bringing it to $741.5M, as online shopping revenue grows 6.4% this yr to $31.2B and credit card adoption decreases.

IBISWorld Predicts:

- BNPL will cont. to grow 9.8% annually over the next 5 yrs to $1.1B.

- BNPL will grow 9.1% in 2020-2021, bringing it to $741.5M, as online shopping revenue grows 6.4% this yr to $31.2B and credit card adoption decreases.

9/ BNPL:

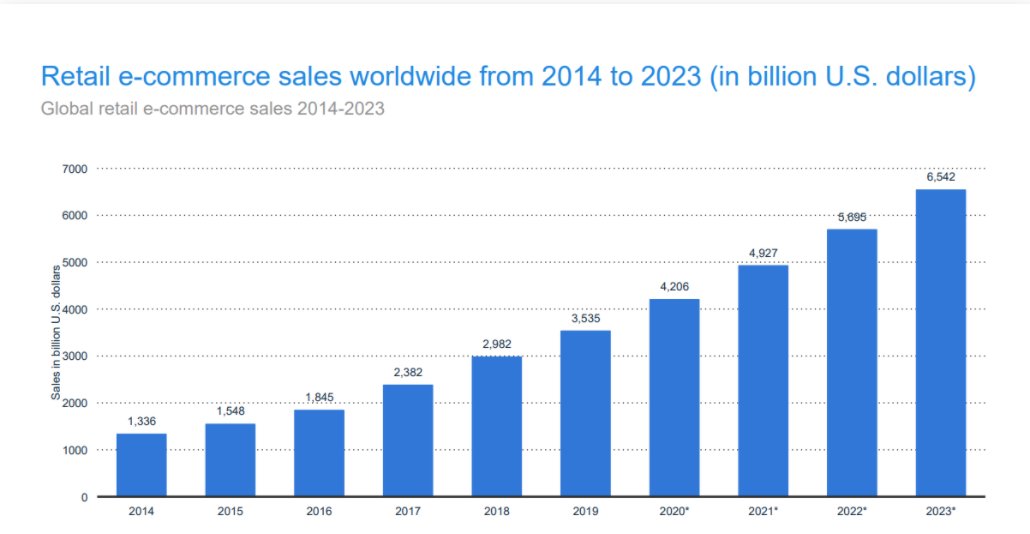

BNPL industry isn't strictly e-commerce focused, but a majority of transactions occur there.

According to Statista, retail e-commerce sales worldwide will reach $6.5 trillion, with only 16% of total retail sales being e-commerce in 2020.

BNPL industry isn't strictly e-commerce focused, but a majority of transactions occur there.

According to Statista, retail e-commerce sales worldwide will reach $6.5 trillion, with only 16% of total retail sales being e-commerce in 2020.

10/ BNPL:

By the end of 2021, Statista predicts 73% of e-commerce sales will occur on a mobile device.

Affirm is poised to capitalize on the millennial transition into the working class.

- Less credit card adoption and more e-commerce sales

- Rated 4.9/5.0 on the app store

By the end of 2021, Statista predicts 73% of e-commerce sales will occur on a mobile device.

Affirm is poised to capitalize on the millennial transition into the working class.

- Less credit card adoption and more e-commerce sales

- Rated 4.9/5.0 on the app store

11/ BNPL:

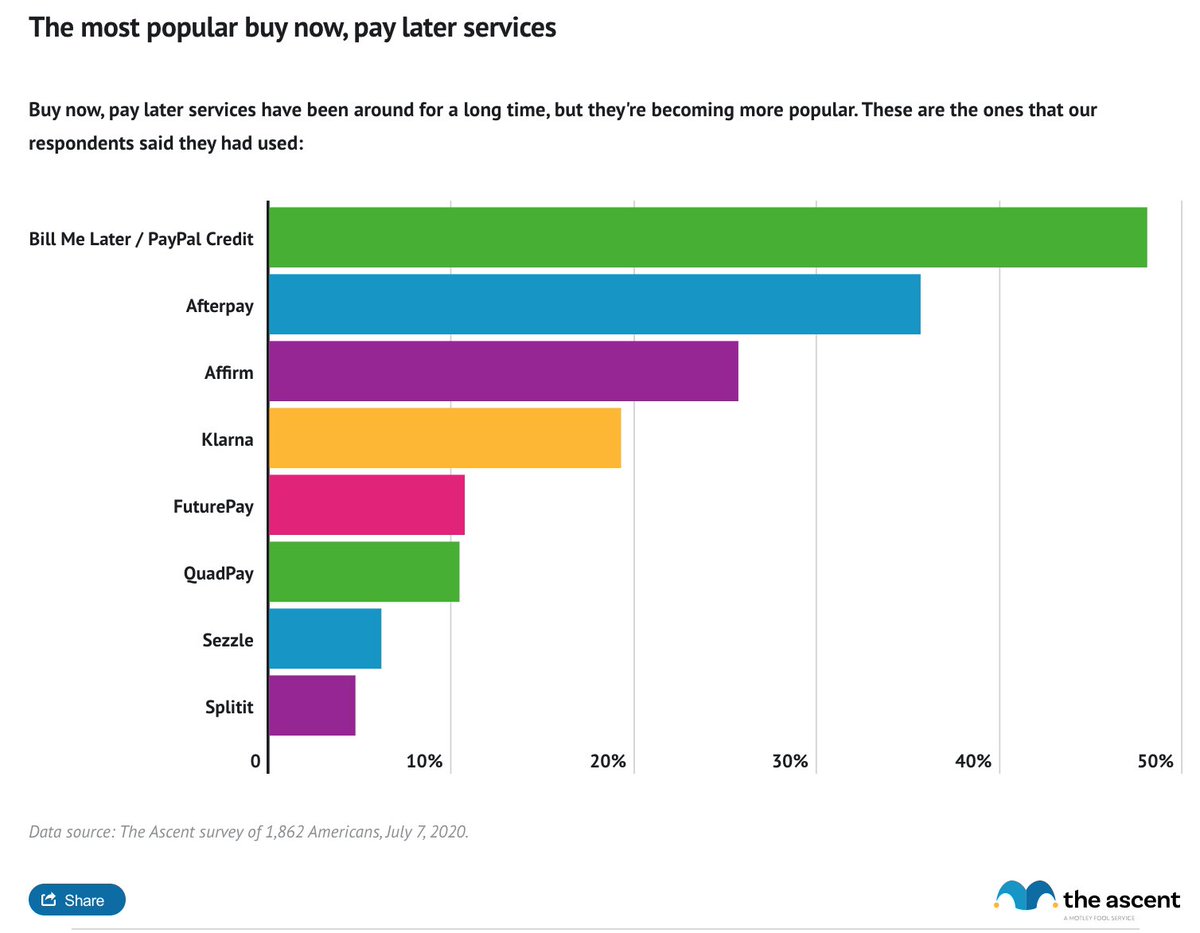

According to a July 2020 Survey of ~1,900 respondents by The Motley Fool, the most popular BNPL services are pictured below.

According to a July 2020 Survey of ~1,900 respondents by The Motley Fool, the most popular BNPL services are pictured below.

12/ Revenue Model:

Merchants

- Merchant contracts

- Fees from converting a sale and powering a payment

- Larger fees on 0% APR transactions

- 0% APR trans. represented 43% of total GMV (YE 2020)

Consumers

- Interest income

- Earn % of interchange fee if the virtual card is used

Merchants

- Merchant contracts

- Fees from converting a sale and powering a payment

- Larger fees on 0% APR transactions

- 0% APR trans. represented 43% of total GMV (YE 2020)

Consumers

- Interest income

- Earn % of interchange fee if the virtual card is used

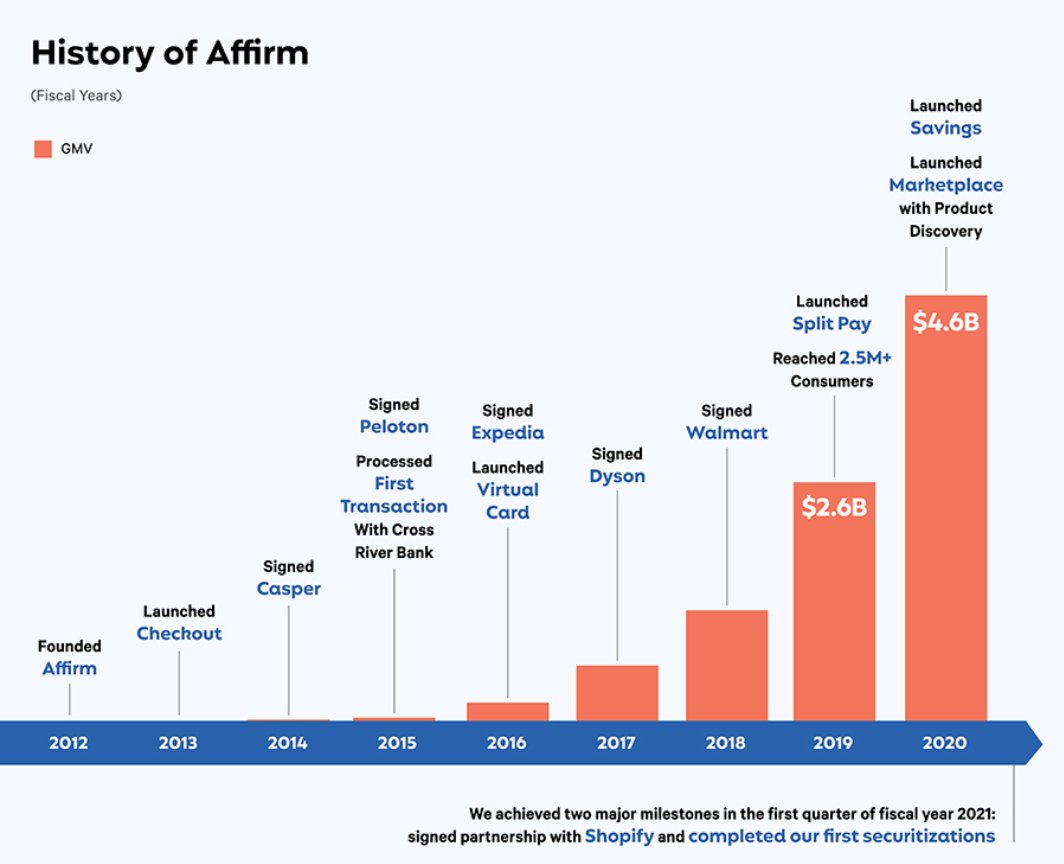

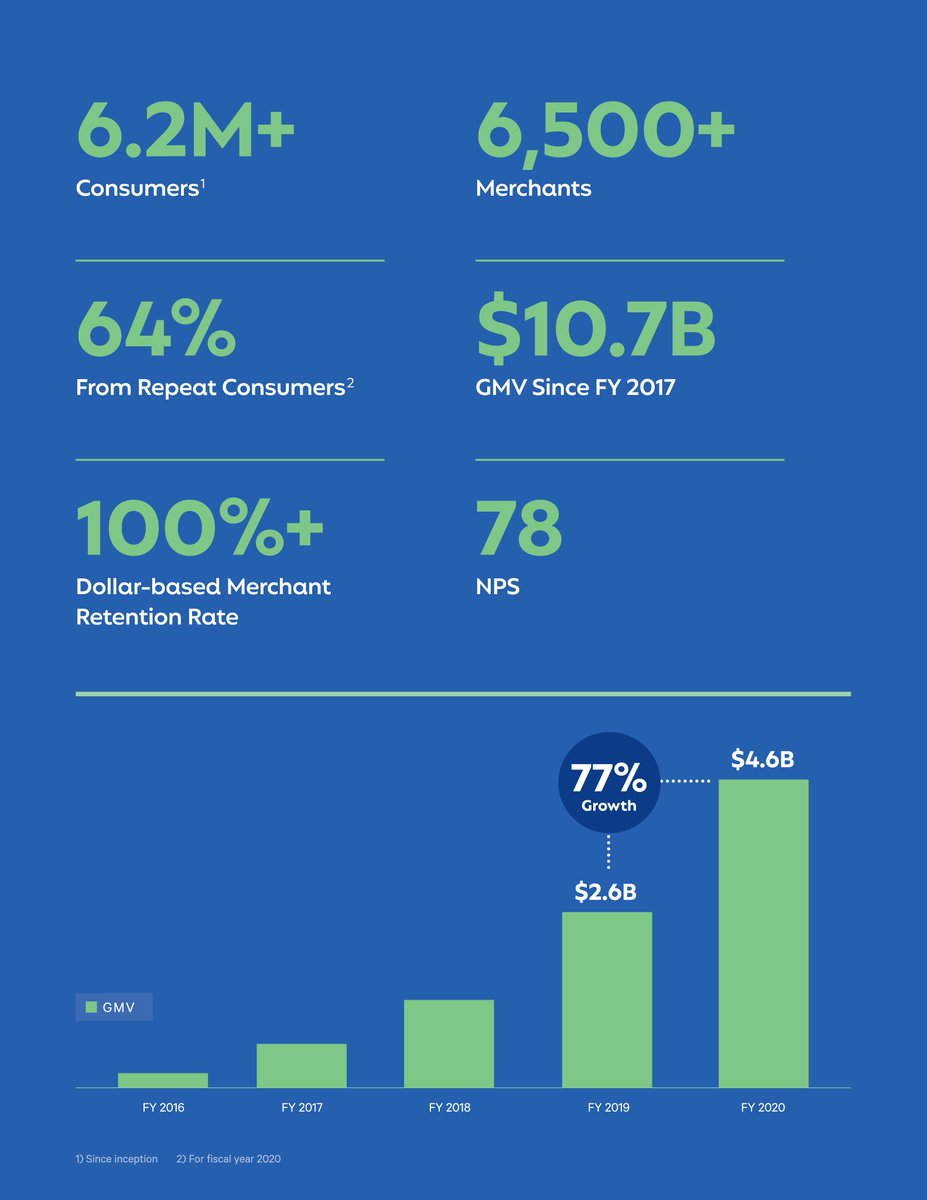

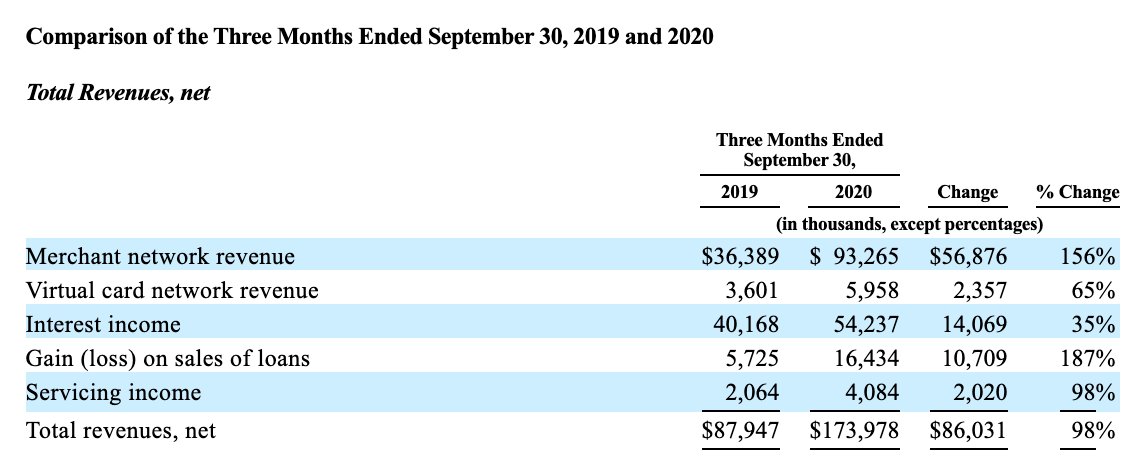

13/ Financials:

Y/Y Growth from 19-20:

- GMV: +77% (+626% since YE 2017)

- Active Customers: +77%

- Merchants: +84%

Info from S-1 pictured below.

Y/Y Growth from 19-20:

- GMV: +77% (+626% since YE 2017)

- Active Customers: +77%

- Merchants: +84%

Info from S-1 pictured below.

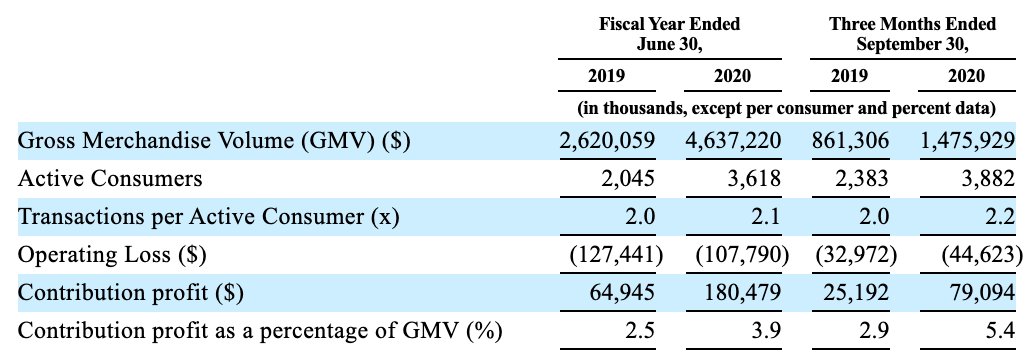

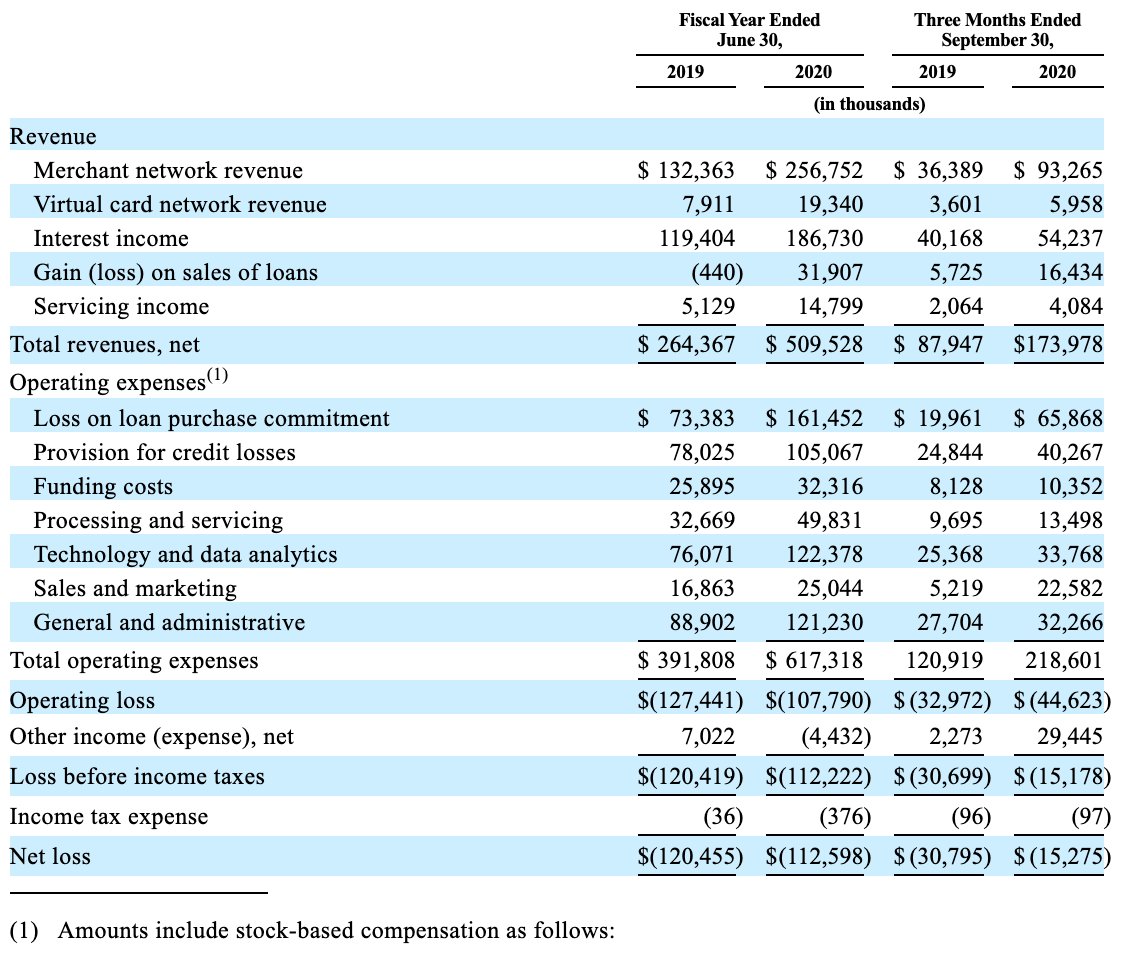

14/ Financials:

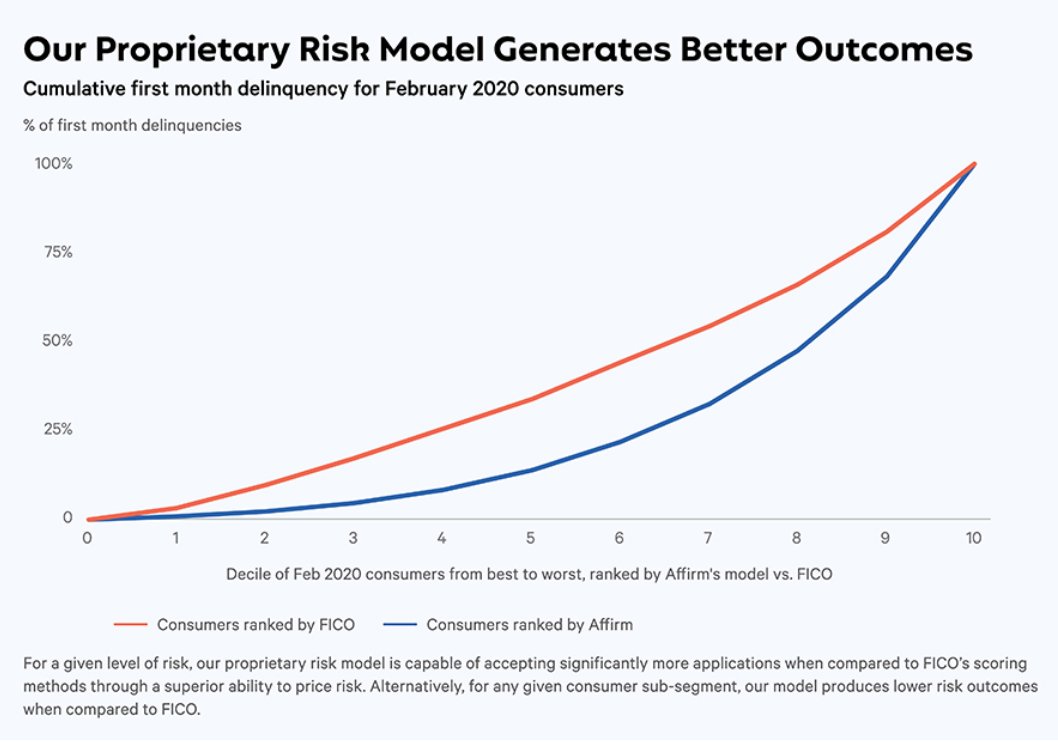

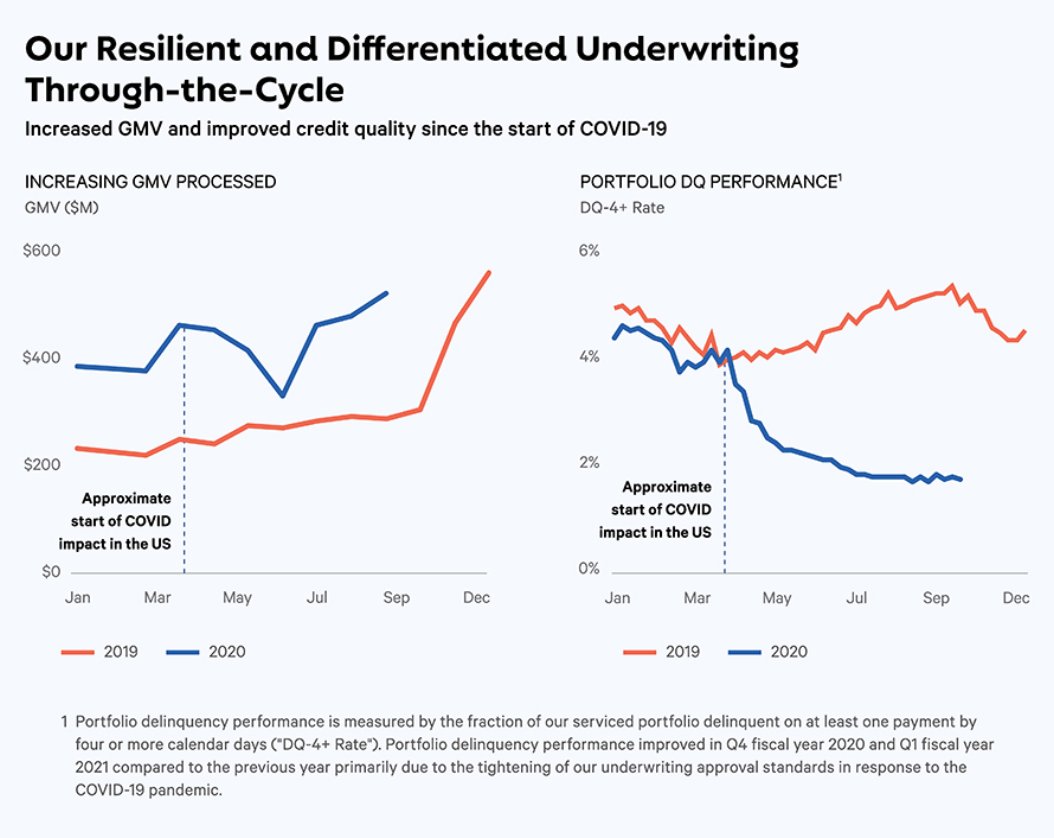

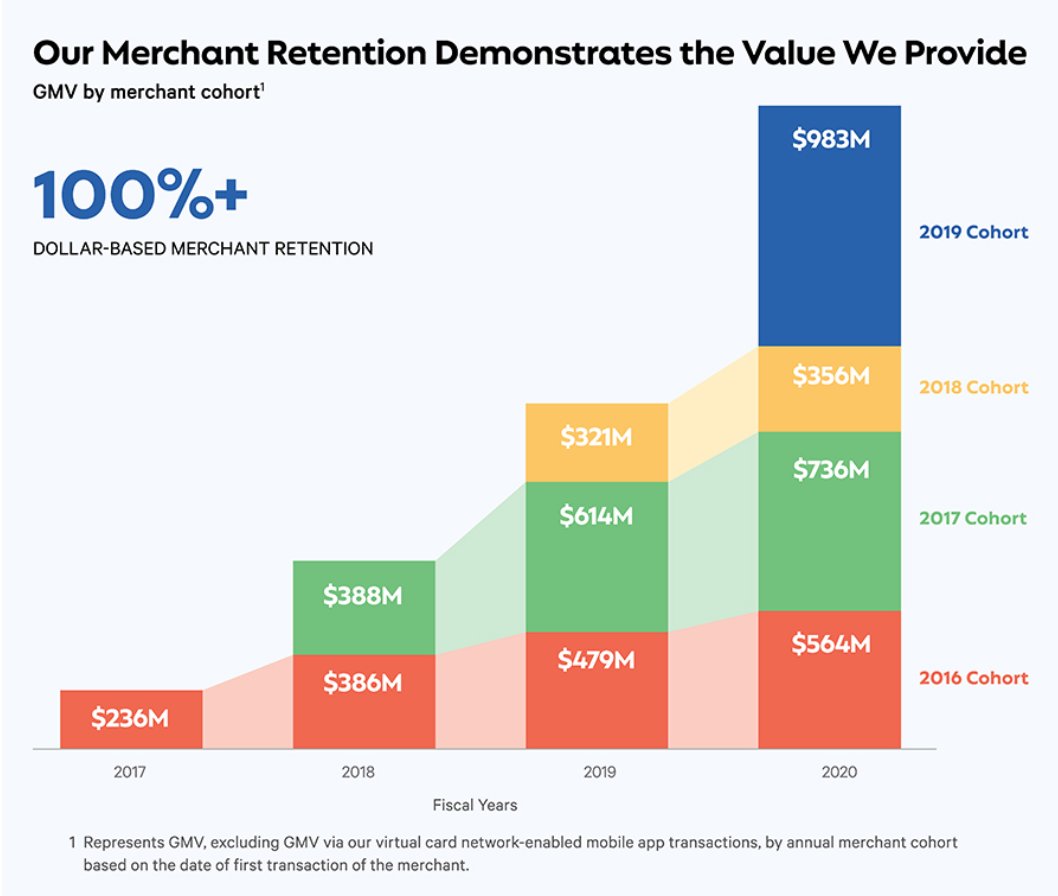

Please see pictures from S-1 regarding:

- Contribution Profit Walk

- Underwriting

- Merchant Retention Rate

Please see pictures from S-1 regarding:

- Contribution Profit Walk

- Underwriting

- Merchant Retention Rate

15/ Financials:

It is important to talk about the current customer concentration risk.

- Peloton $PTON represents ~28% of total rev for YE 2020

- Top 10 merchants represent ~35% of total rev for YE 2020

It is important to talk about the current customer concentration risk.

- Peloton $PTON represents ~28% of total rev for YE 2020

- Top 10 merchants represent ~35% of total rev for YE 2020

16/ Financials:

The fluctuations in general economic conditions could materially affect $AFRM future revenues.

In Sept. of 2020, Affirm entered into another 3-year contract with Peloton, ending Sept. 2023. This will automatically renew on an annual basis until terminated.

The fluctuations in general economic conditions could materially affect $AFRM future revenues.

In Sept. of 2020, Affirm entered into another 3-year contract with Peloton, ending Sept. 2023. This will automatically renew on an annual basis until terminated.

17/ Financials:

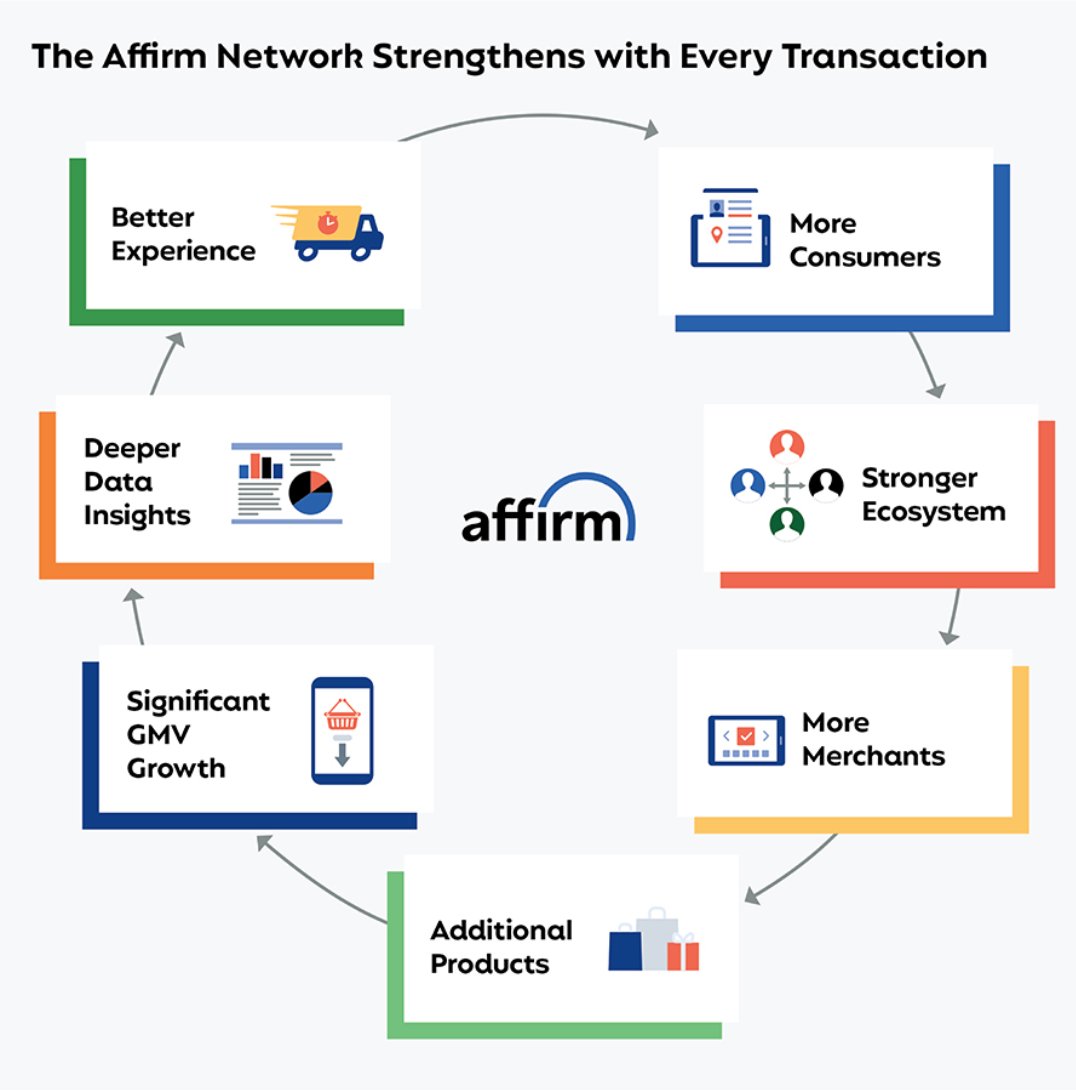

If the company vision of ubiquitous growth and full integration with merchants and consumers can be executed, future customer revenue concentration should be mitigated. For now, it is a risk.

If the company vision of ubiquitous growth and full integration with merchants and consumers can be executed, future customer revenue concentration should be mitigated. For now, it is a risk.

19/ Conclusion:

Although I won't be buying the IPO, I think the BNPL industry has many catalysts that could push further adoption among consumers. Affirm is also positioned well to disrupt the traditional credit card industry.

I will keep an eye on this company.

Cheers

Although I won't be buying the IPO, I think the BNPL industry has many catalysts that could push further adoption among consumers. Affirm is also positioned well to disrupt the traditional credit card industry.

I will keep an eye on this company.

Cheers

CORRECTION: IPO is 01/13/2021, not 2020

Mistake

Mistake

Read on Twitter

Read on Twitter![1/ Affirm Holdings, Inc. - $AFRMSet to IPO on 01/13/2020, Affirm shares are expected to start trading anywhere from $41-$44, a jump from the previously anticipated $33-$38 range.In this [THREAD ]:- Overview- Mgmt- How It Works- BNPL Industry- FinancialsLet's go 1/ Affirm Holdings, Inc. - $AFRMSet to IPO on 01/13/2020, Affirm shares are expected to start trading anywhere from $41-$44, a jump from the previously anticipated $33-$38 range.In this [THREAD ]:- Overview- Mgmt- How It Works- BNPL Industry- FinancialsLet's go](https://pbs.twimg.com/media/Eri8GbLXUAA29az.jpg)