1/ The Index-ification of the Alt Investment Universe.

Who will be the category-defining companies of the alt space?

Thread below

below

Check out @GoesAlt post #2 on Substack for what will define category leaders in this space https://altgoesmainstream.substack.com/p/the-indexing-of-the-alt-assets-universe

https://altgoesmainstream.substack.com/p/the-indexing-of-the-alt-assets-universe

Who will be the category-defining companies of the alt space?

Thread

below

below

Check out @GoesAlt post #2 on Substack for what will define category leaders in this space

https://altgoesmainstream.substack.com/p/the-indexing-of-the-alt-assets-universe

https://altgoesmainstream.substack.com/p/the-indexing-of-the-alt-assets-universe

2/ @eladgil recently wrote a great blog post about Index Companies.

Index Companies are critical to the growth of their markets because they are an essential component of market infrastructure

Users need them to transact and Markets need them to establish a data reference.

Index Companies are critical to the growth of their markets because they are an essential component of market infrastructure

Users need them to transact and Markets need them to establish a data reference.

4/ Who will become the defining companies of the alt asset space and what makes Index Companies so different and valuable?

5/  They benefit from the growth in their space

They benefit from the growth in their space

Index Companies are growth enablers.

They increase transactions in their space - and as their markets grow in size and scale, Index Companies grow in lockstep.

They benefit from the growth in their space

They benefit from the growth in their space

Index Companies are growth enablers.

They increase transactions in their space - and as their markets grow in size and scale, Index Companies grow in lockstep.

6/  They are a critical piece of market infrastructure

They are a critical piece of market infrastructure

They are necessary in order to participate in their market.

To access alt funds? @icapitalnetwork

@icapitalnetwork

To access startups as a non-accred investor? @joinrepublic

@joinrepublic

To manage and track trading cards? @OnlyAltOfficial

@OnlyAltOfficial

They are a critical piece of market infrastructure

They are a critical piece of market infrastructure

They are necessary in order to participate in their market.

To access alt funds?

@icapitalnetwork

@icapitalnetwork To access startups as a non-accred investor?

@joinrepublic

@joinrepublic To manage and track trading cards?

@OnlyAltOfficial

@OnlyAltOfficial

7/  They become the personification or identifier of their space

They become the personification or identifier of their space

"Uber here," "Google it." @Uber and @Google are verbs.

When brands become verbs, they become significant because the company becomes synonymous with the category.

They become the personification or identifier of their space

They become the personification or identifier of their space

"Uber here," "Google it." @Uber and @Google are verbs.

When brands become verbs, they become significant because the company becomes synonymous with the category.

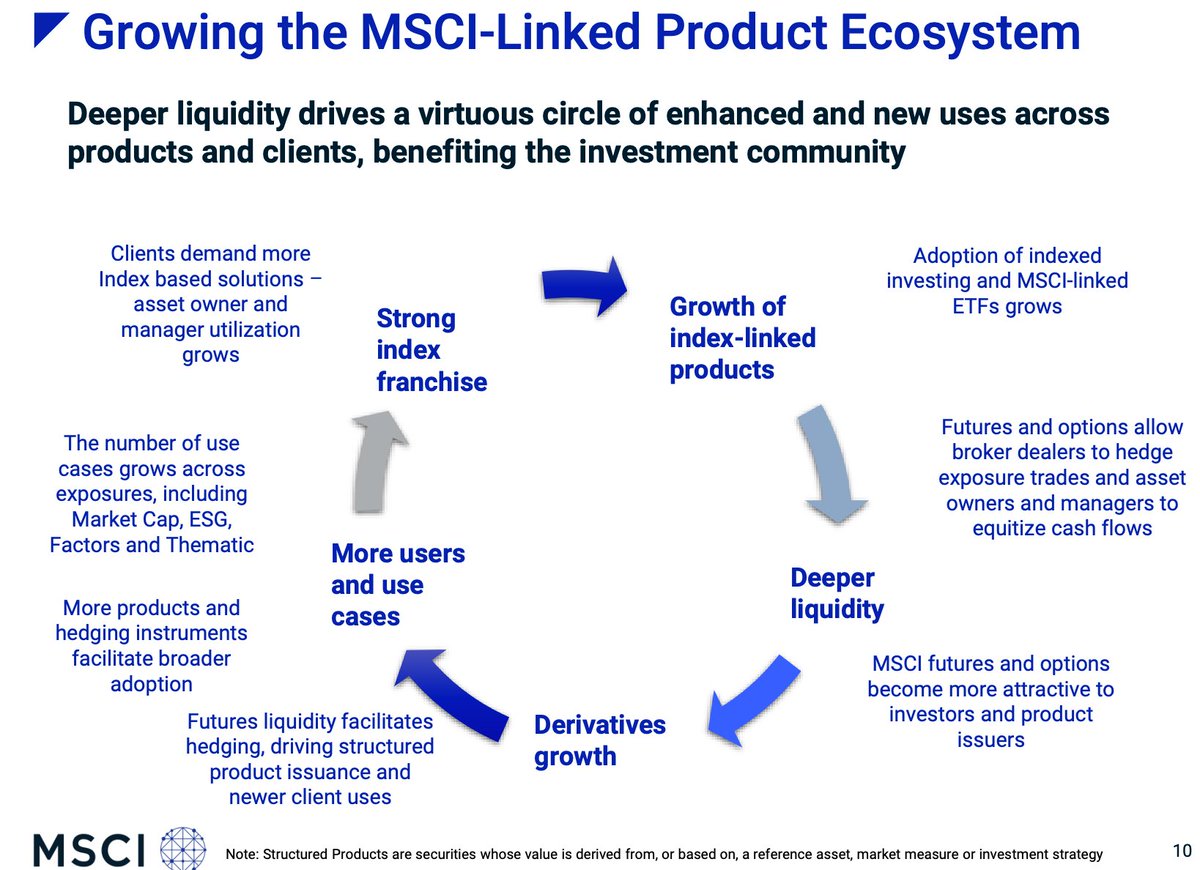

8/  They aggregate liquidity

They aggregate liquidity

Many Index Companies enable users to exchange value and become incredibly valuable companies because they:

Aggregate liquidity

Aggregate liquidity

Provide the platform for discovery

Provide the platform for discovery

Create the trusted venue for exchange

Create the trusted venue for exchange

Be the place where ppl transact

Be the place where ppl transact

They aggregate liquidity

They aggregate liquidity

Many Index Companies enable users to exchange value and become incredibly valuable companies because they:

Aggregate liquidity

Aggregate liquidity Provide the platform for discovery

Provide the platform for discovery Create the trusted venue for exchange

Create the trusted venue for exchange Be the place where ppl transact

Be the place where ppl transact

9/  Data is a feature - and becomes the moat

Data is a feature - and becomes the moat

Companies that own the data own the space.

Data is the enabler for liquidity & institutionalization of a financial asset.

Some of the most successful FinTech co's? Data biz @business, @MSCI_Inc, @IHSMarkit

They make markets go.

Data is a feature - and becomes the moat

Data is a feature - and becomes the moat

Companies that own the data own the space.

Data is the enabler for liquidity & institutionalization of a financial asset.

Some of the most successful FinTech co's? Data biz @business, @MSCI_Inc, @IHSMarkit

They make markets go.

10/  They create community

They create community

The FinTech companies of tomorrow will win by creating community.

Millennials and Gen Zs want to be part of movements - and they want to put their money where the movement is.

They create community

They create community

The FinTech companies of tomorrow will win by creating community.

Millennials and Gen Zs want to be part of movements - and they want to put their money where the movement is.

11/ Who are Index Companies in alt assets?

In crypto, the possible Index Company is @coinbase. W/ over 35M customers, they are the onramp for mainstream investors to access crypto.

In alt funds, the possible Index Company is @icapitalnetwork with $65B AUM and hundreds of funds.

In crypto, the possible Index Company is @coinbase. W/ over 35M customers, they are the onramp for mainstream investors to access crypto.

In alt funds, the possible Index Company is @icapitalnetwork with $65B AUM and hundreds of funds.

12/ The financialization of everything = the index-ification of everything?

Index providers in traditional financial markets are incredibly valuable.

Look no further than @MSCI_Inc - over $1.7B in 2020 run rate revenue and 58% EBITDA (!) margin.

Index providers in traditional financial markets are incredibly valuable.

Look no further than @MSCI_Inc - over $1.7B in 2020 run rate revenue and 58% EBITDA (!) margin.

13/ Companies that have the ability to create indexes in their market have the potential to become incredibly valuable.

If the financialization of everything occurs, then we will see a new wave of Index Companies create indexes based on their market position and data advantages

If the financialization of everything occurs, then we will see a new wave of Index Companies create indexes based on their market position and data advantages

14/ Imagine if @indify had an index of artists and people could invest in the top 10 artists on @indify.

Imagine if @SubstackInc had an index of writers and people could invest in the top 10 newsletters on @SubstackInc

Imagine if @SubstackInc had an index of writers and people could invest in the top 10 newsletters on @SubstackInc

15/ ETFs and derivatives on trading cards and writers? Not at all out of the question ...

Once there's index-ification of an asset class, then we can see a path to institutionalization.

Once there's index-ification of an asset class, then we can see a path to institutionalization.

16/ When we have a @Fidelity @stockx ETF or an @InvescoUS @OnlyAltOfficial ETF, we'll know which companies can be the Index Companies in their respective markets - literally and figuratively.

And we'll know that Alt Goes Mainstream.

And we'll know that Alt Goes Mainstream.

Read on Twitter

Read on Twitter