99% Growth & Profitable

99% Growth & Profitable

Leading MOBILE game developer & publisher

Leading MOBILE game developer & publisher Growing 99% YoY and scoring EBIT margins of 41%

Growing 99% YoY and scoring EBIT margins of 41% Unlocking transactional, technical and marketing synergies all at ONCE

Unlocking transactional, technical and marketing synergies all at ONCEHere is an EASY thread

Stillfront Group AB $SF.ST is a game developer and publisher  It was founded in 2010 by Jorgen Larsson in Sweden

It was founded in 2010 by Jorgen Larsson in Sweden

It aims to become the leading free-to-play games developer for mobile games with a global footprint

It was founded in 2010 by Jorgen Larsson in Sweden

It was founded in 2010 by Jorgen Larsson in SwedenIt aims to become the leading free-to-play games developer for mobile games with a global footprint

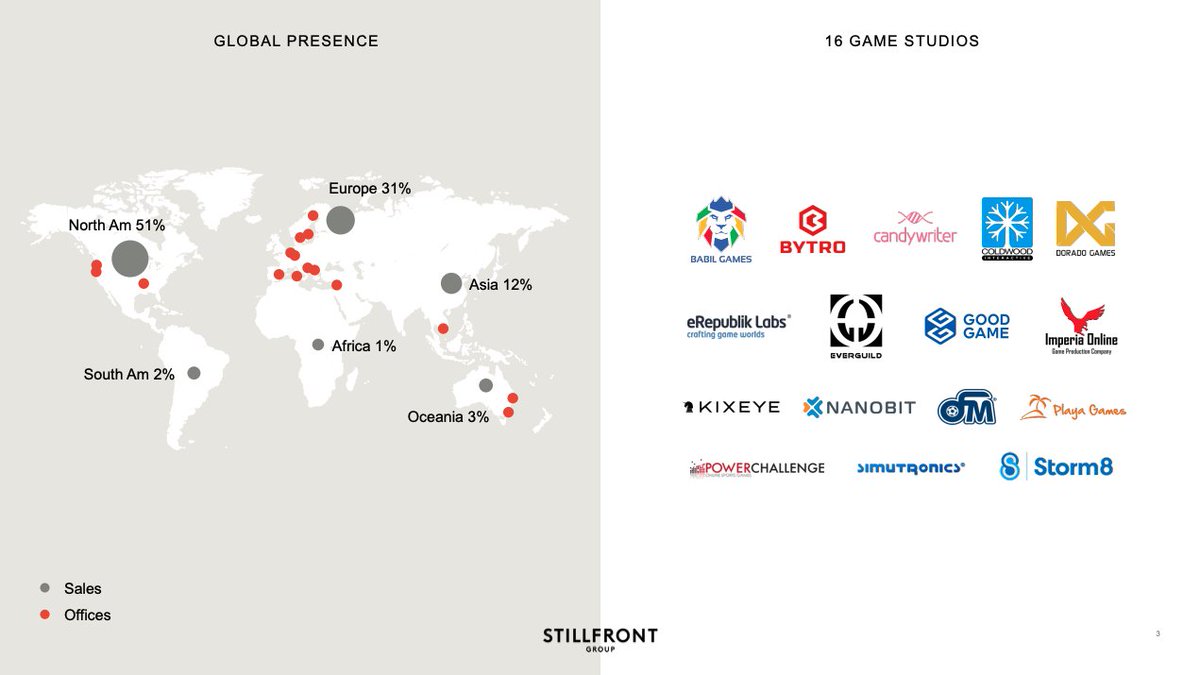

Growth is driven by M&A and the group now consists of 18 gaming studios which count 23m MAUs and 4m DAUs

The group generates the majority of its sales from North America (51% of sales), Europe (31%) and Asia (12%)

The group generates the majority of its sales from North America (51% of sales), Europe (31%) and Asia (12%)

The group generates the majority of its sales from North America (51% of sales), Europe (31%) and Asia (12%)

The group generates the majority of its sales from North America (51% of sales), Europe (31%) and Asia (12%)

Diversified Format With a Global Footprint

Diversified Format With a Global Footprint

Stillfront has over 50 collaboration projects with 38 active games that geographically spread

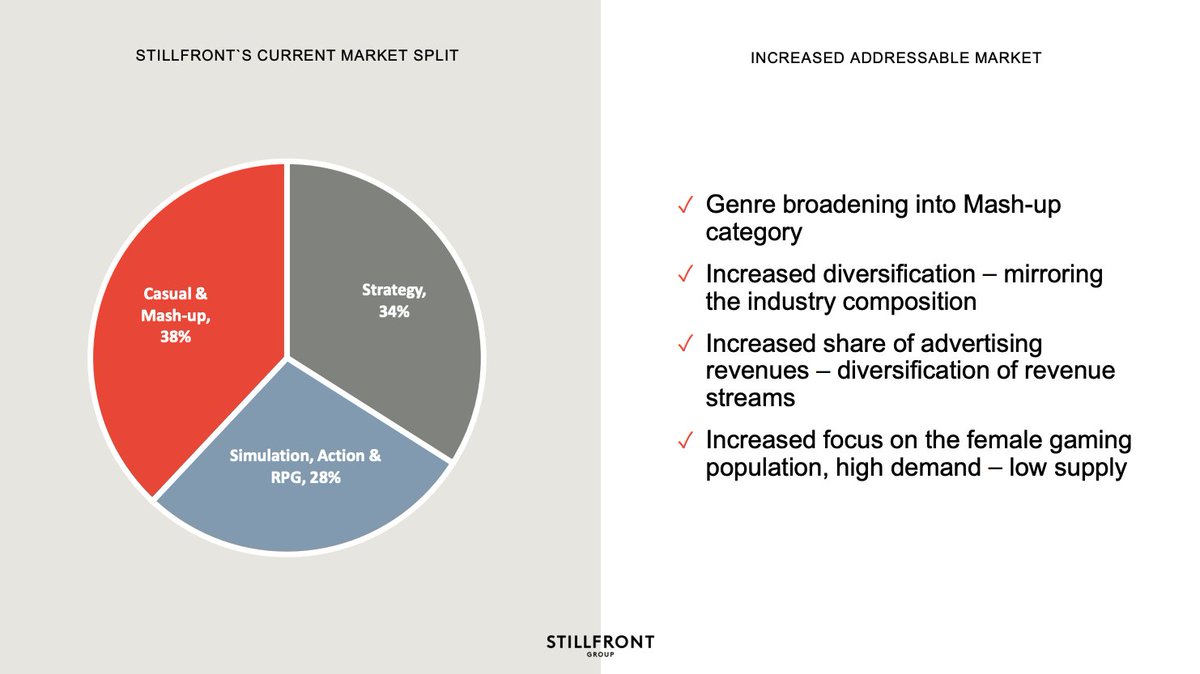

These are Casual & Mash-Up games (40% of sales), Strategy games (33%) and simulation, Action & RPG games (27%)

These are Casual & Mash-Up games (40% of sales), Strategy games (33%) and simulation, Action & RPG games (27%)

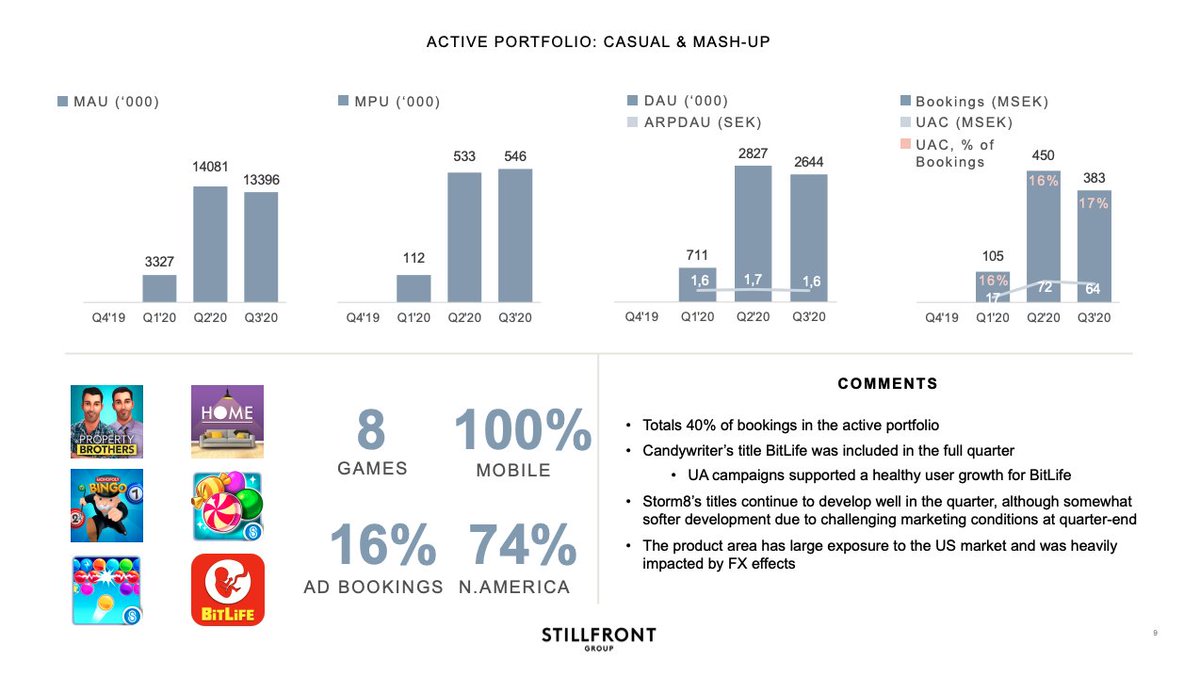

Casual & Mash-Up games (40% of sales) were fully mobile driven

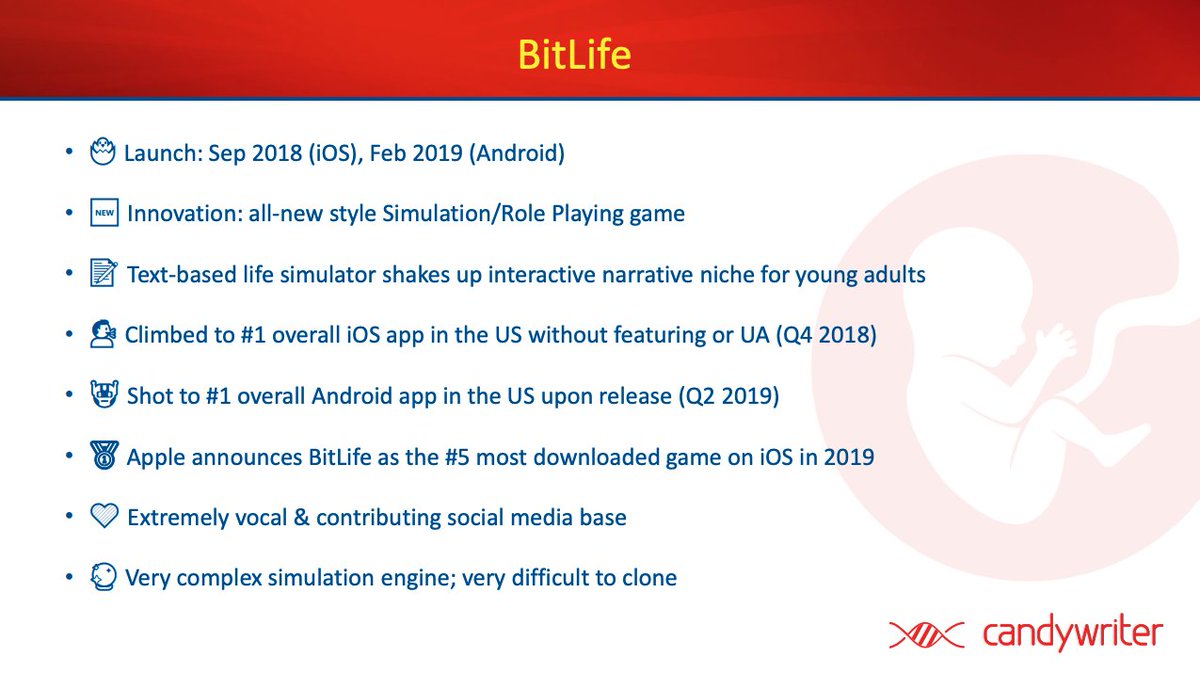

Casual & Mash-Up games (40% of sales) were fully mobile driven· Sales were led by BitLife which is developed by Candywriter

· Stillfront acquired the group for $ 74m in April 2020

· Candywriter had around 1.2m DAUs and 7.8m MAUS

· It generated sales of around $ 26m in 2019 with EBIT margins of 59%

· Their flagship game, BitLife had around 42m downloads to date and was #1 in the App Store in the USA, UK and CA

· It generated sales of around $ 26m in 2019 with EBIT margins of 59%

· Their flagship game, BitLife had around 42m downloads to date and was #1 in the App Store in the USA, UK and CA

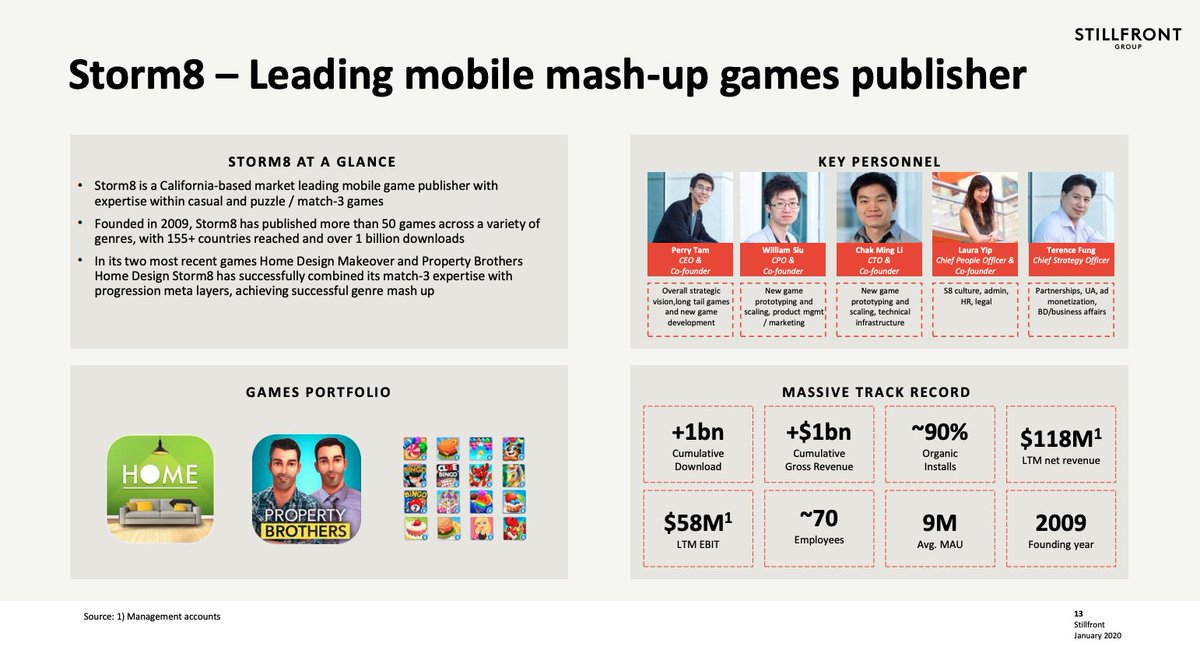

· Stillfront also completed the acquisition of Storm8 for $ 300m

· Storm8 generated 1B in lifetime downloads with 90% of organic installs

· The group grossed over $ 1B in sales

· Storm8 is not best known for its “Property Brothers” game

· Storm8 generated 1B in lifetime downloads with 90% of organic installs

· The group grossed over $ 1B in sales

· Storm8 is not best known for its “Property Brothers” game

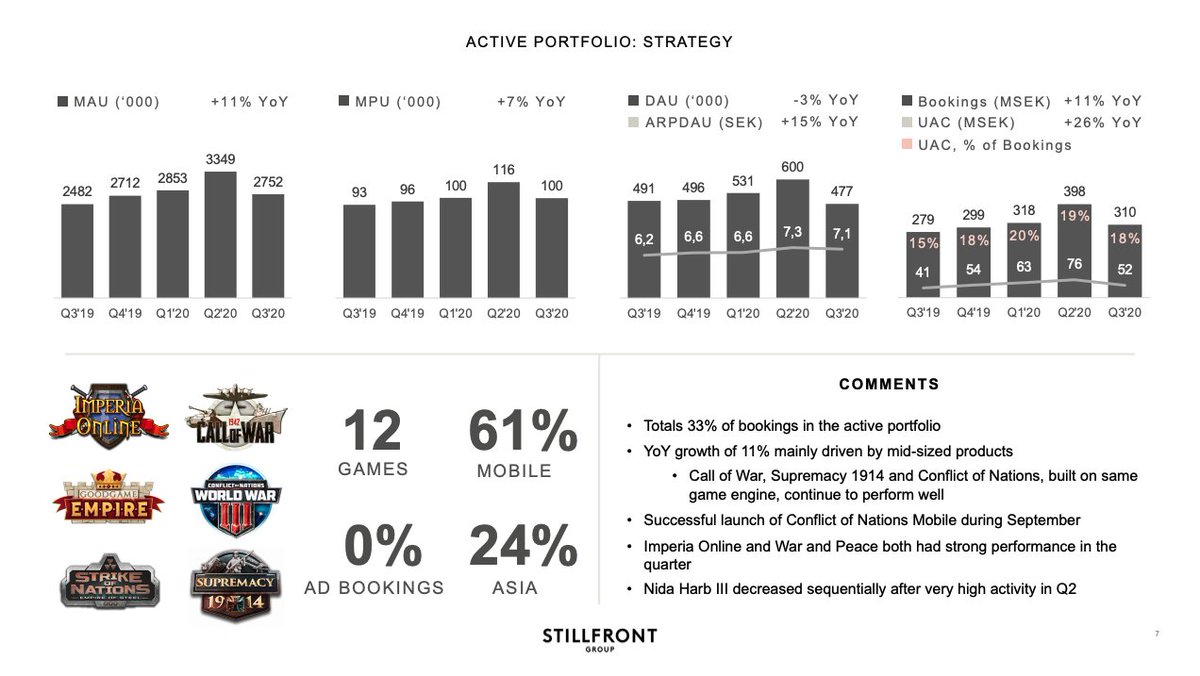

Strategy games (33% of sales) saw moderate MAU growth of 11% YoY in Q3 ’20

Strategy games (33% of sales) saw moderate MAU growth of 11% YoY in Q3 ’20· 61% of the genre’s games are mobile

· 24% of sales are generated in Asia

· Key in this genre is the “Nida Harb III” game and is developed by Babil Games

· Babil Games is a studio focussed on the MENA market and was acquired for $ 17m by Stillfront in 2016

· At the time, the studio generated $ 3m in sales and a 15% net margin https://www.stillfront.com/en/stillfront-group-ab-stillfront-acquires-babil-games-the-leading-mena-region-mobile-games-publisher/

· At the time, the studio generated $ 3m in sales and a 15% net margin https://www.stillfront.com/en/stillfront-group-ab-stillfront-acquires-babil-games-the-leading-mena-region-mobile-games-publisher/

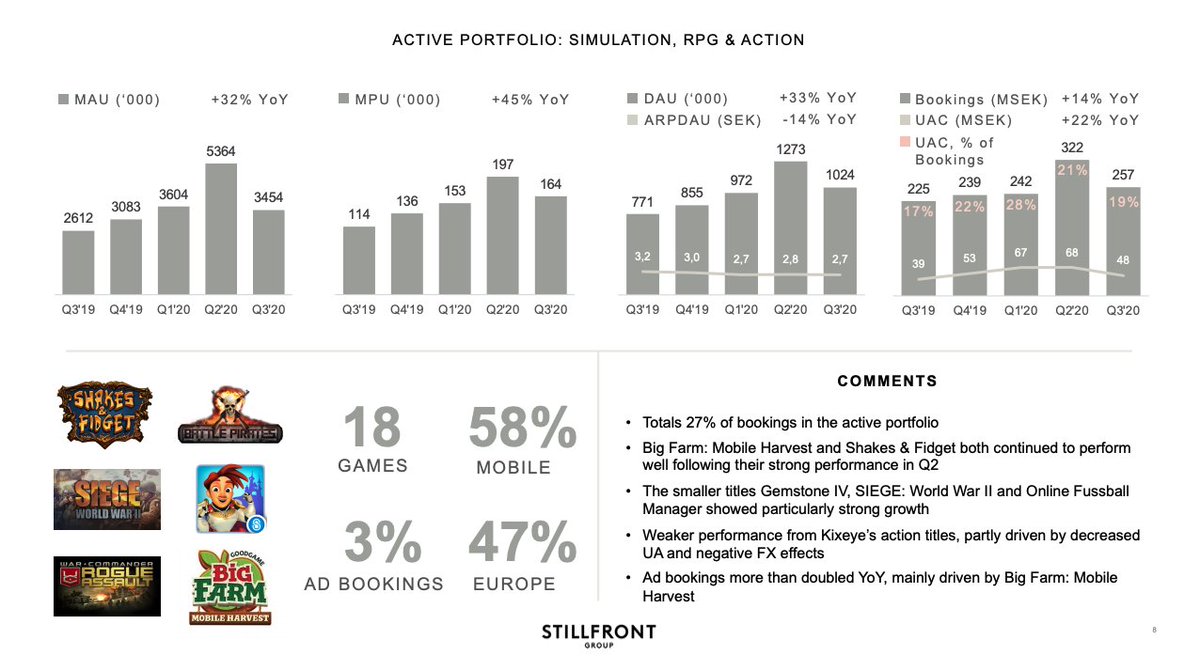

Simulation RPG & Action games (27% of sales) grew MAUs by 32% YoY in Q3 ’20

Simulation RPG & Action games (27% of sales) grew MAUs by 32% YoY in Q3 ’20· Monthly Paying Users (MPU) grew 45% YoY

· Majority of sales are generated in Europe (47%)

· It counts 18 games and 58% of sales are mobile-generated

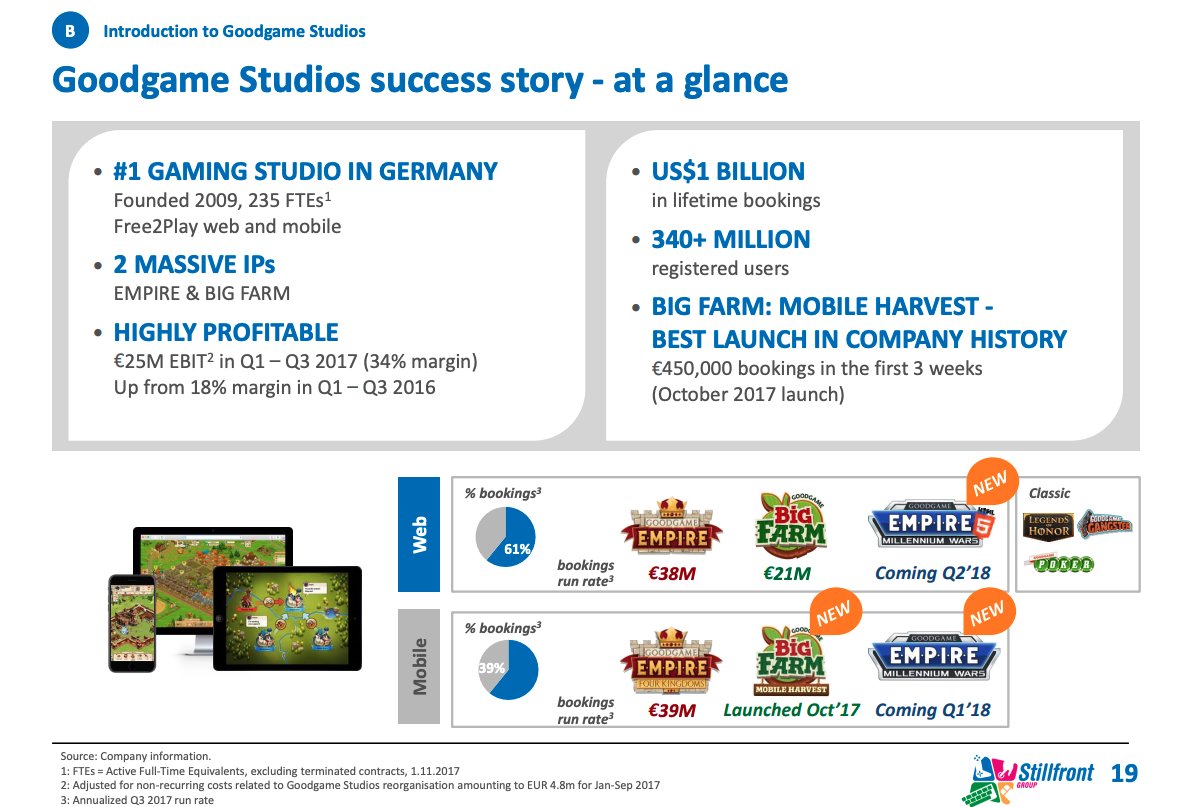

· Genre is lead by the “Big Farm” game, developed by Goodgame studios in 2018 for around $ 310m

· Genre is lead by the “Big Farm” game, developed by Goodgame studios in 2018 for around $ 310m

M&A Driven Growth

M&A Driven Growth

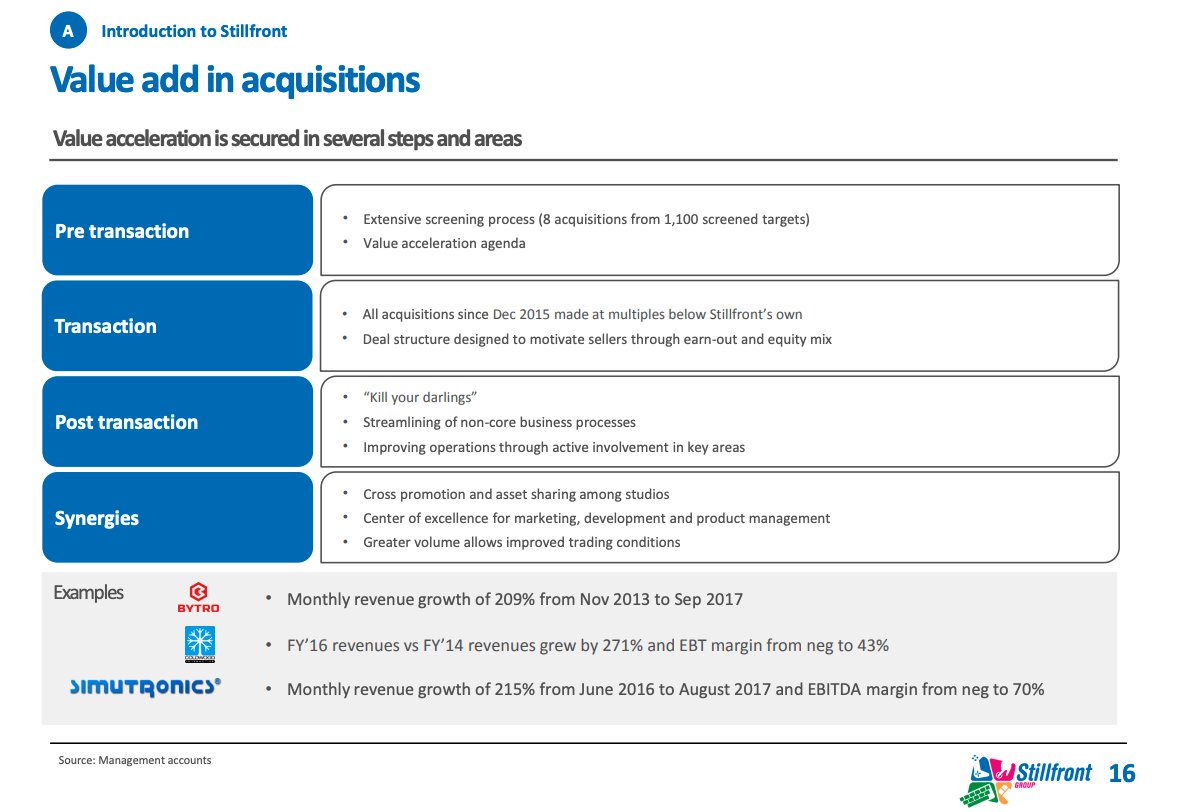

The group is constantly looking for M&A targets in order to grow its user and revenue base

But there is more to this M&A strategy, here are the key points Stillfront tries to leverage in the process

But there is more to this M&A strategy, here are the key points Stillfront tries to leverage in the process

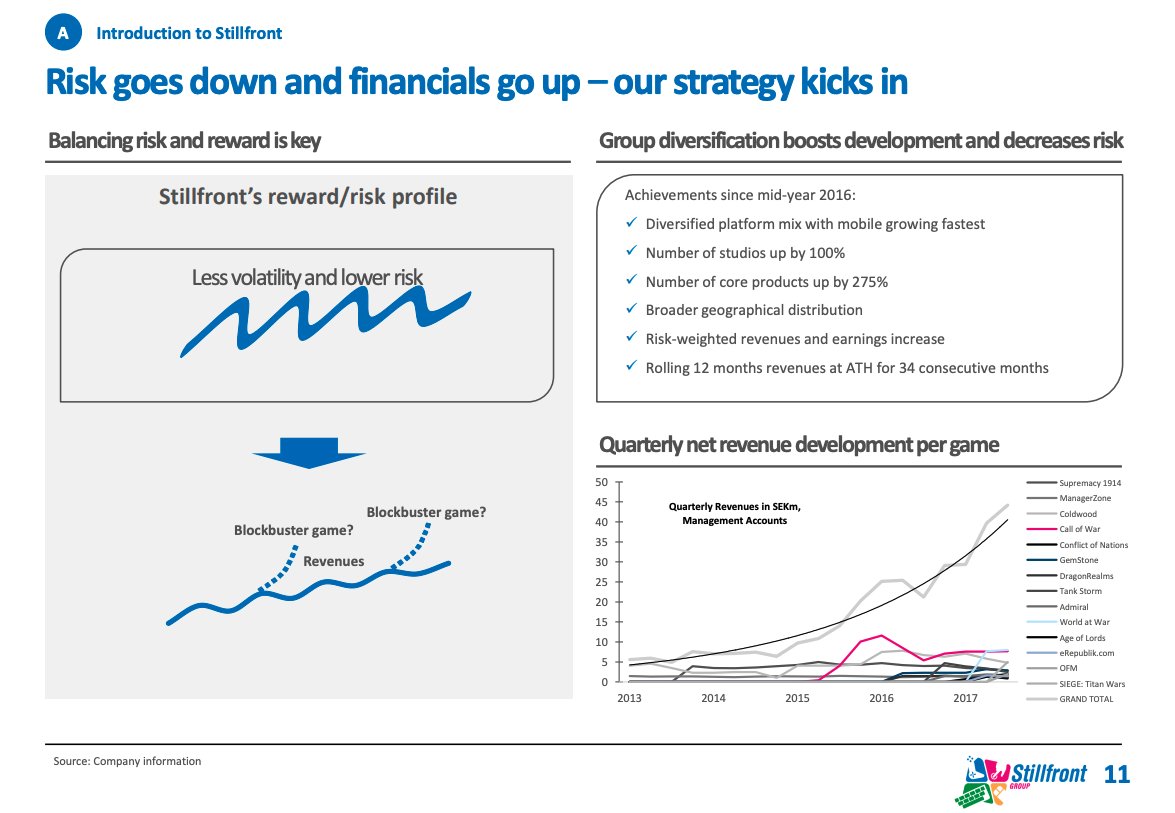

Lowering Revenue Volatility

Lowering Revenue VolatilityStillfront aims to make its sales more predictable and less reliant on the fate of a few “blockbuster” games

This is done by having a high number of games, from different genres, played on different devices and exposed to different geographies

This is done by having a high number of games, from different genres, played on different devices and exposed to different geographies

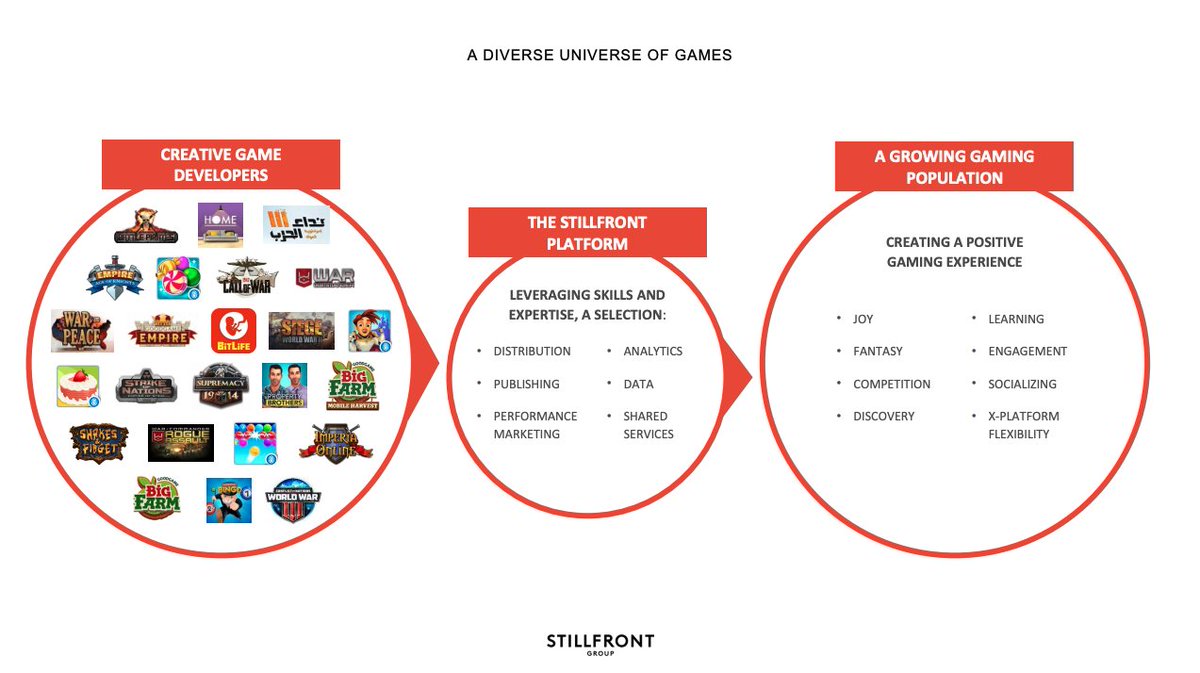

Chase Small Studios And Create Synergies

Chase Small Studios And Create SynergiesStillfront provides shares distribution, publishing, marketing, analytics and admin services to its studios

Enabling these studios to cut overhead staff and focus on the core all while retaining their independence

Enabling these studios to cut overhead staff and focus on the core all while retaining their independence

Turn One Time Hits Into LT Cash Generators

Turn One Time Hits Into LT Cash GeneratorsStillfront provides the required cash and experience to turn games into long lasting successes with a strong user base

Key success factors include shared best practises, marketing & distribution and access to working capital

Key success factors include shared best practises, marketing & distribution and access to working capital

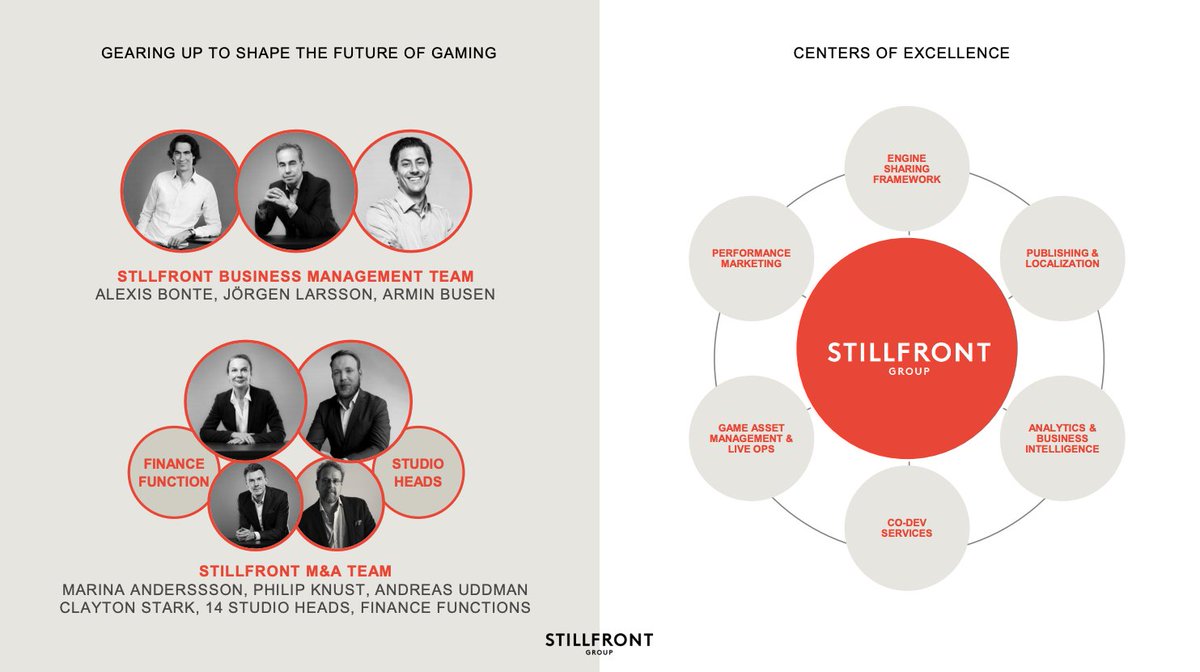

Management Team

Management Team

This strategy is orchestrated by Jorgen Larsson, Alexis Bonte and Armin Busen

Supported by Stillfront’s M&A team which consists of the finance heads and their studio heads

Supported by Stillfront’s M&A team which consists of the finance heads and their studio heads

Jorgen Larsson

Jorgen Larsson· CEO at Stillfront and Founder of Stillfront

· Previously worked 7 years at Ericsson GSM

· Founded ESN Social Software which was later acquired by $EA

Alexis Bonte

Alexis Bonte· COO at Stillfront and Co-founder of eRepublik Labs (acq. by Stillfornt)

· Founded eRepublik Labs in 2007 and built it into a 7m players games

· Was partner at Atomic, an European VC with Stripe, Supercall, Lime and Klarna amongst its investments

Armin Busen

Armin Busen· SVP Business Operations at Stillfront

· Previously worked 9 years at InnoGames where he was Chief Product Officer and Chief Financial Officer

· Majored in Finance and Corporate Strategy at Maastricht University

Market Rationale

Market Rationale

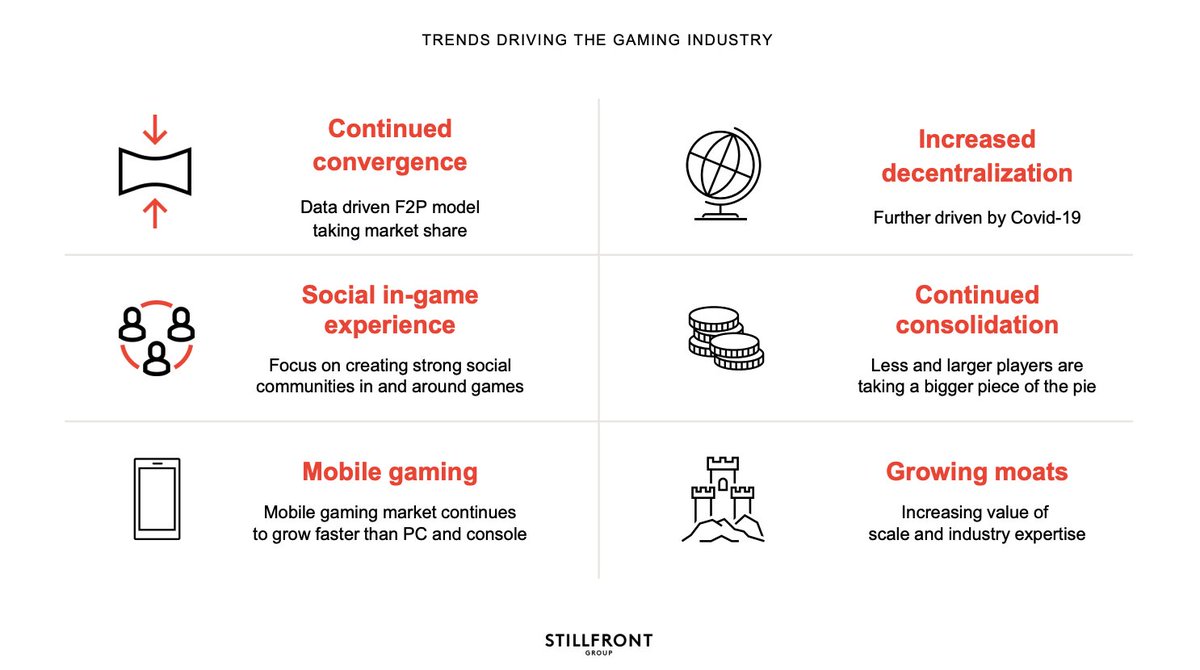

Stillfront’s strategy is driven by ongoing and lasting market consolidation and a focus on mobile games

Increasing barriers to entry for newer studios as larger game publishers can easily develop and market popular genres

Increasing barriers to entry for newer studios as larger game publishers can easily develop and market popular genres

· Mobile gaming industry is one of the fastest growing gaming segment

· Gaming industry is consolidating at all levels (large, medium and small publishers)

· Gaming industry is consolidating at all levels (large, medium and small publishers)

“Total investment and M&A activity […] in April-June 2020 surpassed USD$10.5bn, representing an approximate 315% increase over the previous quarter” https://www.thegamingeconomy.com/2020/07/27/tge-index-quarterly-investment-report-q2-2020/

Yes, the mobile gaming market is NOT slowing down

According to Mordor Intelligence, the mobile gaming market is set to grow by 14% each year over the 2020 - 2025 period

According to Mordor Intelligence, the mobile gaming market is set to grow by 14% each year over the 2020 - 2025 period

According to Mordor Intelligence, the mobile gaming market is set to grow by 14% each year over the 2020 - 2025 period

According to Mordor Intelligence, the mobile gaming market is set to grow by 14% each year over the 2020 - 2025 period

Driven by growing smartphone penetration, the continued rise of the free-to-play business model and technological advancement that boost mobile and online gaming

Driven by growing smartphone penetration, the continued rise of the free-to-play business model and technological advancement that boost mobile and online gaminghttps://www.mordorintelligence.com/industry-reports/mobile-games-market

According to Statista, the mobile gaming market is set to grow by 10% each year over the 2021 - 2025 period

According to Statista, the mobile gaming market is set to grow by 10% each year over the 2021 - 2025 period Driven by higher user penetration, going from 23.9% in 2021 to 28.5% in 2025 https://www.statista.com/outlook/211/100/mobile-games/worldwide

Driven by higher user penetration, going from 23.9% in 2021 to 28.5% in 2025 https://www.statista.com/outlook/211/100/mobile-games/worldwide

According to Newzoo, mobiles games spending grew 13.3% in 2020 and reached $ 77.2B

According to Newzoo, mobiles games spending grew 13.3% in 2020 and reached $ 77.2B Driven by higher smartphone penetration and the “free-to-play” model which enables gamers to quickly pick-up new games

Driven by higher smartphone penetration and the “free-to-play” model which enables gamers to quickly pick-up new games

“Mobile will enjoy more growth than both PC and console gaming for a few reasons. Mobile gaming has the lowest barrier to entry: more than two-fifths of the global population owns a smartphone...

....— and many mobile titles are free to play.“ By Dean Takahashi for Venture Beat https://venturebeat.com/2020/05/08/newzoo-2-7-billion-gamers-will-spend-159-3-billion-on-games-in-2020/

According to Mordor Intelligence the global gaming market is set to grow by 9.2% a year over the 2020 - 2025 period

According to Mordor Intelligence the global gaming market is set to grow by 9.2% a year over the 2020 - 2025 period

Going from $ 151B in 2019 to $ 257B by 2025 and driven by the upgrade cycle in consoles (Sony and Microsoft), the emergence of cloud gaming and the rise of eSports

Going from $ 151B in 2019 to $ 257B by 2025 and driven by the upgrade cycle in consoles (Sony and Microsoft), the emergence of cloud gaming and the rise of eSportshttps://www.reportlinker.com/p05903704/Gaming-Industry-Growth-Trends-and-Forecast.html

According to Global Data, the global gaming market could reach $ 300B by 2025 up from $ 131B in 2018

According to Global Data, the global gaming market could reach $ 300B by 2025 up from $ 131B in 2018 Driven by the advent of mobile gaming, cloud gaming and virtual reality gaming and new payments model (in-game micro-payments) which boost spending

Driven by the advent of mobile gaming, cloud gaming and virtual reality gaming and new payments model (in-game micro-payments) which boost spending

“At the same time, new technologies like 5G, cloud, and virtual reality will usher in a new phase of innovation” - Ed Thomas, Global Data https://variety.com/2019/gaming/news/video-games-300-billion-industry-2025-report-1203202672/

Secret Synergies

Secret Synergies

This M&A strategy wouldn’t work with Stillfront’s personal touch which unlock synergies at 3 levels

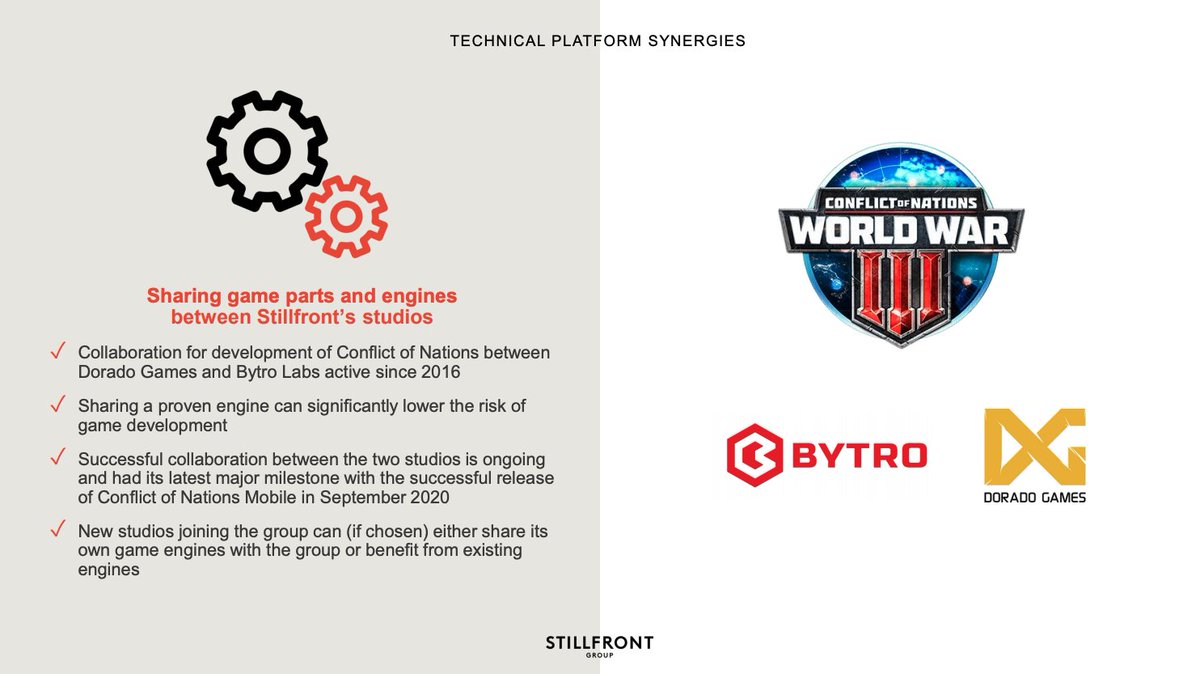

Technical Platform Synergies

Technical Platform Synergies User Acquisition Synergies

User Acquisition Synergies Shared Webshop Synergies

Shared Webshop Synergies

Technical Platform Synergies

Technical Platform Synergies· Sharing games parts and engines between the 18 Stillfront studios

· This lowers the development risk and reduces development times

User Acquisition Synergies

User Acquisition Synergies· Provides joint access to global marketing capabilities and optimised user acquisition channels

· Lower the customer acquisition costs and increases the group’s bargaining power with media partners

Shared Webshop Synergies

Shared Webshop Synergies· Enables studios to share their PSPs and currency-conversion contracts

· Reducing their transactions costs and providing instantaneous access to foreign markets

Financial Check

Financial Check

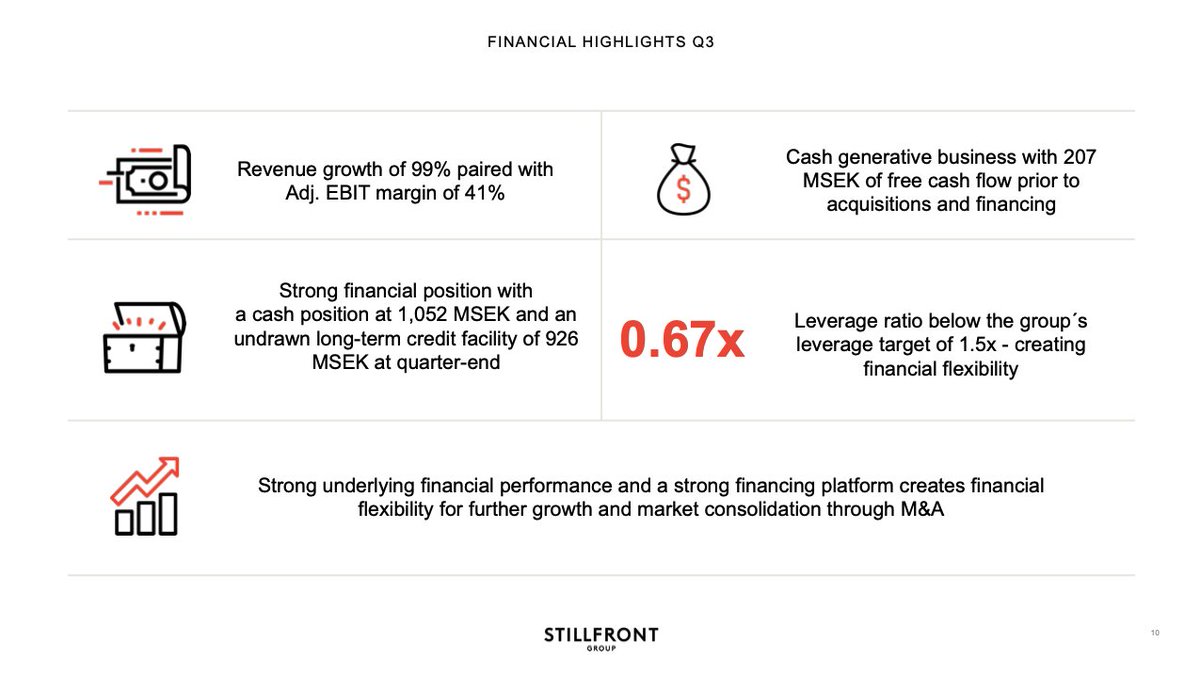

Total Sales grew 94% in Q3 ’20 to SEK 1,117m ($ 134m) versus SEK 577m ($ 70m) a year earlier

Total Sales grew 94% in Q3 ’20 to SEK 1,117m ($ 134m) versus SEK 577m ($ 70m) a year earlier Gross margins decreased to 73% from 74% a year earlier

Gross margins decreased to 73% from 74% a year earlier User acquisition costs as % of net revenue stayed constant at 16%

User acquisition costs as % of net revenue stayed constant at 16%

Personnel expenses as % of sales decreased to 15% from 19% a year earlier

Personnel expenses as % of sales decreased to 15% from 19% a year earlier Cash & Equivalents stood at SEK 1,052m ($ 126m) versus SEK 447m ($ 54m) in current liabilities

Cash & Equivalents stood at SEK 1,052m ($ 126m) versus SEK 447m ($ 54m) in current liabilities EBITDA margins increased to 41%, up from 36% a year earlier

EBITDA margins increased to 41%, up from 36% a year earlier

By 2023, the group is aiming for sales of SEK 10,000m ($ 1.2B)

Representing an increase of 124% versus Q3 ’20 Annual Run Rate

Representing an increase of 124% versus Q3 ’20 Annual Run Rate

All while keeping EBIT margins above 35% (currently at 37.5%)

All while keeping EBIT margins above 35% (currently at 37.5%)

Representing an increase of 124% versus Q3 ’20 Annual Run Rate

Representing an increase of 124% versus Q3 ’20 Annual Run Rate All while keeping EBIT margins above 35% (currently at 37.5%)

All while keeping EBIT margins above 35% (currently at 37.5%)

The Bottom Line

The Bottom Line

Mobile games market is growing at around 12.5% over the next 5 years, boosted by the free-to-play format and smartphone penetration

Mobile games market is growing at around 12.5% over the next 5 years, boosted by the free-to-play format and smartphone penetration Stillfront has proven that it is able to turn an one-time-hit it acquired into a LT cash generating machine

Stillfront has proven that it is able to turn an one-time-hit it acquired into a LT cash generating machine

Stillfront has turned itself into a well-oiled M&A machine, using cheap money to finance profitable acquisitions

Stillfront has turned itself into a well-oiled M&A machine, using cheap money to finance profitable acquisitions It is fully taking part in the industry’s consolidation and is able to unlock considerable technical, marketing and transactional synergies

It is fully taking part in the industry’s consolidation and is able to unlock considerable technical, marketing and transactional synergies

Stillfront’s strategy could hit an anti-trust roadblock

Stillfront’s strategy could hit an anti-trust roadblock An increase in interest rates could decrease the ease as which Stillfront is able to raise funds

An increase in interest rates could decrease the ease as which Stillfront is able to raise funds

Disclaimer - This is not investment advice in any form and investors are responsible for conducting their own research before investing.

Sources

✑ Investor presentation

✑ Company website

✑ Mordor Intelligence

✑ Global Data

✑ NewZoo

Sources

✑ Investor presentation

✑ Company website

✑ Mordor Intelligence

✑ Global Data

✑ NewZoo

✑ Global Legal Chronicle

✑ Bloomberg

✑ Crunchbase

✑ TechCrunch

✑ TheGamingEconomy

✑ Variety

✑ Bloomberg

✑ Crunchbase

✑ TechCrunch

✑ TheGamingEconomy

✑ Variety

Hope you liked this thread!

For more content, follow us on Twitter

For more content, follow us on Twitter

EASY BRIEFINGS delivered straight to your inbox

EASY BRIEFINGS delivered straight to your inbox  Don’t MISS IT

Don’t MISS IT  https://getbenchmark.substack.com

https://getbenchmark.substack.com

For more content, follow us on Twitter

For more content, follow us on Twitter

EASY BRIEFINGS delivered straight to your inbox

EASY BRIEFINGS delivered straight to your inbox  Don’t MISS IT

Don’t MISS IT  https://getbenchmark.substack.com

https://getbenchmark.substack.com

Read on Twitter

Read on Twitter

To Be Reviewed SOON

To Be Reviewed SOON