Bull market thread

Yesterday marked the first major pull back of this bull market for #Bitcoin & #Ethereum.

& #Ethereum.

The intense volatility completely flipped the going narrative on social media. Reports of a "crash" hit the news.

SL's triggered. Liquidations hit. Pure mayhem.

/1

Yesterday marked the first major pull back of this bull market for #Bitcoin

& #Ethereum.

& #Ethereum. The intense volatility completely flipped the going narrative on social media. Reports of a "crash" hit the news.

SL's triggered. Liquidations hit. Pure mayhem.

/1

Of course, analysis is about establishing probabilities and possibilities.

There is no crystal ball.

No certainty.

All we can do is apply an objective analysis and take positions based on what is "most likely" to happen..

/2

There is no crystal ball.

No certainty.

All we can do is apply an objective analysis and take positions based on what is "most likely" to happen..

/2

Objectively speaking, the 2017 $BTC bull market experienced 7 pullbacks that averaged 33.35%.

Some of them lasted days, some lasted weeks, and all (but one) were followed, eventually, by explosive continuation moves as the dip sellers + new buyers FOMO'd back into position.

/3

Some of them lasted days, some lasted weeks, and all (but one) were followed, eventually, by explosive continuation moves as the dip sellers + new buyers FOMO'd back into position.

/3

During each one of these pullbacks the natural reaction for those who aren't taking profits into parabolic moves is to "protect capital".

This is how we're programmed. We feel pain, regret, and other strong emotions that cause us to execute trades at the worst possible time!

/4

This is how we're programmed. We feel pain, regret, and other strong emotions that cause us to execute trades at the worst possible time!

/4

It's no secret that markets play on human emotion and cause the majority of participants buy tops and sell bottoms.

No matter how much better we think we are than the rest, we all fall prey to this trap from time to time.

/5

No matter how much better we think we are than the rest, we all fall prey to this trap from time to time.

/5

Today, let's be objective. The dust has settled for now, we can approach this price action with a clear head.

What did the 2017 drawdowns look like? What did the top look like? How does that compare to what we're seeing now?

/6

What did the 2017 drawdowns look like? What did the top look like? How does that compare to what we're seeing now?

/6

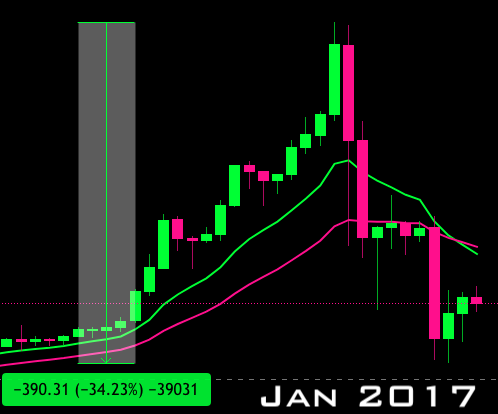

January 2017

Bitcoin experienced a steep drop over a period of 8 days, following an approach to previous all-time highs, amounting to a 34.23% drop from high to low.

/7

Bitcoin experienced a steep drop over a period of 8 days, following an approach to previous all-time highs, amounting to a 34.23% drop from high to low.

/7

March 2017

Bitcoin broke through previous all-time highs just to be smacked down over a period of about 3 weeks, totalling 34.06% from high to low.

/8

Bitcoin broke through previous all-time highs just to be smacked down over a period of about 3 weeks, totalling 34.06% from high to low.

/8

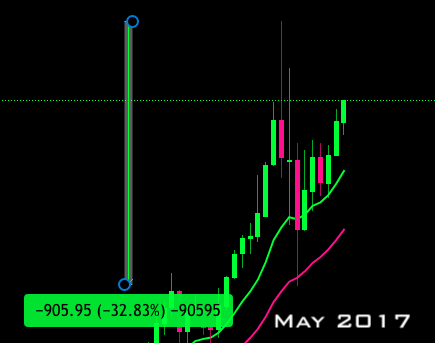

May 2017 (I bought my first Bitcoin into this rise, just before the drop, PAINFUL)

$BTC dropped 32.83% over one weekend, for no reason other than it was overextended and needed a "breather".

Headlines read "Pop goes the weasel, BITCOIN CRASHES OVER 30%"

Scary times.

/9

$BTC dropped 32.83% over one weekend, for no reason other than it was overextended and needed a "breather".

Headlines read "Pop goes the weasel, BITCOIN CRASHES OVER 30%"

Scary times.

/9

July 2017

Bitcoin devs and miners split their opinion on how best to scale the network and the $BCH fork drama unfolded.

"Bitcoin blockchain could cease to exist if enough miners move to the new chain, you could lose everything"

38.68% drop over 35 days

/10

Bitcoin devs and miners split their opinion on how best to scale the network and the $BCH fork drama unfolded.

"Bitcoin blockchain could cease to exist if enough miners move to the new chain, you could lose everything"

38.68% drop over 35 days

/10

September 2017

"China bans #Bitcoin " - The Chinese government announced a BAN on #cryptocurrency exchanges.

" - The Chinese government announced a BAN on #cryptocurrency exchanges.

@binance was the new, hot exchange at the time, and still operating out of China. $BNB dropped over 75%.

$BTC 40.30% drop over 14 days

/11

"China bans #Bitcoin

" - The Chinese government announced a BAN on #cryptocurrency exchanges.

" - The Chinese government announced a BAN on #cryptocurrency exchanges. @binance was the new, hot exchange at the time, and still operating out of China. $BNB dropped over 75%.

$BTC 40.30% drop over 14 days

/11

December 7th, 2017

On approach to what would mark the top, BTC dropped 23.59% in 3 days. Buy volume was declining, there were still no signs of divergence on the daily momentum indicators.

Dec 7th, marked the bottom for $ETHBTC and #altcoins vs. #Bitcoin

/13

On approach to what would mark the top, BTC dropped 23.59% in 3 days. Buy volume was declining, there were still no signs of divergence on the daily momentum indicators.

Dec 7th, marked the bottom for $ETHBTC and #altcoins vs. #Bitcoin

/13

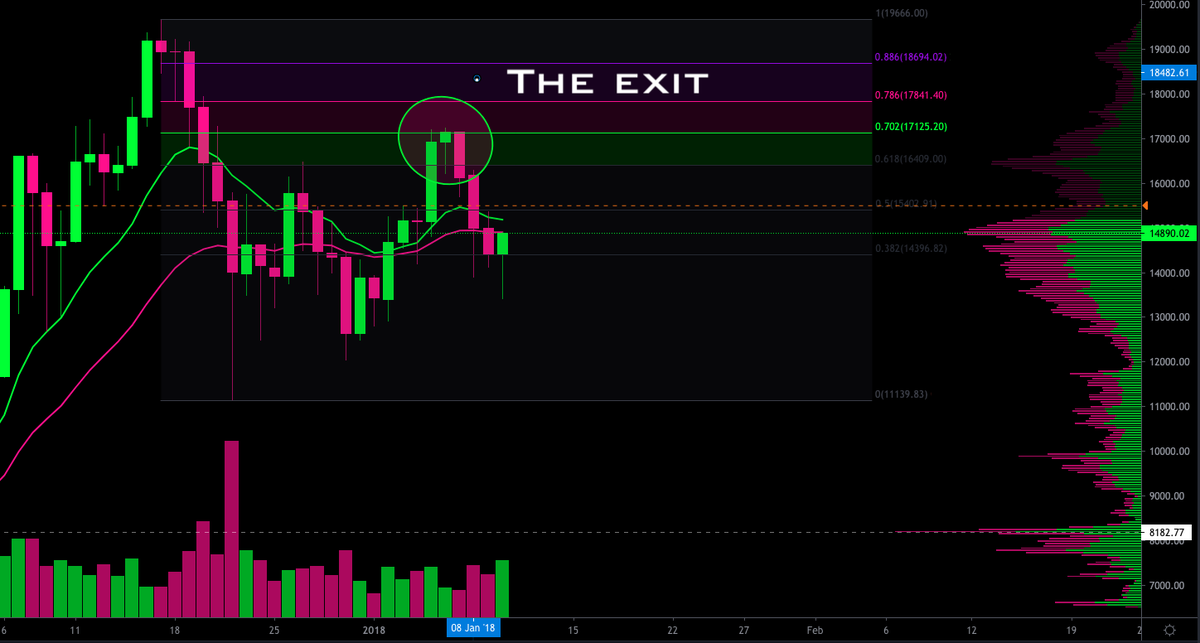

December 17th, 2017

After pushing to a new ATH yet again, bearish divergences appeared on momentum indicators, buy volume showed great weakness and on the day that CME futures went live, BTC proceeded to fall 43.44% over a period of 6 days.

This turned out to be the top!

/14

After pushing to a new ATH yet again, bearish divergences appeared on momentum indicators, buy volume showed great weakness and on the day that CME futures went live, BTC proceeded to fall 43.44% over a period of 6 days.

This turned out to be the top!

/14

In the following weeks, the dip buying mentality that had been carved into bulls mind, was kind enough to offer a polite exit up in the short reload zone (RLZ) of the fib drawn off the ATH/pivot low.

/15

/15

That was how the previous cycle played out.

It's very easy to look back at it now and mistakenly think that it was so easy to trade.

The fact is that after each new ATH and pullback, the top calling was VERY intense.

Bearish charts FLOODED social media.

/16

It's very easy to look back at it now and mistakenly think that it was so easy to trade.

The fact is that after each new ATH and pullback, the top calling was VERY intense.

Bearish charts FLOODED social media.

/16

Fast forward to today. #Bitcoin  broke the previous all-time high 27 days ago.

broke the previous all-time high 27 days ago.

The first wave of new ATH fomo has played out and we've experienced a 28.15% pullback from highs.

/17

broke the previous all-time high 27 days ago.

broke the previous all-time high 27 days ago. The first wave of new ATH fomo has played out and we've experienced a 28.15% pullback from highs.

/17

Was that it? Could we be headed back to 25k? 20k? Or even lower? New bear cycle? Sure. It's possible.

We can only establish probabilities based on what we know, objectively.

Institutional interest remains

Retail interest is growing

Printer still going Brrrrrr...

/17

We can only establish probabilities based on what we know, objectively.

Institutional interest remains

Retail interest is growing

Printer still going Brrrrrr...

/17

From a TA perspective, volume and momentum continued making new highs into the recent "top".

No signs of divergence, no signs of weakness.

#Altcoins are still almost all sitting near the lows vs. BTC and many have barely moved vs. USD in comparison to $ETH & $BTC vs USD.

/18

No signs of divergence, no signs of weakness.

#Altcoins are still almost all sitting near the lows vs. BTC and many have barely moved vs. USD in comparison to $ETH & $BTC vs USD.

/18

Objectively speaking, the probability that this marks the top and end of the bull cycle appears to be very low.

The 28.15% drawdown on no real narrative change, appears to be completely normal, and "healthy" as part of a larger trend.

/19

The 28.15% drawdown on no real narrative change, appears to be completely normal, and "healthy" as part of a larger trend.

/19

I still "feel" like 20k needs a retest someday. I keep a cash position on hand ALWAYS, so that I can maneuver on both sides of the price action.

But when I unpack the historical data, I can't bring myself to call tops on this market.

Not here..

Not yet...

/20

But when I unpack the historical data, I can't bring myself to call tops on this market.

Not here..

Not yet...

/20

A few of my alt/usd positions were stopped out yesterday. (Some in profit  , some loss

, some loss  ).

).

I watched a large USD drawdown take place on my holdings.

It felt gross.

"Why didn't I sell on the weekend?"

"I could have shorted and made money"

Strong emotions.

/21

, some loss

, some loss  ).

).I watched a large USD drawdown take place on my holdings.

It felt gross.

"Why didn't I sell on the weekend?"

"I could have shorted and made money"

Strong emotions.

/21

Today I zoomed out, spent some time analyzing. Checked the LTF structure and have decided to position myself on the long side of the market at these levels.

/22

/22

Objectively speaking. This pullback was completely fucking normal and there is nothing about it that looks like a top to me.

At least not yet

Long & Strong.

LFG

At least not yet

Long & Strong.

LFG

Read on Twitter

Read on Twitter