Affirm goes public tomorrow!

We'll find out if it was worth the wait. If you're thinking about investing, learn more here or via the deeply researched S-1 Club report (below).

<3 @ImChauncey @yrechtman @MarcRuby @julieverhage @ndardenn @AnnikaSays @jakesing_ @dlwei17 + SM.

We'll find out if it was worth the wait. If you're thinking about investing, learn more here or via the deeply researched S-1 Club report (below).

<3 @ImChauncey @yrechtman @MarcRuby @julieverhage @ndardenn @AnnikaSays @jakesing_ @dlwei17 + SM.

The full report is here.

So far, 15K have read and (I hope!) liked it. Check it out and sign up if you'd like the next break down :) https://thegeneralist.substack.com/p/affirm-the-morality-of-money

So far, 15K have read and (I hope!) liked it. Check it out and sign up if you'd like the next break down :) https://thegeneralist.substack.com/p/affirm-the-morality-of-money

1

Affirm in 30 seconds

- Delayed listing after $ABNB + $DASH run ups

- Expected to price $41-44/share

- Implied valuation of $10.7B at top-end

- Revenue at $509.5M for last fiscal year

- Huge customer concentration w/ Peloton

- Net losses of $112.6M in 2020

Affirm in 30 seconds

- Delayed listing after $ABNB + $DASH run ups

- Expected to price $41-44/share

- Implied valuation of $10.7B at top-end

- Revenue at $509.5M for last fiscal year

- Huge customer concentration w/ Peloton

- Net losses of $112.6M in 2020

2

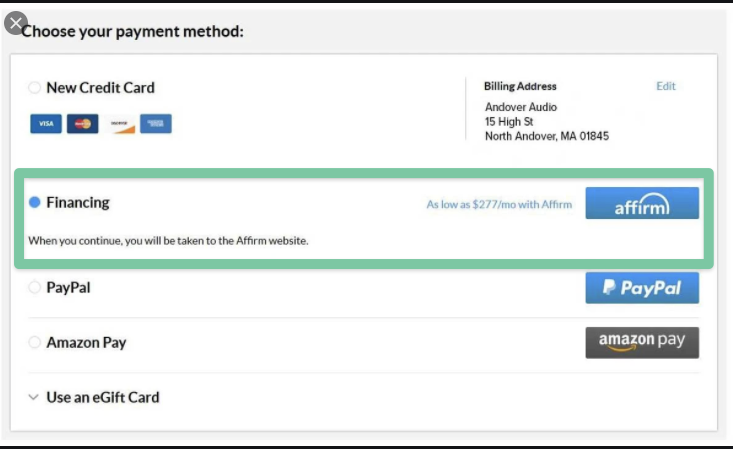

What does Affirm do?

You might have seen it when you reach a checkout page online. Basically, Affirm helps you pay for a purchase in installments.

So instead of paying $1000 upfront for a mattress, you can pay $250 four times, over four months.

What does Affirm do?

You might have seen it when you reach a checkout page online. Basically, Affirm helps you pay for a purchase in installments.

So instead of paying $1000 upfront for a mattress, you can pay $250 four times, over four months.

3

How does Affirm make money?

Two ways.

1. It charges the customer interest.

2. It takes a cut of the transaction from the merchant.

Affirm's interest rates range from 0-30% APR. When a zero-interest loan is offered, Affirm takes a larger cut from merchants.

How does Affirm make money?

Two ways.

1. It charges the customer interest.

2. It takes a cut of the transaction from the merchant.

Affirm's interest rates range from 0-30% APR. When a zero-interest loan is offered, Affirm takes a larger cut from merchants.

4

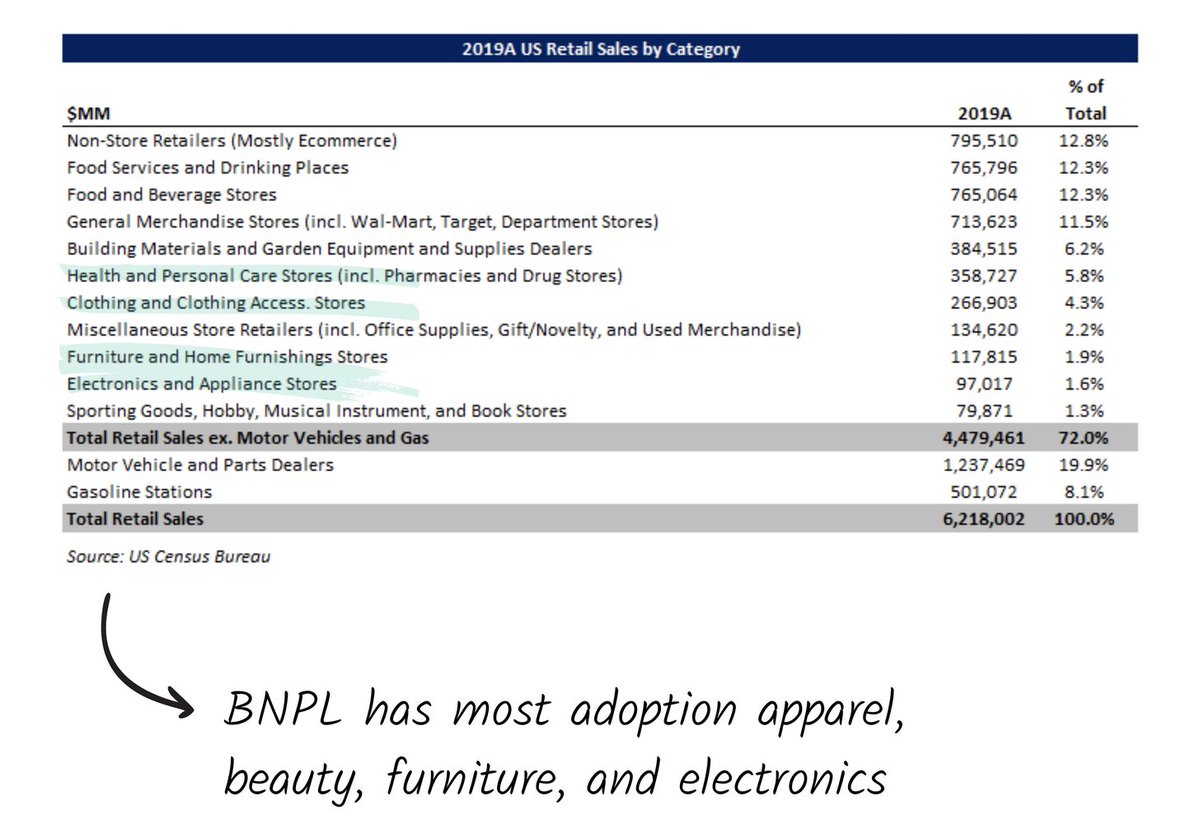

Is this a big market?

It depends how you look at it. Right now, "buy now, pay later" (BNPL) companies like Affirm only process sales in the tens of billions.

They're almost exclusively used online, and mostly on purchases in apparel, furniture, and electronics.

Is this a big market?

It depends how you look at it. Right now, "buy now, pay later" (BNPL) companies like Affirm only process sales in the tens of billions.

They're almost exclusively used online, and mostly on purchases in apparel, furniture, and electronics.

5

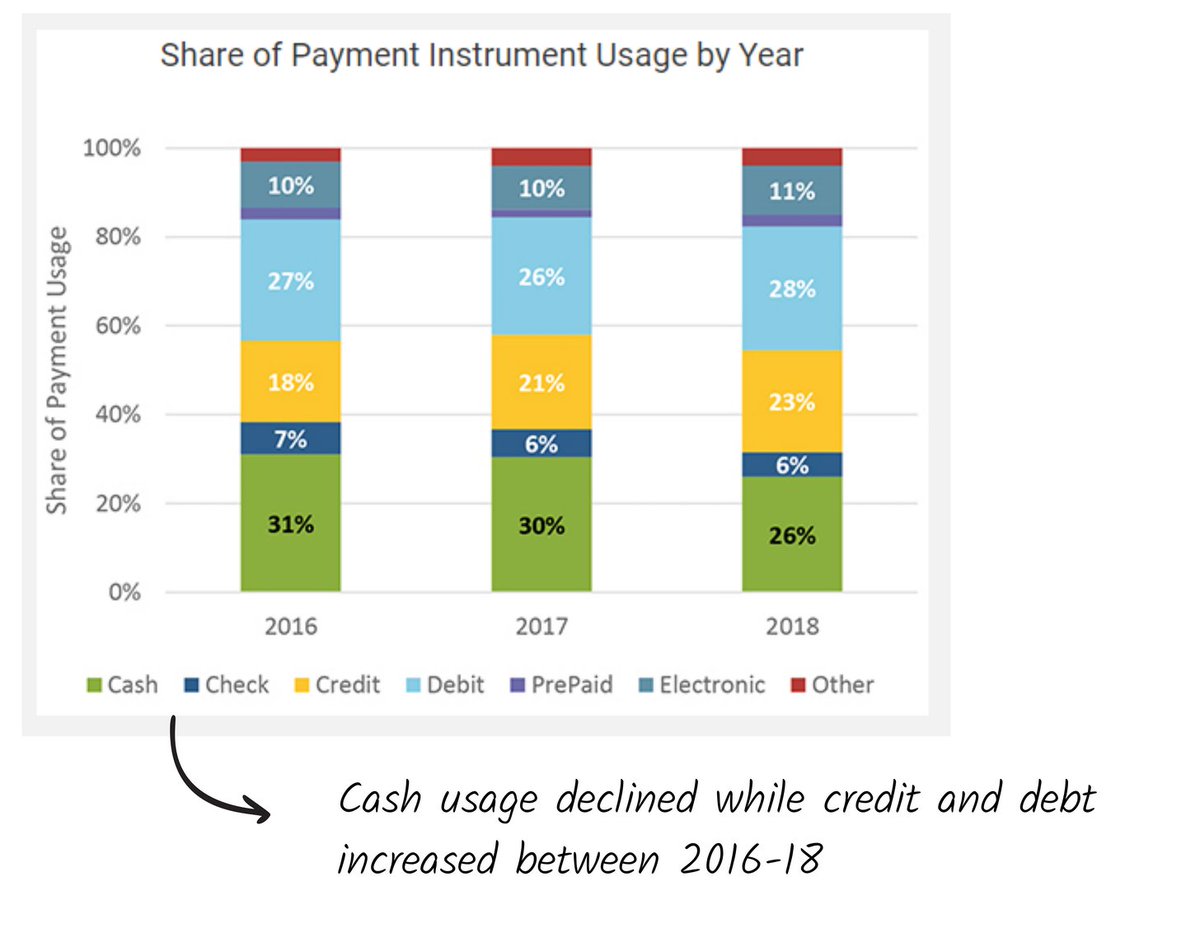

What's another way to look at it?

Optimists might say $AFRM's TAM is really the $25T in global retail spend. Almost every purchase could, theoretically, be amortized with BNPL.

In particular, Affirm will hope to steal share from the 23% of purchases made via credit cards.

What's another way to look at it?

Optimists might say $AFRM's TAM is really the $25T in global retail spend. Almost every purchase could, theoretically, be amortized with BNPL.

In particular, Affirm will hope to steal share from the 23% of purchases made via credit cards.

6

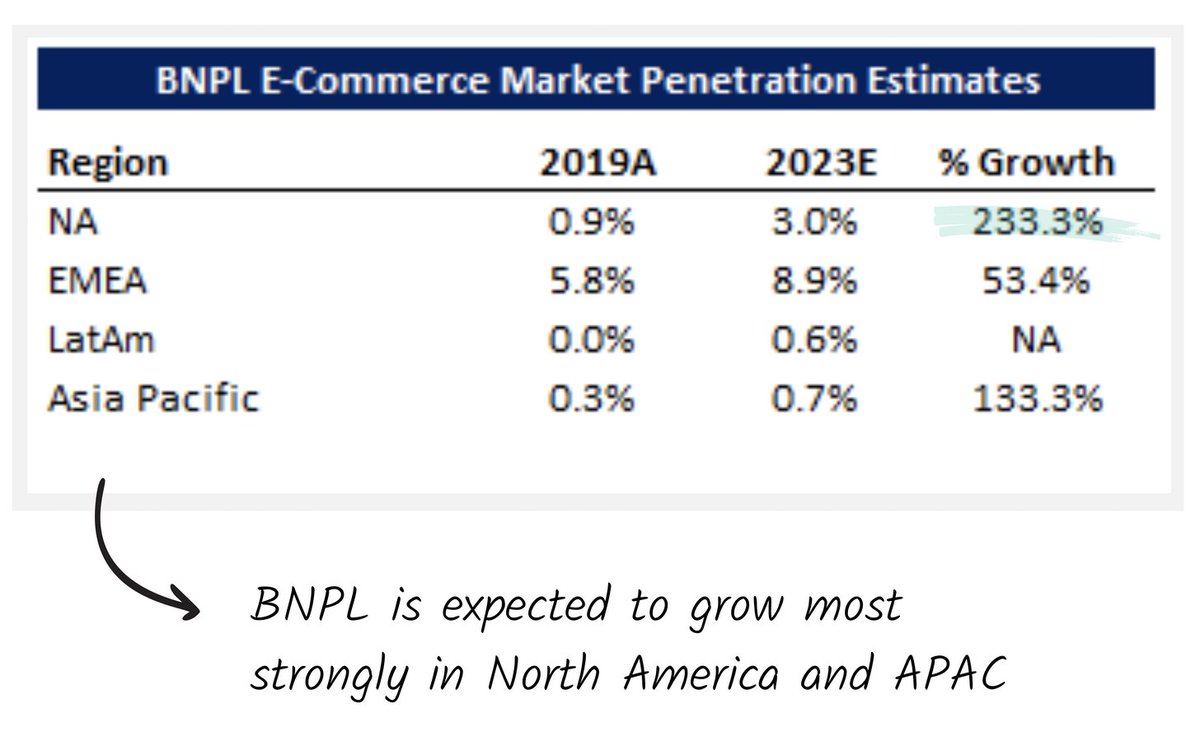

How important is e-commerce adoption?

Very.

BNPL solutions have experimented with offering physical cards, but atm the product is best suited to online purchases.

Bulls will be excited to seeBNPL is expected to grab a bigger % of e-commerce spending in coming years.

How important is e-commerce adoption?

Very.

BNPL solutions have experimented with offering physical cards, but atm the product is best suited to online purchases.

Bulls will be excited to seeBNPL is expected to grab a bigger % of e-commerce spending in coming years.

7

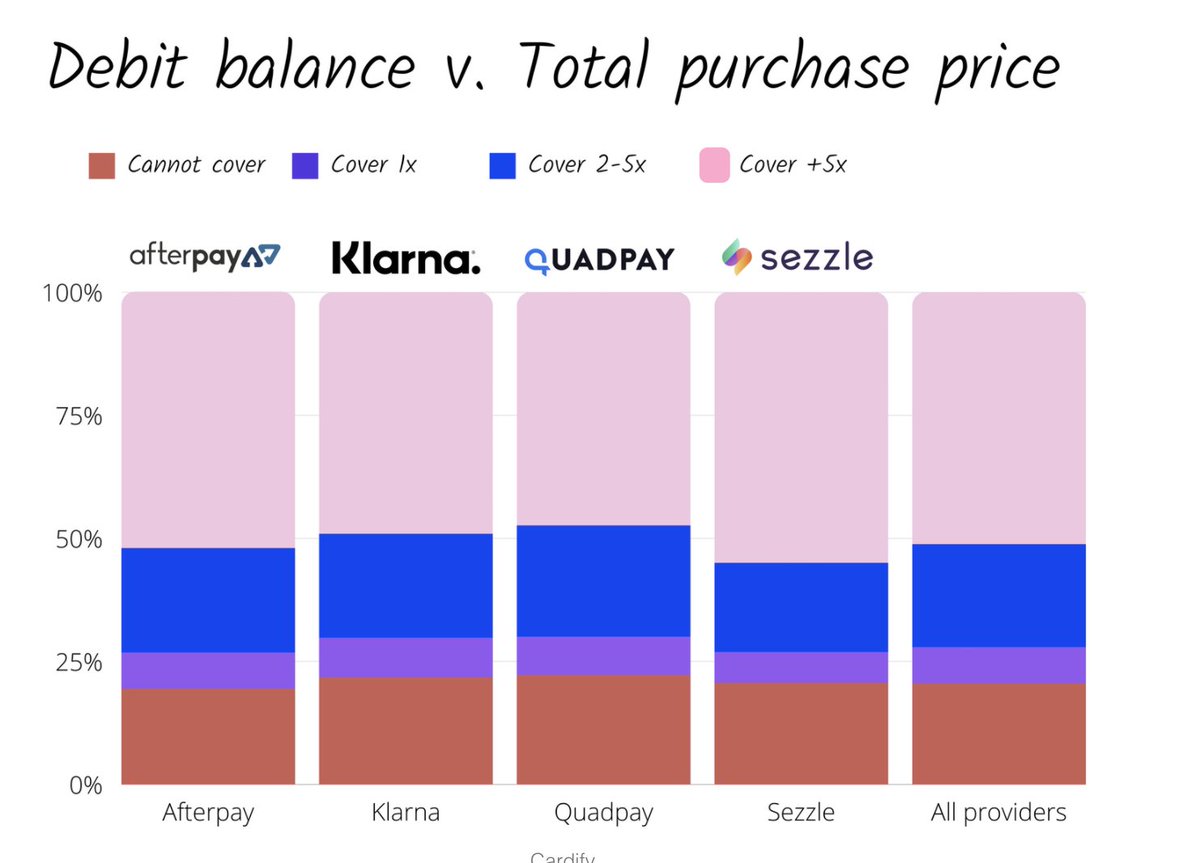

Are BNPL customers *good* customers?

Or to put it another way: is there a significant risk of default?

Most customers are actually able to cover the costs of their purchase at the time of checkout. For these folks, BNPL is a *preference* not a *necessity*.

Are BNPL customers *good* customers?

Or to put it another way: is there a significant risk of default?

Most customers are actually able to cover the costs of their purchase at the time of checkout. For these folks, BNPL is a *preference* not a *necessity*.

8

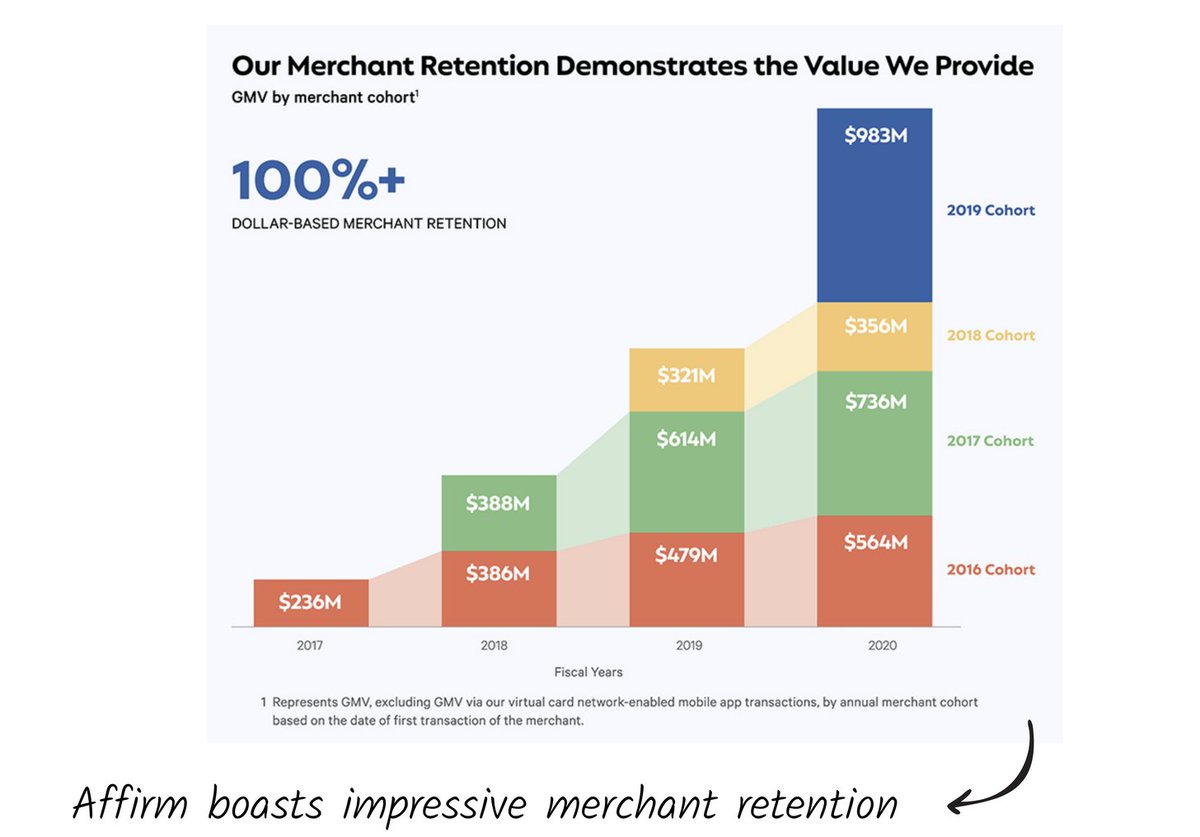

Is Affirm a good solution?

Merchants seem to like it. The S-1 features a graphic that shows that retention is strong.

Plus, the company claims to increase AOV by 85% and repeat purchase rates by 20%.

Impressive.

Is Affirm a good solution?

Merchants seem to like it. The S-1 features a graphic that shows that retention is strong.

Plus, the company claims to increase AOV by 85% and repeat purchase rates by 20%.

Impressive.

9

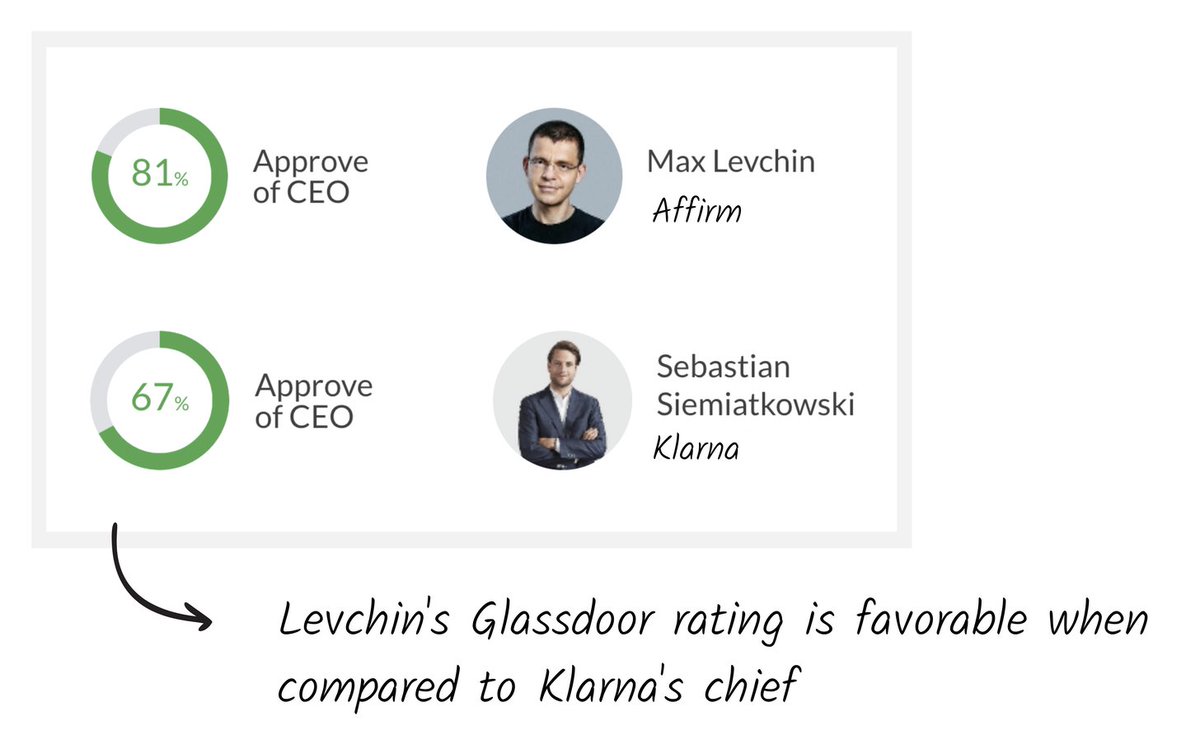

Who's the CEO?

Max Levchin.

It's hard to think of someone *better* suited to run a company like this. Levchin was a co-founder of Paypal, where he spent a lot of time focused on risk modeling and underwriting. Pretty handy.

He also seems well-liked.

Who's the CEO?

Max Levchin.

It's hard to think of someone *better* suited to run a company like this. Levchin was a co-founder of Paypal, where he spent a lot of time focused on risk modeling and underwriting. Pretty handy.

He also seems well-liked.

10

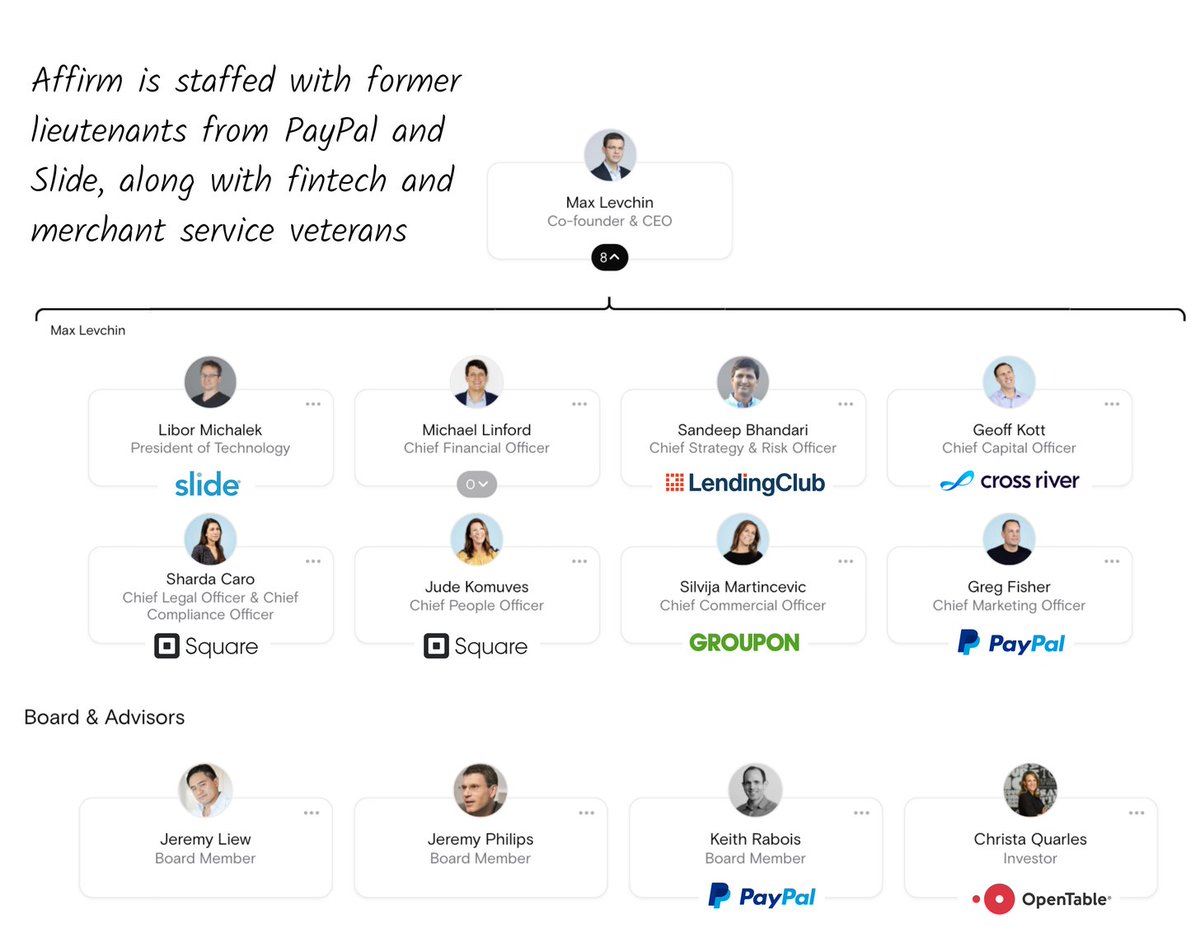

What does the rest of the team look like?

Very solid. Levchin's looped in veteran fintech operators, in addition to tapping his old alma maters.

- CTO from Slide

- CSO from Lending Club

- CCO from Cross River

- CLO + CPO from Square

- CMO from Paypal

What does the rest of the team look like?

Very solid. Levchin's looped in veteran fintech operators, in addition to tapping his old alma maters.

- CTO from Slide

- CSO from Lending Club

- CCO from Cross River

- CLO + CPO from Square

- CMO from Paypal

11

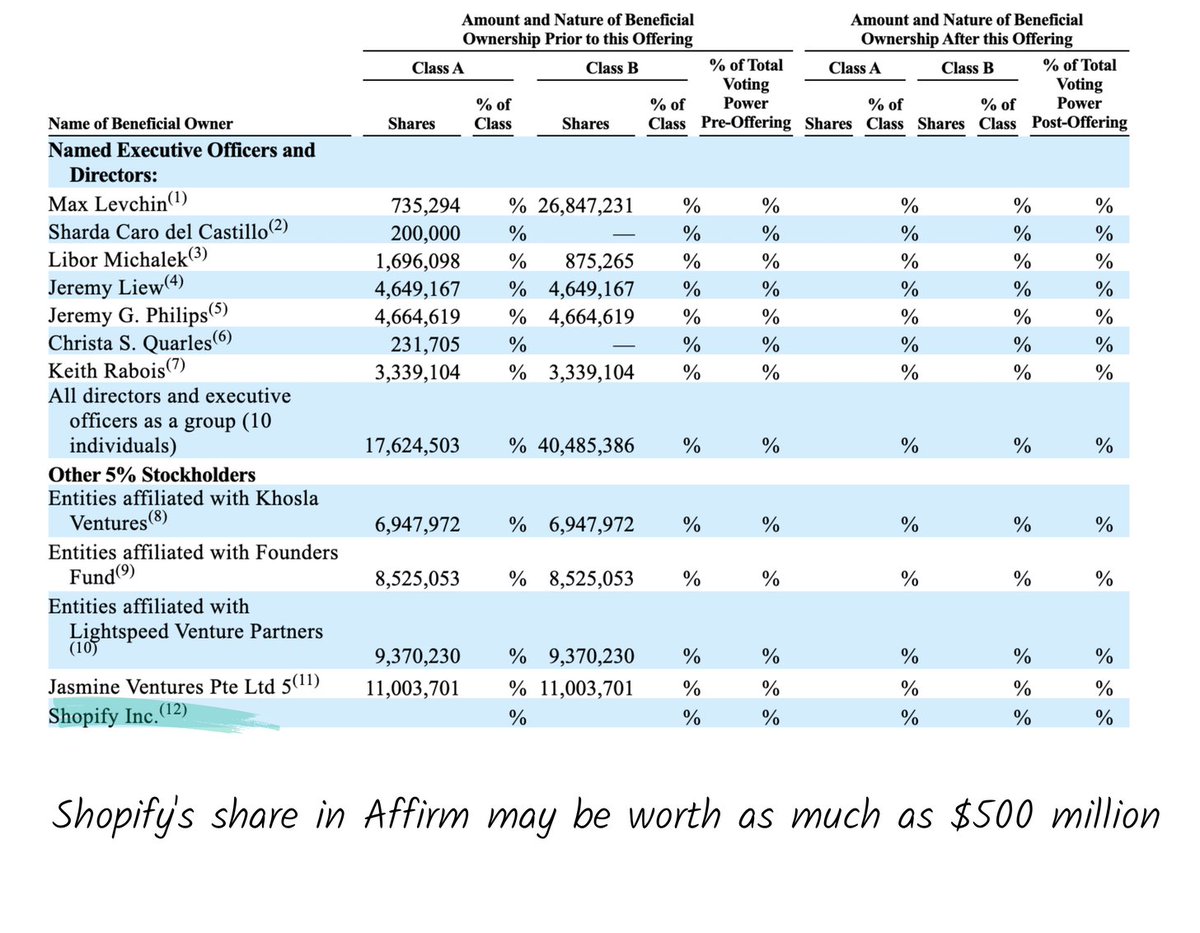

Who's a winner in this IPO?

The Paypal Mafia should get a nice windfall. Thiel's firm, Founders Fund invested, while Keith Rabois led Khosla's investment.

One additional winner? Shopify. As part of a partnership, the e-comm co received warrants possibly worth $500M.

Who's a winner in this IPO?

The Paypal Mafia should get a nice windfall. Thiel's firm, Founders Fund invested, while Keith Rabois led Khosla's investment.

One additional winner? Shopify. As part of a partnership, the e-comm co received warrants possibly worth $500M.

12

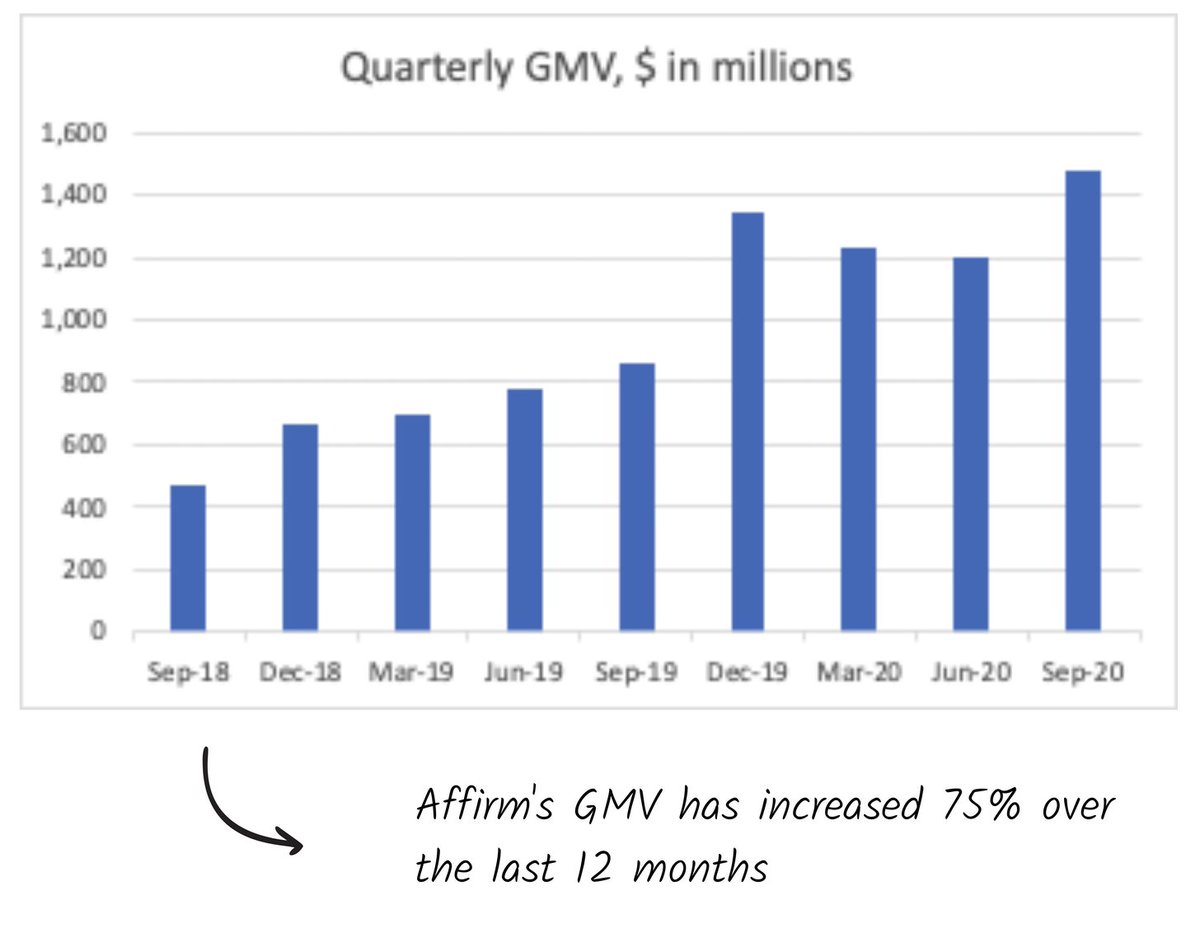

What do the numbers look like?

- GMV up 75% YoY

- 8.5M transactions processed

- AOV of $615

- Contribution profit equivalent to 4.5% of GMV

What do the numbers look like?

- GMV up 75% YoY

- 8.5M transactions processed

- AOV of $615

- Contribution profit equivalent to 4.5% of GMV

13

What other numbers should I pay attention to?

There's a lot of nitty-gritty here. The full piece gets deeply into merchant network revenue, and lending revenue.

Ctrl-F "Financial highlights" to jump to that section. https://thegeneralist.substack.com/p/affirm-the-morality-of-money

What other numbers should I pay attention to?

There's a lot of nitty-gritty here. The full piece gets deeply into merchant network revenue, and lending revenue.

Ctrl-F "Financial highlights" to jump to that section. https://thegeneralist.substack.com/p/affirm-the-morality-of-money

14

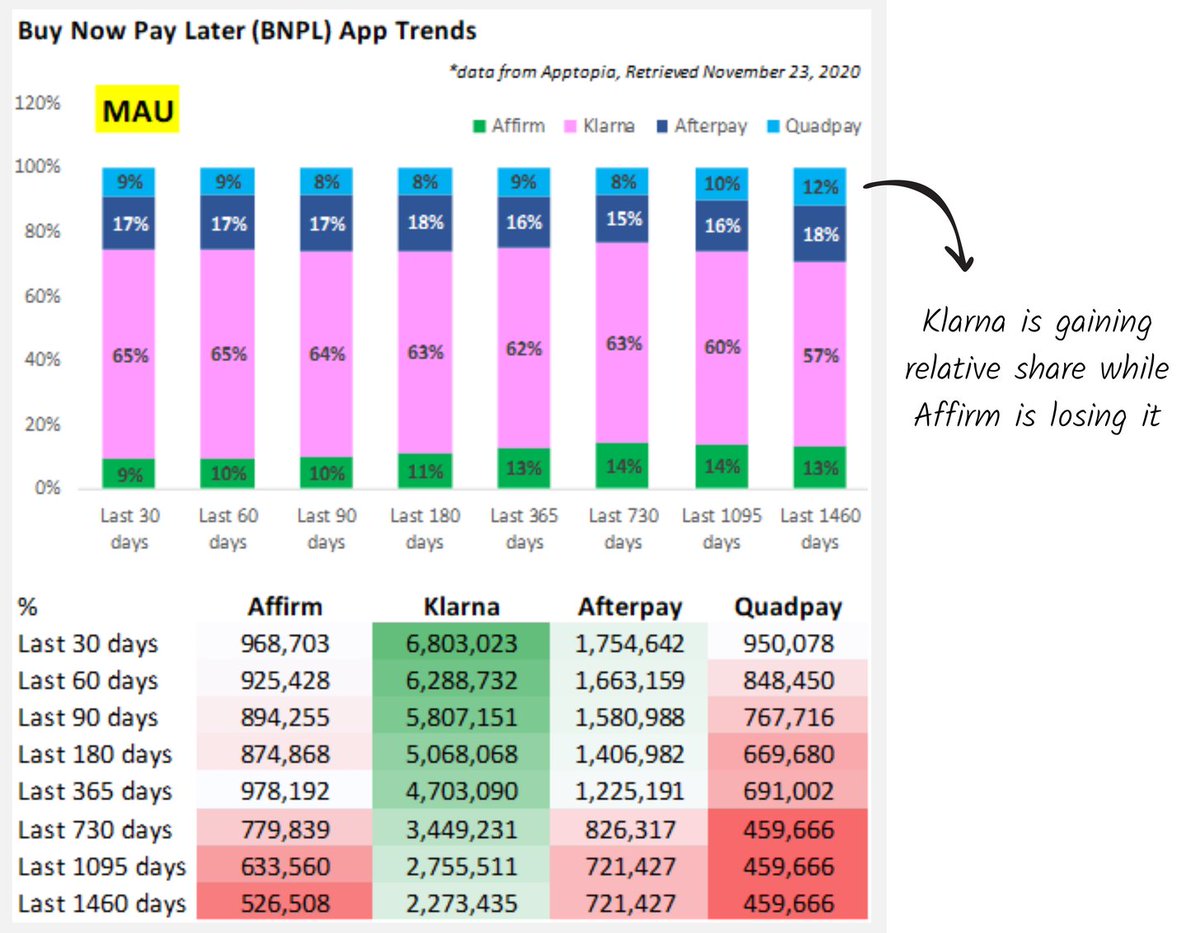

Is there competition?

Eek. Yes.

Klarna and Afterpay are serious threats. Quadpay, Sezzle and others are dangerous insurgents.

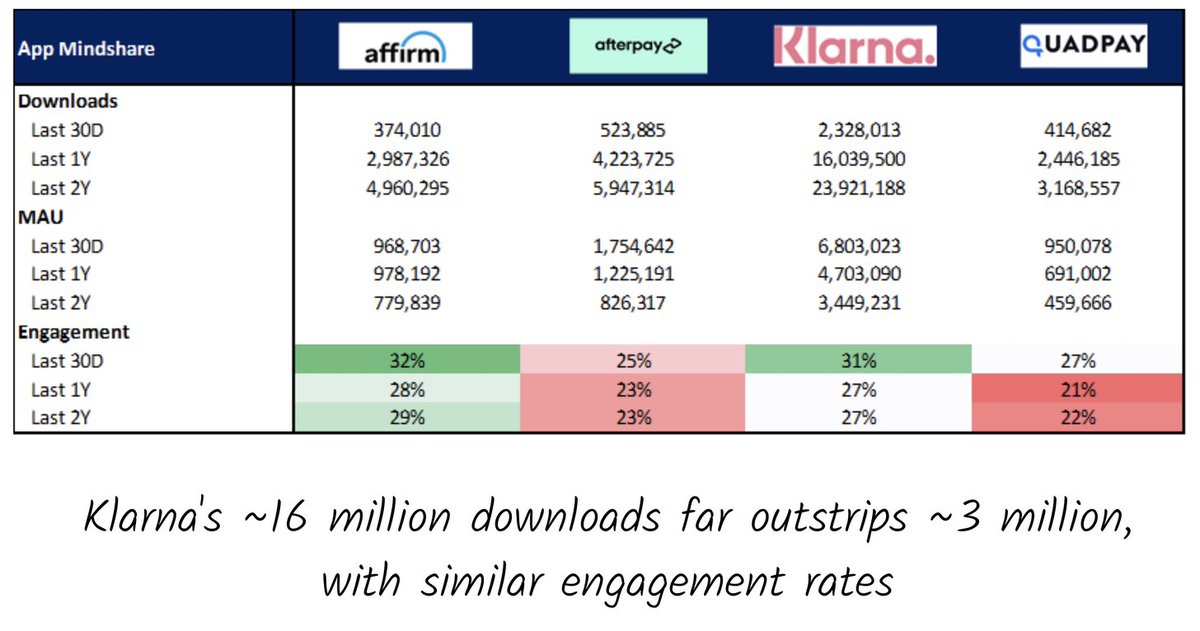

Klarna is currently the largest player in the space. Looking at some data from Apptopia, there's reason to believe Affirm might be losing share.

Is there competition?

Eek. Yes.

Klarna and Afterpay are serious threats. Quadpay, Sezzle and others are dangerous insurgents.

Klarna is currently the largest player in the space. Looking at some data from Apptopia, there's reason to believe Affirm might be losing share.

15

How does Affirm stack up?

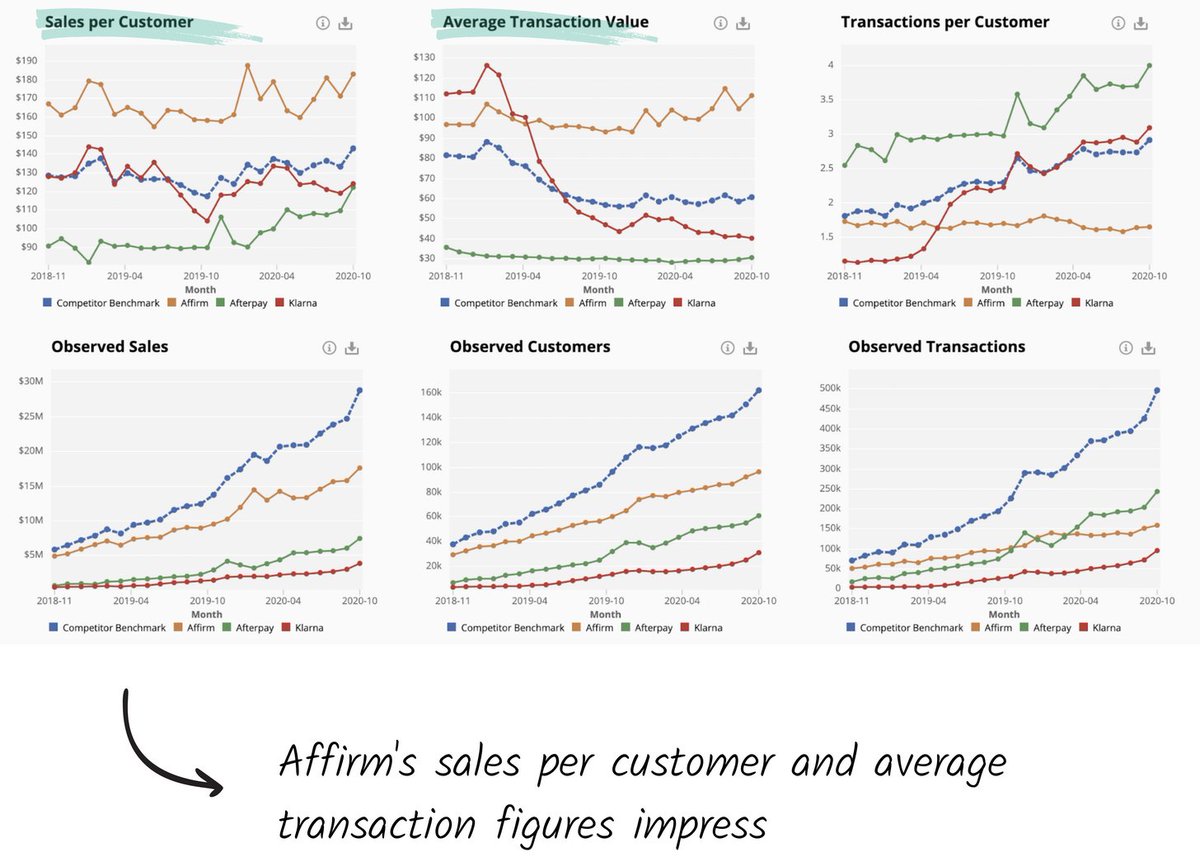

They look good when checking out sales per customer, and average transaction value. That's because Affirm is often used for high-value purchases (like a Peloton).

The other side of that coin is they have a low # of transactions per customer.

How does Affirm stack up?

They look good when checking out sales per customer, and average transaction value. That's because Affirm is often used for high-value purchases (like a Peloton).

The other side of that coin is they have a low # of transactions per customer.

16

What else do they need to worry about?

Defensibility.

Honestly, there doesn't appear to be much product differentiation and there isn't a steep barrier to entry. That might lead to big companies offering their own financing options in-house.

What else do they need to worry about?

Defensibility.

Honestly, there doesn't appear to be much product differentiation and there isn't a steep barrier to entry. That might lead to big companies offering their own financing options in-house.

17

Is this already happening?

Yes. JP Morgan Chase, Amazon, and Paypal all provide installment payment options now.

To build an enduring advantage, Affirm needs to sign enduring partnerships like it has with Shopify. Having deep distribution is key.

Is this already happening?

Yes. JP Morgan Chase, Amazon, and Paypal all provide installment payment options now.

To build an enduring advantage, Affirm needs to sign enduring partnerships like it has with Shopify. Having deep distribution is key.

18

Is regulation a concern?

Yes. Particularly the "rent-a-bank" model that $AFRM leverages via Cross River. More in the piece.

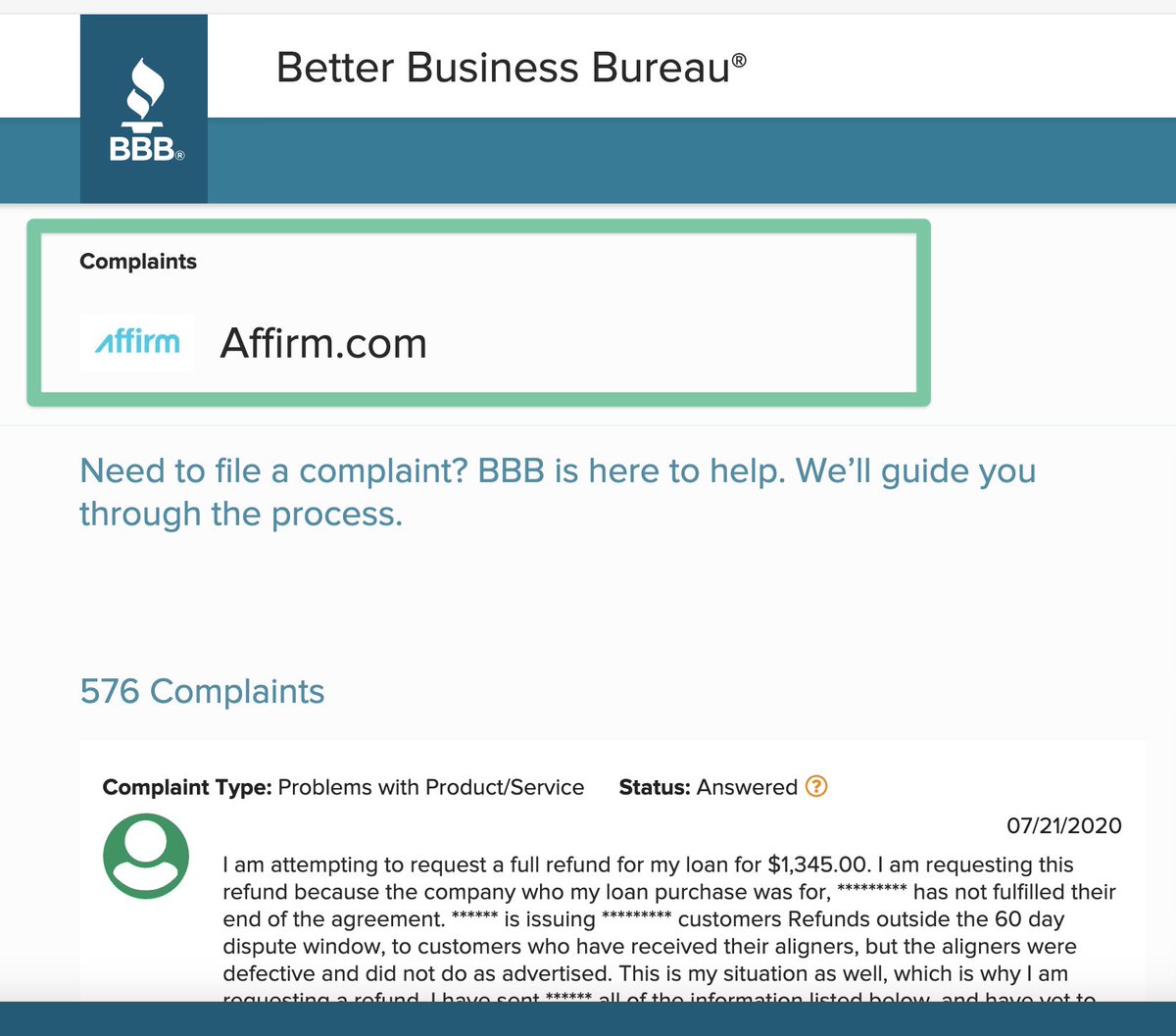

Beyond that, a change in consumer sentiment might push regulators to look more closely. Complaints w/ the BBB rose significantly in the last year.

Is regulation a concern?

Yes. Particularly the "rent-a-bank" model that $AFRM leverages via Cross River. More in the piece.

Beyond that, a change in consumer sentiment might push regulators to look more closely. Complaints w/ the BBB rose significantly in the last year.

This was a super fun one to dig into with a baller crew.

There's a lot more in the full piece about Affirm's flywheel, their relationship with Cross River, and Levchin's origins.

Check it out here :) https://thegeneralist.substack.com/p/affirm-the-morality-of-money

There's a lot more in the full piece about Affirm's flywheel, their relationship with Cross River, and Levchin's origins.

Check it out here :) https://thegeneralist.substack.com/p/affirm-the-morality-of-money

Read on Twitter

Read on Twitter