$STPK Interesting SPAC that will merge with Stem Inc

Quick thread on some points I’ve gathered:

- Market leader in AI energy storage solutions.

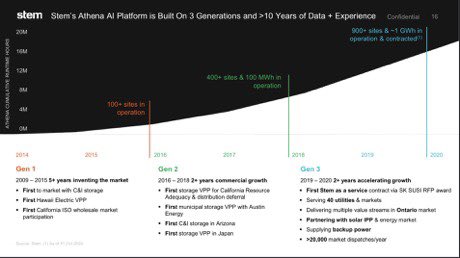

- AI driven SaaS platform called Athena with 80% gross margins. (1 of 3 parts of their biz)

- Energy Storage market has a $1.2T TAM

Quick thread on some points I’ve gathered:

- Market leader in AI energy storage solutions.

- AI driven SaaS platform called Athena with 80% gross margins. (1 of 3 parts of their biz)

- Energy Storage market has a $1.2T TAM

How does it generate revenue?

- Offers battery hardware produced by suppliers such as $TSLA by layering on its smart technology.

- Athena its Ai driven software platform collects data and helps customers alternate between various energy sources to optimise energy efficiency.

- Offers battery hardware produced by suppliers such as $TSLA by layering on its smart technology.

- Athena its Ai driven software platform collects data and helps customers alternate between various energy sources to optimise energy efficiency.

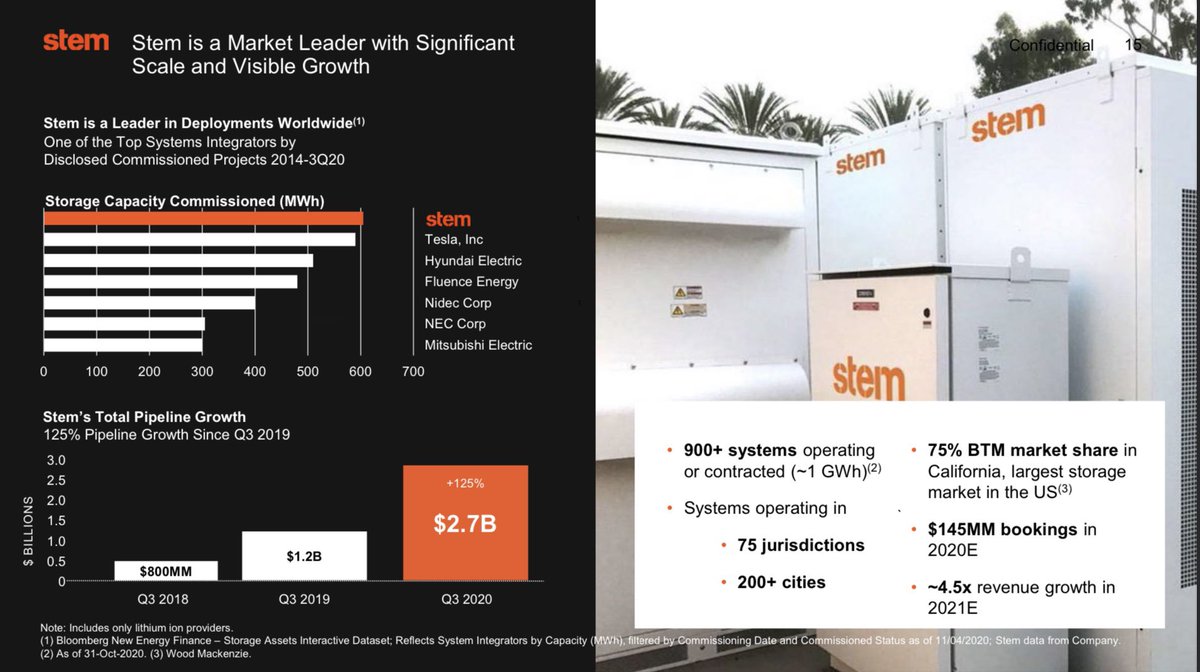

How is it a leader?

- More storage capacity commissioned than peers.

- 75% market share in the California Commercial and industrial sprague market.

- Over 900 systems operating/contracted with their Athena software platform.

- More storage capacity commissioned than peers.

- 75% market share in the California Commercial and industrial sprague market.

- Over 900 systems operating/contracted with their Athena software platform.

Experienced management:

- CEO was previous executive at $FSLR where he grew revenue from $400 mil to $2B

- CTO was previous CTO of the multinational conglomerate Siemens

- CEO was previous executive at $FSLR where he grew revenue from $400 mil to $2B

- CTO was previous CTO of the multinational conglomerate Siemens

Catalysts:

- The most obvious one, Biden’s proposed huge $2T infrastructure and green energy plan, of which Stem will be a huge beneficiary for this.

- Attractive valuation: Despite growth projections higher than peers, currently trading at a lower multiple compared to comp.

- The most obvious one, Biden’s proposed huge $2T infrastructure and green energy plan, of which Stem will be a huge beneficiary for this.

- Attractive valuation: Despite growth projections higher than peers, currently trading at a lower multiple compared to comp.

@SeifelCapital @Soumyazen @saxena_puru @GrowthStockInv1 @skaushi @DPogrebinsky

Any quick thoughts on the company?

Any quick thoughts on the company?

Read on Twitter

Read on Twitter