1/n

@EffMktHype thank you (I'm a fan of your work)

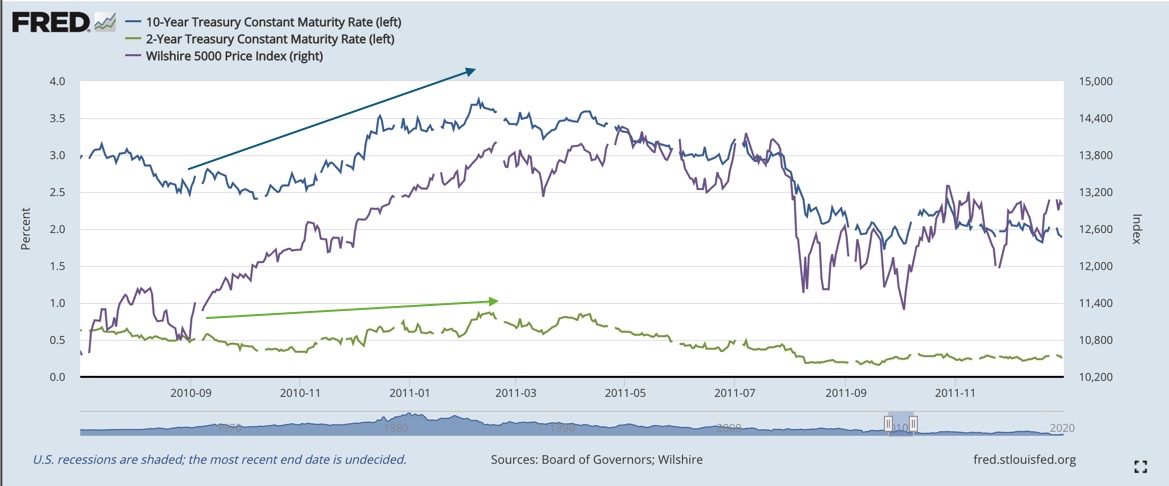

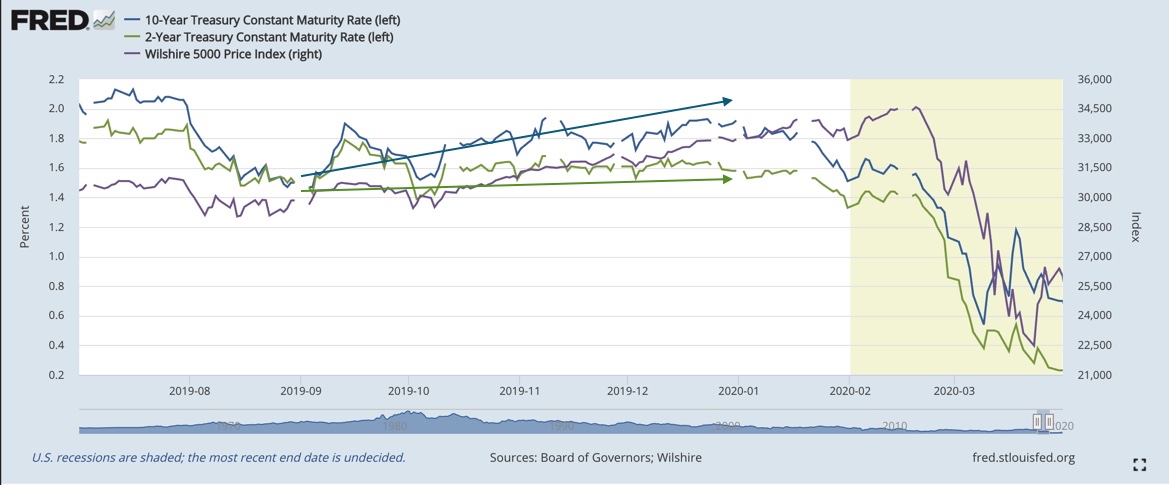

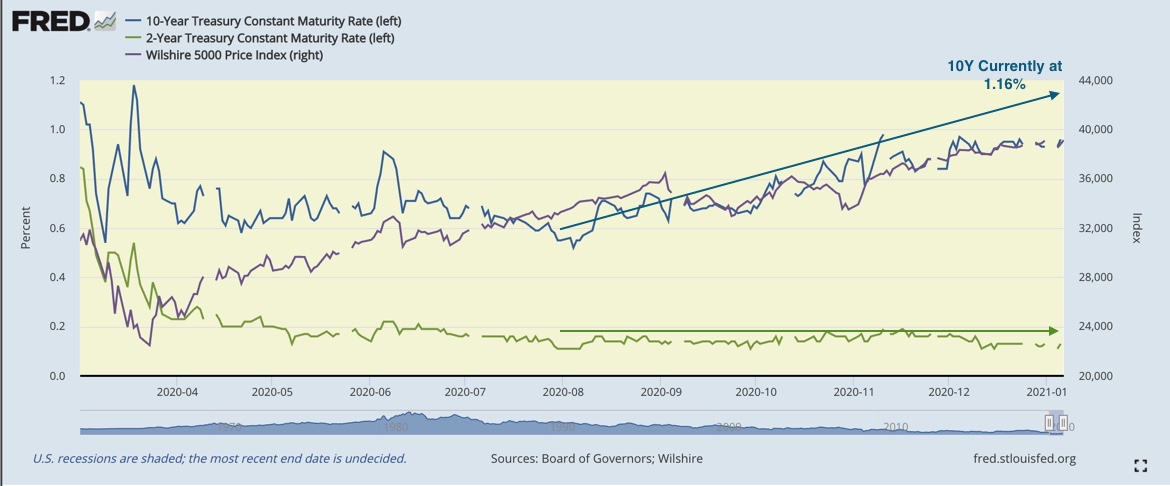

All the instances I've quoted have involved bear steepening (not bull i.e. not rate cut driven). Also, the bull market resumed following the correction in all cases.

Below are the corresponding charts

@EffMktHype thank you (I'm a fan of your work)

All the instances I've quoted have involved bear steepening (not bull i.e. not rate cut driven). Also, the bull market resumed following the correction in all cases.

Below are the corresponding charts

3/n

I'm not implying the relationship is causal (more anecdotal). Also of note in each instance bear steepening coincided with a rising equity market prior to the correction. I agree that FCI is the most important factor. This from yesterday https://twitter.com/siddiqui71/status/1348727542807715842?s=20

I'm not implying the relationship is causal (more anecdotal). Also of note in each instance bear steepening coincided with a rising equity market prior to the correction. I agree that FCI is the most important factor. This from yesterday https://twitter.com/siddiqui71/status/1348727542807715842?s=20

4/n

The same for spreads https://twitter.com/macro_daily/status/1348960164074844163?s=20

The same for spreads https://twitter.com/macro_daily/status/1348960164074844163?s=20

5/n

Vix and MOVE are however nudging higher https://twitter.com/macro_daily/status/1348945316142223362?s=20

Vix and MOVE are however nudging higher https://twitter.com/macro_daily/status/1348945316142223362?s=20

6/n

There may be several other factors at play. A potential reversal in the USD, inflation expectations topping out (?), real rates bottoming (?), rate-sensitive sectors particularly growth tech' vulnerability to this, valuations in general, CTAs' ... https://twitter.com/siddiqui71/status/1334895802460856322?s=20

There may be several other factors at play. A potential reversal in the USD, inflation expectations topping out (?), real rates bottoming (?), rate-sensitive sectors particularly growth tech' vulnerability to this, valuations in general, CTAs' ... https://twitter.com/siddiqui71/status/1334895802460856322?s=20

7/n

... CTAs' reaction, rising yields = +ve feedback loop leading to foreign buyers returning, a tsunami of fresh UST issuance may cause draining of reserves, a rising USD may dampen rising commodity prices and the inflation narrative with it, etc. https://twitter.com/EVMacro/status/1348267715027480577?s=20

... CTAs' reaction, rising yields = +ve feedback loop leading to foreign buyers returning, a tsunami of fresh UST issuance may cause draining of reserves, a rising USD may dampen rising commodity prices and the inflation narrative with it, etc. https://twitter.com/EVMacro/status/1348267715027480577?s=20

8/n

Starting with the USD, here's a great thread explaining my own view https://twitter.com/BittelJulien/status/1348938265777336320?s=20

Starting with the USD, here's a great thread explaining my own view https://twitter.com/BittelJulien/status/1348938265777336320?s=20

9/n

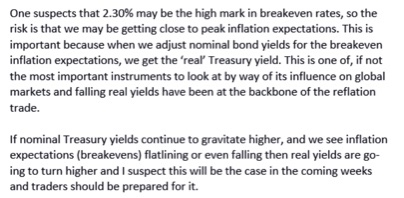

Inflation expectations potentially topping out (rising USD?)

Another great post below on this. https://twitter.com/benbreitholtz/status/1347202863378935813?s=20

Inflation expectations potentially topping out (rising USD?)

Another great post below on this. https://twitter.com/benbreitholtz/status/1347202863378935813?s=20

10/n

On real rates potentially bottoming and inflation expectations potentially topping here's a great note by @ChrisWeston_PS

https://twitter.com/ChrisWeston_PS/status/1348417410437582851?s=20

On real rates potentially bottoming and inflation expectations potentially topping here's a great note by @ChrisWeston_PS

https://twitter.com/ChrisWeston_PS/status/1348417410437582851?s=20

11/n

Prospect of higher 'blue' taxes and a clampdown on big tech?

Rate sensitive sectors https://twitter.com/Stimpyz1/status/1347180731768786948?s=20

https://twitter.com/Stimpyz1/status/1347180731768786948?s=20

Prospect of higher 'blue' taxes and a clampdown on big tech?

Rate sensitive sectors

https://twitter.com/Stimpyz1/status/1347180731768786948?s=20

https://twitter.com/Stimpyz1/status/1347180731768786948?s=20

15/n

CTAs: Here's an interesting article h/t @StephenSpratt https://twitter.com/StephenSpratt/status/1346725559892549633?s=20

CTAs: Here's an interesting article h/t @StephenSpratt https://twitter.com/StephenSpratt/status/1346725559892549633?s=20

16/n

Why higher back-end rates are a cure for higher back-end rates. As yields rise foreign buyers should step back in https://twitter.com/StephenSpratt/status/1347317794837196800?s=20

Why higher back-end rates are a cure for higher back-end rates. As yields rise foreign buyers should step back in https://twitter.com/StephenSpratt/status/1347317794837196800?s=20

17/n

High yields in UST will cause EM stress https://twitter.com/siddiqui71/status/1348651826862764032?s=20

High yields in UST will cause EM stress https://twitter.com/siddiqui71/status/1348651826862764032?s=20

18/n

The tsunami of fresh UST issuance could lead to tighter liquidity (via draining of reserves) if UST issuance net of SOMA is positive (likely to be the case, $1.7T in the TGA notwithstanding. https://twitter.com/siddiqui71/status/1348048382628147200?s=20

The tsunami of fresh UST issuance could lead to tighter liquidity (via draining of reserves) if UST issuance net of SOMA is positive (likely to be the case, $1.7T in the TGA notwithstanding. https://twitter.com/siddiqui71/status/1348048382628147200?s=20

19/n

Fed currently buying ~$80b/m ($240B/qtr). Est. issuance according to the Treasury for Q1 '21 is $1.123T. They also plan to maintain a balance of $800B at the end of Q1 '21. This potentially leaves a sizeable gap that needs to be funded privately

https://home.treasury.gov/system/files/136/Sources-and-Uses-Nov-2-2020.pdf

Fed currently buying ~$80b/m ($240B/qtr). Est. issuance according to the Treasury for Q1 '21 is $1.123T. They also plan to maintain a balance of $800B at the end of Q1 '21. This potentially leaves a sizeable gap that needs to be funded privately

https://home.treasury.gov/system/files/136/Sources-and-Uses-Nov-2-2020.pdf

20/n

Taper talk may lead to market jitters? https://www.bloomberg.com/news/articles/2021-01-11/fed-officials-see-strong-economic-rebound-fanning-talk-of-taper?srnd=premium-europe

Taper talk may lead to market jitters? https://www.bloomberg.com/news/articles/2021-01-11/fed-officials-see-strong-economic-rebound-fanning-talk-of-taper?srnd=premium-europe

21/n

Also, I think the speed with which the back-end has steepened is important. https://twitter.com/siddiqui71/status/1347686121971589120?s=20

Also, I think the speed with which the back-end has steepened is important. https://twitter.com/siddiqui71/status/1347686121971589120?s=20

n/n

Here's Goldman yesterday https://twitter.com/zerohedge/status/1348687643282989061?s=20

Here's Goldman yesterday https://twitter.com/zerohedge/status/1348687643282989061?s=20

Read on Twitter

Read on Twitter