1/

One of my larger but less talked about long term plays is #ACP.

Some very good but for me expected news on battery grade quality testing through CSIRO yesterday.

Expected because their very near neighbour Blackrock has already confirmed effectively confirmed the area...

One of my larger but less talked about long term plays is #ACP.

Some very good but for me expected news on battery grade quality testing through CSIRO yesterday.

Expected because their very near neighbour Blackrock has already confirmed effectively confirmed the area...

2/

to contain graphite that is capable of being employed for batteries.

For those interested in potential future valuations, Blackrock (BKT) is an excellent barometer for pending Armadale progress.

Some facts on Blackrock.

Current MC = c. £45m so c. £25m higher than ACP.

to contain graphite that is capable of being employed for batteries.

For those interested in potential future valuations, Blackrock (BKT) is an excellent barometer for pending Armadale progress.

Some facts on Blackrock.

Current MC = c. £45m so c. £25m higher than ACP.

3/

That's an equivalent SP of c. 9.8p

To assess what sort of progress that valuation includes, one need only read through MDs John De Fries letter to shareholders, dated 24th Dec 2020.

https://blackrockmining.com.au/letter-to-shareholders-from-john-de-vries-managing-director/

That's an equivalent SP of c. 9.8p

To assess what sort of progress that valuation includes, one need only read through MDs John De Fries letter to shareholders, dated 24th Dec 2020.

https://blackrockmining.com.au/letter-to-shareholders-from-john-de-vries-managing-director/

4/

Summary of key additional progress for BKT beyond ACP ;

1. Mining Right in place.

2. EPC Partner in place with US$24m deferred costs until final plant performance tests (not first production).

3. Additional agreement on deferred costs with Yantai Jinyuan for mining machinery,

Summary of key additional progress for BKT beyond ACP ;

1. Mining Right in place.

2. EPC Partner in place with US$24m deferred costs until final plant performance tests (not first production).

3. Additional agreement on deferred costs with Yantai Jinyuan for mining machinery,

5/

bringing total deferred costs upto US$35m of the total US$115m they require for phase 1.

4. Project resettlement plan agreed.

5. Potential POSCO off take and pre-payment facility for 20-40k tonnes, generating c. $10-20m.

6. 15% Equity investment by POSCO for US $7.5m...

bringing total deferred costs upto US$35m of the total US$115m they require for phase 1.

4. Project resettlement plan agreed.

5. Potential POSCO off take and pre-payment facility for 20-40k tonnes, generating c. $10-20m.

6. 15% Equity investment by POSCO for US $7.5m...

6/

valuing BKT at a revised c. £46.7m when closed (due before 15th Jan).

Thus pushing an equivalent ACP to an SP of 10.15p.

Importantly, to get to the stage they are at, BKT haven't had to finalise the Tanzanian governments 16% free carry agreement, which remains under review.

valuing BKT at a revised c. £46.7m when closed (due before 15th Jan).

Thus pushing an equivalent ACP to an SP of 10.15p.

Importantly, to get to the stage they are at, BKT haven't had to finalise the Tanzanian governments 16% free carry agreement, which remains under review.

7/

Now nothing is ever so simple.

Firstly, this is merely a point in time and the clearly closure of the POSCO equity fiance will have an affect on their valuation, which I expect to be positive.

However, in terms of achievable milestones, be it there is risk,

Now nothing is ever so simple.

Firstly, this is merely a point in time and the clearly closure of the POSCO equity fiance will have an affect on their valuation, which I expect to be positive.

However, in terms of achievable milestones, be it there is risk,

8/

right now I don't see ACP having much difficulty in at least matching BKTs progress in 2021.

If so, then in very simply terms, that 10.15p fig should be on.

However, the one key difference here is the CAPEX.

BKT total stage 1 = $115m

ACP = $39.7m

right now I don't see ACP having much difficulty in at least matching BKTs progress in 2021.

If so, then in very simply terms, that 10.15p fig should be on.

However, the one key difference here is the CAPEX.

BKT total stage 1 = $115m

ACP = $39.7m

9/

Whilst BKT have made great inroads into their CAPEX, they are still some way from closing it out.

BKT cash reserves at 30th Sept 2020 were A$1.7m + A$2m raise in Oct = c. A$3.7m (US$2.9m)

Even with the POSCO pre-payment facility maxed out, BKT have just $30m of their...

Whilst BKT have made great inroads into their CAPEX, they are still some way from closing it out.

BKT cash reserves at 30th Sept 2020 were A$1.7m + A$2m raise in Oct = c. A$3.7m (US$2.9m)

Even with the POSCO pre-payment facility maxed out, BKT have just $30m of their...

10/

required CAPEX + $35m in deferred payments, which will potentially still need to be paid prior to first production.

So still US$50m short, which right now is looking like equity.

This is for me where the strength of ACPs smaller CAPEX kicks in because as the above...

required CAPEX + $35m in deferred payments, which will potentially still need to be paid prior to first production.

So still US$50m short, which right now is looking like equity.

This is for me where the strength of ACPs smaller CAPEX kicks in because as the above...

11/

milestones begin to get ticked off, ACP should at the very least, see an amplified affect on its valuation.

If ACP were to secure 60% of its CAPEX along the same sort of lines, then its feasible that the valuation could push much closer to that of BKT, prior to equity close.

milestones begin to get ticked off, ACP should at the very least, see an amplified affect on its valuation.

If ACP were to secure 60% of its CAPEX along the same sort of lines, then its feasible that the valuation could push much closer to that of BKT, prior to equity close.

12/

40% equity is 'just' £12.2m.

If ACP were able to make up even just half the difference to BKT prior to this, then the valuation would stand at close to £33m, meaning just c. 37% dilution for access to a project with a current NPV of $430m...

40% equity is 'just' £12.2m.

If ACP were able to make up even just half the difference to BKT prior to this, then the valuation would stand at close to £33m, meaning just c. 37% dilution for access to a project with a current NPV of $430m...

13/

and this does not include my expected uplift in BKT, that will come once that equity finance/pre-payment facility is formally agreed.

If ACP hit the same sort of valuation as BKT prior to finance, driven by the above milestones and what is effectively debt financing,

and this does not include my expected uplift in BKT, that will come once that equity finance/pre-payment facility is formally agreed.

If ACP hit the same sort of valuation as BKT prior to finance, driven by the above milestones and what is effectively debt financing,

14/

then at c. £47m, that £12.2m is looking even easier to swallow.

None of this is without risk. For me ACP is a riskier investment than a BCN or HZM but its also arguably got far more potential from these low levels.

There is the warrants factor, of which there are c. 88m...

then at c. £47m, that £12.2m is looking even easier to swallow.

None of this is without risk. For me ACP is a riskier investment than a BCN or HZM but its also arguably got far more potential from these low levels.

There is the warrants factor, of which there are c. 88m...

15/

at my last count at ave. 2.4p, which could bring in up to £2m in additional funds for ACP. Dilution yes but also very handy cash for a company needing just c. £30m to unlock that $430m NPV.

The other important ingredient here of course is product price,

at my last count at ave. 2.4p, which could bring in up to £2m in additional funds for ACP. Dilution yes but also very handy cash for a company needing just c. £30m to unlock that $430m NPV.

The other important ingredient here of course is product price,

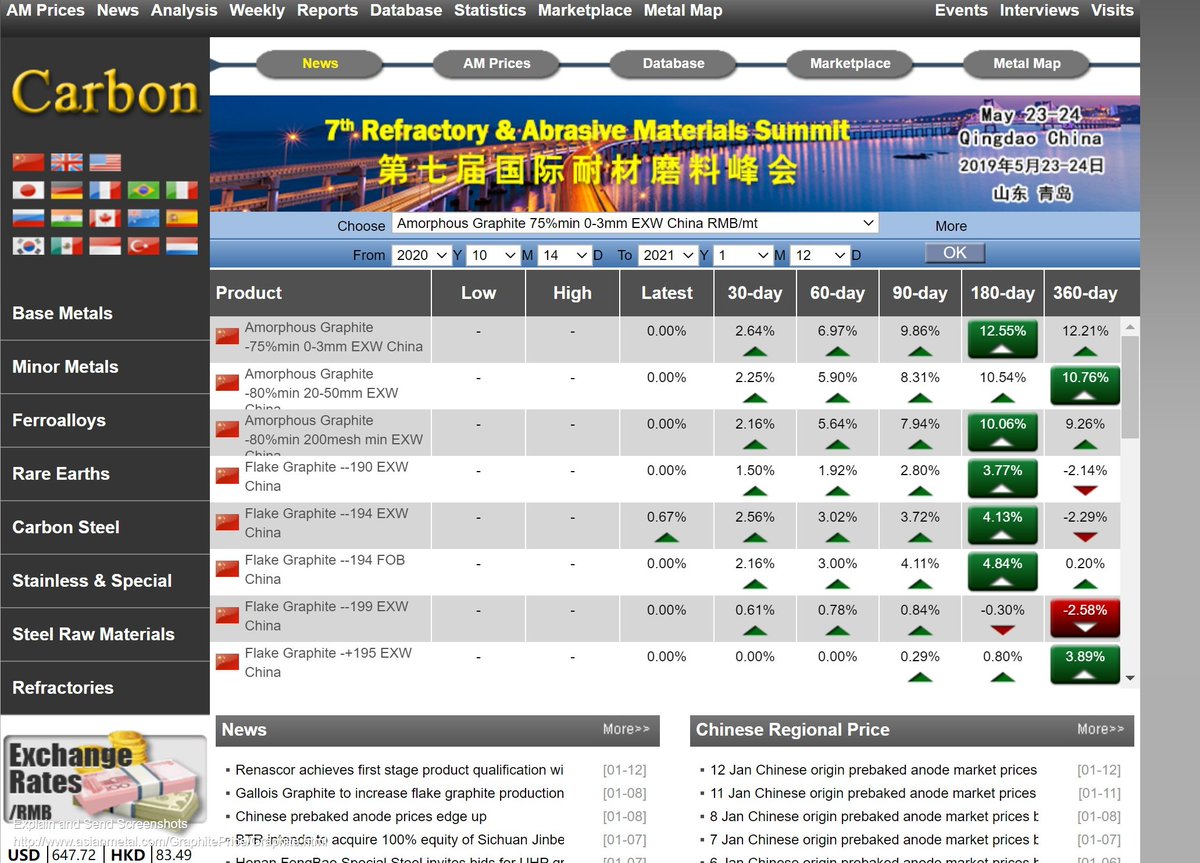

16/

which could well make the whole valuation debate irrelevant.

There are signs that things are starting to move, be it gradual but well worth keeping an eye on.

which could well make the whole valuation debate irrelevant.

There are signs that things are starting to move, be it gradual but well worth keeping an eye on.

17/

I have no doubt that the graphite market and its participants are going to see a great deal of demand in time. The commodities bull market with EV at its centre, will for me certainly see to that.

If ACP can time its update, starting with the all important Mining Right,

I have no doubt that the graphite market and its participants are going to see a great deal of demand in time. The commodities bull market with EV at its centre, will for me certainly see to that.

If ACP can time its update, starting with the all important Mining Right,

18/

the the two could well combine into a significant re-rate in 2021, demonstrated by the clear and measurable progress made by its neighbour Blackrock mining.

the the two could well combine into a significant re-rate in 2021, demonstrated by the clear and measurable progress made by its neighbour Blackrock mining.

18A

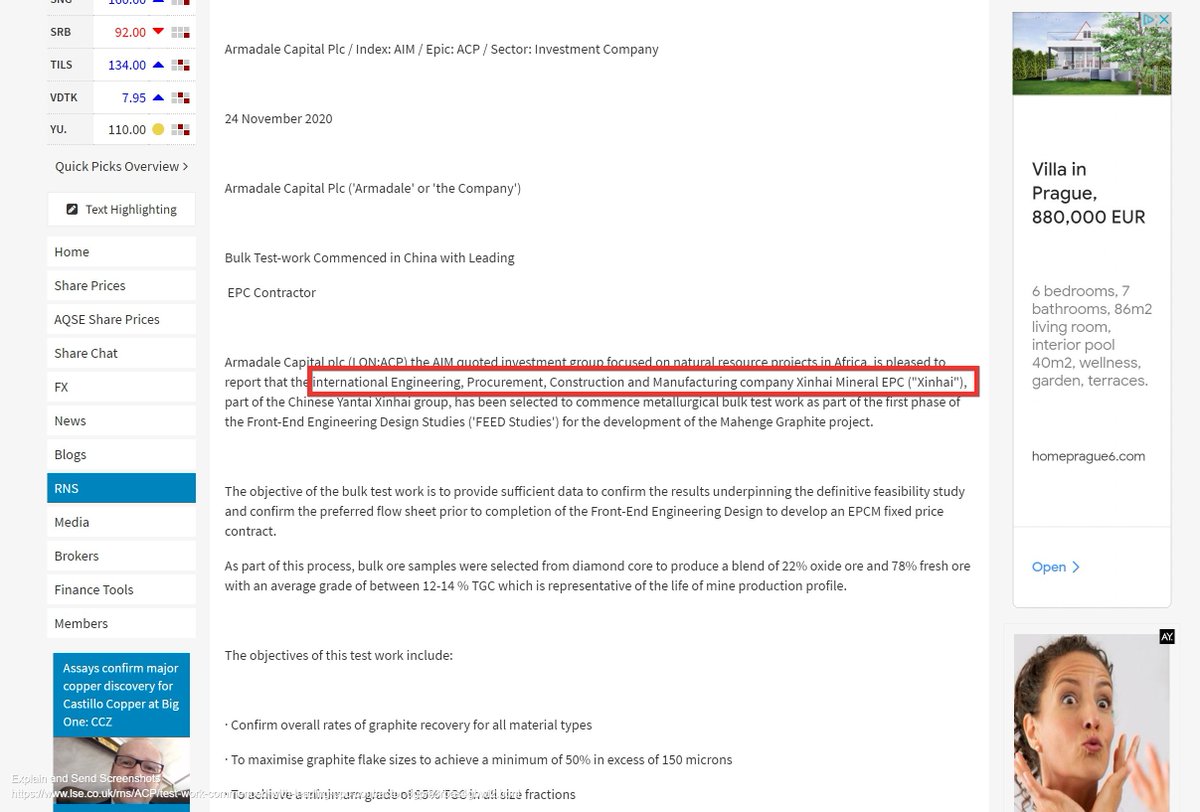

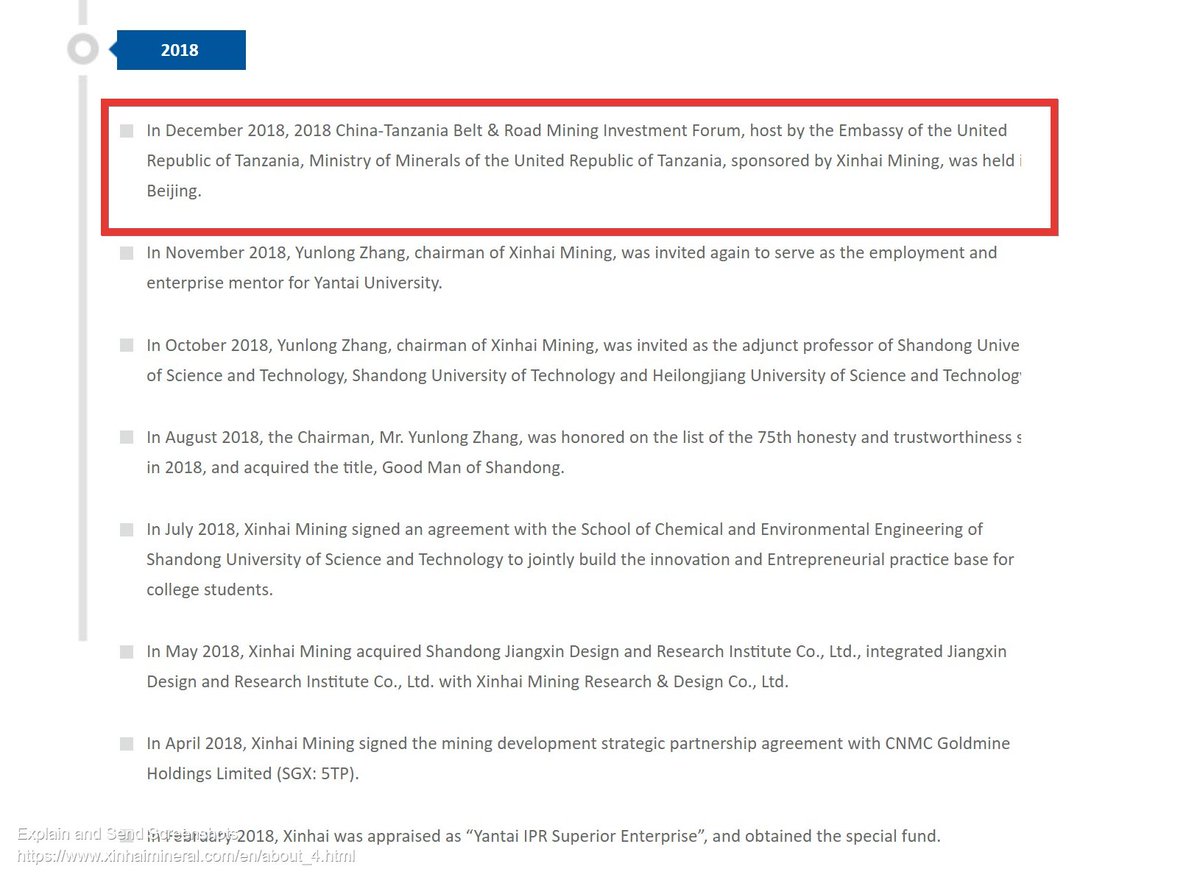

Its worthy of note that #ACP pending EPC contractor Xinhai Mineral EPC have positive history with the Tanzanian Ministry of Minerals too.

ACP not always the most communicative of companies but from what I've seen, certainly very capable when it comes to workings of Tanzania.

Its worthy of note that #ACP pending EPC contractor Xinhai Mineral EPC have positive history with the Tanzanian Ministry of Minerals too.

ACP not always the most communicative of companies but from what I've seen, certainly very capable when it comes to workings of Tanzania.

18B

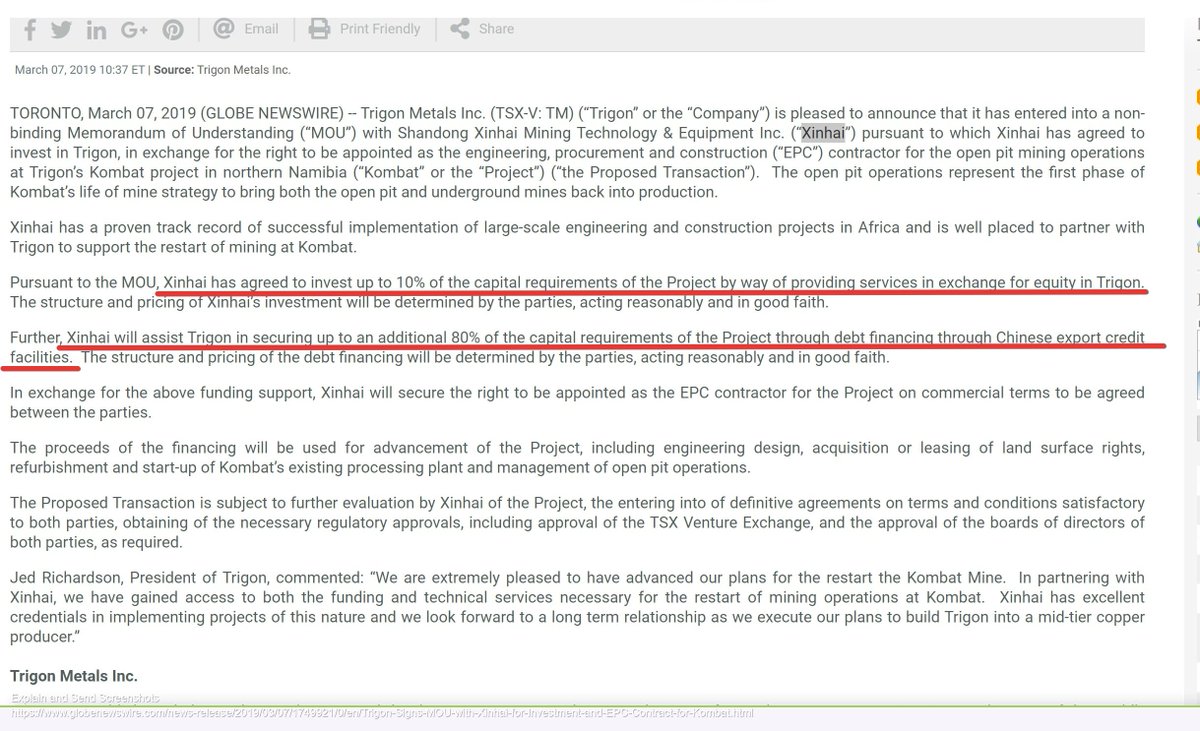

To appreciate what sort of deal Xinhai Mineral EPC are capable of bringing to the party, here's an example of another Africa based deal they signed with Trigon Metals in 2019.

10% CAPEX cost in equity stake with willingness to seek out further 80% in Chinese debt financing.

To appreciate what sort of deal Xinhai Mineral EPC are capable of bringing to the party, here's an example of another Africa based deal they signed with Trigon Metals in 2019.

10% CAPEX cost in equity stake with willingness to seek out further 80% in Chinese debt financing.

18C/

The Trigon project CAPEX was far more limited than what ACP are seeking but the principal of the debt/equity ratio, remains valid.

Deal was MOU only and curtailed by Covid and a desire by Trigon to increase its size but never the less,v ery muchnon the table at the time.

The Trigon project CAPEX was far more limited than what ACP are seeking but the principal of the debt/equity ratio, remains valid.

Deal was MOU only and curtailed by Covid and a desire by Trigon to increase its size but never the less,v ery muchnon the table at the time.

Read on Twitter

Read on Twitter