2) NOT INVESTMENT ADVICE

3) Yesterday I looked into Bakkt's SPAC.

It did not look very good.

idk maybe it'll be worth $10b soon because fuck everything. https://twitter.com/SBF_Alameda/status/1348668218370506754

It did not look very good.

idk maybe it'll be worth $10b soon because fuck everything. https://twitter.com/SBF_Alameda/status/1348668218370506754

4) So how about the elephant in the room?

http://ftx.com/trade/CBSE/USD

Coinbase is probably likely going to try to IPO this year.

What are its numbers?

http://ftx.com/trade/CBSE/USD

Coinbase is probably likely going to try to IPO this year.

What are its numbers?

5) Well, it's hard to find a lot of them.

But, roughly, it looks like they made about $1-2b of revenue last year, had moderately high expenses, and had something like ~50m customers, give or take.

But, roughly, it looks like they made about $1-2b of revenue last year, had moderately high expenses, and had something like ~50m customers, give or take.

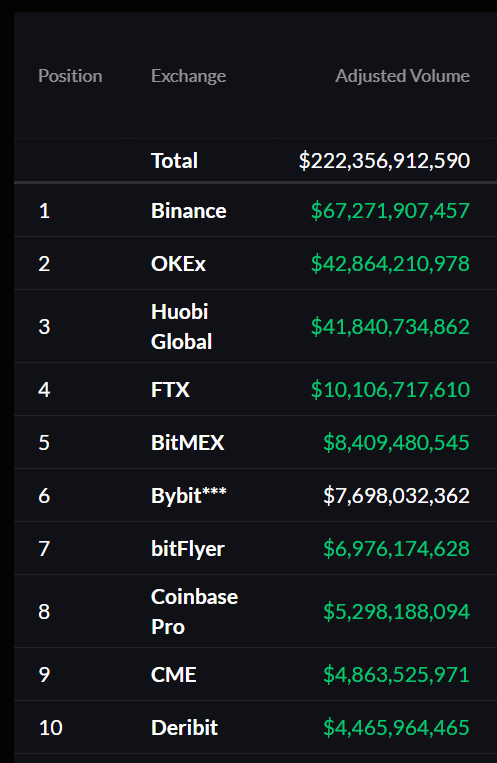

6) The first thing that jumps out:

FTX traded about 2x what Coinbase did last year.

FTX did not make $1.5b of revenue.

What's going on there?

FTX traded about 2x what Coinbase did last year.

FTX did not make $1.5b of revenue.

What's going on there?

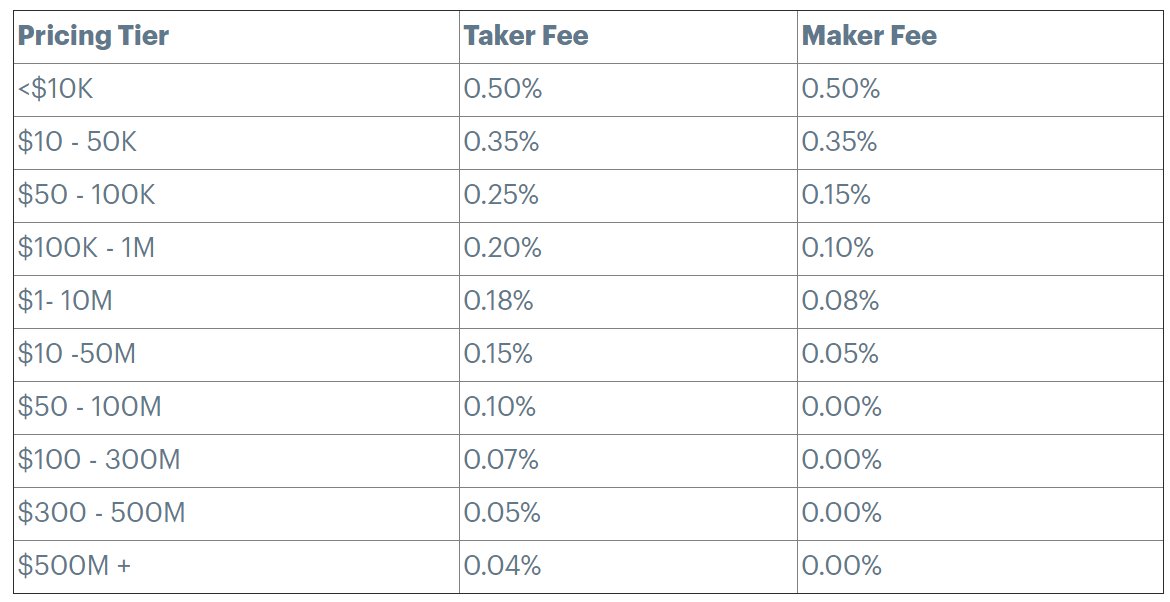

7) Well, their fees are higher than FTX--something like 4x as high!

But that still doesn't explain it.

But that still doesn't explain it.

9) Now, I want to tread lightly here--don't throw stones in glass houses!

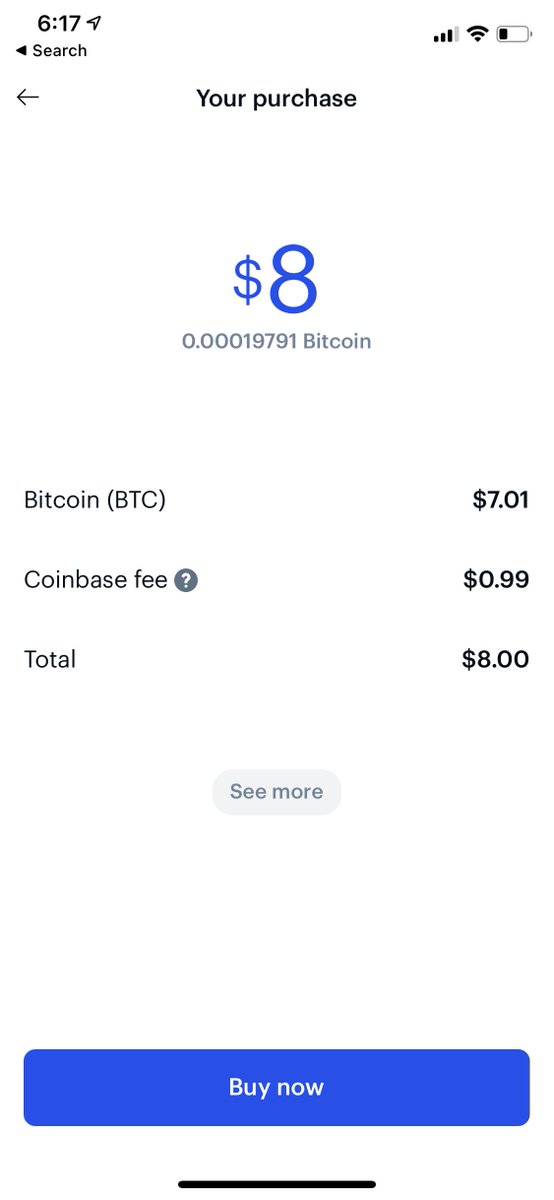

But I tried to buy $8 of BTC. The price I got was... $40,422.

BTC is currently trading at $35,250.

That's a 14.5% fee.

14.5% is a lot.

(Maybe people should check out FTX!)

But I tried to buy $8 of BTC. The price I got was... $40,422.

BTC is currently trading at $35,250.

That's a 14.5% fee.

14.5% is a lot.

(Maybe people should check out FTX!)

10) Well ok then.

So, mostly this is the "Coinbase fee". This isn't a % fee, it's a $ fee; in this case, $0.99. On a $8 trade.

So that's 12% right there.

The other 2.5%? Well, that's the spread.

So, mostly this is the "Coinbase fee". This isn't a % fee, it's a $ fee; in this case, $0.99. On a $8 trade.

So that's 12% right there.

The other 2.5%? Well, that's the spread.

11) Ok, so now things start to line up more.

If they traded $500m/day, and made $1.5b, that means that Coinbase made about 1% on their average trade.

Which, presumably, is some blended rate between ~8bps on their "Coinbase Pro" trades, and 1-10% on their app trades.

If they traded $500m/day, and made $1.5b, that means that Coinbase made about 1% on their average trade.

Which, presumably, is some blended rate between ~8bps on their "Coinbase Pro" trades, and 1-10% on their app trades.

12) A lot of people complain about Coinbase downtime, or lack of features, or ratelimits, or withdrawals.

I wonder if Coinbase even cares.

Its 'pro' fees can't have been more than 10-20% of its revenue, really: 8bps*$500m*365 = $150m.

I wonder if Coinbase even cares.

Its 'pro' fees can't have been more than 10-20% of its revenue, really: 8bps*$500m*365 = $150m.

13) Coinbase doesn't make money when people use its API, or go to http://prime.coinbase.com , or use their ratelimits.

Coinbase makes its money when your high school classmate decides to buy their first $25 of BTC on the app.

Coinbase makes its money when your high school classmate decides to buy their first $25 of BTC on the app.

14) So:

a) Coinbase does, actually, make real money! This isn't Bakkt 2.0.

b) http://ftx.com/trade/CBSE/USD might be worth a lot. Maybe it shouldn't sell itself short. https://twitter.com/SBF_Alameda/status/1342282950054821888

But there's another interesting question here.

What happens when volumes skyrocket?

a) Coinbase does, actually, make real money! This isn't Bakkt 2.0.

b) http://ftx.com/trade/CBSE/USD might be worth a lot. Maybe it shouldn't sell itself short. https://twitter.com/SBF_Alameda/status/1342282950054821888

But there's another interesting question here.

What happens when volumes skyrocket?

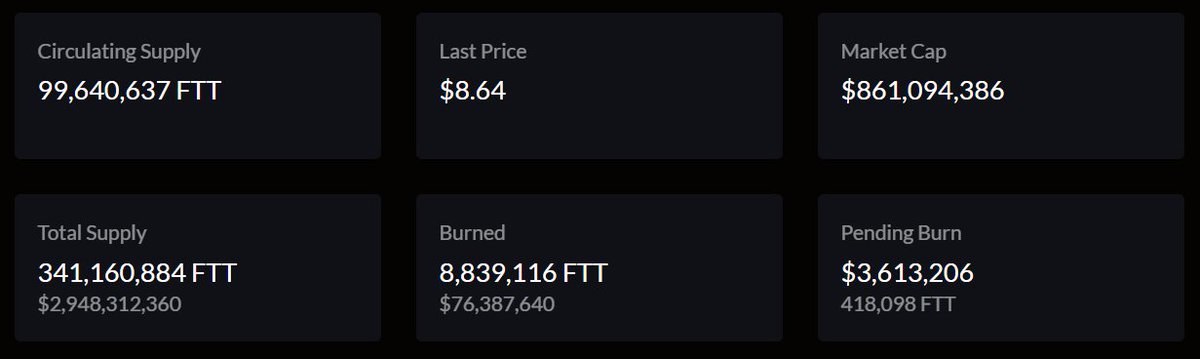

15) For FTX, the answer is pretty simple.

Just go to http://ftx.com/FTT .

Last week, FTX had its first ever $2m buy/burn.

Today, we're having a $3m buy/burn.

More volume has exactly the expected effect.

Just go to http://ftx.com/FTT .

Last week, FTX had its first ever $2m buy/burn.

Today, we're having a $3m buy/burn.

More volume has exactly the expected effect.

16) For Coinbase.... I'm actually pretty curious.

Today, Coinbase has $5b of volume. That's a lot!

It's also half of FTX.

Today, Coinbase has $5b of volume. That's a lot!

It's also half of FTX.

17) If this kept up for a year, would Coinbase make $300m? Or $15b?

*Which* volume goes up?

Is it @AWice? Or is it his high school classmate buying their first BTC?

Is it @cmsholdings's bots, or Dan while he's bored in a meeting?

Are they paying 1-10bps or 1-10%?

*Which* volume goes up?

Is it @AWice? Or is it his high school classmate buying their first BTC?

Is it @cmsholdings's bots, or Dan while he's bored in a meeting?

Are they paying 1-10bps or 1-10%?

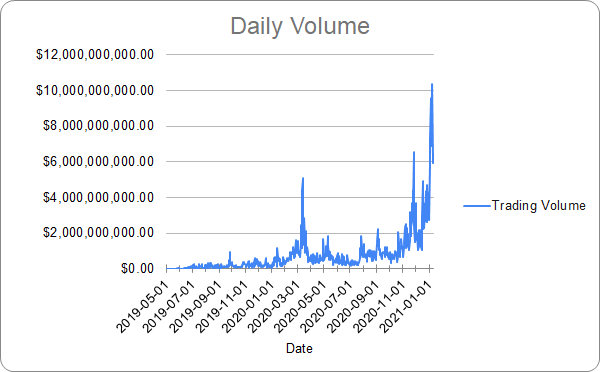

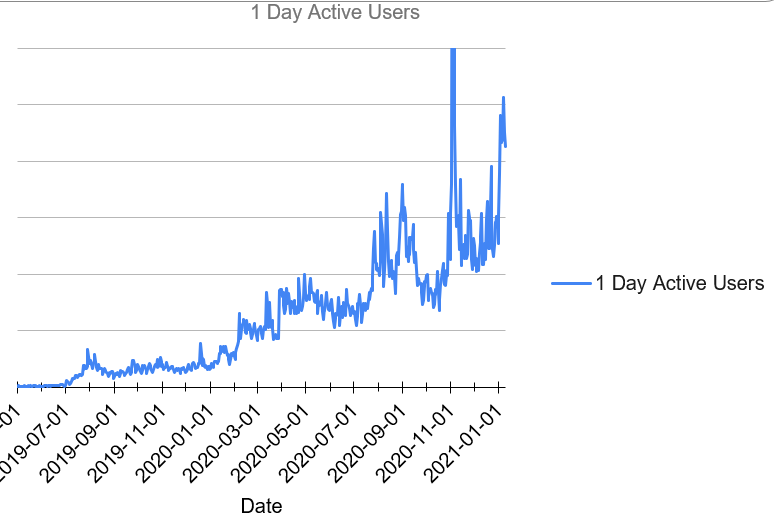

19) On FTX:

--Volume is up about 10x from a month ago

--Active userbase is up about 1.5x

So if FTX is any guide, most of the volume growth is the heavy duty traders; retail growth is smaller.

Which would imply that Coinbase's revenue is up more like 50% than 500%.

--Volume is up about 10x from a month ago

--Active userbase is up about 1.5x

So if FTX is any guide, most of the volume growth is the heavy duty traders; retail growth is smaller.

Which would imply that Coinbase's revenue is up more like 50% than 500%.

20) But maybe Coinbase isn't like FTX.

Maybe Coinbase really did have 10m users load their app to buy $100 each of BTC yesterday, each paying about $3 in fees.

That would be, at least from Coinbase's perspective, impressive.

Maybe Coinbase really did have 10m users load their app to buy $100 each of BTC yesterday, each paying about $3 in fees.

That would be, at least from Coinbase's perspective, impressive.

Read on Twitter

Read on Twitter