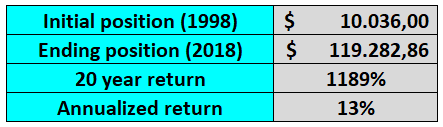

(1/6) I decided to backtest the thesis that finding one (just one!) very big winner can offset by far the loses of the remaining losers and beat the S&P500 return. THREAD

(2/6) Characteristics of the test:

Equally weighted portfolio of 10 stocks ($1,000 in each)

Equally weighted portfolio of 10 stocks ($1,000 in each)

Data is based on companies of the S&P500

Data is based on companies of the S&P500

Period from 1998 to 2018

Period from 1998 to 2018

1 big winner

1 big winner  $AMZN

$AMZN

9 big losers

9 big losers

Equally weighted portfolio of 10 stocks ($1,000 in each)

Equally weighted portfolio of 10 stocks ($1,000 in each) Data is based on companies of the S&P500

Data is based on companies of the S&P500 Period from 1998 to 2018

Period from 1998 to 2018 1 big winner

1 big winner  $AMZN

$AMZN 9 big losers

9 big losers

(3/6) Lets go with the biggest losers of the S&P500 from 1998 to 2018. Chart belongs to @SeekingAlpha

(4/6) Lets see now our only winner´s performance over the period

Total 20-year return: 11,265%

Annualized return: 26,7%

Total 20-year return: 11,265%

Annualized return: 26,7%

(6/6) I thing that this thread reinforces the vision of @FromValue because:

When you look for 10 baggers you just have to be right a small amount of times and it will still payoff

When you look for 10 baggers you just have to be right a small amount of times and it will still payoff

Buying a 10 bagger at a 5% premium/discount will not make that much difference in the LR

Buying a 10 bagger at a 5% premium/discount will not make that much difference in the LR

When you look for 10 baggers you just have to be right a small amount of times and it will still payoff

When you look for 10 baggers you just have to be right a small amount of times and it will still payoff Buying a 10 bagger at a 5% premium/discount will not make that much difference in the LR

Buying a 10 bagger at a 5% premium/discount will not make that much difference in the LR

Read on Twitter

Read on Twitter