I'm not sure what I make of this, but...

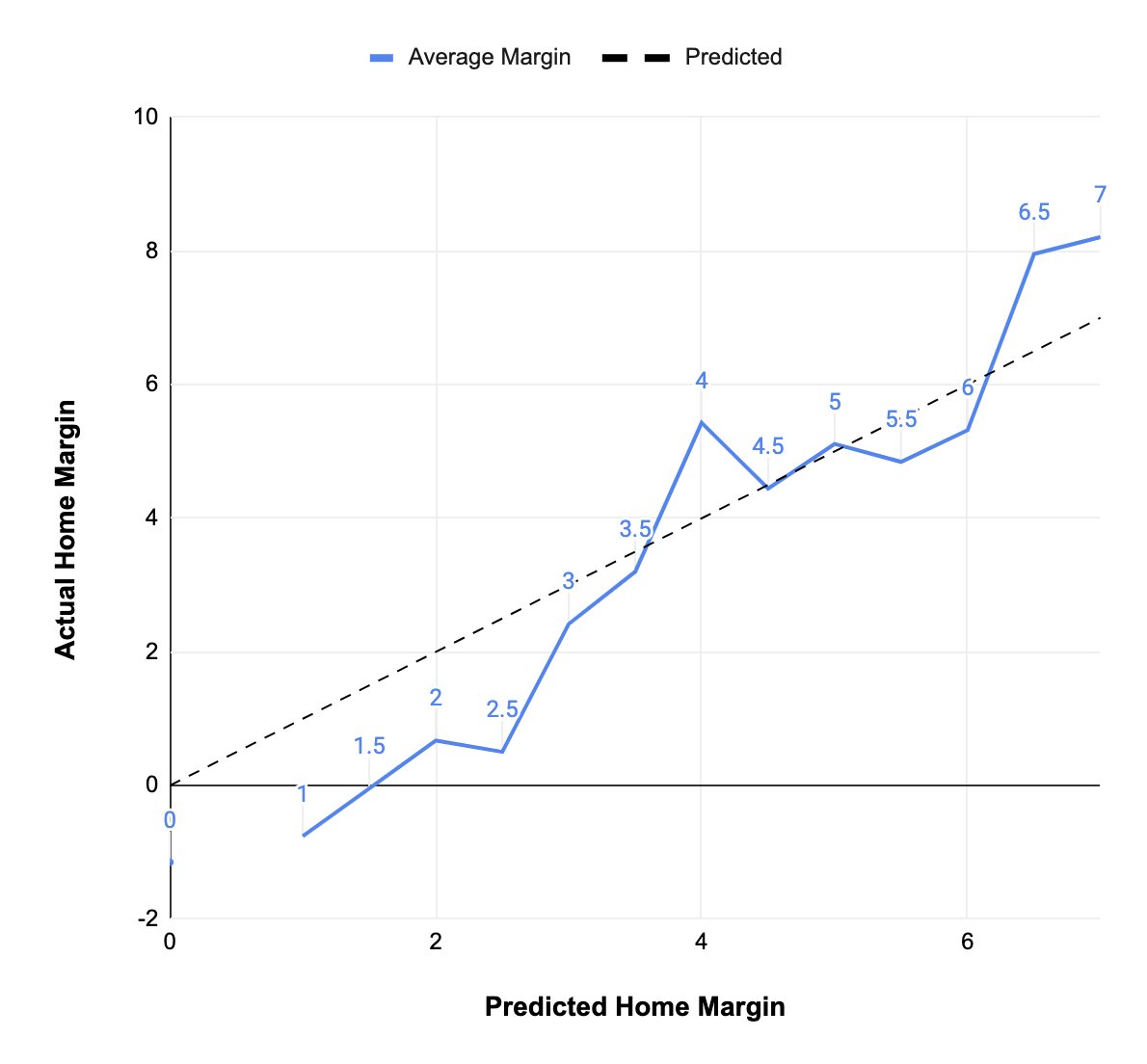

The closer the market's predicted margin is to a key number, the wider the distribution of actual margins are, resulting in higher prediction error

The closer the market's predicted margin is to a key number, the wider the distribution of actual margins are, resulting in higher prediction error

More weirdness...

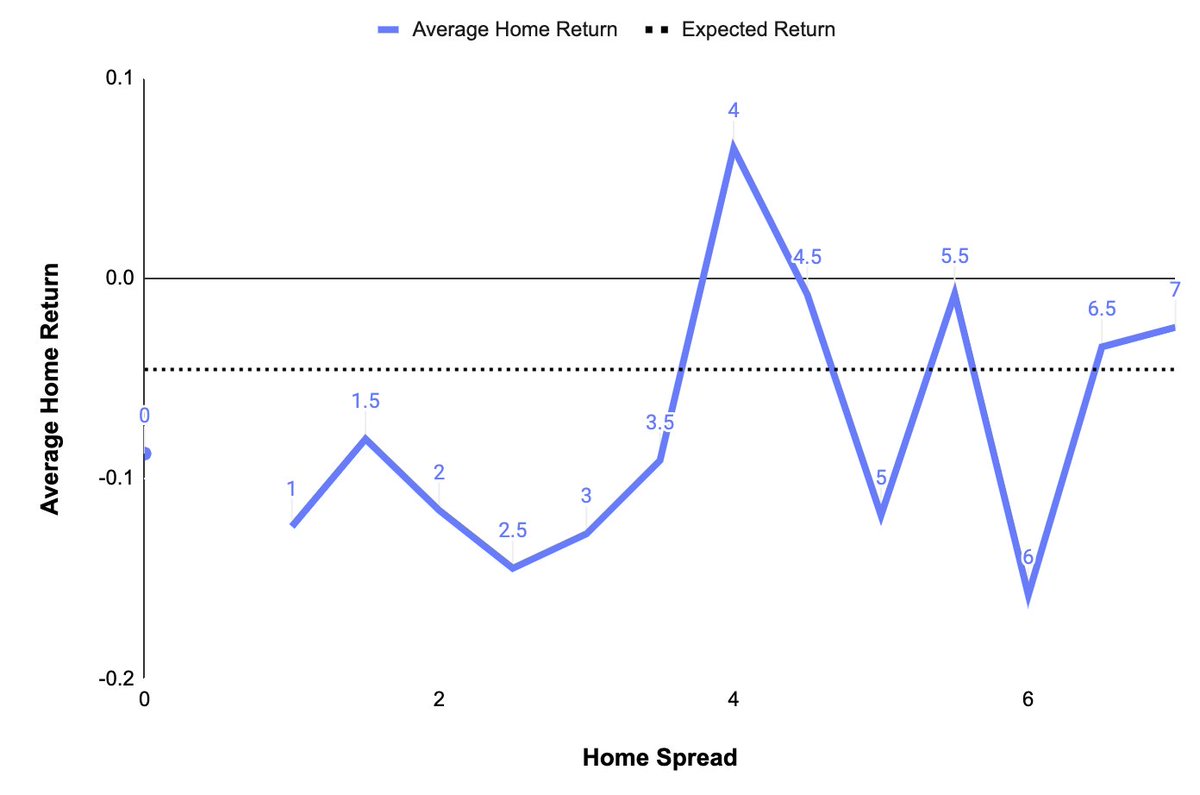

Short home favs are overvalued and mid home favs are undervalued

3 is the most likely margin, so if the home team isn't good enough to warrant the full 3, it's basically a signal that the team has a higher than implied chance of losing

Short home favs are overvalued and mid home favs are undervalued

3 is the most likely margin, so if the home team isn't good enough to warrant the full 3, it's basically a signal that the team has a higher than implied chance of losing

If I were try to rationalize...

If you are between key numbers, you are firmly between those numbers, otherwise the line would be pushed to the key number

If you're on the key number, you're actually measurably better or worse, but the market has pushed you to the number

If you are between key numbers, you are firmly between those numbers, otherwise the line would be pushed to the key number

If you're on the key number, you're actually measurably better or worse, but the market has pushed you to the number

This post shows how conditionally regressing a model to the market based on the market's trailing accuracy is better than a flat regression to the market number

https://www.nfeloapp.com/analysis/using-market-regression-to-improve-prediction-accuracy-in-the-nfl

Could probably be made even better by regressing less when the market is on a key number

https://www.nfeloapp.com/analysis/using-market-regression-to-improve-prediction-accuracy-in-the-nfl

Could probably be made even better by regressing less when the market is on a key number

The thread continues...

@LeeSharpeNFL and @AudacityOfHoops suggested these dynamics could potentially be explained by the odds offered on the spread

As it turns out, those short road favorites that appear to overvalued by the number are cheaper in terms of price

@LeeSharpeNFL and @AudacityOfHoops suggested these dynamics could potentially be explained by the odds offered on the spread

As it turns out, those short road favorites that appear to overvalued by the number are cheaper in terms of price

But, the lower price doesn't fully compensate buyers for the lower cover probability

Even in when accounting for lower prices, short favorites have had worse returns. (2009 - present)

Even in when accounting for lower prices, short favorites have had worse returns. (2009 - present)

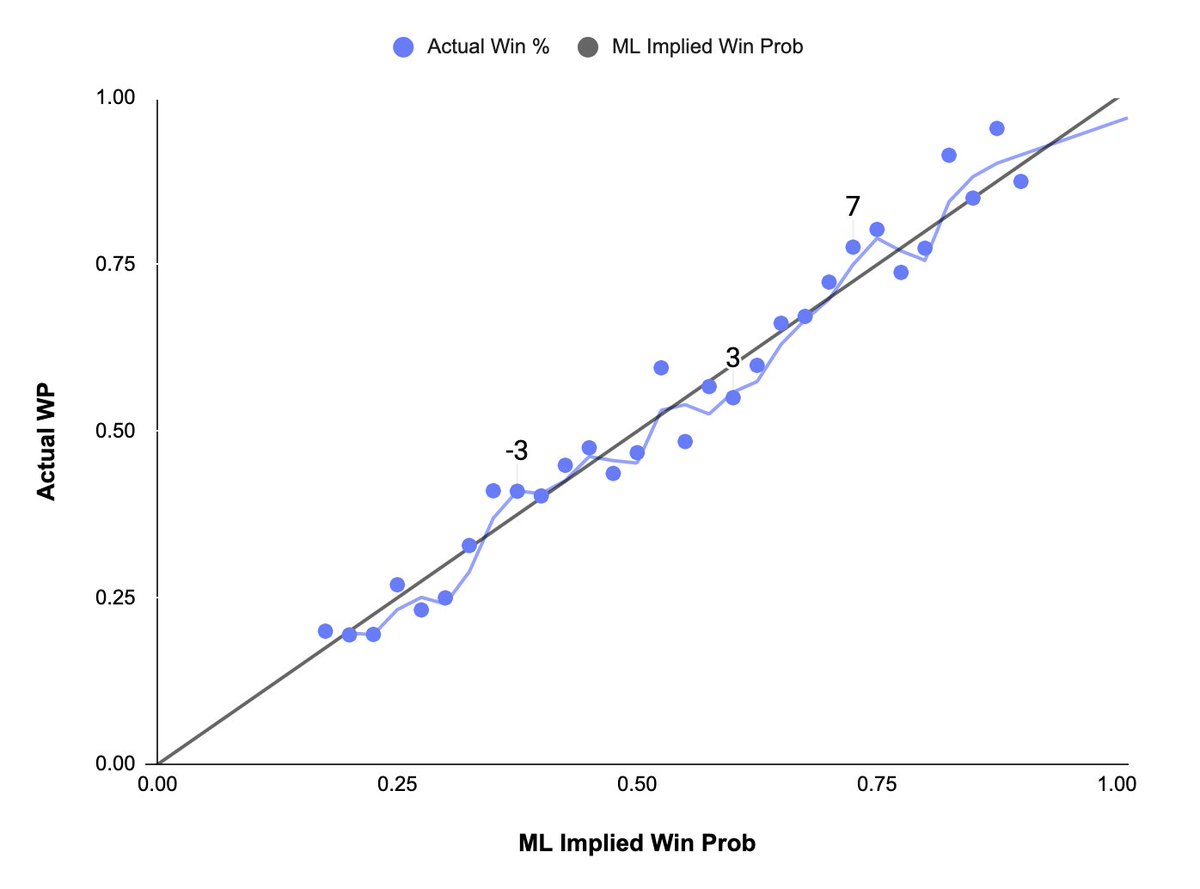

Going back to the original question, "Is a key number a sign that the market will be less accurate" we can also look at money lines

Here is the ML implied win probability vs the actual win percent along w/ labels for when the average spread for a given ML is a key number

Here is the ML implied win probability vs the actual win percent along w/ labels for when the average spread for a given ML is a key number

No variations seem to be out of line with the overall error term of the regression, but it does look like the money lines are maybe less accurate when the spread is near a key number

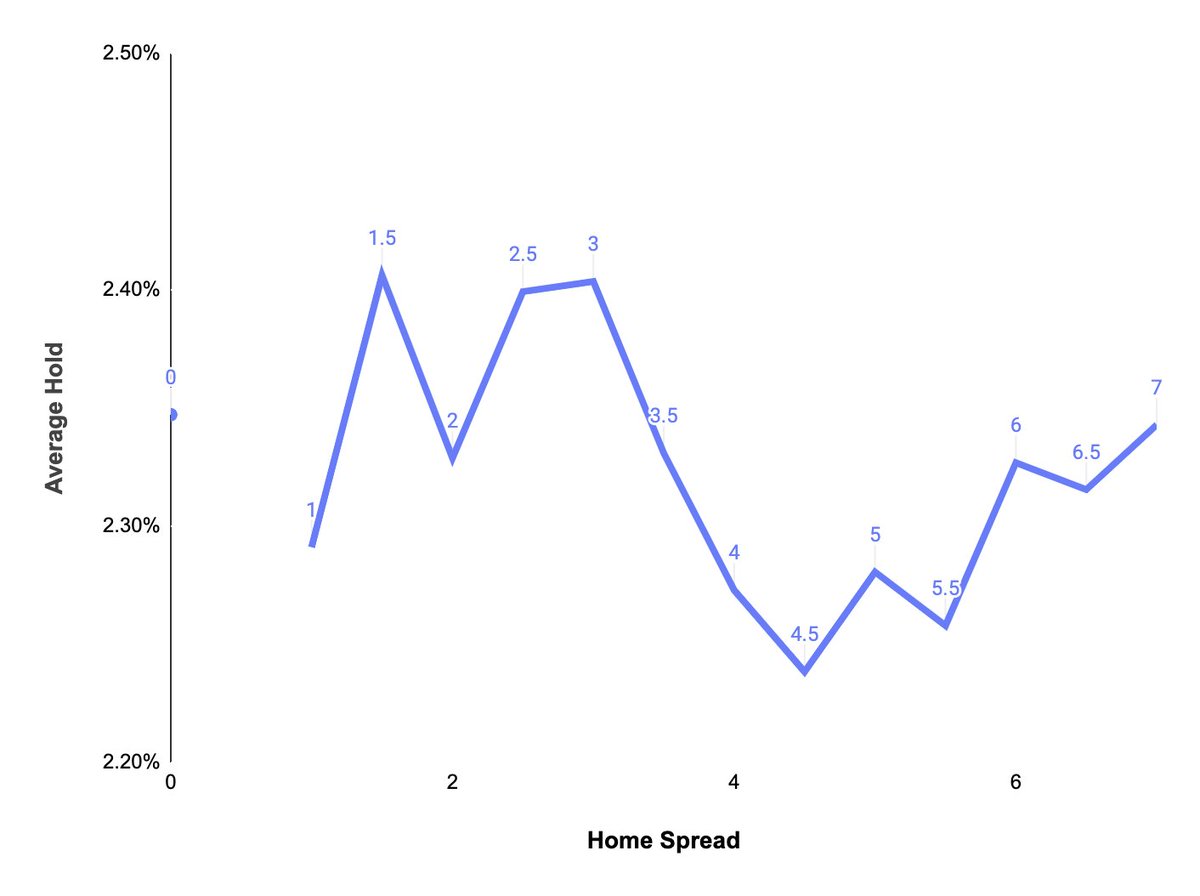

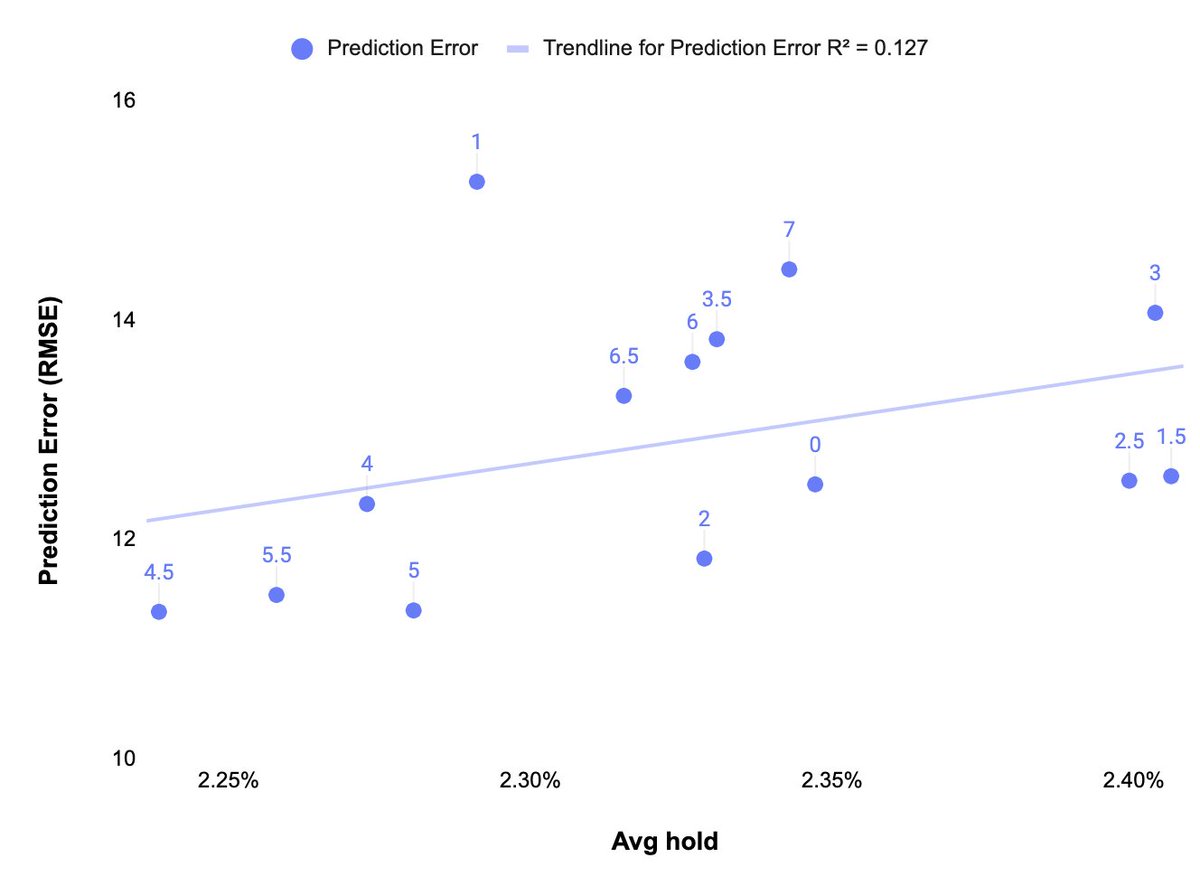

Ok, here is one more point of evidence that there is less certainty around key numbers...

If I'm a bookmaker and I'm less certain about the outcome, I'd require a higher return to compensate for the risk

Here is hold by home spread -- Odds makers *do* take more for key numbers

If I'm a bookmaker and I'm less certain about the outcome, I'd require a higher return to compensate for the risk

Here is hold by home spread -- Odds makers *do* take more for key numbers

These hold numbers are a little low (-110 on both sides is 4.5%), but that's what the data set shows

Read on Twitter

Read on Twitter