$FUBO - the most hated/loved company on #Fintwit

I have a position & given the very relevant bear arguments, I have reaffirmed why I invested in the company.

I believe that this company is a "Story" Stock & to invest, you need to believe in the story

THREAD

I have a position & given the very relevant bear arguments, I have reaffirmed why I invested in the company.

I believe that this company is a "Story" Stock & to invest, you need to believe in the story

THREAD

Story Stock - what is it?

- Visionary CEO

- Youthful Company (Major execution risk)

- Poor Current Business Model

- #Fintwit Arguments

- Great Brand

- Great but unproven future prospects

- High Short Interest

- A List Investor Base

- Visionary CEO

- Youthful Company (Major execution risk)

- Poor Current Business Model

- #Fintwit Arguments

- Great Brand

- Great but unproven future prospects

- High Short Interest

- A List Investor Base

Bear Case - Terrible Current Unit Economics (Business Model)

- $FUBO may NEVER make profit from subscription income

- Costs increase as subscription income increases

- Saturated Market (YouTube TV, HULU, Sling)

I totally agree, then why invest?

- $FUBO may NEVER make profit from subscription income

- Costs increase as subscription income increases

- Saturated Market (YouTube TV, HULU, Sling)

I totally agree, then why invest?

$FUBO Story:

- Sports First Platform (Live TV Streaming)

- Wagering/Gambling

- CTV Ads

- Gaming

- Exclusive sporting events

- A List Investors

- High growth

- Tech first company

- Management Team

- Sports First Platform (Live TV Streaming)

- Wagering/Gambling

- CTV Ads

- Gaming

- Exclusive sporting events

- A List Investors

- High growth

- Tech first company

- Management Team

Company Size - $Fubo is a small & young company, for comparison:

$Fubo - $1.6bn (mrkt cap) - 2015 (founded)

$NFLX - $220bn - 1997

$SPOT - $65bn - 2006

$ROKU - $51bn - 2001

If you dont want execution risk, $Fubo's not for you. However, possible 10X or more (possible $0 too).

$Fubo - $1.6bn (mrkt cap) - 2015 (founded)

$NFLX - $220bn - 1997

$SPOT - $65bn - 2006

$ROKU - $51bn - 2001

If you dont want execution risk, $Fubo's not for you. However, possible 10X or more (possible $0 too).

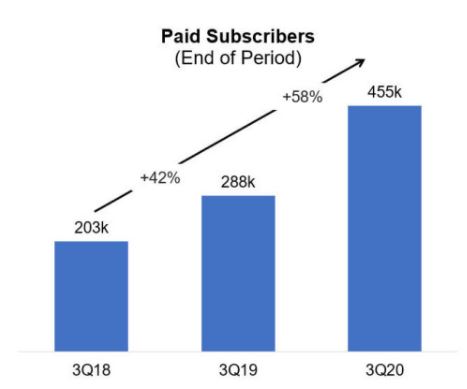

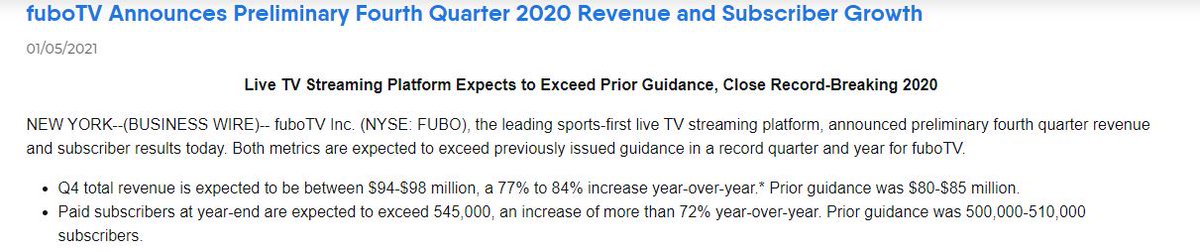

Subscription Numbers:

- $FUBO subscribers are the funnel to the eco system (similar to $ROKU selling hardware devices).

- 545k subscribers as of Dec 2020 (previous forecast 500 - 510k) - 72% YoY

- $FUBO is under promising and over delivering (essential in a story stock)

- $FUBO subscribers are the funnel to the eco system (similar to $ROKU selling hardware devices).

- 545k subscribers as of Dec 2020 (previous forecast 500 - 510k) - 72% YoY

- $FUBO is under promising and over delivering (essential in a story stock)

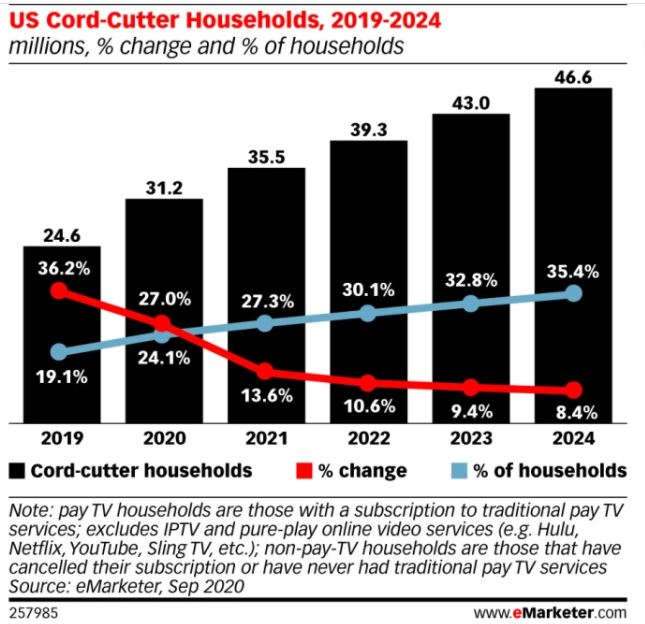

Secular Trends:

- Cord Cutting

- Sports Lovers

- CTV Advertising

- Gambling/Wagering

$FUBO is at the intersection of all 4.

- Cord Cutting

- Sports Lovers

- CTV Advertising

- Gambling/Wagering

$FUBO is at the intersection of all 4.

Cord Cutting:

- Even the biggest of Bears can accept CC is a positive for $FUBO

- Most CC still pay for cable due to live Sports

- CC should accelerate subscribers to $FUBO and online competitors (YouTube, Sling, Hulu)

- CEO: "90% of customers are Cord Cutters"

- Even the biggest of Bears can accept CC is a positive for $FUBO

- Most CC still pay for cable due to live Sports

- CC should accelerate subscribers to $FUBO and online competitors (YouTube, Sling, Hulu)

- CEO: "90% of customers are Cord Cutters"

Sports Lovers / Brand:

- $Fubo has positioned itself as the online Sports service

- As a sports fanatic, I know how much I pay for live sports, gambling & related activities

- $NFLX, $AMZN prime just doesn't cut it

- $Fubo customers stream 121 hours per month ($NFLX only 50)

- $Fubo has positioned itself as the online Sports service

- As a sports fanatic, I know how much I pay for live sports, gambling & related activities

- $NFLX, $AMZN prime just doesn't cut it

- $Fubo customers stream 121 hours per month ($NFLX only 50)

CTV Ads:

- $FUBO allocated 20% of ad inventory per hour (same deal as local cable)

- However, use programmatic ads (big advantage)

- $FUBO currently takes in $7 ad ARPU per month - target of $20 net after expenses ARPU (ticket to profitability)

- Q3 2020, $7.5m (153% YoY)

- $FUBO allocated 20% of ad inventory per hour (same deal as local cable)

- However, use programmatic ads (big advantage)

- $FUBO currently takes in $7 ad ARPU per month - target of $20 net after expenses ARPU (ticket to profitability)

- Q3 2020, $7.5m (153% YoY)

CTV Potential Rev:

- If 1m subs, $10/monthly ARPU - $120m (annual Rev)

- If 1m, $20 ARPU - $240m

- If 5m, $10 ARPU - $600m

- If 5m, $20 ARPU - $1.2bn

- If 10m, $10 ARPU - $1.2bn

- If 10m, $20 ARPU - $2.4bn

This platform can become profitable through CTV ads (w/out wagering)

- If 1m subs, $10/monthly ARPU - $120m (annual Rev)

- If 1m, $20 ARPU - $240m

- If 5m, $10 ARPU - $600m

- If 5m, $20 ARPU - $1.2bn

- If 10m, $10 ARPU - $1.2bn

- If 10m, $20 ARPU - $2.4bn

This platform can become profitable through CTV ads (w/out wagering)

Programmatic Ads - future:

- CEO: "If you like to bet on field goals, can we show you 11 games that are about to go into field goals"

- Can watch 4 games concurrently on 1 screen

- Could we order $DPZ through one click CTV ads?

- Stream on 5 devices, 5 different targeted ads?

- CEO: "If you like to bet on field goals, can we show you 11 games that are about to go into field goals"

- Can watch 4 games concurrently on 1 screen

- Could we order $DPZ through one click CTV ads?

- Stream on 5 devices, 5 different targeted ads?

Wagering:

- Complex but CEO keen to get involved

"online sports wagering is expected to be a $155bn market by 2024" Zion Market Research

- Even if $Fubo, doesn't have their own gambling site, Ad $$ will be huge on $Fubo.

- Balto Sports Acq - aim to drive gaming on $Fubo

- Complex but CEO keen to get involved

"online sports wagering is expected to be a $155bn market by 2024" Zion Market Research

- Even if $Fubo, doesn't have their own gambling site, Ad $$ will be huge on $Fubo.

- Balto Sports Acq - aim to drive gaming on $Fubo

Exclusive Sports Rights:

- Launched its own ad supported TV network in June 2019 (Fubo Network TV)

- Cannot compete for NFL, NBA rights (could start with Niche sports)

- CEO has stated intention in recent interview

- Launched its own ad supported TV network in June 2019 (Fubo Network TV)

- Cannot compete for NFL, NBA rights (could start with Niche sports)

- CEO has stated intention in recent interview

Management / Investors:

- I love to invest alongside the best investors

- As you can gather, the Live TV Streaming space is incredibly complex

- Therefore, I am placing my faith in this A List of investors/mgmt to make the story come to fruition

- I love to invest alongside the best investors

- As you can gather, the Live TV Streaming space is incredibly complex

- Therefore, I am placing my faith in this A List of investors/mgmt to make the story come to fruition

CEO/Co-Founder - David Gandler:

- He's a story teller

- Passionate about sports

- Owns 4%

- Great (short) recent interview

- He's a story teller

- Passionate about sports

- Owns 4%

- Great (short) recent interview

Mike Berkley – Chief Product Officer

- Former Comcast, Viacom and Spotify exec who joined Fubo in Nov 2020

Quote from Mike:

"The potential for casual gaming and wagering as part of the live sports viewing experience is especially compelling. I love the company’s ambition.”

- Former Comcast, Viacom and Spotify exec who joined Fubo in Nov 2020

Quote from Mike:

"The potential for casual gaming and wagering as part of the live sports viewing experience is especially compelling. I love the company’s ambition.”

Daniel Leff - BOD:

- Owns 6% of the voting shares (worth around $120m)

- Purchased an additional 200k shares @ $10 on public listing in 13 Oct 2020

- Early $Roku investor and current board member (Massive!)

- The Athletic investor & BOD

This guy knows what he is doing!

- Owns 6% of the voting shares (worth around $120m)

- Purchased an additional 200k shares @ $10 on public listing in 13 Oct 2020

- Early $Roku investor and current board member (Massive!)

- The Athletic investor & BOD

This guy knows what he is doing!

Edgar Bronfman Jr (Executive Chairman)

- Former chairman and CEO of Warner Music

- Owns close to 6% of the voting share (worth around $120m)

- Purchased an additional 200k shares @ $10 on public listing in 13 October 2020

- Knows the complex dynamics of the industry

- Former chairman and CEO of Warner Music

- Owns close to 6% of the voting share (worth around $120m)

- Purchased an additional 200k shares @ $10 on public listing in 13 October 2020

- Knows the complex dynamics of the industry

John Textor (Head of Studio)

- Co-founder and previous CEO of Facebank Group (merged with $Fubo).

- Owns 12% of $Fubo

- Former Pro Skateboarder

- Owner of Sims Snowboards, the world’s 2nd leading snowboard brand, through which he created the World Snowboarding Championship

- Co-founder and previous CEO of Facebank Group (merged with $Fubo).

- Owns 12% of $Fubo

- Former Pro Skateboarder

- Owner of Sims Snowboards, the world’s 2nd leading snowboard brand, through which he created the World Snowboarding Championship

TV network investors:

- $DIS - 2.85% of the voting rights - investment made in conjunction with an agreement to launch Disney channels on the platform (ESPN)

- $VIAC - 2.62% of the voting rights

- $CMCSA (Sky) –3.2% of the voting rights (prior to recent sell off.....cont'd

- $DIS - 2.85% of the voting rights - investment made in conjunction with an agreement to launch Disney channels on the platform (ESPN)

- $VIAC - 2.62% of the voting rights

- $CMCSA (Sky) –3.2% of the voting rights (prior to recent sell off.....cont'd

$CMCSA:

Sky was an early investor in $Fubo (major plus as run sports & gambling empire in the UK)

$CMCSA purchased Sky in Oct 2018

$CMCSA sold 500k shares on 31 Dec 2020

For perspective, $CMCSA sold 5.2m shares of $PTON in Apr 2020 for $34.21 or $177m (currently worth $792m)

Sky was an early investor in $Fubo (major plus as run sports & gambling empire in the UK)

$CMCSA purchased Sky in Oct 2018

$CMCSA sold 500k shares on 31 Dec 2020

For perspective, $CMCSA sold 5.2m shares of $PTON in Apr 2020 for $34.21 or $177m (currently worth $792m)

Summary Investment Thesis:

Creation of sticky sports platform including live Sports, Wagering, Games, Fantasy

- Subscriptions may NEVER be profitable (will act as a funnel)

- $FUBO acquire direct sports rights

- CTV ads & wagering will be the profit makers

- Int'l expansion

Creation of sticky sports platform including live Sports, Wagering, Games, Fantasy

- Subscriptions may NEVER be profitable (will act as a funnel)

- $FUBO acquire direct sports rights

- CTV ads & wagering will be the profit makers

- Int'l expansion

I fully understand that as a "Story" Stock, there is a large amount of execution risk.

It is quite likely that the company could go out of business

I am happy with these risks given the huge potential.

Long $FUBO

Thanks @rorycarron for questioning!

@Beth_Kindig @Market

It is quite likely that the company could go out of business

I am happy with these risks given the huge potential.

Long $FUBO

Thanks @rorycarron for questioning!

@Beth_Kindig @Market

Read on Twitter

Read on Twitter