Back in December, each member of my Asset Allocation and Security Selection class were tasked with selecting a company to buy and hold for the next year.

$300,000 split between 14 stocks @ SP500 weights

Here's what I found about my selection: Schrodinger $SDGR

$300,000 split between 14 stocks @ SP500 weights

Here's what I found about my selection: Schrodinger $SDGR

About 1/

Schrodinger is a physics-based software platform that enables the discovery of new molecules.

The software is used to predict molecule properties with high accuracy. Application is wide-reaching but is primarily focused on drug discovery and material science.

Schrodinger is a physics-based software platform that enables the discovery of new molecules.

The software is used to predict molecule properties with high accuracy. Application is wide-reaching but is primarily focused on drug discovery and material science.

2/

Company was founded in 1990 by Richard Friesner and William Goddard who serve as director and scientific advisors.

Current CEO is Ramy Farid who has been with Schrodinger since 2002. Farid also sits on the board of Nimbus Therapeutics which he cofounded in 2009.

Company was founded in 1990 by Richard Friesner and William Goddard who serve as director and scientific advisors.

Current CEO is Ramy Farid who has been with Schrodinger since 2002. Farid also sits on the board of Nimbus Therapeutics which he cofounded in 2009.

Business 1/

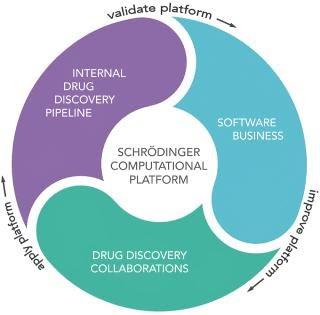

Company makes money primarily by software licenses but also participates in drug discovery collaborations as well have developing its own drug discovery pipeline.

Company makes money primarily by software licenses but also participates in drug discovery collaborations as well have developing its own drug discovery pipeline.

2/

In drug development, Schrodinger's software enables exploring and evaluating at a large scale. This assists in generating not only accurate property prediction but faster discovery.

The software provides the ability for billions of molecules to be evaluated every week.

In drug development, Schrodinger's software enables exploring and evaluating at a large scale. This assists in generating not only accurate property prediction but faster discovery.

The software provides the ability for billions of molecules to be evaluated every week.

3/

In materials science, the software is used to simulate different materials (organic, inorganic, polymers, fluids) interacting with one another which is a prerequisite to production.

Application includes aerospace, energy, semiconductors, and displays.

In materials science, the software is used to simulate different materials (organic, inorganic, polymers, fluids) interacting with one another which is a prerequisite to production.

Application includes aerospace, energy, semiconductors, and displays.

Qualitative 1/

Schrodinger's mission: To improve human health and quality of life by transforming the way therapeutics and materials are discovered.

Drug discovery is more important than ever - 2020 is a perfect example.

Schrodinger's mission: To improve human health and quality of life by transforming the way therapeutics and materials are discovered.

Drug discovery is more important than ever - 2020 is a perfect example.

2/

Strong buy in from employees.

Finviz reports 22% insider ownership.

4.5/5 Glassdoor rating

95% CEO approval rating

Strong buy in from employees.

Finviz reports 22% insider ownership.

4.5/5 Glassdoor rating

95% CEO approval rating

Revenue 1/

Software accounts for 78% of revenue currently at 79.5% gross margin.

Rev Growth YoY -

2018: 19.7%

19: 28.4%

20E: 31.3%

21E: 55.7%

Software accounts for 78% of revenue currently at 79.5% gross margin.

Rev Growth YoY -

2018: 19.7%

19: 28.4%

20E: 31.3%

21E: 55.7%

2/

Currently, all top 20 pharma companies use Schrodinger software. The largest customers only use enough software to enable 2 projects.

For context, Abbvie had 94 advertised active projects.

Currently, all top 20 pharma companies use Schrodinger software. The largest customers only use enough software to enable 2 projects.

For context, Abbvie had 94 advertised active projects.

3/

78% of annual contracts have value over $100K

Contracts over $100K

2017: 103

2018: 122

2019: 131

Customers with a $100K contract value have a retention rate of 96%

Top 20 customers account for 28% of revenue. None more than 5%.

78% of annual contracts have value over $100K

Contracts over $100K

2017: 103

2018: 122

2019: 131

Customers with a $100K contract value have a retention rate of 96%

Top 20 customers account for 28% of revenue. None more than 5%.

4/

Royalty payments for drug discovery collaboration grew 176% from 2018 > 2019.

In November 2020, announced a collaboration with $BMY - received $55mm upfront, $2.7bn in development payments based on milestones, as well as royalties on sales.

Royalty payments for drug discovery collaboration grew 176% from 2018 > 2019.

In November 2020, announced a collaboration with $BMY - received $55mm upfront, $2.7bn in development payments based on milestones, as well as royalties on sales.

5/

In the "other bets" section, currently 3 wholly-owned programs in drug discovery with 5 programs launching in 2021.

In the "other bets" section, currently 3 wholly-owned programs in drug discovery with 5 programs launching in 2021.

Balance Sheet 1/

Q ended 9/30/20

Current Assets: 621mm, total 680mm

Current Liabilities: 39mm, total 49mm

6mm of long term debt is capital leases

Q ended 9/30/20

Current Assets: 621mm, total 680mm

Current Liabilities: 39mm, total 49mm

6mm of long term debt is capital leases

Other 1/

36.8% institutional ownership - lots of room for big money buying

Bill and Melinda Gates Foundation own 8.84% of company FWIW.

36.8% institutional ownership - lots of room for big money buying

Bill and Melinda Gates Foundation own 8.84% of company FWIW.

5 billion-dollar SaaS company

Empowering one of the largest industries in the world

Cash rich to support R&D

Strong revenue model with optionality

Empowering one of the largest industries in the world

Cash rich to support R&D

Strong revenue model with optionality

I'm personally long and bullish on the future of $SDGR.

If the stock performs well, it'll mean more scholarships funded for students in need at my university.

Entry Price: $67.24 Dec 8

If the stock performs well, it'll mean more scholarships funded for students in need at my university.

Entry Price: $67.24 Dec 8

Read on Twitter

Read on Twitter