1. THREAD. Governor Hogan is announcing the $1 BILLION RELIEF Act of 2021, an emergency #COVID19 stimulus and tax relief package. https://twitter.com/GovLarryHogan/status/1348661469299281921

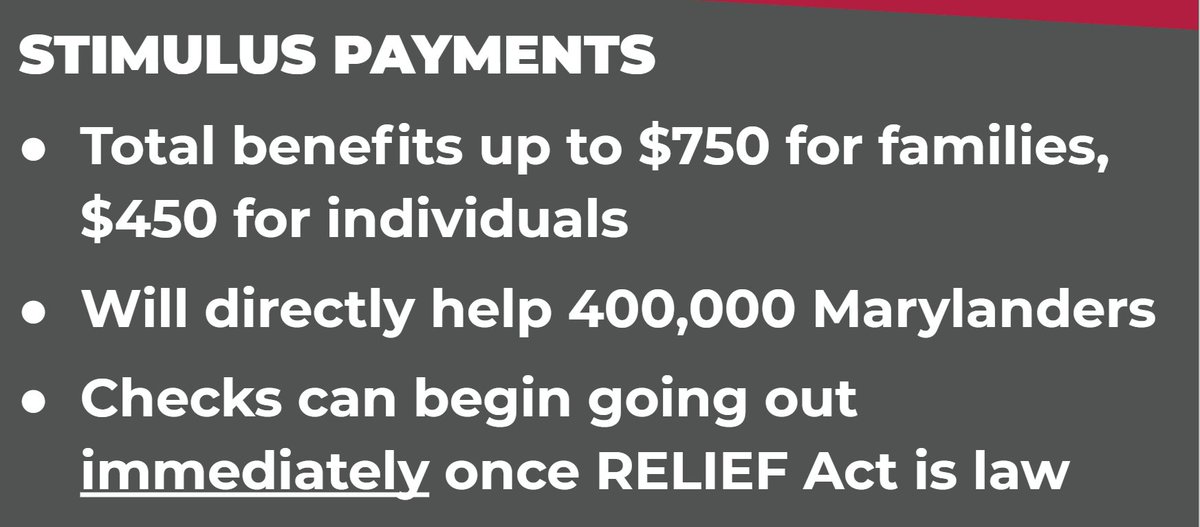

2. The RELIEF Act provides direct stimulus payments for low-to-moderate income Marylanders, totaling $750 for families, and $450 for individuals.

This is for Earned Income Tax Credit filers, and relief is broken up into two rounds. First checks can go out once RELIEF Act is law.

This is for Earned Income Tax Credit filers, and relief is broken up into two rounds. First checks can go out once RELIEF Act is law.

3. The RELIEF Act repeals state and local income taxes on unemployment benefits.

4. The RELIEF Act makes a $300 million commitment to supporting small businesses with sales tax credits of up to $3,000 per month for four months—for a total of up to $12,000. This relief will directly help more than 55,000 Maryland small businesses.

4a. This relief is automatic & based on a sliding scale up to $3,000. Examples: if you're a business with $100,000 in monthly revenue and you collect $6,000 in sales taxes, you only remit $3,000. If you have $50,000 revenue and you collect $3,000 in sales taxes, you keep it all.

5. UNEMPLOYMENT TAX RELIEF FOR SMALL BUSINESSES

The RELIEF Act extends unemployment tax relief for small businesses, staving off sudden and substantial tax hikes in 2021. This provision codifies an emergency order the governor issued last month.

The RELIEF Act extends unemployment tax relief for small businesses, staving off sudden and substantial tax hikes in 2021. This provision codifies an emergency order the governor issued last month.

6. The RELIEF Act safeguards Maryland businesses against any tax increase triggered by the use of state loan or grant funds.

7. The RELIEF Act will be introduced as emergency legislation, so that it can take immediate effect upon enactment, and checks can begin to go out immediately.

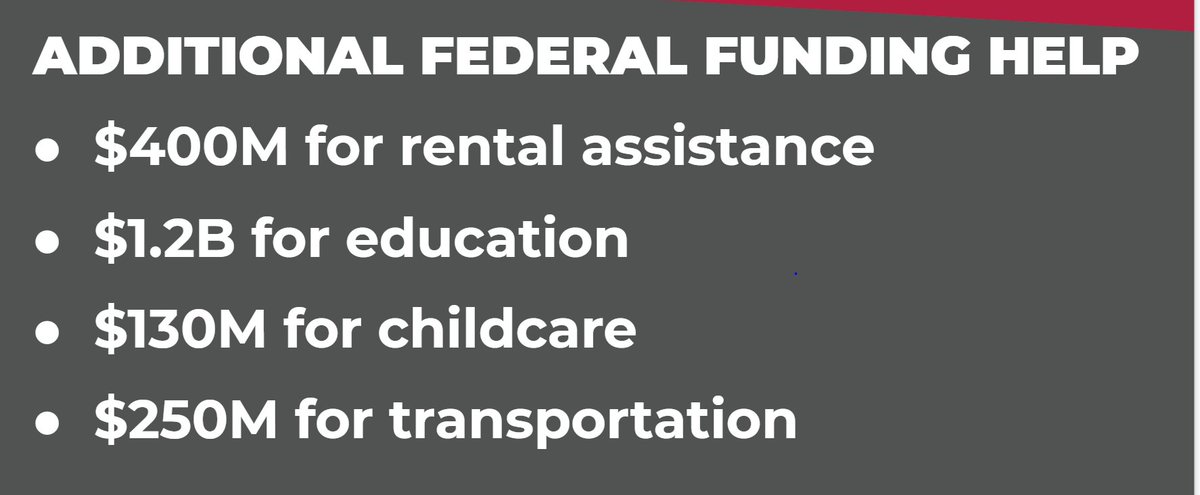

8. The governor is detailing how much Maryland stands to gain from the new federal relief bill: nearly $15 billion.

This includes another $400 million for rental assistance, that can be used for help with rent and utility bills.

This includes another $400 million for rental assistance, that can be used for help with rent and utility bills.

9. The legislation is funded through a variety of sources, including leftover surplus from FY20, and budgetary actions taken by the Board of Public Works.

There is bipartisan agreement we should not drain the state's Rainy Day Fund.

There is bipartisan agreement we should not drain the state's Rainy Day Fund.

Read on Twitter

Read on Twitter