**THREAD**

Enough shitposting time for a thread of value.

I want to talk about "BTFD" and the dangers of being fresh in this market and blindly following along with the spammed advice for those who are new to trading and are active now on exchanges.

Enough shitposting time for a thread of value.

I want to talk about "BTFD" and the dangers of being fresh in this market and blindly following along with the spammed advice for those who are new to trading and are active now on exchanges.

We've got a monster sell off that we see regularly across all markets, but is felt especially hard in the markets of focus for many of you, crypto.

Over the past few weeks you've been conditioned into thinking that the market only goes up and selling is reversed quickly.

Over the past few weeks you've been conditioned into thinking that the market only goes up and selling is reversed quickly.

Then a day like today occurs and suddenly there's no buyers, there's no bounce and your BTFD mentality is thrown into chaos.

Let's clarify a couple of things.

Generally speaking BTFD isn't bad as a principle in this market. As we trend higher sells are absorbed and we bounce, but there are always events that throw this out of the window.

Everyone says "BTFD" - no one says when the dip is done.

Generally speaking BTFD isn't bad as a principle in this market. As we trend higher sells are absorbed and we bounce, but there are always events that throw this out of the window.

Everyone says "BTFD" - no one says when the dip is done.

Bull markets correct and they correct hard. The purpose is to shake you out, shake up the market and to teach you some lessons in profit taking. It obviously assists some entities in re-establishing positions amongst the chaos.

The majority of you are poor with risk management. You overleverage and your position sizes are way too big for what they should be.

BTFD is probably the worst advice you can absorb in these conditions.

BTFD is probably the worst advice you can absorb in these conditions.

You'll have been subconsciously conditioned to be actively and aggressively looking for long positions based on the content on Twitter for the last few weeks.

This means your positions are usually larger in the hopes you're catching the next leg up to $50k.

This means your positions are usually larger in the hopes you're catching the next leg up to $50k.

You're taking huge risk because big PNL numbers appear in your feed daily and you feel entitled/greedy to achieve those figures in these conditions.

It also means that days like today have the ability to wipe you out.

At all times keep in mind that it's actually patience that wins in these situations and not sniping the bottom of a 20% sell off.

At all times keep in mind that it's actually patience that wins in these situations and not sniping the bottom of a 20% sell off.

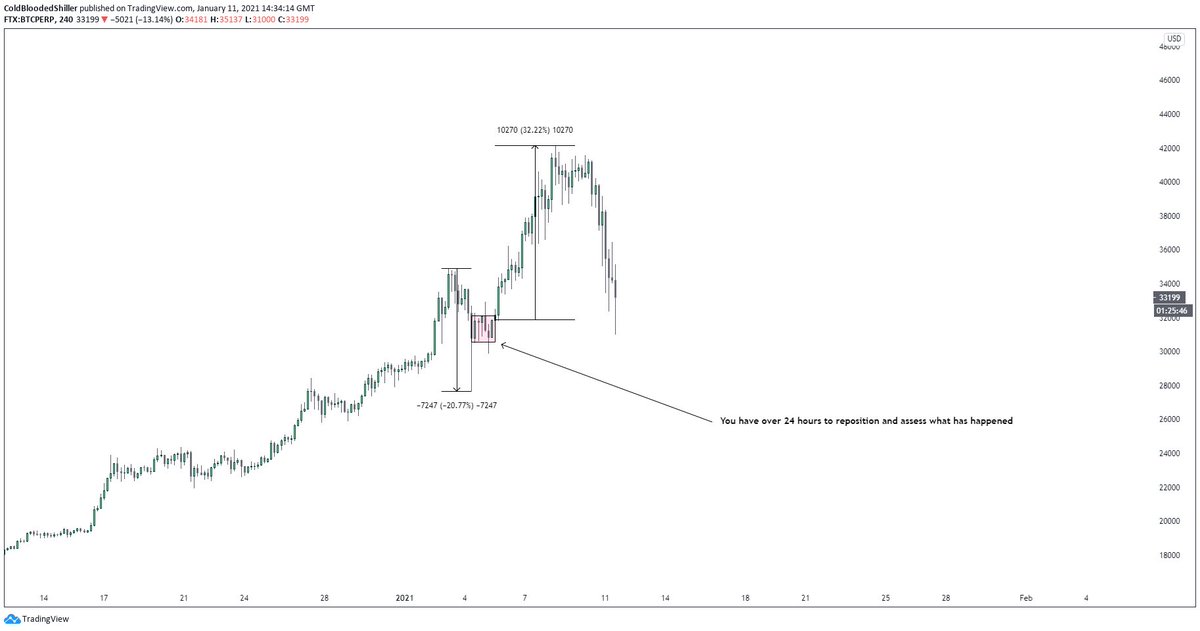

Take the first sell off of 20%. Sure you didn't catch the bottom, but by waiting, letting the dust settle and taking account of the conditions you could have positioned yourself for a 32% upside move.

Whenever we get strong selling, the best thing you can do is to sit on your hands. Wait, let the dust settle, let the market stabilise and make a decision on what you'd like to do.

Blindly taking the BTFD mentality is detrimental because of the way YOU manage risk.

Blindly taking the BTFD mentality is detrimental because of the way YOU manage risk.

Yes opportunity is created in these moments, but it's not done within the space of 5 minutes and if you don't act immediately you're going to lose your shot at glory.

This will be a first real test for a lot of you that hope to take trading more seriously, sitting on your hands and waiting for the market to hold up is challenging, especially when you're battling with greed and wanting to have the best entry possible.

Those you follow on Twitter will be quick to post their "bottom" entries continuing to condition you on being late and therefore missing out on opportunity.

You have time. You will not have time if you blow your account and balance now.

You have time. You will not have time if you blow your account and balance now.

Sell offs very quickly eliminate profit from the uptrends. This will force you into more aggressive and more risky situations in order to:

1. Make back your lost profit.

2. Confirm that buying dips is right and you shouldn't stop your process.

1. Make back your lost profit.

2. Confirm that buying dips is right and you shouldn't stop your process.

Do not become a brain-dead CT moron that spams BTFD at every opportunity or worse yet, acts on those tweets.

BTFD will get you burned especially if you are fresh to trading. Act sensibly and don't assign yourself to a sub-community of morons that circle jerk the philosophy.

BTFD will get you burned especially if you are fresh to trading. Act sensibly and don't assign yourself to a sub-community of morons that circle jerk the philosophy.

Let's summarise:

1. Sell offs happen, do not blindly long LTF charts everytime we get a green candle.

2. Don't listen to Twitter sarcastically asking "did you buy the dip anon?"

3. Take your time. Last 20% sell off gave over 24 hours to position before moving +32%.

1. Sell offs happen, do not blindly long LTF charts everytime we get a green candle.

2. Don't listen to Twitter sarcastically asking "did you buy the dip anon?"

3. Take your time. Last 20% sell off gave over 24 hours to position before moving +32%.

4. Ignore tweets in between the dip claiming bottom entries or that you missed your chance.

5. The market is still up, so don't try and flip short at moments like these.

6. Use your brain. We're selling off strongly. Wait for the dust to settle.

5. The market is still up, so don't try and flip short at moments like these.

6. Use your brain. We're selling off strongly. Wait for the dust to settle.

7. Manage your risk, don't overleverage. Build slowly and sensibly when the opportunity comes.

8. We always go lower than you think.

9. Do not enter the sub-community of BTFD to the point you're acting irrationally.

10. Like and RT this thread.

8. We always go lower than you think.

9. Do not enter the sub-community of BTFD to the point you're acting irrationally.

10. Like and RT this thread.

Read on Twitter

Read on Twitter