(1/5) $BTC and gang have deviated from the mean.

This week's pullback is nothing more than a reversion to the mean (return to the average price).

For more on that, let's talk about the 10 and 20 EMAs that are always on my charts...

This week's pullback is nothing more than a reversion to the mean (return to the average price).

For more on that, let's talk about the 10 and 20 EMAs that are always on my charts...

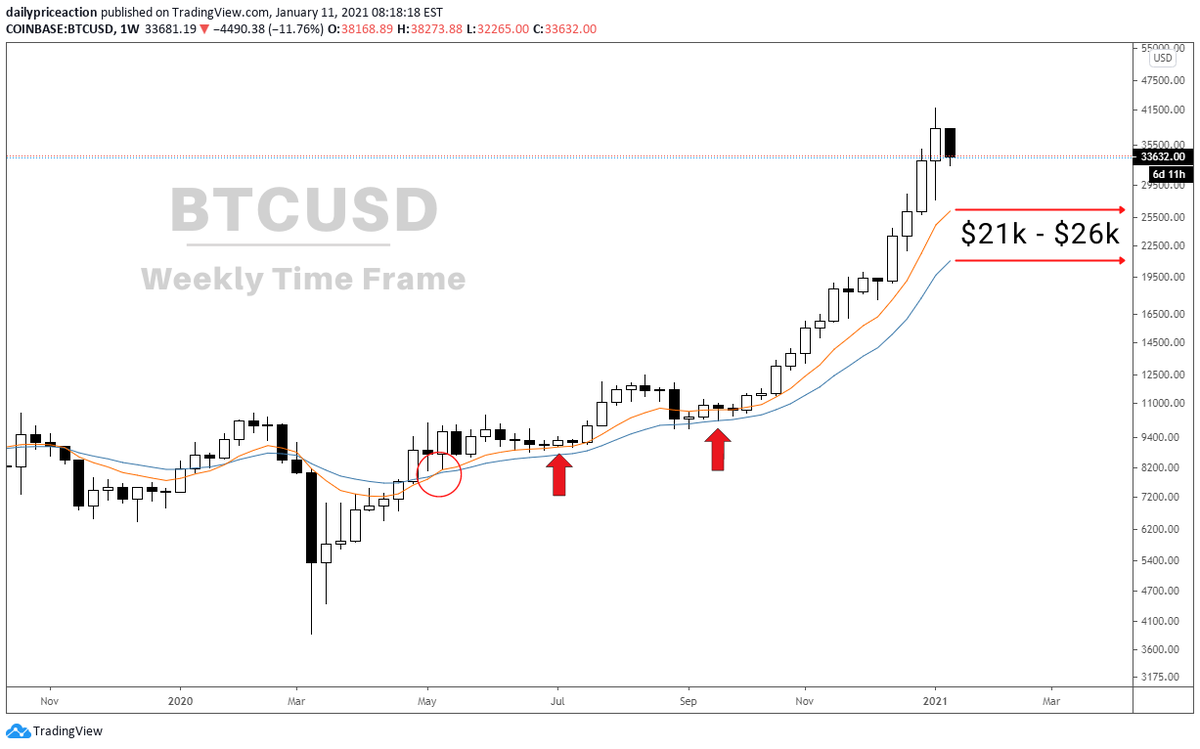

(2/5) In a trending market, the area between these two averages represents the mean or average price.

Notice how the #Bitcoin price reacted to this area during the 2017 bull run.

price reacted to this area during the 2017 bull run.

Once these MAs crossed, the area between them offered multiple buying opportunities.

Notice how the #Bitcoin

price reacted to this area during the 2017 bull run.

price reacted to this area during the 2017 bull run.Once these MAs crossed, the area between them offered multiple buying opportunities.

(3/5) The same thing has started to happen this bull run.

The weekly 10 and 20 EMAs crossed over in May 2020.

Since then, we've had two buying opportunities per mean reversion theory.

As of right now, the average price is between $21,000 and $26,000.

The weekly 10 and 20 EMAs crossed over in May 2020.

Since then, we've had two buying opportunities per mean reversion theory.

As of right now, the average price is between $21,000 and $26,000.

(4/5) One of two things needs to occur...

1) BTC moves sideways for the next few weeks to establish a new (higher) average weekly price range, or...

2) BTC pulls back toward the $21,000 - $26,000 area.

Keep in mind that the average price will move up over time.

1) BTC moves sideways for the next few weeks to establish a new (higher) average weekly price range, or...

2) BTC pulls back toward the $21,000 - $26,000 area.

Keep in mind that the average price will move up over time.

(5/5) Either way, anticipate a stalled #crypto market for the next few weeks.

Pro tips:

1) Ignore the noise

2) Avoid leverage at all costs

3) Take advantage of the fear

4) When in doubt, zoom out

HODL!

Pro tips:

1) Ignore the noise

2) Avoid leverage at all costs

3) Take advantage of the fear

4) When in doubt, zoom out

HODL!

Read on Twitter

Read on Twitter