This is the line that stands out from the Paris Club statement, for me: GoK “is also committed to seek all its other bilateral official creditors a debt service treatment that is in line with the agreed term sheet & its addendum.”

Put another way, one group of our creditors have decided to give #Kenya a break. But will #China do the same thing? The answer's not quite as clear cut as it seems.

#China is $Kenya's biggest, single bilateral lender, and it takes the lion share of bilateral debt service already [about as much as we pay to service Eurobonds].

But we've not started servicing all debt taken on to build the Standard Gauge Rail line.

But we've not started servicing all debt taken on to build the Standard Gauge Rail line.

Remember, just over $ 5 Billion was borrowed by #Kenya to build the #SGR, all of it from the Exim Bank of China [ $ 1.6 B + $ 2 B for the Nairobi-Mombasa leg, $ 1.48 B for the Nairobi-Naivasha leg], priced at LIBOR +360 bp and LIBOR + 300 bp

Payments on the $ 2 Billion tranche started in late July 2019. Payments on the $ 1.48 B tranche start in another 10 days [January 21], and payment on the $ 1.6 B tranche start on July 21st.

Put another way, even if China were to match DSSI relief, it would not cover some of the debt due to them, from #Kenya. Since the debt in question is also from a state-owned entity, but not a state, I'm also not 100% certain if it would qualify for DSSI-like treatment.

In November 2020, Kenya's Treasury vehemently argued that any claims the country is broke were "unfortunate & malicious." Makes one wonder though - if you're asking for [and have gotten] debt relief, are you not essentially, you know, broke?

You will see plenty of arguments about how Kenya opted out of deferring $ 800-odd million in debt service payments had it taken part in DSSI between May-December 2020. But the decision to not take part in DSSI needs some nuanced explanation.

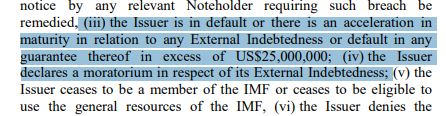

Imagine, for argument's sake, that you're in charge of Treasury....and you have outstanding Eurobond notes which define default events, inter alia, like this:

Put another way, holders of the 2028 & 2048 notes can make the case that #Kenya seeking a moratorium "in respect of its external indebtedness", = default event...and things get really hairy from that point.

So, what did Treasury tell holders of Kenya's Eurobonds as it made this DSSI application?

At this point, I don't know.

But that would be a fascinating conversation to hear about. In any case, Eurobond payments are still on schedule, with no slippage.

At this point, I don't know.

But that would be a fascinating conversation to hear about. In any case, Eurobond payments are still on schedule, with no slippage.

Read on Twitter

Read on Twitter