#CDSL

( #TechnoFunda Analysis)

Please Read Fully Thread..

~ CDSL Incorporated in 1999 under Depositories act,1996 with Some Unique Business Model..

~ Almost Recession Free Business is Key Factor...

~ Provide Depositories (Opening DEMAT) Related Services.

(1/n)

( #TechnoFunda Analysis)

Please Read Fully Thread..

~ CDSL Incorporated in 1999 under Depositories act,1996 with Some Unique Business Model..

~ Almost Recession Free Business is Key Factor...

~ Provide Depositories (Opening DEMAT) Related Services.

(1/n)

Financials:

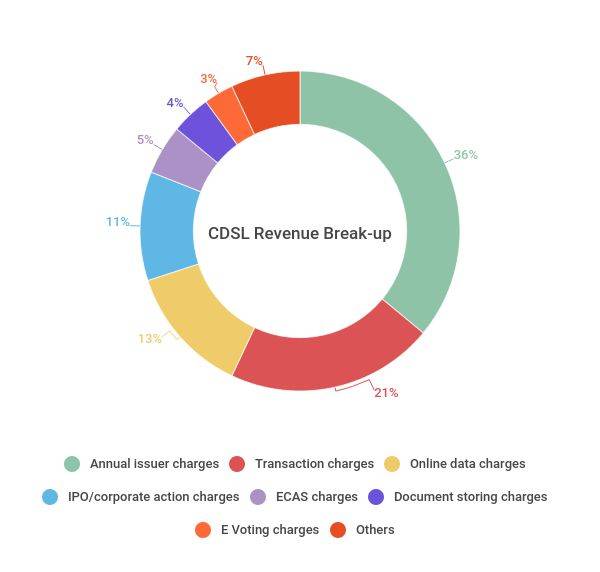

~ Revenue Comes from Diversified Source:

E-KYC (CDSL Venture)

E-KYC (CDSL Venture)

Transaction Fees

Transaction Fees

Annual Charges

Annual Charges

IPO Listing

IPO Listing

~ OPM are 55% (May Rise More in Q3)

~ Expenses are Mostly Fixed and Main things is that Revenue Growth is NOT Linked with Capex.

(Big +ve)

(Big +ve)

(2/n)

~ Revenue Comes from Diversified Source:

E-KYC (CDSL Venture)

E-KYC (CDSL Venture) Transaction Fees

Transaction Fees Annual Charges

Annual Charges IPO Listing

IPO Listing~ OPM are 55% (May Rise More in Q3)

~ Expenses are Mostly Fixed and Main things is that Revenue Growth is NOT Linked with Capex.

(Big +ve)

(Big +ve)(2/n)

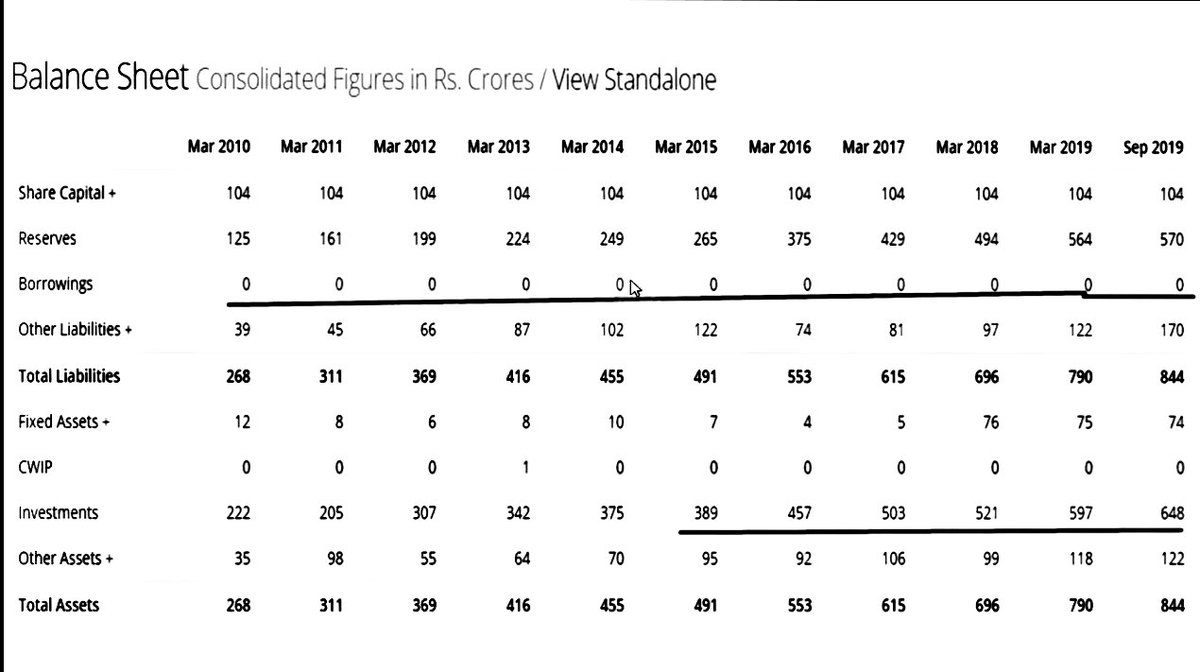

Important:

Important:~ Diversified Business is Key for This Company..

~ Almost "

" Working Capital Required,

" Working Capital Required, So Have V.well Free Cash Flow and Investment.

~ Strong Balance Sheet and Ratio's

~ Pure Debt Free..

(No Int. Cost)

(No Int. Cost)~ Almost

% Reserve on Balance Sheet..

% Reserve on Balance Sheet..(3/n)

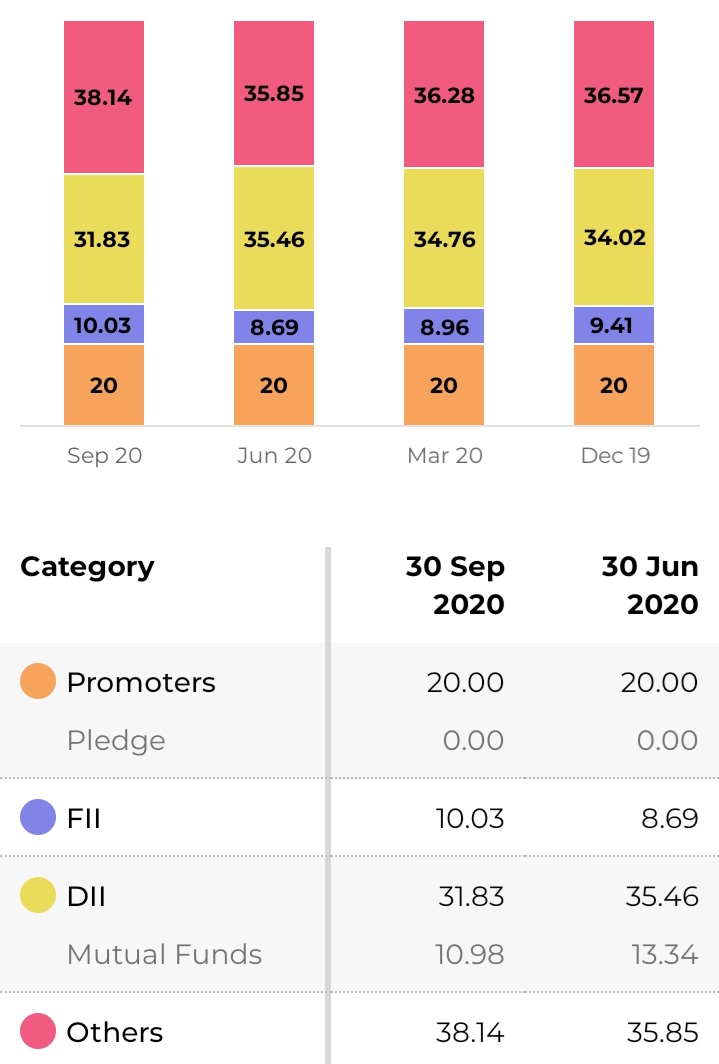

Holding:

Holding:BSE: 20%

MF: 11%

DII: 31.8%

FII: 10.03%

~ Ratio's:

ROE: 15.33%

ROE: 15.33% ROCE: 19.6%

ROCE: 19.6% ROA: 13%

ROA: 13% Positive:

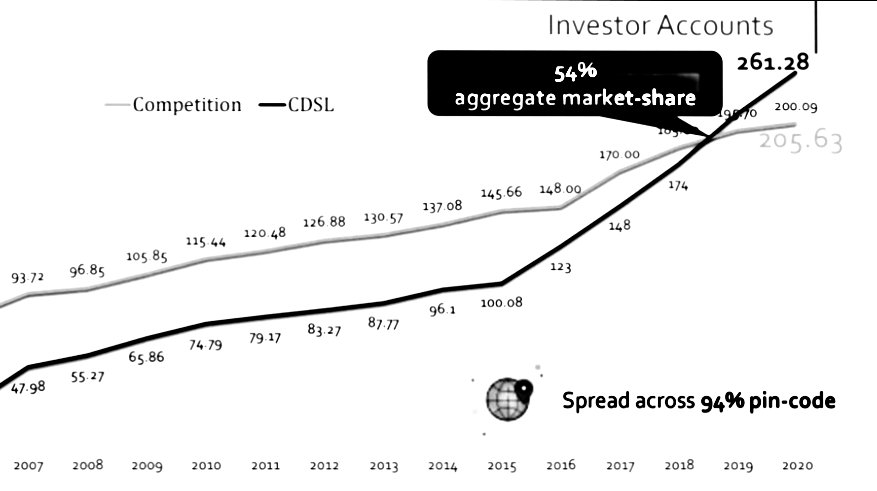

Positive:~ There are only 2 Company in Whole Market for DEMAT Securities Related Sagement..

1) CDSL

2) NSDL

~ CDSL Mostly Focus in Retail DEMAT Opening...

(4/n)

~ Duology Market

~ New Firm's Entry is Prevented...

~ High MOAT (+ve)

~ CDSL has Higher Market Share Compared to NSDL and it Continues Rising..

~ Out of Both, Only #CDSL Listed (Than No Peers Comparison)..

~ Company's bBusiness Have A Brightest Future..

(5/n)

~ New Firm's Entry is Prevented...

~ High MOAT (+ve)

~ CDSL has Higher Market Share Compared to NSDL and it Continues Rising..

~ Out of Both, Only #CDSL Listed (Than No Peers Comparison)..

~ Company's bBusiness Have A Brightest Future..

(5/n)

Potential Growth Trigger:

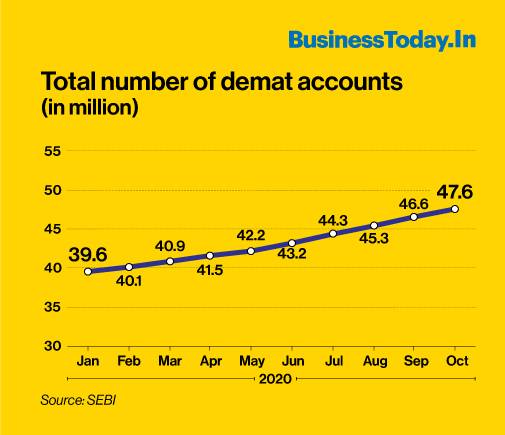

Potential Growth Trigger:~ New DEMAT Opening is Rising Repidly

~ 22% Growth on New DEMAT Opening in 2020.

~ No.Of New IPO's Increased.

~ Digitalization is Must Key Trigger.

I'm Not Surprised If Stock Goes Up to

I'm Not Surprised If Stock Goes Up to  Digit at end of Decade.

Digit at end of Decade. Share My Views Only.

Share My Views Only.6/n.

Hope You all Enjoy Thread.

I Try Best to Share Some Knowledge in Simply Way

Thank You

@Investor_Mohit @Rishikesh_ADX @RajarshitaS @CAPratik_INDIAN

@VRtrendfollower @Atulsingh_asan @Jitendra_stock @MarketScientist @Stockstudy8 @nishkumar1977 @caniravkaria

#RETWEEET

I Try Best to Share Some Knowledge in Simply Way

Thank You

@Investor_Mohit @Rishikesh_ADX @RajarshitaS @CAPratik_INDIAN

@VRtrendfollower @Atulsingh_asan @Jitendra_stock @MarketScientist @Stockstudy8 @nishkumar1977 @caniravkaria

#RETWEEET

Try to Going More Depth in CDSL's Business in Day by Days Ahead...

Will Share Technical Chart also Once That Ready.

Stay Tune Ahead :)

Thank You...

Will Share Technical Chart also Once That Ready.

Stay Tune Ahead :)

Thank You...

Read on Twitter

Read on Twitter