Last few months I've been studying Bitcoin quite a bit. Since there's a buy opportunity next few days I want to explain about it. Read this thread to learn what Bitcoin is, why it's valuable, why its price is so high right now, and how you can invest, if you want.

Bitcoin (BTC) is a digital currency. I'll address the first question most people have right away: How can the price be so high when it has no inherent value?

Because there's no such thing as inherent value. Or at least, it doesn't work quite the way you think it does.

Because there's no such thing as inherent value. Or at least, it doesn't work quite the way you think it does.

Imagine you buy an insurance policy. It doesn't have what you're probably thinking of as "inherent value". But it definitely costs money to buy and can sometimes be a good purchase. Its value may not be "inherent" but it still has value.

In truth, things have value not because they're inherently useful or practical, but because people assign them value. So the proper question would rather be: Why do people assign value to BTC?

The primary answer right now is that BTC is an inflation-resistant store of wealth.

The primary answer right now is that BTC is an inflation-resistant store of wealth.

If there's inflation that means there are more dollars chasing the same number of assets. If everyone gets a million dollars in their bank accounts tomorrow then the price of a car would go up to compensate. So inflation (more dollars) causes prices to go up.

Before BTC, if as an investor you think there's going to be inflation then you buy gold. There's only so much gold, it's very difficult to dig it up and refine it. If you own it when the price goes up, then you can sell it again and retain the real value of your investment.

Now there's BTC. There will only ever be 21 million BTC ever mined. With gold, more keeps coming out of the ground, diluting your gold's worth if you own some. That can never happen with BTC. So buying BTC is a better way than buying gold to protect yourself against inflation.

Imagine you want to pass your wealth to your grandkids. If you keep it in dollars, you will lose it to inflation. If you buy bonds or take out certificates, you won't get interest rate better than inflation, so you'll still lose money.

Buying gold will work pretty well in the long term, but those gold miners are always working at digging gold out of the ground, and who knows, some engineer may get really good at doing it faster. If they do, your gold will lose value. BTC starting to look like a good option.

OK but that doesn't explain why it's going up so freaking much right now. To understand that we have to talk about the halving cycle.

When BTC was first created, miners could create new coins at a rate of 50 per ten minutes or so.

When BTC was first created, miners could create new coins at a rate of 50 per ten minutes or so.

For four years, anyone who mined BTC would get new BTC at this rate. The price was pretty low because there was always new BTC coming in all the time. But after 4 years in Nov 2012 the rate at which new BTC got created was cut in half. This is called a "halving".

The halvings were programmed into BTC from the very beginning, by its creator. The rate of new BTC creation will halve every four years until eventually there is no new BTC created ever.

Here's the kicker: Every time BTC gets halved, the supply of new coins drops.

Here's the kicker: Every time BTC gets halved, the supply of new coins drops.

If you remember from economics, price is approximately demand / supply. When supply is high the price is low. But when supply goes down then the price will increase. That's what happens at each halving.

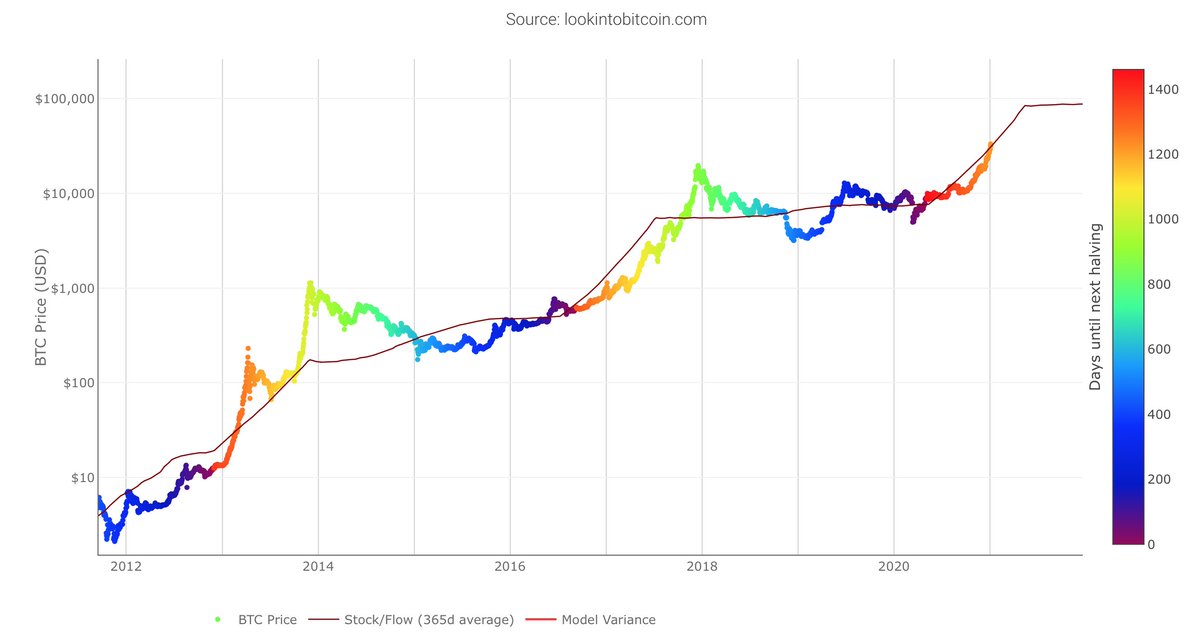

Most likely, each time you heard about the BTC price being ridiculously high, it's because it just went through a halving cycle. There was one in 2012 causing a new all-time high of about $1100, then a halving in 2016 causing a high of $20000.

And the last halving was last May.

And the last halving was last May.

Thing is there's a delay between the halving event, when BTC starts coming out of miners slower, and the all-time high. This is because it takes time for the reduced supply to trickle out into the market. Generally there has been about a year between halving and the new high.

That would place the new all-time high to come some time between April and November of this year. Between now and then, the supply of BTC will continue to contract because of last May's halving, forcing the pricing up.

It's as if half of the companies that mine gold were to close up shop at the same time. The price of gold wouldn't immediately spike, but eventually the lack of supply would cause the price to skyrocket. That's what we're seeing right now with Bitcoin.

Here's a graph of the halving in action. In late 2012, mid 2016, and mid 2020 you can see the price start going up, then top out about a year later, and stabilize a bit lower.

It's true that BTC has bubbled a lot, but notice that each time the bubble bursts, it lands higher than it was previously.

There's another less significant reason BTC is going up right now: institutional adoption. Large companies, endowment funds, insurance companies, etc have decided that BTC is no longer a speculative currency, and they've been quietly buying a ton of it.

Until mid-December, the current BTC bull run was largely linear, and driven by companies like MicroStrategy, MassMutual, Paypal, and Stripe buying in. But after BTC hit its new all-time high, retail investors started getting involved, and the price shot up.

How high will it go? If nothing disruptive happens, the price will go to $50k some time in February or March and then, barring any short-term corrections that will quickly recover, it will never again fall below the $50k line.

If BTC follows the trend of the previous two halvings, it will top out somewhere between $250k and $700k some time between May and October. I know that's a huge range, but I couldn't honestly tell you I have confidence in any tighter range.

But WHATEVER, I don't have to have any confidence, because that's at least a 7x increase in 8 months, or in other words it will give you a 27.5% return on investment EVERY MONTH in the worst case, or a 211% return (

) in the best case.

) in the best case.

) in the best case.

) in the best case.

That is PER MONTH, mind you. Double every month for four months, until it hits the top and starts falling again.

Its new steady-state level that it will reach when this halving is done is somewhere between $150k and $400k, if past patterns continue.

Its new steady-state level that it will reach when this halving is done is somewhere between $150k and $400k, if past patterns continue.

So if you look at the price of BTC and you're worried that it has already gone up a lot making it a bad time to get in, think about the halving cycle.

Think about how it has already done this twice previously, five years ago and nine years ago.

There are of course risks. It could drop and never recover. But the upside is enormous, and it's currently at a 15% correction, making right now a good time to buy.

If you decide you want to invest, go to http://coinbase.com . Remember that investing is dangerous, and you probably shouldn't risk more money in a single investment than you're willing to lose.

It's easy to see how far up is has gone and be worried it will go back down. The technique I used to deal with this was to invest half immediately and then wait until the market went up or down 10%.

If it goes up, you feel good about buying in early, and you can feel good about buying the other half. If it goes down, then you feel good about buying the other half at a low price and lowering your dollar cost average.

Good luck, ask me if you have any questions.

A great thread on BTC that addresses common concerns https://twitter.com/danheld/status/1348347794302459904?s=20

Read on Twitter

Read on Twitter