I’ve been interested in finance, investing, and the market for some time. Of particular interest to me is knowing which well performing stocks others hold.

Many folks on fintwit post their holdings and monthly performance.

Thread:

Many folks on fintwit post their holdings and monthly performance.

Thread:

I've been fascinated by the concept of "The Wisdom of Crowds"[1], and wondered if many people were holding the same stocks, or given the large universe, were holdings very disparate. I realize there’s not enough of a “crowd” in my sample below, but I’m still curious...

...as to top holdings of other investors.

I decided to look at the self-reported, Dec. 2020 holdings of:

@adventuresinfi

@ayandasnr

@BornInvestor

@cperruna

@dannyvena

@dhaval_kotecha

@ebcapital

@ericdss

@InvestingInTech

@InvestorSantosh

@JonahLupton

@KermitCapital

@MST401k

I decided to look at the self-reported, Dec. 2020 holdings of:

@adventuresinfi

@ayandasnr

@BornInvestor

@cperruna

@dannyvena

@dhaval_kotecha

@ebcapital

@ericdss

@InvestingInTech

@InvestorSantosh

@JonahLupton

@KermitCapital

@MST401k

@paul_essen

@PythiaR

@RedCoatChicago

@richard_chu97

@RroseSelavy2

@saxena_puru

@stronghobbit

@StuSim

@ztinvesting

These are all accounts I follow on Twitter and have seen regular, monthly updates from (they're also all worth a follow!).

@PythiaR

@RedCoatChicago

@richard_chu97

@RroseSelavy2

@saxena_puru

@stronghobbit

@StuSim

@ztinvesting

These are all accounts I follow on Twitter and have seen regular, monthly updates from (they're also all worth a follow!).

(If you’re in this list or follow them, and would RT this thread, I’d very much appreciate it).

@DrBDT (a friend and Excel guru!) was kind enough to help me put together an Excel file with pivot tables to easily enter data and have automatically updated pivot tables to analyze.

@DrBDT (a friend and Excel guru!) was kind enough to help me put together an Excel file with pivot tables to easily enter data and have automatically updated pivot tables to analyze.

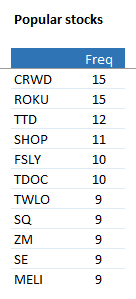

Let’s cut to the chase:

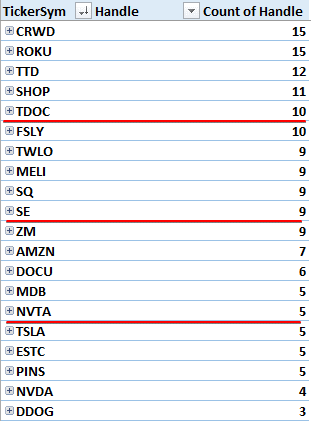

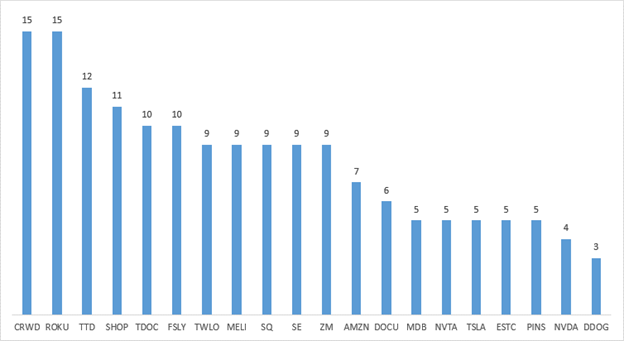

I looked at the Dec. 2020 holdings of 22 Twitter accounts (listed above).

These 22 accounts reported holding 141 different stocks [2].

Average number of stock held by the accounts: 15

The least: 7 (by @ayandasnr)

The most: 26 (by @BornInvestor)

I looked at the Dec. 2020 holdings of 22 Twitter accounts (listed above).

These 22 accounts reported holding 141 different stocks [2].

Average number of stock held by the accounts: 15

The least: 7 (by @ayandasnr)

The most: 26 (by @BornInvestor)

I’m personally surprised by the top list.

I didn’t expect $CRWD to be so commonly held. $ROKU is less of a surprise (to me).

I’m very surprised that neither $AAPL, $AMZN, nor $TSLA are a common, top 10 holding. More on that below.

I didn’t expect $CRWD to be so commonly held. $ROKU is less of a surprise (to me).

I’m very surprised that neither $AAPL, $AMZN, nor $TSLA are a common, top 10 holding. More on that below.

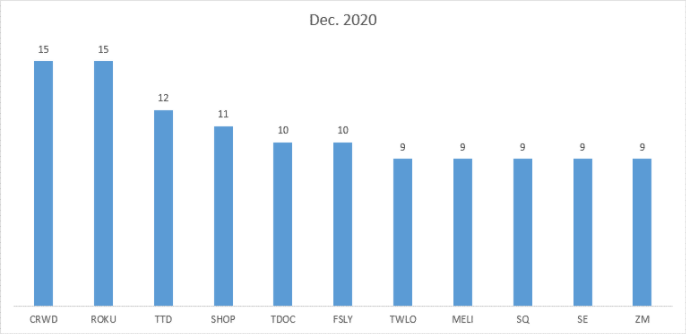

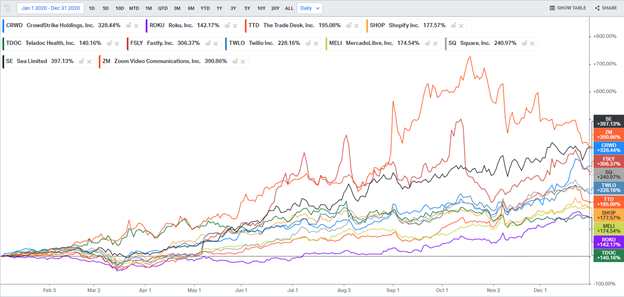

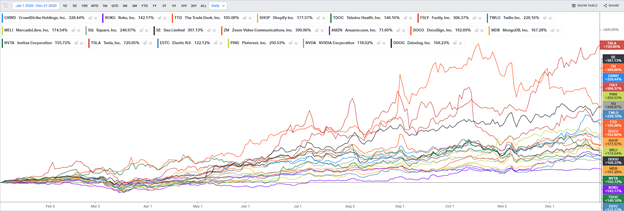

If you look at the performance of the Top 11 over all of 2020 relative to one another, $SE is the winner (thanks @KoyfinCharts) w/ $ZM being a close runner-up:

https://app.koyfin.com/share/75454eeb84

https://app.koyfin.com/share/75454eeb84

The average performance of these 11 holdings was: 247.40% over all of 2020!

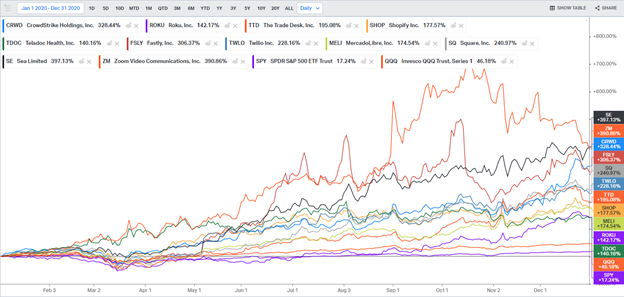

Compared to the $SPY (17.24%) and $QQQ (46.18%), they did amazingly well. Again, relative performance w/ SPY and QQQ added:

https://app.koyfin.com/share/e2031285db

Compared to the $SPY (17.24%) and $QQQ (46.18%), they did amazingly well. Again, relative performance w/ SPY and QQQ added:

https://app.koyfin.com/share/e2031285db

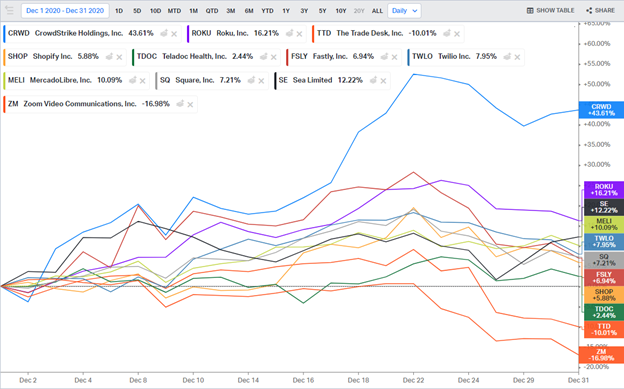

Looking at *just* Dec. 2020 performance, we can see $CRWD leading the pack, with $ZM and $TTD in the red:

https://app.koyfin.com/share/2efea33667

https://app.koyfin.com/share/2efea33667

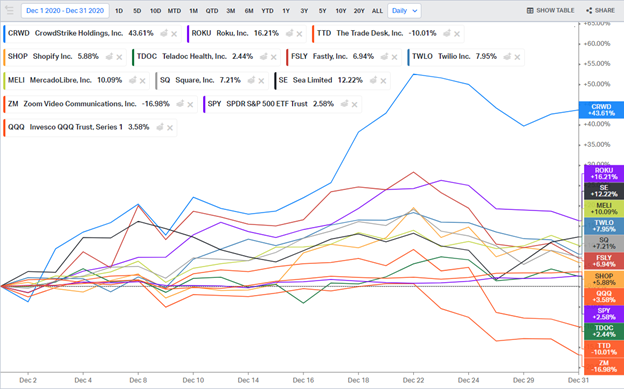

Here’s the same w/ $SPY & $QQQ added to that list for just Dec. 2020:

https://app.koyfin.com/share/6f98fd733c

https://app.koyfin.com/share/6f98fd733c

Going back to $AAPL and $AMZN (and some others):

- $AAPL doesn’t even make the Top 20. It’s held by only 2 of the 22 accounts

- $AMZN isn’t a top 10 holding, but it does sit at #12 (it’s held by 7 of 22)

- $AAPL doesn’t even make the Top 20. It’s held by only 2 of the 22 accounts

- $AMZN isn’t a top 10 holding, but it does sit at #12 (it’s held by 7 of 22)

- $TSLA ranks surprisingly low in list. It sits at #16 (held by 5 of 22)

- $NFLX doesn’t make the Top 20 (held by just 2 of 22)

- $NFLX doesn’t make the Top 20 (held by just 2 of 22)

Here’s the Top 20.

You can see from the why I cut the list off at 11 (and not 10). $ZM has the same number of holders as $SE.

You can see from the why I cut the list off at 11 (and not 10). $ZM has the same number of holders as $SE.

Looking at the relative performance of *all* 20 top holdings over 2020, here’s how they ended the year relative to one another:

https://app.koyfin.com/share/9b8095fbc7

https://app.koyfin.com/share/9b8095fbc7

$TSLA here is the monster winner, coming in at a relative gain of 720.05%! The second closest, $SE, is only slightly better than half as well performing as TSLA.

If you’d held the entire portfolio of 20 stocks over all of 2020, your performance would have been 234.39% (vs. 247.20% for just the top 11).

If you’d held the bottom 9 stocks, your performance over 2020 would have still been $218.49%. Still impressive, and still way better than $SPY and $QQQ.

I think it would be fascinating to track a portfolio of stocks updated monthly containing the top holdings of a large group of Twitter followers.

I’d love to track monthly holdings across accounts and see which ones stay in the top bracket, which are dropped, and if their position in the list changes.

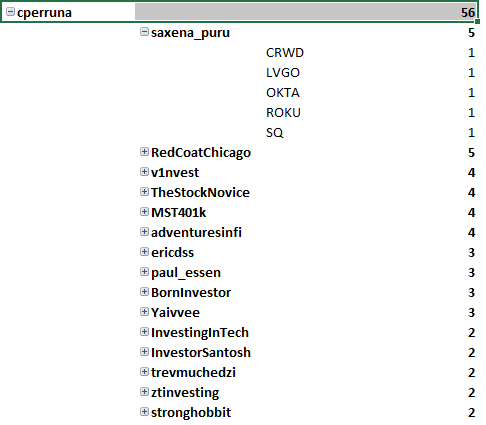

Another thing @DrBDT’s sheet let me do is see which accounts had the most similar holdings to another account. Here’s a couple of examples:

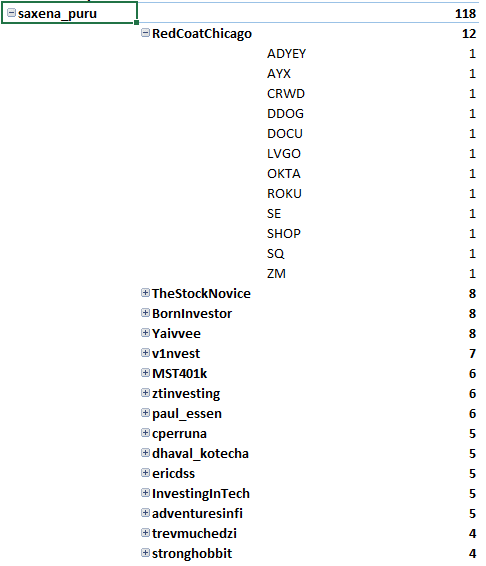

@saxena_puru’s holdings were most closely matched by @RedCoatChicago’s holdings, who had 12 of the same stock:

@saxena_puru’s holdings were most closely matched by @RedCoatChicago’s holdings, who had 12 of the same stock:

There’s too many accounts to go through one-by-one, but I hope this is interesting/educational.

I’d love to do this monthly, and see how the #Top20stocks list changes.

I’d love to do this monthly, and see how the #Top20stocks list changes.

If you publish your holdings monthly and are interested in being included in future posts, please reach out to me directly.

Some notes:

[1] For those interested, there's a fascinating book about The Wisdom of Crowds by @JamesSurowiecki - https://www.goodreads.com/book/show/68143.The_Wisdom_of_Crowds?ac=1&from_search=true&qid=iXOGPC0m41&rank=1

[2] I recorded the holdings as best I could. They ranged from tweets & screenshots, to blog posts. As such, I could have mis-typed a holding.

[1] For those interested, there's a fascinating book about The Wisdom of Crowds by @JamesSurowiecki - https://www.goodreads.com/book/show/68143.The_Wisdom_of_Crowds?ac=1&from_search=true&qid=iXOGPC0m41&rank=1

[2] I recorded the holdings as best I could. They ranged from tweets & screenshots, to blog posts. As such, I could have mis-typed a holding.

I hope you enjoyed the above.

Again, I realize this isn't true "wisdom of crowds" stuff and it could be argued that I'm cherry-picking the accounts I analyzed.

Like I said above, if you're a regular portfolio updater or have recommendations for accounts I should follow, LMK!

Again, I realize this isn't true "wisdom of crowds" stuff and it could be argued that I'm cherry-picking the accounts I analyzed.

Like I said above, if you're a regular portfolio updater or have recommendations for accounts I should follow, LMK!

PS - The charts are all from the amazing @KoyfinCharts!

Read on Twitter

Read on Twitter