YOU MUST PAY TAXES

The dividend tax on ordinary dividends are the same as the regular federal income tax rates.

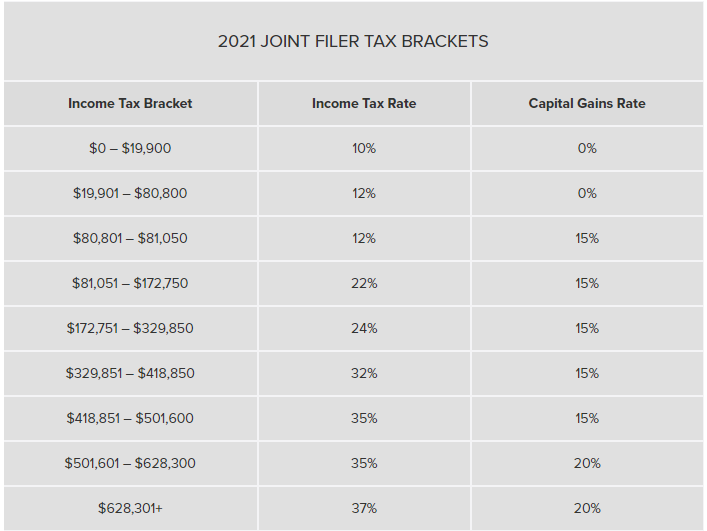

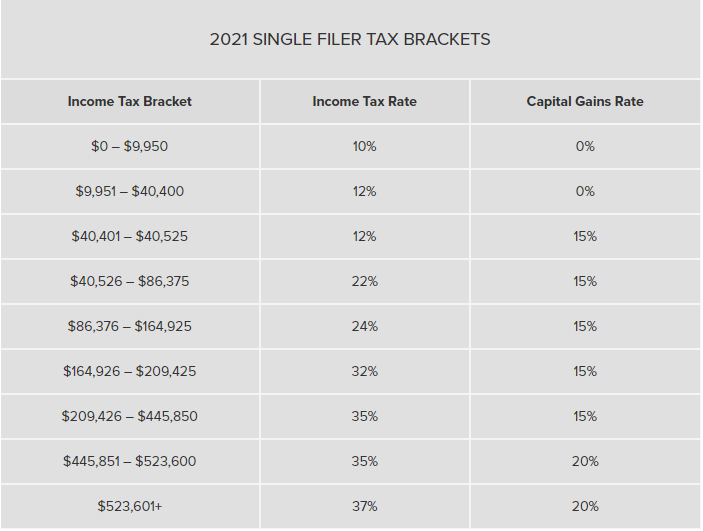

The federal income tax rates range from 10% to 37%

The exact dividend tax rate depends on what kind of dividends you have – ordinary (unqualified) or qualified.

The dividend tax on ordinary dividends are the same as the regular federal income tax rates.

The federal income tax rates range from 10% to 37%

The exact dividend tax rate depends on what kind of dividends you have – ordinary (unqualified) or qualified.

A dividend is qualified if you have held the stock for more than 60 days before the ex-dividend date.

Nonqualified dividends (ordinary), include dividends you may receive, including dividends on employee stock etc

Nonqualified dividends (ordinary), include dividends you may receive, including dividends on employee stock etc

Read on Twitter

Read on Twitter