1/ My 2021 Runner-Up Pick: $GDRX

It’s no secret that access to affordable healthcare still remains out of reach for many Americans.

When ~66% of personal bankruptcies are due to medical issues, GoodRx’s mission of making healthcare affordable has never been more important.

It’s no secret that access to affordable healthcare still remains out of reach for many Americans.

When ~66% of personal bankruptcies are due to medical issues, GoodRx’s mission of making healthcare affordable has never been more important.

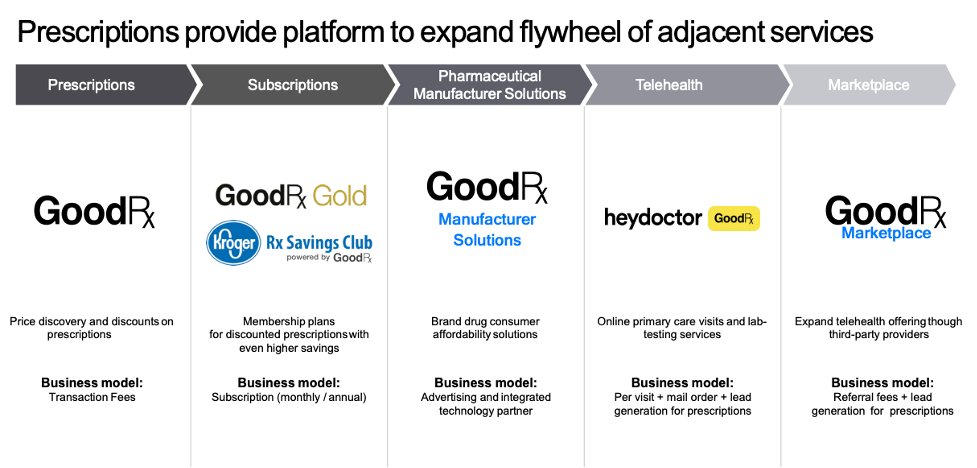

2/ GoodRx started out as a price comparison tool for prescriptions but soon expanded into subscriptions, brand advertising, telehealth.

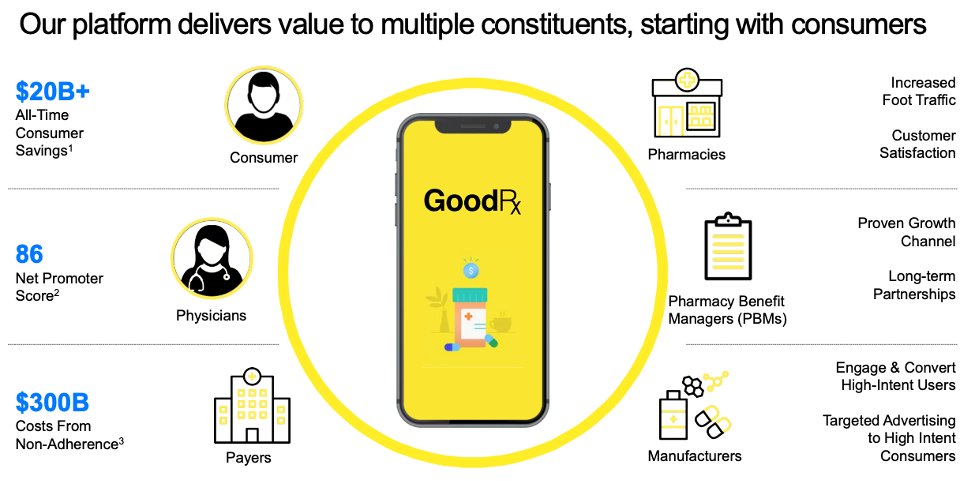

Today, 4.9 million Americans a month rely on GoodRx in order to find affordable healthcare and it has saved a cumulative $25 billion since 2011

Today, 4.9 million Americans a month rely on GoodRx in order to find affordable healthcare and it has saved a cumulative $25 billion since 2011

3/ Prescriptions

Through GoodRx’s app or website, consumers access coupons that significantly reduce their cost of medication (average discount is >70%)

As a result, consumers are 50-70% more likely to afford and fill a prescription and follow through with their treatment plan

Through GoodRx’s app or website, consumers access coupons that significantly reduce their cost of medication (average discount is >70%)

As a result, consumers are 50-70% more likely to afford and fill a prescription and follow through with their treatment plan

4/ PBMs negotiate discounted rates with pharmacies that they make available to GoodRx in return for a share of each transaction, competing against the other 12 PBMs on its platform.

Pharmacies cannot offer the same without breaching their contracts.

GoodRx > PBMs > Pharmacies.

Pharmacies cannot offer the same without breaching their contracts.

GoodRx > PBMs > Pharmacies.

5/ Having the largest userbase makes GoodRx a more attractive partner to PBMs compared to smaller competitors, which results in the most data points, thereby increasing the likelihood that they will be able to find lower prices than competitors and driving further user growth.

6/ GoodRx circumvents traditional marketing channels and achieves a great 8-month payback period by partnering with providers.

Improving affordability leads to improved medication adherence which leads to better outcomes and lower overall costs so many providers recommend them.

Improving affordability leads to improved medication adherence which leads to better outcomes and lower overall costs so many providers recommend them.

7/ Its business model is a win-win-win for consumers, PBMs, and providers with an amazing +90 consumer NPS and +86 provider NPS that has propelled GoodRx to become the second most popular medical app on the App Store and well on its way to creating the front door to healthcare.

8/ GoodRx is increasingly leveraging its userbase to expand into other markets, forming 11% of revenues last qtr.

With GoodRx Gold, frequent users of the app can pay a monthly subscription fee to access features like free mail order delivery and cheap telemedicine consultations.

With GoodRx Gold, frequent users of the app can pay a monthly subscription fee to access features like free mail order delivery and cheap telemedicine consultations.

9/ Pharmaceutical Manufacturer’s Solutions

GoodRx is also increasingly moving into brand medications by partnering with pharmaceutical manufacturers that pay to advertise their offerings and integrate affordability solutions such as co-pay cards and patient assistance programs.

GoodRx is also increasingly moving into brand medications by partnering with pharmaceutical manufacturers that pay to advertise their offerings and integrate affordability solutions such as co-pay cards and patient assistance programs.

10/ Telemedicine

GoodRx entered telemedicine in 2019 with their acquisition of HeyDoctor which offers DTC visits for over 25 conditions starting at $20.

It also launched a Telehealth Marketplace in 2020 where consumers can access third-party telehealth and lab test providers.

GoodRx entered telemedicine in 2019 with their acquisition of HeyDoctor which offers DTC visits for over 25 conditions starting at $20.

It also launched a Telehealth Marketplace in 2020 where consumers can access third-party telehealth and lab test providers.

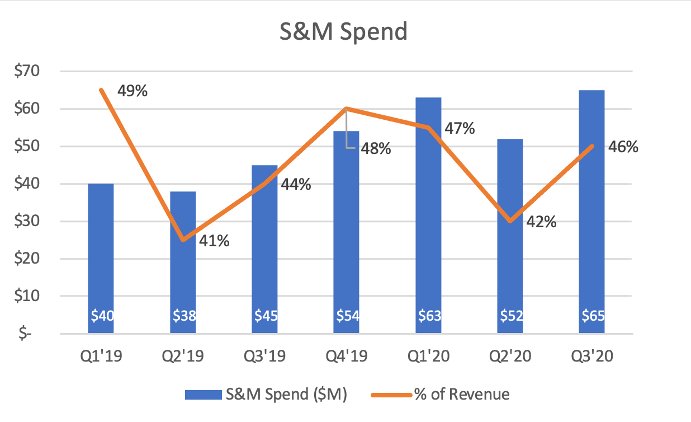

11/ Financials

GDRX grew revenues at a 57% CAGR between 2016 and 2019 with 95% GMs.

In Q3’20, they reported revenue of $140.5 million (+38% YoY) and a 38% adj EBITDA margin. S&M spending remained stable. MAUs dipped slightly because of COVID but should benefit from reopening.

GDRX grew revenues at a 57% CAGR between 2016 and 2019 with 95% GMs.

In Q3’20, they reported revenue of $140.5 million (+38% YoY) and a 38% adj EBITDA margin. S&M spending remained stable. MAUs dipped slightly because of COVID but should benefit from reopening.

12/ Total Addressable Market

While GoodRx advertises an $800B TAM, I believe its serviceable market is closer to $35B (see my article). Still, they have just ~3% share of generics spend.

When nearly half of US adults are underinsured or uninsured, there's no shortage of runway.

While GoodRx advertises an $800B TAM, I believe its serviceable market is closer to $35B (see my article). Still, they have just ~3% share of generics spend.

When nearly half of US adults are underinsured or uninsured, there's no shortage of runway.

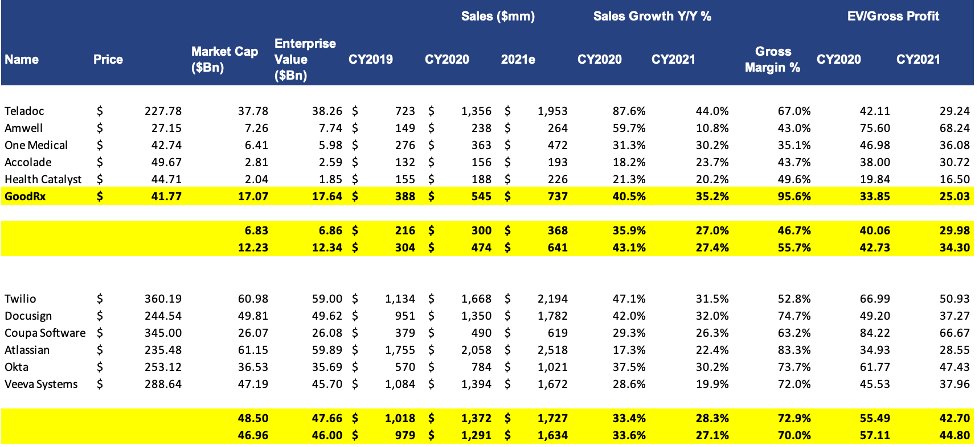

13/ GoodRx seems relatively undervalued trading at 25x 2021 gross profit estimates. I believe it deserves a premium for its strong profitability and rev growth.

Although it isn’t SaaS, its prescription offering is predictable with 80% of transactions coming from repeat activity.

Although it isn’t SaaS, its prescription offering is predictable with 80% of transactions coming from repeat activity.

14/ Competition

GoodRx is by far the leader with SingleCare and RxSaver as its closest competitors. There are also various PBM and pharmacy-owned prescription savings programs

GoodRx works with the most pharmacies and offers the lowest prices by having the most PBM partnerships

GoodRx is by far the leader with SingleCare and RxSaver as its closest competitors. There are also various PBM and pharmacy-owned prescription savings programs

GoodRx works with the most pharmacies and offers the lowest prices by having the most PBM partnerships

15/ Amazon

I don’t believe Amazon Pharmacy will have a material impact on GoodRx anytime soon because of the following:

-Focus on mail order over its discount card

-GDRX’s pricing advantage (AMZN just one PBM)

-PBMs dislike working w/AMZN bc of competing mail-order business

I don’t believe Amazon Pharmacy will have a material impact on GoodRx anytime soon because of the following:

-Focus on mail order over its discount card

-GDRX’s pricing advantage (AMZN just one PBM)

-PBMs dislike working w/AMZN bc of competing mail-order business

16/ Concentration Risk

GoodRx’s top three PBM partners accounted for 48% of revenue in H1’20.

I’m not worried bc PBMs must continue paying GoodRx for the transactions they generate even after contract termination. GoodRx also frequently shifts volume around different contracts.

GoodRx’s top three PBM partners accounted for 48% of revenue in H1’20.

I’m not worried bc PBMs must continue paying GoodRx for the transactions they generate even after contract termination. GoodRx also frequently shifts volume around different contracts.

17/ Regulatory Risk

Reform on prescription drug pricing is a frequent issue every election but faces intense opposition and no substantial change has been achieved.

Also, the steps that have been proposed focus largely on branded medications which form 5% of GoodRx’s revenue.

Reform on prescription drug pricing is a frequent issue every election but faces intense opposition and no substantial change has been achieved.

Also, the steps that have been proposed focus largely on branded medications which form 5% of GoodRx’s revenue.

18/ The combination of a growing moat, huge TAM, great management, and strong rev growth + profitability is hard to find

When 70% of consumers still don't know they can price shop for their prescriptions, I think GoodRx is just getting started

For more: https://richardchu97.substack.com/p/goodrx-the-frontdoor-to-healthcare

When 70% of consumers still don't know they can price shop for their prescriptions, I think GoodRx is just getting started

For more: https://richardchu97.substack.com/p/goodrx-the-frontdoor-to-healthcare

Read on Twitter

Read on Twitter