Excited that my paper with Christoph Trebesch and @henrikenderlein on sovereign debt litigation is published in the @JIntlEcon! Short thread what it's about and why the topic matters (1/6): https://www.sciencedirect.com/science/article/abs/pii/S0022199620301033

Government debt is often considered fundamentally non-enforceable: there is no international bankruptcy court that could organize a workout. Yet stories of creditors suing defaulting countries abound, most notoriously Argentina @RobinWigg @ElaineDMoore https://www.ft.com/content/90dc38fa-2412-11e6-aa98-db1e01fabc0c 2/6

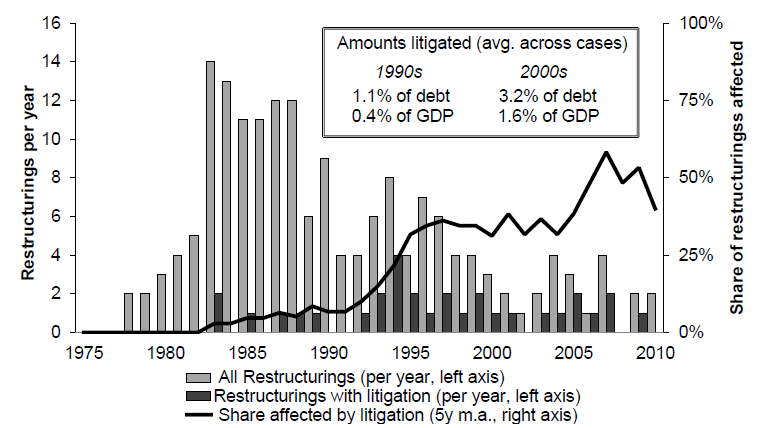

In our paper, we show that these cases are more than idiosyncratic events by disgruntled investors. They've become a standard element of sovereign debt crises, so much so that since the early 2000s, on average one in two defaulting countries has been challenged in court (3/6)

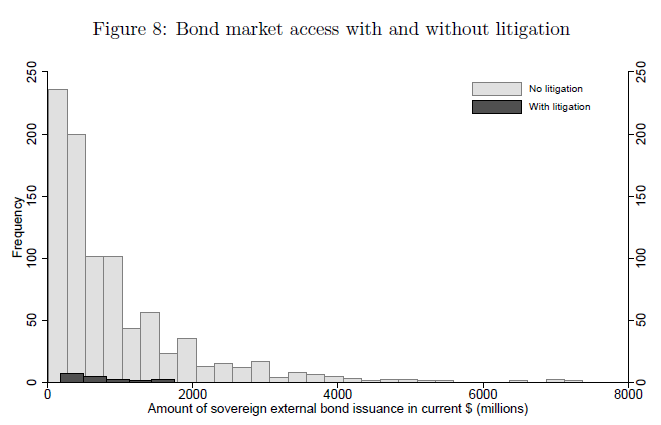

More important than raw numbers is that creditor litigation has economic consequences for the country. A pending lawsuit means that it is virtually impossible for govts to return to international capital markets, even after controlling for general "reputational" effects. (4/6)

Is this a bad thing? Not necessarily - perhaps the threat of litigation discourages countries from defaulting too easily in the first place. But there is a risk that the pendulum has swung too far, in some cases unnecessarily delaying the inevitable (5/6). https://www.ft.com/content/55ebfe26-a665-11e6-8b69-02899e8bd9d1

That's why the @IMFNews's recent push to reform the international sovereign debt architecture further is welcome - with the goal to allow a smooth restructuring process if governments and creditors can agree on commonly acceptable terms (6/6) https://blogs.imf.org/2020/10/01/reform-of-the-international-debt-architecture-is-urgently-needed/

Read on Twitter

Read on Twitter