1) There are several secrets to becoming a successful #investor and most are hiding in plain sight.

2) This many sound like a cliché, but it hides a simple truth: buy quality companies. When I started #investing, I didn't feel like I could identify quality, so I bought a subscription to @TheMotleyFool and let them do the heavy lifting.

3) I paid $199 per year each for @TheMotleyFool #StockAdvisor and #RuleBreakers subscriptions. They have paid for themselves MANY times over.

4) Another obvious strategy that FAR too many #investors ignore is that "winners keep winning." "That one got away from me, and now I'm waiting for a pullback" has probably lost investors more money than every pullback combined.

5) To put this into practice, I look at the recent list of @TheMotleyFool recommendations and see which #stocks have put up double- or triple-digits gains in recent months and then try to understand why. In many cases, I end up buying the stock, even after 30% 40% 50% gains.

6) I also look at my own portfolio to see what stocks have jumped while I wasn't looking and see what's driving the gains. If I still believe in the #stock enough to own it, I usually believe in it enough to add to a winning position.

7) This isn't just hypothetical. About 3 year ago, I had to open a new SEP retirement account and wanted to populate it with recent winners. I used exactly the process outlined above to look for #stocks to buy. My first investment was on 2-23-18.

8) That portfolio currently holds 25 #stocks: $ALGN $ANET $APPN $AYX $CVNA $DOCU $GH $HUBS $IQ $JD $MDB $MGNI $MTCH $NVDA $ODFL $OKTA $PINS $ROKU $SFIX $TCEHY $TDOC $TTD $TWLO $WWE $ZS

9) I have added to several of those #stocks multiple times as they went up -- adding to my winners: $TTD $ROKU $MDB $TDOC (3 positions each) $APPN $DOCU $NVDA (2 positions each).

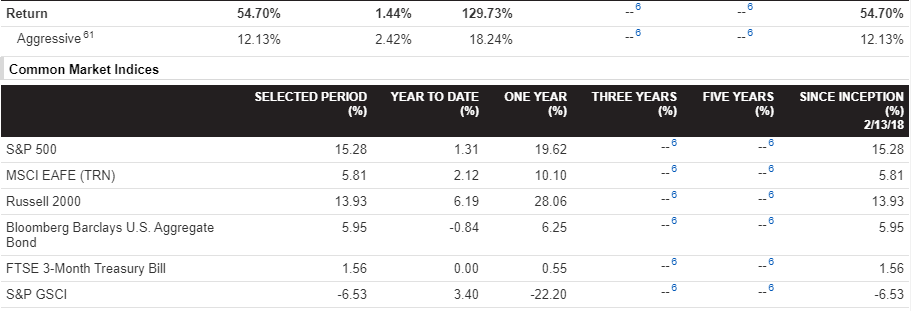

10) The value of the stocks in that portfolio has more than tripled in in less than three years, with an annualized return of 54%. It also posted 123% gains last year alone.

11) Here's the image from my brokerage detailing this portfolio's returns vs the market and various benchmarks.

12) This isn't to say it works all the time with every stock (I'm looking at you $ANET $IQ $WWE). It also isn't because I'm a great investor. I have been extremely fortunate, in that I followed @DavidGFool's #RuleBreaking advice early in my investing career.

13) I add to my winners. I almost NEVER consider valuation when I am initially evaluating a stock -- I've seen too many people avoid stocks that ran for years because they were "too expensive." I rarely trim a "winning" position and almost never "buy the dip."

14) Exception to "buying the dip." If I have followed a stock extensively, and believe the market is overreacting to a bit of news, I will buy the dip. Recent example $FSLY. TikTok represented just 11% of revenue, but following news of a potential ban, $FSLY lost half its value.

15) Exception No. 2 to buying the dip. In a correction or recession, investors typically "throw out the baby with the bathwater" selling both good stocks and bad. The end of March was an excellent time to buy stocks. I did.

16) Finally, and perhaps most importantly, remember that time is on your side. Sometimes stocks take years to find their stride. I bought $TSLA in 2013. It was a successful investment, but you could still buy shares for less than $50 in Oct. 2019. Recently trading for $880.

17) A stock can only ever go DOWN 100%. A big winner, however, can grow multiple times its original value over the years. MOST of the time, the best thing to do when a stock isn't performing (over the short-term) is -- nothing.

Read on Twitter

Read on Twitter