BREAKING: A coalition of 15 institutional investors representing $2.4 trillion in assets & 117 individual investors, coordinated by @ShareAction, have filed a climate resolution at Europe's second largest fossil fuel financier @HSBC

A thread

A thread

The institutional co-filing group includes Europe's largest asset manager & top 25 shareholder in HSBC @Amundi_FR, the world's largest publicly listed hedge fund @ManGroup, & leading asset owners & managers from Denmark, France, Sweden & the UK

Full list below

Full list below

The resolution asks HSBC to reduce its exposure to fossil fuel assets on a timeline aligned w the Paris goals

It also asks HSBC to act in line w the #JustTransition & not rely excessively on Negative Emissions Technologies when devising its strategy https://shareaction.org/weve-filed-a-climate-resolution-at-hsbc-heres-why/

It also asks HSBC to act in line w the #JustTransition & not rely excessively on Negative Emissions Technologies when devising its strategy https://shareaction.org/weve-filed-a-climate-resolution-at-hsbc-heres-why/

Why HSBC?

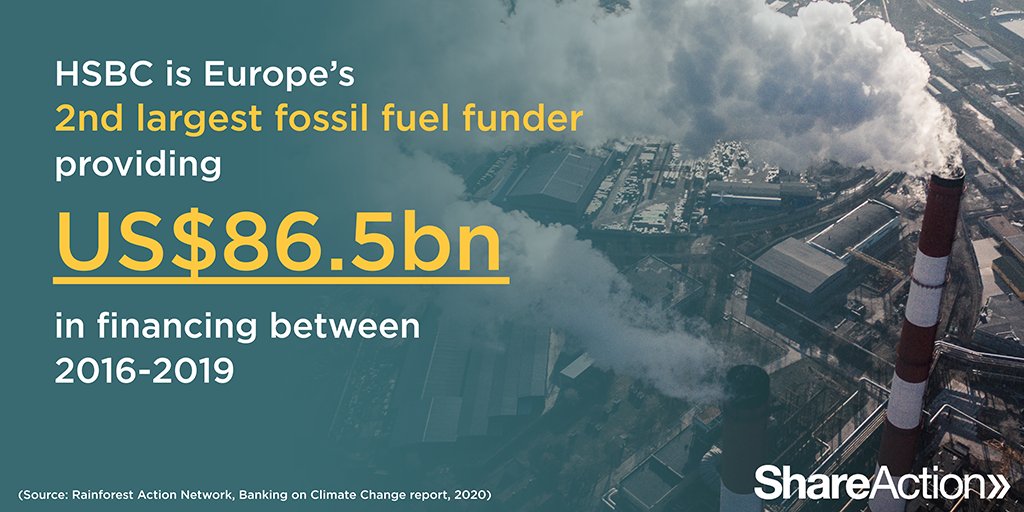

It's Europe's 2nd largest fossil fuel financier, after @Barclays, according to @RAN

Since the signing of the Paris agreement, it provided $86.5bn to the fossil fuel sector

Its financial support to coal power companies was 3.5 times higher in 2019 than it was in 2016

It's Europe's 2nd largest fossil fuel financier, after @Barclays, according to @RAN

Since the signing of the Paris agreement, it provided $86.5bn to the fossil fuel sector

Its financial support to coal power companies was 3.5 times higher in 2019 than it was in 2016

It is also the culmination of a 4-year engagement process with the bank

In March 2019 a letter backed by investors with $1trn in assets such as @Schroders & @EOSFedHermes asked HSBC to strengthen its coal policy

HSBC only complied with 1 of 3 asks https://shareaction.org/investors-hold-hsbcs-feet-to-the-fire-on-coal/

In March 2019 a letter backed by investors with $1trn in assets such as @Schroders & @EOSFedHermes asked HSBC to strengthen its coal policy

HSBC only complied with 1 of 3 asks https://shareaction.org/investors-hold-hsbcs-feet-to-the-fire-on-coal/

The resolution also comes after HSBC's announcement to be a #netzero bank by 2050 at the latest

@ShareAction published an analysis of HSBC's ambition when it came out

In a nutshell: it lacked details & the bank remained silent on fossil fuels... https://shareaction.org/resources/a-detailed-analysis-of-hsbcs-net-zero-ambition/

@ShareAction published an analysis of HSBC's ambition when it came out

In a nutshell: it lacked details & the bank remained silent on fossil fuels... https://shareaction.org/resources/a-detailed-analysis-of-hsbcs-net-zero-ambition/

Furthermore, in the 4 months leading up to the announcement, HSBC provided $1.8bn to fossil fuel companies, including some working to expand the coal & oil sands industry.

These findings further cast doubt on the company's commitment to net zero. https://www.ft.com/content/9063f7c0-574c-4d82-825f-44e00add2818

These findings further cast doubt on the company's commitment to net zero. https://www.ft.com/content/9063f7c0-574c-4d82-825f-44e00add2818

The lack of mention of fossil fuels is problematic because, in the words of @sarasinpartners, a filer of the resolution: "In the end, increasing financing for green activities only gets us halfway; the Board must be clear on its intent to withdraw financing of harmful emissions"

. @ColinBaines1 at @FProvFoundation, a filer of the resolution agrees. He said: "HSBC’s ambition for net-zero emissions by 2050 means little without a transition plan to get there, including a timetable to exit fossil fuel finance that is aligned with the climate science."

Indeed.

“Without a credible transition plan, the net-zero ambition isn’t a new and improved recipe for the bank, it’s just new packaging," said @Price_RI at @BrunelPP, another filer of the resolution https://bloom.bg/3hXRsaF

“Without a credible transition plan, the net-zero ambition isn’t a new and improved recipe for the bank, it’s just new packaging," said @Price_RI at @BrunelPP, another filer of the resolution https://bloom.bg/3hXRsaF

This resolutions makes it clear that net zero ambitions by top fossil fuel financiers are simply not credible if they fail to be backed up by fossil fuel phase out plans

Any fossil fuel bank considering announcing a net zero ambition should take note https://bit.ly/3s6gjxD

Any fossil fuel bank considering announcing a net zero ambition should take note https://bit.ly/3s6gjxD

Institutional investors are not the only ones being dissatisfied with the bank's financing of the fossil fuel industry - including coal, oil and Arctic oil and gas.

Its own customers have started expressing discontent at the bank's lack of progress too.

#HSBCResolution

Its own customers have started expressing discontent at the bank's lack of progress too.

#HSBCResolution

In the lead up to the much awaited #COP26, this resolution presents a unique opportunity to show leadership on coal & other fossil fuels.

We are urging @HSBC's board to back the resolution - and investors to vote for it too.

[End of thread]

We are urging @HSBC's board to back the resolution - and investors to vote for it too.

[End of thread]

Read on Twitter

Read on Twitter

![In the lead up to the much awaited #COP26, this resolution presents a unique opportunity to show leadership on coal & other fossil fuels.We are urging @HSBC's board to back the resolution - and investors to vote for it too.[End of thread] In the lead up to the much awaited #COP26, this resolution presents a unique opportunity to show leadership on coal & other fossil fuels.We are urging @HSBC's board to back the resolution - and investors to vote for it too.[End of thread]](https://pbs.twimg.com/media/ErYuqKhXcAAUyiY.jpg)