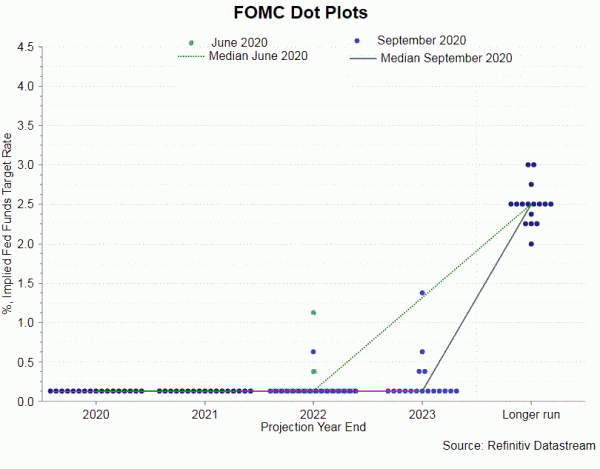

Long term rates cannot rise until the Fed keeps the "zero rates until 2023" language: see the Fed "dot plot" rate graph - which in 2020 they have shifted into the future due to Covid.

I.e. TSLA valuation out to 2023 won't be impacted much even by an uptick in inflation.

1/ https://twitter.com/garyblack00/status/1348306563635818502

I.e. TSLA valuation out to 2023 won't be impacted much even by an uptick in inflation.

1/ https://twitter.com/garyblack00/status/1348306563635818502

2/

Vaccinations aren't expected to be complete by September-ish, and the Covid shock will take a few quarters to wear off.

I.e. IMO it will take at least 2 quarters of robust macro data for the Fed to change their language. We are far from robust data today, with Covid raging.

Vaccinations aren't expected to be complete by September-ish, and the Covid shock will take a few quarters to wear off.

I.e. IMO it will take at least 2 quarters of robust macro data for the Fed to change their language. We are far from robust data today, with Covid raging.

3/

TSLA valuations up to 2024-2025 might be impacted more by growth data - but few Wall Street analysts use them, as they result in too high TSLA price targets.

Personally I think the realization of Tesla robotaxi revenue will happen earlier than any Fed tightening messages.

TSLA valuations up to 2024-2025 might be impacted more by growth data - but few Wall Street analysts use them, as they result in too high TSLA price targets.

Personally I think the realization of Tesla robotaxi revenue will happen earlier than any Fed tightening messages.

4/

An uptick in inflation would be "happy news", it would coincide with a roaring bull market and soaring consumer confidence - the best environment for Tesla to achieve record growth.

This reality of observed Tesla growth could counter any longer term inflation worries.

An uptick in inflation would be "happy news", it would coincide with a roaring bull market and soaring consumer confidence - the best environment for Tesla to achieve record growth.

This reality of observed Tesla growth could counter any longer term inflation worries.

5/

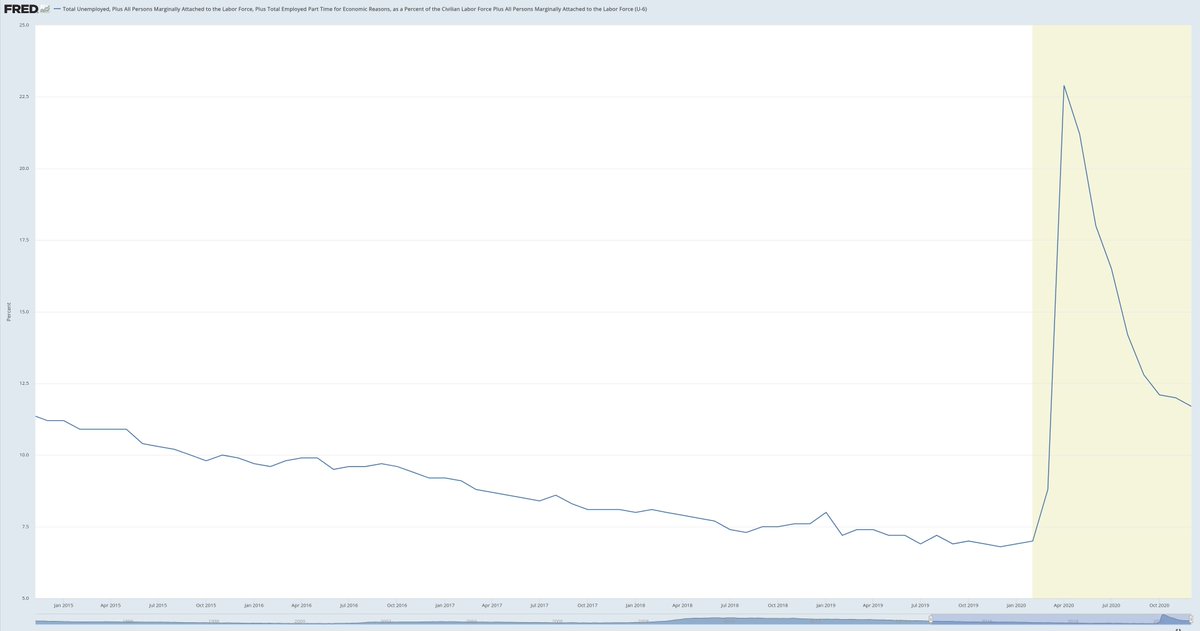

With current unemployment figures there's near zero chance for inflation to tick up within the next 2 quarters that would worry the Fed.

(But there's the tail risk of the Fed playing politics - most Fed governors are Republican appointed.)

With current unemployment figures there's near zero chance for inflation to tick up within the next 2 quarters that would worry the Fed.

(But there's the tail risk of the Fed playing politics - most Fed governors are Republican appointed.)

6/

The Fed has a "dual mandate", i.e. they have to watch over unemployment 𝐚𝐧𝐝 inflation.

An uptick in inflation 𝐚𝐧𝐝 return to pre-Covid normalcy in the employment market would be required for the Fed to become more hawkish (higher rates).

Neither are fast processes.

The Fed has a "dual mandate", i.e. they have to watch over unemployment 𝐚𝐧𝐝 inflation.

An uptick in inflation 𝐚𝐧𝐝 return to pre-Covid normalcy in the employment market would be required for the Fed to become more hawkish (higher rates).

Neither are fast processes.

7/

Finally, an important factor: an uptick in inflation would necessarily and directly weaken the US dollar - but this is advantageous to Tesla, who are paying almost all of their (manufacturing) expenses on an USD basis, but around half of their income is in other currencies.

Finally, an important factor: an uptick in inflation would necessarily and directly weaken the US dollar - but this is advantageous to Tesla, who are paying almost all of their (manufacturing) expenses on an USD basis, but around half of their income is in other currencies.

8/

𝐓𝐋;𝐃𝐑:

Stimulus program inflation worries will be countered by:

These are slow processes that take time,

These are slow processes that take time,

Fed dual mandate means employment has to recover too,

Fed dual mandate means employment has to recover too,

weaker USD increases Tesla EPS,

weaker USD increases Tesla EPS,

the "New Roaring Twenties" benefit Tesla sales & valuation first.

the "New Roaring Twenties" benefit Tesla sales & valuation first.

𝐓𝐋;𝐃𝐑:

Stimulus program inflation worries will be countered by:

These are slow processes that take time,

These are slow processes that take time, Fed dual mandate means employment has to recover too,

Fed dual mandate means employment has to recover too, weaker USD increases Tesla EPS,

weaker USD increases Tesla EPS, the "New Roaring Twenties" benefit Tesla sales & valuation first.

the "New Roaring Twenties" benefit Tesla sales & valuation first.

Read on Twitter

Read on Twitter