on where #Bitcoin

on where #Bitcoin  is valued in this market cycle based on a number of valuation metrics and charts below.

is valued in this market cycle based on a number of valuation metrics and charts below.TLDR: Although short term we may be a little overheated, we are far from a real market top in this cycle based on the metrics below.

1/ The Puell multiple created by @kenoshaking works by dividing the daily issuance value of bitcoins by the 365-day moving average of daily issuance value. Miners are natural sellers of #Bitcoin  and this metric helps gauge market cycles from the miners perspective.

and this metric helps gauge market cycles from the miners perspective.

and this metric helps gauge market cycles from the miners perspective.

and this metric helps gauge market cycles from the miners perspective.

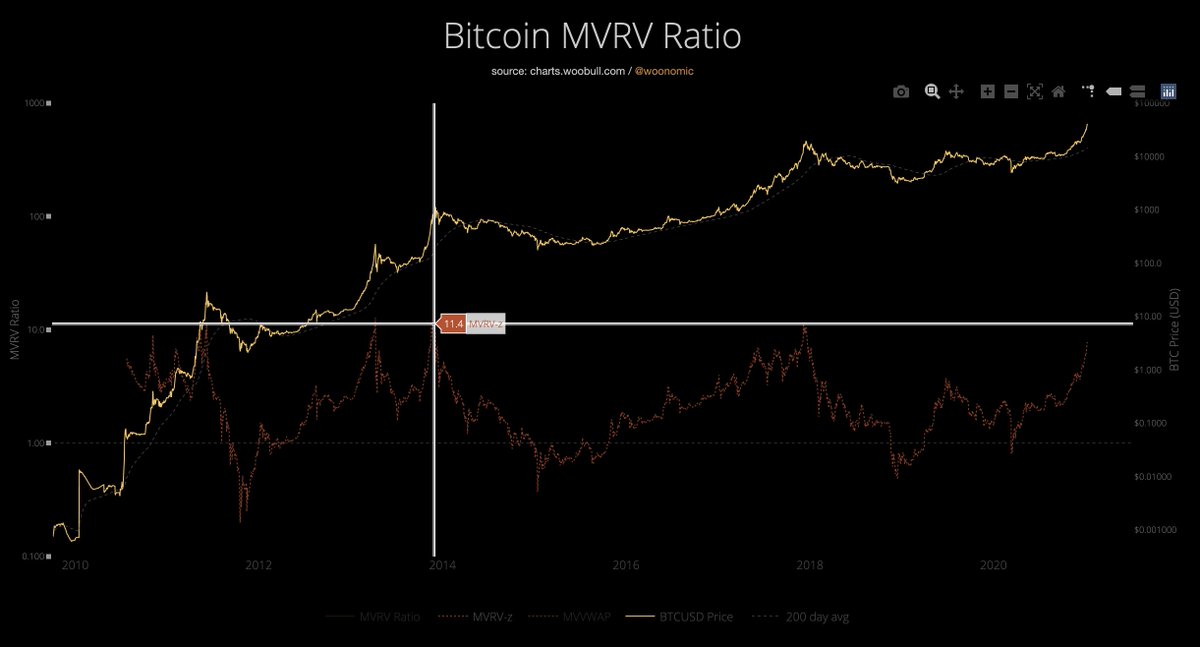

2/ The #Bitcoin  MVRV Z-Score as seen below @glassnode and @woonomic provides a barometer for understanding whether Bitcoin is under or over valued in relation to its 'fair value'. As can be seen, a value of c.11 has coincided with market tops previously.

MVRV Z-Score as seen below @glassnode and @woonomic provides a barometer for understanding whether Bitcoin is under or over valued in relation to its 'fair value'. As can be seen, a value of c.11 has coincided with market tops previously.

MVRV Z-Score as seen below @glassnode and @woonomic provides a barometer for understanding whether Bitcoin is under or over valued in relation to its 'fair value'. As can be seen, a value of c.11 has coincided with market tops previously.

MVRV Z-Score as seen below @glassnode and @woonomic provides a barometer for understanding whether Bitcoin is under or over valued in relation to its 'fair value'. As can be seen, a value of c.11 has coincided with market tops previously.

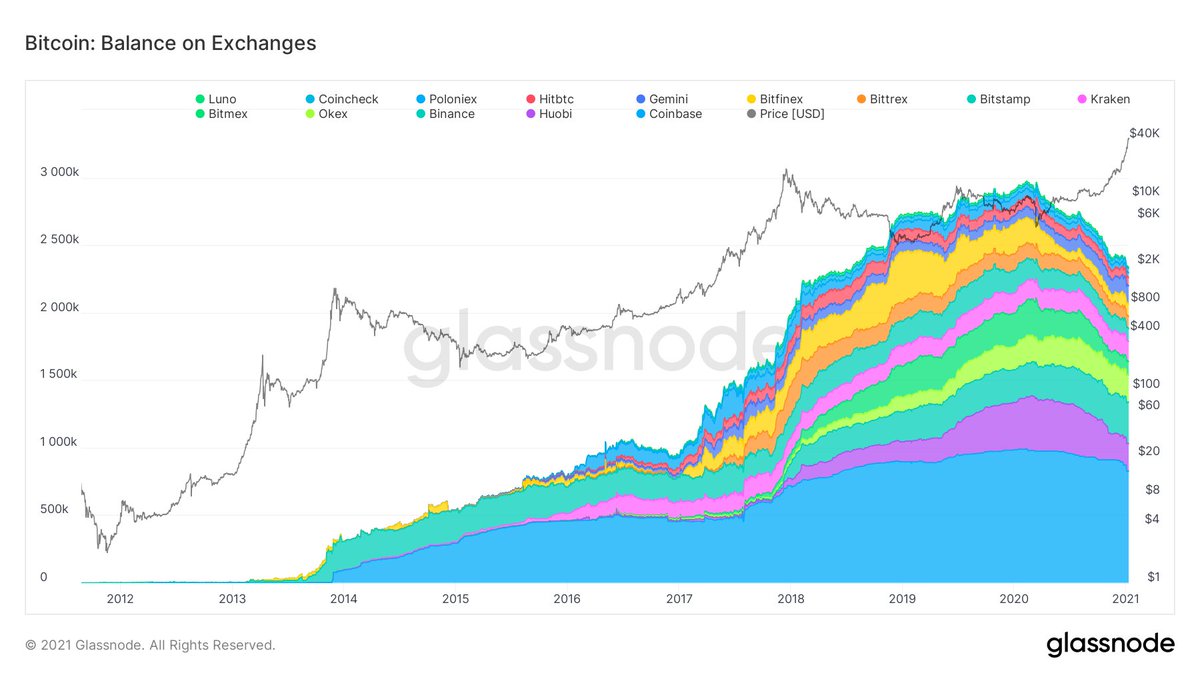

3/ #Bitcoin  continues to leave exchanges at a meaningful rate not seen before in previous cycles. This is interpreted as bullish as there is less sell pressure as Bitcoin moves off exchange and into cold storage.

continues to leave exchanges at a meaningful rate not seen before in previous cycles. This is interpreted as bullish as there is less sell pressure as Bitcoin moves off exchange and into cold storage.

continues to leave exchanges at a meaningful rate not seen before in previous cycles. This is interpreted as bullish as there is less sell pressure as Bitcoin moves off exchange and into cold storage.

continues to leave exchanges at a meaningful rate not seen before in previous cycles. This is interpreted as bullish as there is less sell pressure as Bitcoin moves off exchange and into cold storage.

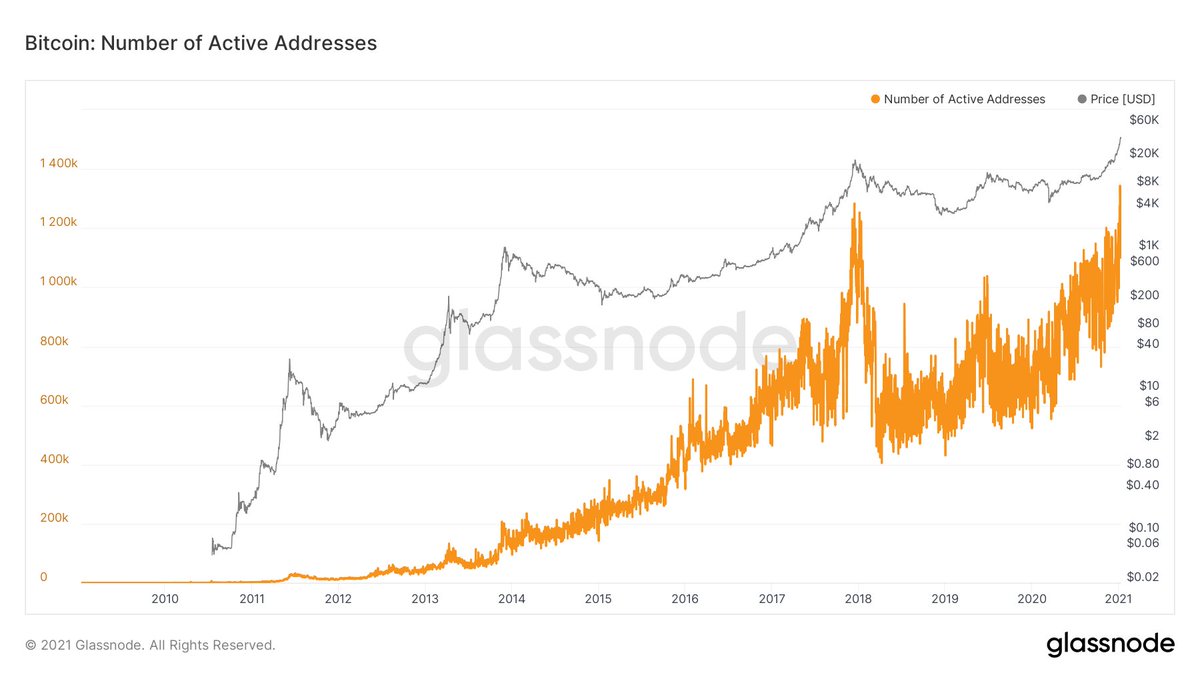

4/ More people now own bitcoin than ever before as the number of active and non-zero balance addresses reach record highs.

5/ Created by @PositiveCrypto the #Bitcoin  Realized HODL Ratio analyses Realized Value HODL waves that are made up of coins that moved in the past week versus Realized Value HODL waves made up of coins that last moved over a 1-2 year timeframe. Sell signals occur in the red area.

Realized HODL Ratio analyses Realized Value HODL waves that are made up of coins that moved in the past week versus Realized Value HODL waves made up of coins that last moved over a 1-2 year timeframe. Sell signals occur in the red area.

Realized HODL Ratio analyses Realized Value HODL waves that are made up of coins that moved in the past week versus Realized Value HODL waves made up of coins that last moved over a 1-2 year timeframe. Sell signals occur in the red area.

Realized HODL Ratio analyses Realized Value HODL waves that are made up of coins that moved in the past week versus Realized Value HODL waves made up of coins that last moved over a 1-2 year timeframe. Sell signals occur in the red area.

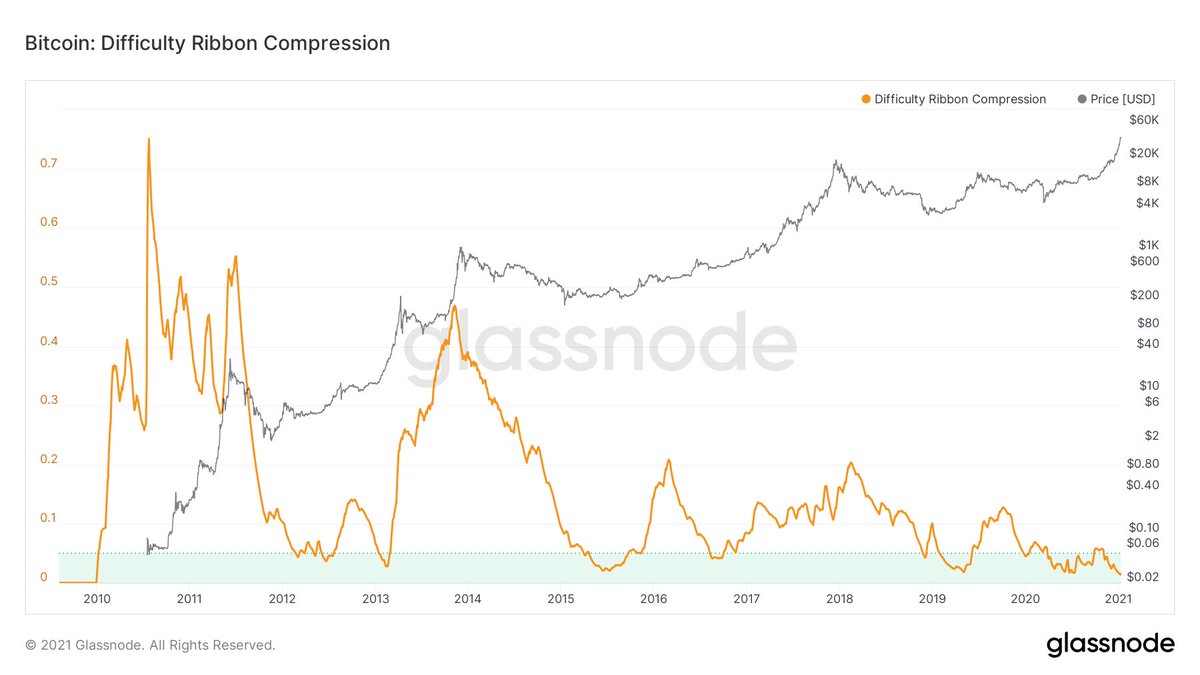

6/ #Bitcoin  Difficulty Ribbon Compression built on the work from @woonomic uses normalized standard deviation to find areas of high compression (light green area). This area has traditionally been a good spot to buy.

Difficulty Ribbon Compression built on the work from @woonomic uses normalized standard deviation to find areas of high compression (light green area). This area has traditionally been a good spot to buy.

Difficulty Ribbon Compression built on the work from @woonomic uses normalized standard deviation to find areas of high compression (light green area). This area has traditionally been a good spot to buy.

Difficulty Ribbon Compression built on the work from @woonomic uses normalized standard deviation to find areas of high compression (light green area). This area has traditionally been a good spot to buy.

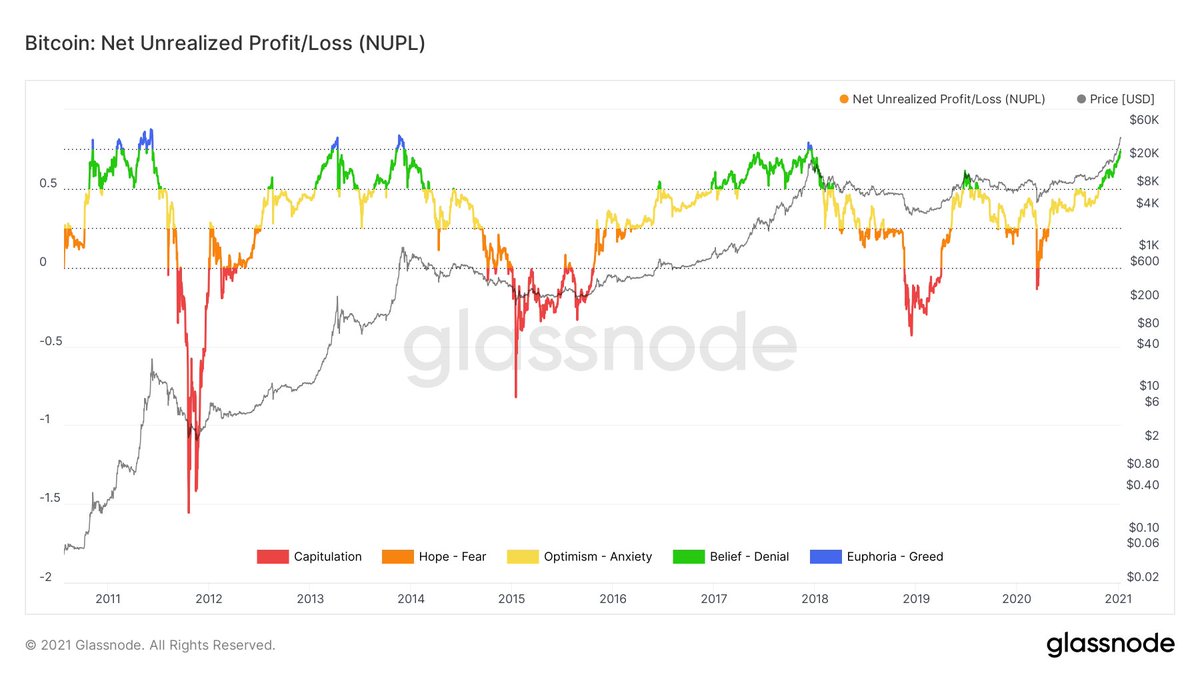

7/ The NUPL looks at the difference between Unrealized Profit and Unrealized Loss to determine whether the network as a whole is currently in a state of profit or loss. Tops generally occur >0.75.

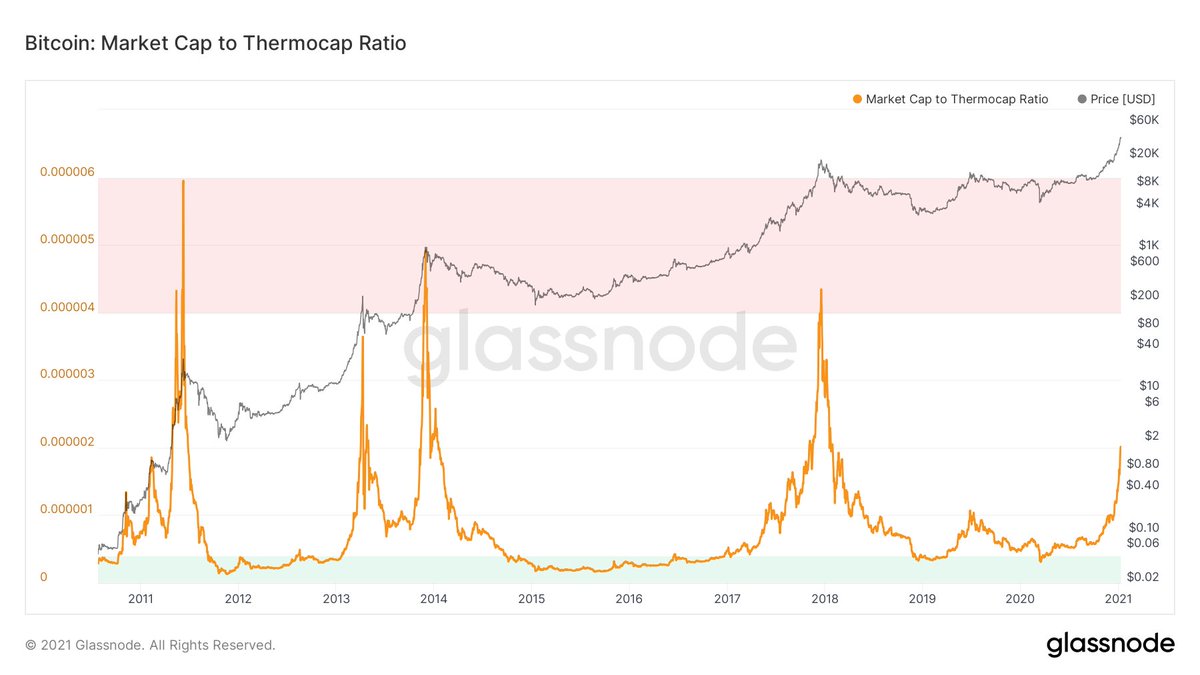

8/ The Market Cap to Thermocap Ratio can be used understand if the asset's price is currently trading at a premium with respect to total security spend by miners. A ratio in the area shaded red has previously provided a reliable top indicator.

9/ Created by @hansthered the #Bitcoin  Reserve Risk indicator is calculated by as: price/HODL Bank where HODL Bank is the opportunity cost of holding the asset. It gives us the ability to understand the confidence of long term hodlers. Areas shaded red flash warning signs

Reserve Risk indicator is calculated by as: price/HODL Bank where HODL Bank is the opportunity cost of holding the asset. It gives us the ability to understand the confidence of long term hodlers. Areas shaded red flash warning signs

Reserve Risk indicator is calculated by as: price/HODL Bank where HODL Bank is the opportunity cost of holding the asset. It gives us the ability to understand the confidence of long term hodlers. Areas shaded red flash warning signs

Reserve Risk indicator is calculated by as: price/HODL Bank where HODL Bank is the opportunity cost of holding the asset. It gives us the ability to understand the confidence of long term hodlers. Areas shaded red flash warning signs

10/ Thanks to @glassnode and everyone else mentioned in this thread @woonomic @kenoshaking @PositiveCrypto @hansthered for your wonderful work helping us all understand the #Bitcoin  ecosystem. If I've missed anyone out please tag them below!

ecosystem. If I've missed anyone out please tag them below!

Fin/

ecosystem. If I've missed anyone out please tag them below!

ecosystem. If I've missed anyone out please tag them below!Fin/

Read on Twitter

Read on Twitter