Isaac Newton: A brilliant scientist, a terrible investor

How Issac Newton lost $4 million due to the first stock market bubble in history and insider trading

/THREAD/

How Issac Newton lost $4 million due to the first stock market bubble in history and insider trading

/THREAD/

1/ Sir Isaac Newton is considered one of the most influential scientists of all time and a key figure in the scientific revolution.

He was a mathematician, physicist, astronomer, theologian, and author.

He was a mathematician, physicist, astronomer, theologian, and author.

2/ The most prominent part of his work was the formulation of the laws of motion and the law of gravity.

However, his most prominent failure was losing an entire fortune in the first stock market bubble in history, the South Sea Company in 1720.

However, his most prominent failure was losing an entire fortune in the first stock market bubble in history, the South Sea Company in 1720.

3/ Newton was usually a cautious investor.

Before 1720 most of his investments were in safe and reliable securities, various government bonds that delivered a regular stream of income, and shares in a few of the larger companies on the exchange, including South Sea Co.

Before 1720 most of his investments were in safe and reliable securities, various government bonds that delivered a regular stream of income, and shares in a few of the larger companies on the exchange, including South Sea Co.

4/ Newton began in 1720 with stocks and bonds worth approximately £32,000 (close to $6-million in current U.S. dollars).

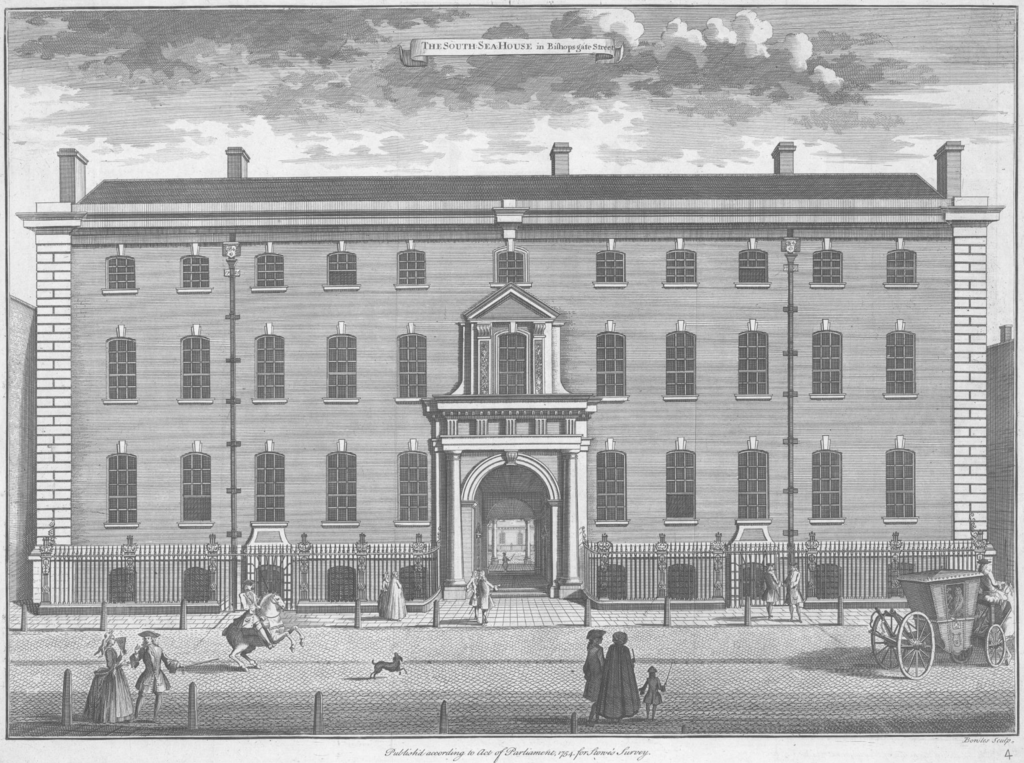

5/ South Sea Co., set up in 1711 to restructure the British government’s debt, was a vehicle for converting government debt into equity.

Government bondholders were given the option to exchange their securities into South Sea Co. shares.

Government bondholders were given the option to exchange their securities into South Sea Co. shares.

6/ Dividends were paid on the stock at a lower rate than interest on bonds.

However, the potential for dividend increases and sizable capital gains was created when Parliament gave the company a monopoly on trade with Spain’s colonies in South America.

However, the potential for dividend increases and sizable capital gains was created when Parliament gave the company a monopoly on trade with Spain’s colonies in South America.

7/ In June 1720, the British Parliament passed the Bubble Act.

It required all companies that sold stock to the public to hold a royal charter aiming to control rampant speculation.

It required all companies that sold stock to the public to hold a royal charter aiming to control rampant speculation.

8/ However, the legislation had been introduced by the South Sea Company presumably as a means of controlling competition in a thriving market.

A well-bribed Parliament and ruling ministry accepted the idea in February, and the deal became official in April.

A well-bribed Parliament and ruling ministry accepted the idea in February, and the deal became official in April.

9/ Investors and gamblers swarmed London’s Exchange Alley, bidding up the stock to £315 on the first day new shares went on sale, 8% up on the day and more than double the price of shares in January.

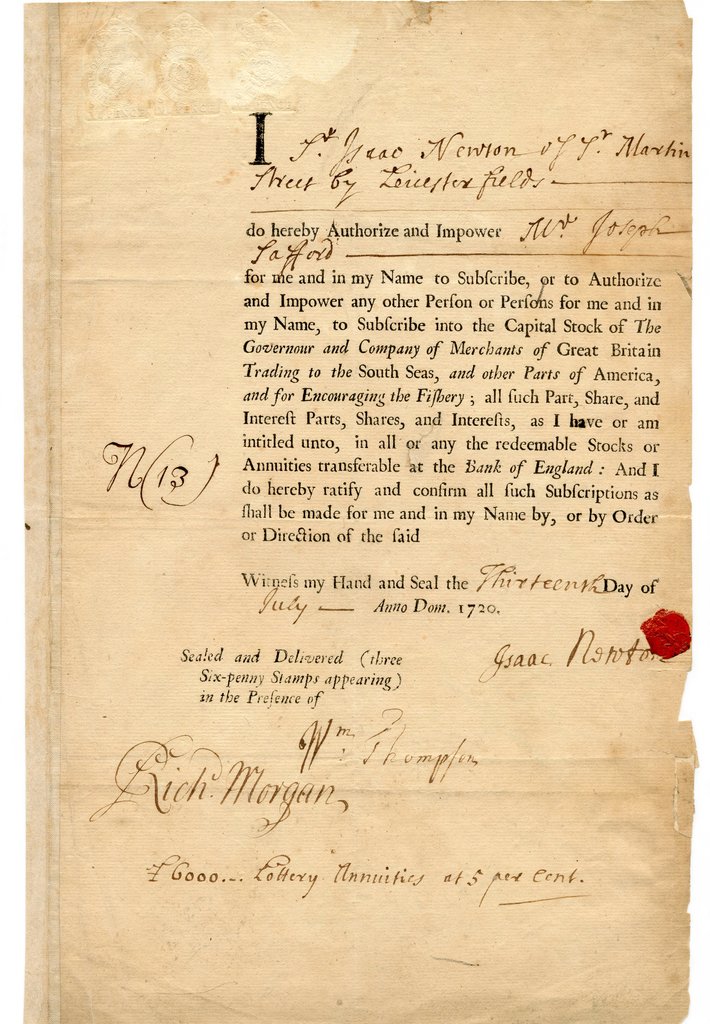

10/ Newton began buying the stock in 1712.

Over the next eight years, he picked up more shares, using his savings and the proceeds from selling his shares in other companies.

In 1720, he converted his government bonds and annuities into the stock.

Over the next eight years, he picked up more shares, using his savings and the proceeds from selling his shares in other companies.

In 1720, he converted his government bonds and annuities into the stock.

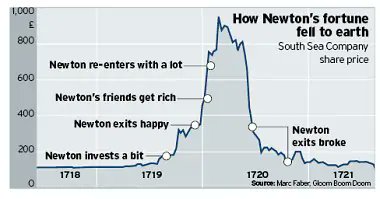

11/ The price of South Sea Co.’s stock shot up in 1720, from £128 in early January to £350 in April.

At this point, Newton unloaded most of his shares for a profit of more than £20,000 equal to 200 years of his former annual salary as a professor at the University of Cambridge.

At this point, Newton unloaded most of his shares for a profit of more than £20,000 equal to 200 years of his former annual salary as a professor at the University of Cambridge.

12/ The stock price skyrocketed due to the trading monopoly the company had.

This was amplified by the hundreds of newspapers in London posting glowing articles from esteemed authors, along with rumors about South American commodities that would be imported back to Europe.

This was amplified by the hundreds of newspapers in London posting glowing articles from esteemed authors, along with rumors about South American commodities that would be imported back to Europe.

13/ The top South Sea leaders did all they could to pump the stock, lending money to fund purchases, secret share buybacks, the aggressive use of an early form of derivatives, and more.

The stock was also made easier to buy through installment plans with 10% downpayments.

The stock was also made easier to buy through installment plans with 10% downpayments.

14/ The stock kept soaring.

With England in a euphoric mood, watching from the sidelines was hard to do.

By mid-June, Newton could no longer stand the thought of the money he’d “lost” by selling too soon and began to buy back in.

With England in a euphoric mood, watching from the sidelines was hard to do.

By mid-June, Newton could no longer stand the thought of the money he’d “lost” by selling too soon and began to buy back in.

15/ Shortly after, the price hit £800, making the company worth twice the value of all the land in England.

By mid-August, he was paying £700 to £1,000 a share, more than double the price he’d sold in April.

By mid-August, he was paying £700 to £1,000 a share, more than double the price he’d sold in April.

16/ But the share price could only be increased so far above the company’s fundamental value.

In the summer, news broke that insiders were selling.

The stock began to tumble and within a few weeks, plunged back to the £200 level.

So ended the infamous South Sea Bubble.

In the summer, news broke that insiders were selling.

The stock began to tumble and within a few weeks, plunged back to the £200 level.

So ended the infamous South Sea Bubble.

17/ The South Sea Co. remained in business, but its shares never did regain their glory before Newton died in 1727.

Newton’s losses were catastrophic, likely £20,000, the equivalent of $4 million today.

Newton’s losses were catastrophic, likely £20,000, the equivalent of $4 million today.

18/ That year was the first time “bubble” was used in reference to publicly traded companies.

1720 was sometimes referred to as the “Bubble Year”

1720 was sometimes referred to as the “Bubble Year”

19/ The South Sea Bubble is alleged to have prompted Newton to exclaim: “I can calculate the motion of the heavenly bodies, but not the madness of people.”

He allegedly forbade everyone from uttering the words "South Sea" in his presence.

/END/

He allegedly forbade everyone from uttering the words "South Sea" in his presence.

/END/

If you liked this thread, give a like and a retweet

https://twitter.com/itsKostasWithK/status/1348300629064749062?s=20

https://twitter.com/itsKostasWithK/status/1348300629064749062?s=20

https://twitter.com/itsKostasWithK/status/1348300629064749062?s=20

https://twitter.com/itsKostasWithK/status/1348300629064749062?s=20

For more educational threads on financial independence and investing for beginners see below for a collection of threads

https://twitter.com/itsKostasWithK/status/1345790210441928708?s=20

https://twitter.com/itsKostasWithK/status/1345790210441928708?s=20

https://twitter.com/itsKostasWithK/status/1345790210441928708?s=20

https://twitter.com/itsKostasWithK/status/1345790210441928708?s=20

I hope you find my content on finance and investing for F.I.R.E. insightful and valuable

Feel free to support my efforts on financial education by buying me a slice of pizza here

here  https://www.buymeacoffee.com/ItsKostasOnFIRE

https://www.buymeacoffee.com/ItsKostasOnFIRE

Feel free to support my efforts on financial education by buying me a slice of pizza

here

here  https://www.buymeacoffee.com/ItsKostasOnFIRE

https://www.buymeacoffee.com/ItsKostasOnFIRE

Read on Twitter

Read on Twitter