Here we go. $BL Deep Dive

Blackline is an automatic accounting company whose mission is to improve the efficiency of accounting and financial processes. They focus on the menial tasks that normally require lots of time. Blackline focuses on automating those tasks to save time.

Blackline is an automatic accounting company whose mission is to improve the efficiency of accounting and financial processes. They focus on the menial tasks that normally require lots of time. Blackline focuses on automating those tasks to save time.

Blackline is an automatic accounting company whose mission is to improve the efficiency of accounting and financial processes. They focus on the menial tasks that normally require lots of time. Blackline focuses on automating those tasks to save time.

Blackline is an automatic accounting company whose mission is to improve the efficiency of accounting and financial processes. They focus on the menial tasks that normally require lots of time. Blackline focuses on automating those tasks to save time.

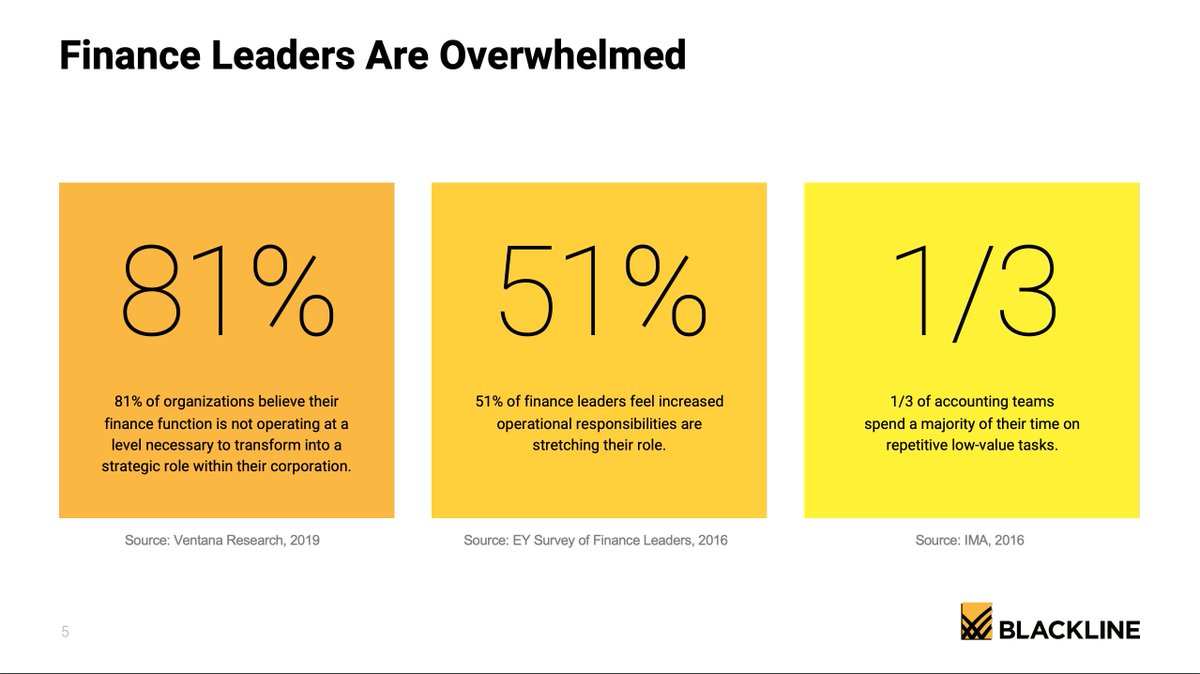

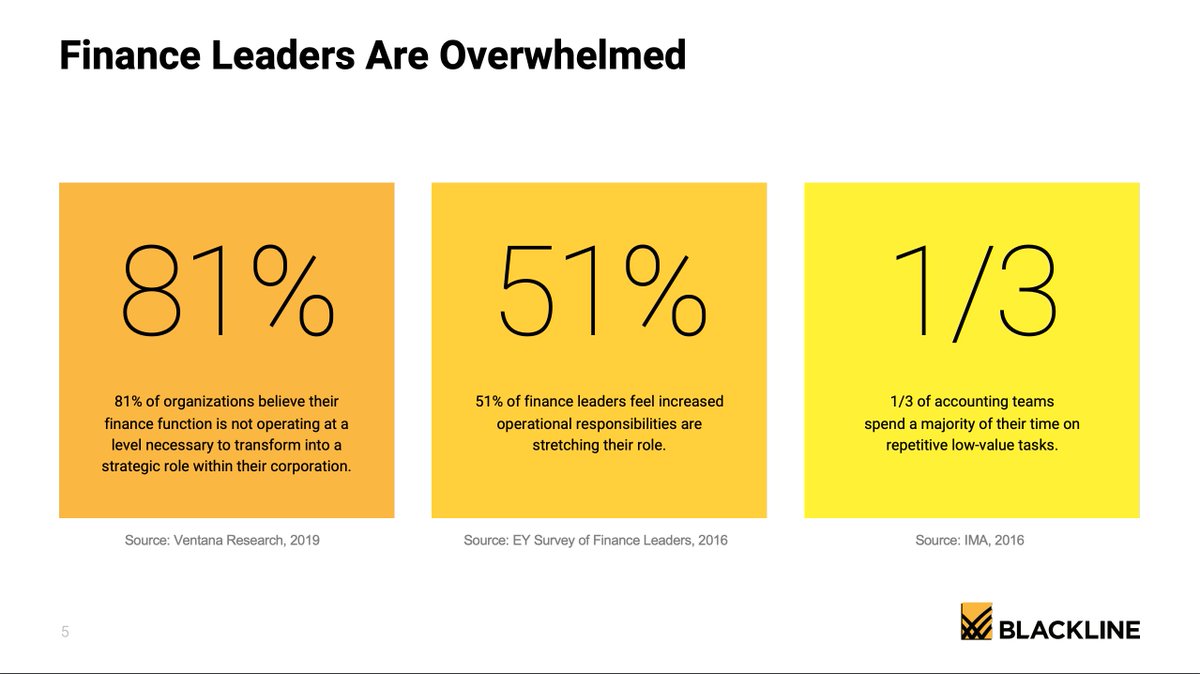

They appeal to companies who believe that their accounting system is not as efficient as it could be. Blackline claims that 81% of companies believe this. They also claim that ⅓ of accounting teams spend the majority of their time on menial tasks.

They appeal to companies who believe that their accounting system is not as efficient as it could be. Blackline claims that 81% of companies believe this. They also claim that ⅓ of accounting teams spend the majority of their time on menial tasks.

These tasks are the tasks that Blackline looks to automate with their software. A company would pay a subscription monthly payment and get these processes automated.

These tasks are the tasks that Blackline looks to automate with their software. A company would pay a subscription monthly payment and get these processes automated.

This company presents a perfect investment for me. In any company, saving time on menial tasks is absolutely crucial, especially in something as important as accounting. They have very little competition, and among their competition, they are the top dog.

This company presents a perfect investment for me. In any company, saving time on menial tasks is absolutely crucial, especially in something as important as accounting. They have very little competition, and among their competition, they are the top dog.

In my accounting classes in college, my professor says how most of these things we work on can be automated and that we are learning them to know the basics. I spend hours and hours on problems knowing that these processes can be automated! $BL can be huge imo.

In my accounting classes in college, my professor says how most of these things we work on can be automated and that we are learning them to know the basics. I spend hours and hours on problems knowing that these processes can be automated! $BL can be huge imo.

The website was very informative, with lots of visuals to help imagine their business easier. I’m an accounting student, so I found this somewhat interesting, but I think for anyone else, they made an automated accounting business as interesting as it could.

The website was very informative, with lots of visuals to help imagine their business easier. I’m an accounting student, so I found this somewhat interesting, but I think for anyone else, they made an automated accounting business as interesting as it could.

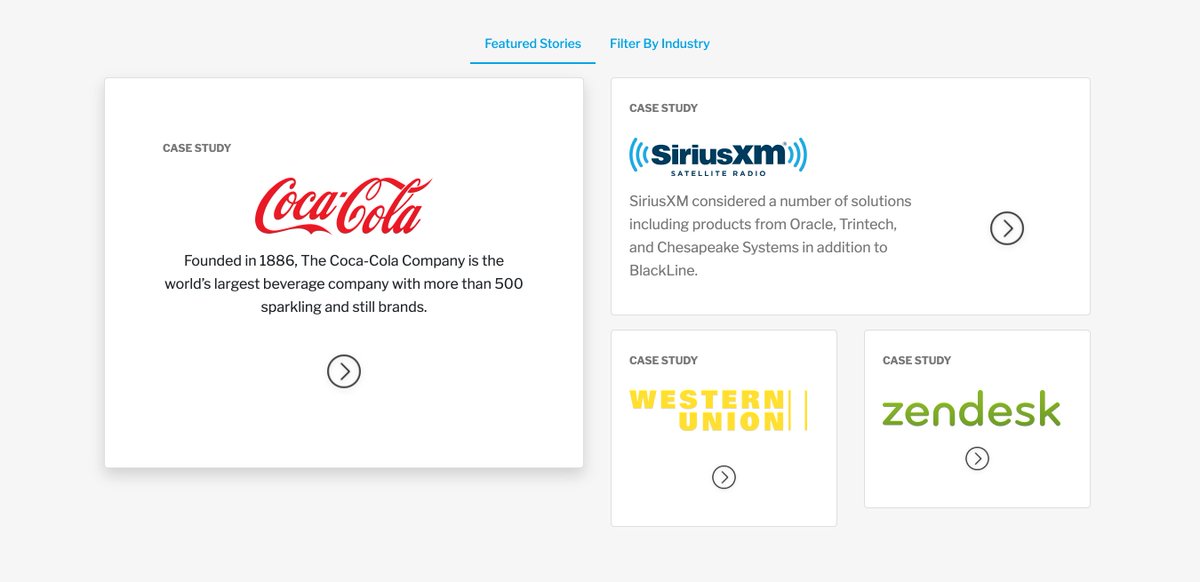

Another thing I enjoyed about their website was how proudly they displayed their customers. On just about every page they were offering to show you reviews, benefits, and how the customers enjoyed using Blackline. The fact that they were proud of this encouraged me greatly.

Another thing I enjoyed about their website was how proudly they displayed their customers. On just about every page they were offering to show you reviews, benefits, and how the customers enjoyed using Blackline. The fact that they were proud of this encouraged me greatly.

Also, their customers were very impressive. Here are some of the big names that stood out to me:

Also, their customers were very impressive. Here are some of the big names that stood out to me:$KO

$NKE

$HSY

$PEP

Gonzaga University

$EBAY

$ROKU

$DPZ

NASDAQ

$ADSK

Yet again, huge props to @chitchatmoney. Ian dropped some info that interested me. He talked abt trust in accounting companies.

Yet again, huge props to @chitchatmoney. Ian dropped some info that interested me. He talked abt trust in accounting companies. “It is something Blackline has been building over time and is important because the industry is the backbone of all these giant companies.”

The conference call had nothing too special, but the presentation that came with it was a treasure trove imo. Here are a few things I found great about their presentation:

The conference call had nothing too special, but the presentation that came with it was a treasure trove imo. Here are a few things I found great about their presentation:

They started their presentation by showing how big the problem they are trying to fix is. This is always a good sign to see for me. Not all companies show this and assume the viewer knows everything. Always good to show what they do imo.

They started their presentation by showing how big the problem they are trying to fix is. This is always a good sign to see for me. Not all companies show this and assume the viewer knows everything. Always good to show what they do imo.

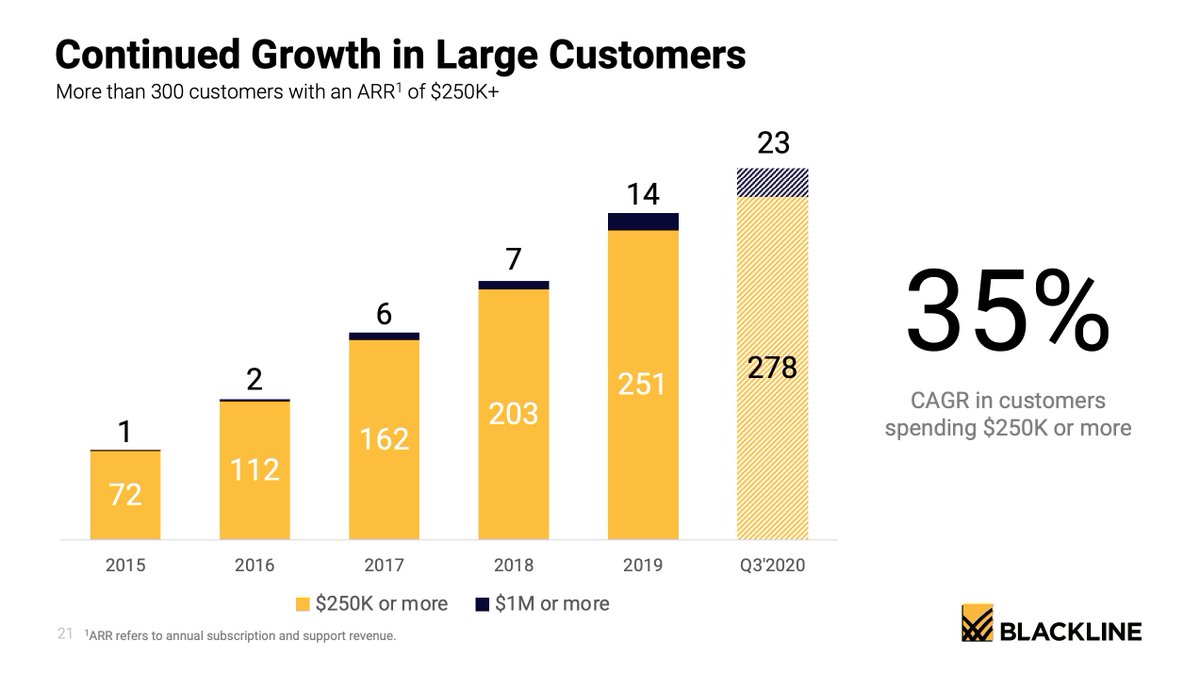

I love the growth they have their customers spending $250k or more, AND the customers spending $1m or more. They had 1 customer spending $1m or more in 2015, 7 in 2018, and now that number is estimated to more than triple.

I love the growth they have their customers spending $250k or more, AND the customers spending $1m or more. They had 1 customer spending $1m or more in 2015, 7 in 2018, and now that number is estimated to more than triple.

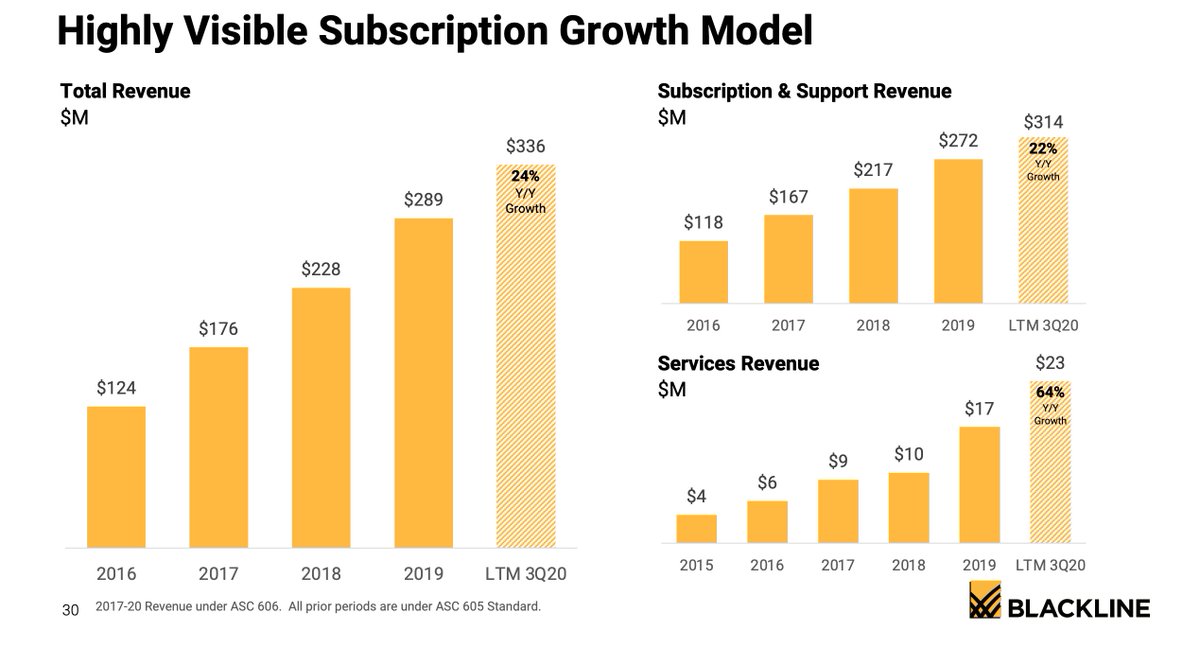

They start with a competitively priced subscription service (That grows 22% YoY), and customers often add additional services like Smart Close. Services Revenue increases YoY by 64%. This shows that their land rev. is growing, but also companies are buying more and expanding

They start with a competitively priced subscription service (That grows 22% YoY), and customers often add additional services like Smart Close. Services Revenue increases YoY by 64%. This shows that their land rev. is growing, but also companies are buying more and expanding

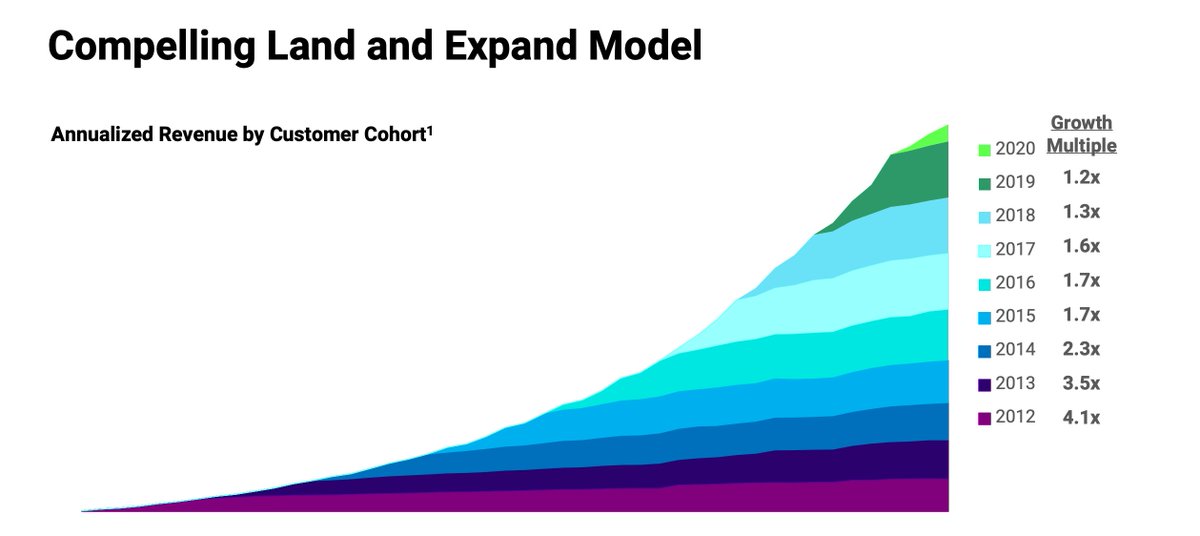

In the presentation, they added a graph that shows the multiples of spending that customers now spend versus what they initially spent when they became new customers. The numbers are staggering. Customers from 2014 spend over 4x what they spent when they became new customers.

In the presentation, they added a graph that shows the multiples of spending that customers now spend versus what they initially spent when they became new customers. The numbers are staggering. Customers from 2014 spend over 4x what they spent when they became new customers.

Revenue growth = 20%

Revenue growth = 20%Net Revenue Retention Rate = 108%

Gross Margins = 83%

FCF Margin = 10% and increasing

The only not-so-great metrics I saw were Cash/LTD ratio. They had large amounts of LTD due to convertible senior notes.

P/B TTM = 17 whereas the industry P/B TTM = 5

I already posted this, but I got a score of 20.5 for $BL on my checklist. This is a borderline buy right now on my checklist score, and the highest score I have gotten on my checklist. Very very impressive.

I already posted this, but I got a score of 20.5 for $BL on my checklist. This is a borderline buy right now on my checklist score, and the highest score I have gotten on my checklist. Very very impressive. Link Below

https://docs.google.com/spreadsheets/d/1_WA2Mp38AkfewIfohy2Y8jAxzrZul3CUArB-cwKyZz8/edit#gid=0

My bull thesis is this:

My bull thesis is this:Automated accounting is something that can help any company greatly. As a top dog in an emerging industry, with high retention and huge expansion potential, Blackline is poised for growth to become a household name for companies in their subscriptions

My bull thesis rides on a few things. It needs to keep both it’s retention rate up and their land and expand multiples. It also holds onto the fact that they find smaller companies and those companies expand. They need to grow in the smaller company market and make a footprint

My bull thesis rides on a few things. It needs to keep both it’s retention rate up and their land and expand multiples. It also holds onto the fact that they find smaller companies and those companies expand. They need to grow in the smaller company market and make a footprint

If they do not expand into the smaller company market, I worry that growth will slow. It is crucial that they do this. I worry about a part of Oracle’s business that competes with $BL. If $BL doesn’t grow in the small company market, $ORCL could step in and take market share.

If they do not expand into the smaller company market, I worry that growth will slow. It is crucial that they do this. I worry about a part of Oracle’s business that competes with $BL. If $BL doesn’t grow in the small company market, $ORCL could step in and take market share.

I worry less about $ORCL, however, since that is only a part of Oracle’s business. Blackline’s whole business is automated accounting and I am confident that they will fight harder to gain market share than Oracle will.

I worry less about $ORCL, however, since that is only a part of Oracle’s business. Blackline’s whole business is automated accounting and I am confident that they will fight harder to gain market share than Oracle will.

This company has become a high conviction stock for me over the past month since I have been looking at it. I believe the automation of menial tasks that consume lots of time in any sector is something that will become something great and amazingly popular in the finance world

This company has become a high conviction stock for me over the past month since I have been looking at it. I believe the automation of menial tasks that consume lots of time in any sector is something that will become something great and amazingly popular in the finance world

The high revenue growth and expansion in revenue from customers is something that amazes me. I cannot get over the 4x multiple in customer spending in such a short time period. This company is smaller, ($7b mcap) and I could easily see them become $50-$100b mcap.

The high revenue growth and expansion in revenue from customers is something that amazes me. I cannot get over the 4x multiple in customer spending in such a short time period. This company is smaller, ($7b mcap) and I could easily see them become $50-$100b mcap.

I am going to buy $BL within the next few weeks. I may watch it for a little longer, but I have become very highly convicted with $BL. One thing that would make me sell is if I see the retention rate or the expansion revenue decrease and failure to get into the small co. market

I am going to buy $BL within the next few weeks. I may watch it for a little longer, but I have become very highly convicted with $BL. One thing that would make me sell is if I see the retention rate or the expansion revenue decrease and failure to get into the small co. market

I would also like to thank @BrianFeroldi for introducing this to me. Without him, I may not have found this stock.

I would also like to thank @BrianFeroldi for introducing this to me. Without him, I may not have found this stock.

Read on Twitter

Read on Twitter