$ACEV & $THBR:

Both semi-conductor plays - but w/different businesses models & different parts of the tech supply chain.

Heres a short thread on the technical differences between these two. (1/x)

Both semi-conductor plays - but w/different businesses models & different parts of the tech supply chain.

Heres a short thread on the technical differences between these two. (1/x)

$ACEV makes field programmable gate arrays (FPGA). This is a similar business to Xilinix which was recently acquired by AMD.

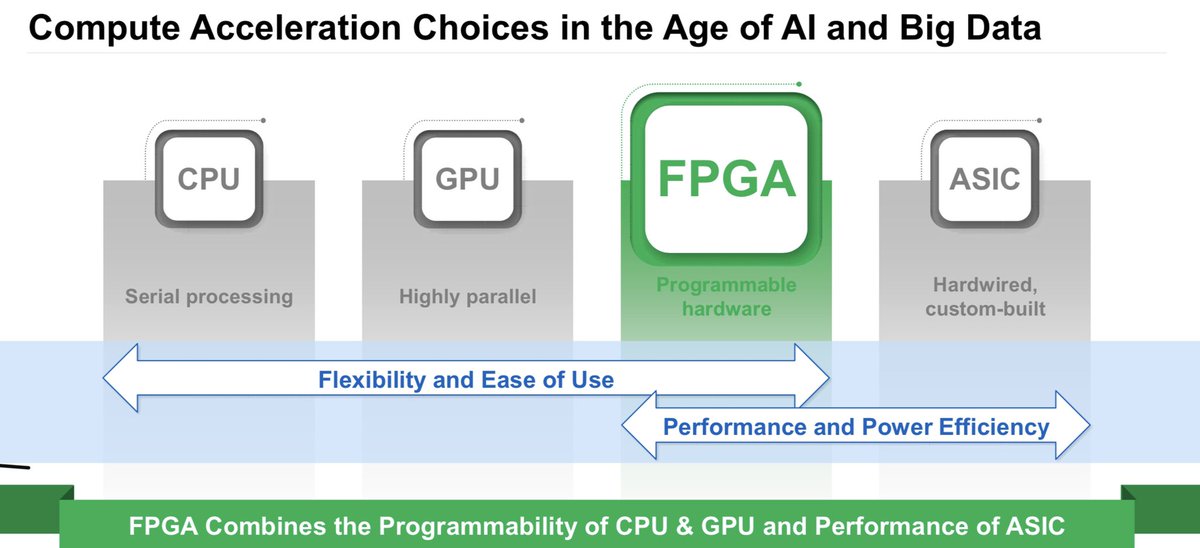

What are FPGAs? They are reconfigurable integrated circuits (ICs). You can think of your computers CPU as a very very generic IC.. (2/x)

What are FPGAs? They are reconfigurable integrated circuits (ICs). You can think of your computers CPU as a very very generic IC.. (2/x)

that can do a very large number of functions. But as a consequence it's not efficient vs implementing a specialised IC which we normally call an application specific integrated circuit (ASIC).

EG of ASIC use: LIDAR sensors In $LAZR, $BTC minings rigs. But theres a problem (3/x)

EG of ASIC use: LIDAR sensors In $LAZR, $BTC minings rigs. But theres a problem (3/x)

ASIC are incredibly expensive to produce at a small scale and only economically viable with mass production.

Hence the FPGA act as a middle ground between the generic CPU / specialised ASIC. You can think of an FPGA as a slower, reconfigurable & cheaper ASIC. (4/x)

Hence the FPGA act as a middle ground between the generic CPU / specialised ASIC. You can think of an FPGA as a slower, reconfigurable & cheaper ASIC. (4/x)

Purpose of an FPGA?

- Use it as a test bench for your ASIC design as they operate on the same principle and can hence be used almost interchangeably

- if you intend to keep a flexible hardware base use FPGA’s in your server rooms: like $MSFT & $GOOG do. (5/x)

- Use it as a test bench for your ASIC design as they operate on the same principle and can hence be used almost interchangeably

- if you intend to keep a flexible hardware base use FPGA’s in your server rooms: like $MSFT & $GOOG do. (5/x)

$ACEV adds a further twist to this by licensing their IP to their customers vs selling the chips - kinda like ARM, they design the tech and let the chip manufacturers (Intel or - long term $GOOG / $MSFT in house) manufacture.

This gives them more regular cashflows (6/x)

This gives them more regular cashflows (6/x)

But back to $THBR vs $ACEV:

THBR position themsleves as designers of ASIC’s for EV components - they need scale to make it work & supposedly seem to be on track.

$ACEV design FPGA’s - one step before the ASIC allowing their chip to be multi-purpose (5G/IoT devices etc.) (6/x)

THBR position themsleves as designers of ASIC’s for EV components - they need scale to make it work & supposedly seem to be on track.

$ACEV design FPGA’s - one step before the ASIC allowing their chip to be multi-purpose (5G/IoT devices etc.) (6/x)

Its upto you to decide which business model (IP vs. Manufacturing) (ASICs vs FPGA) you prefer.

I will add that given their IP & small market cap - they are primed M&A targets long term ala. $AMD / Xilinx.

Intel is also their largest customer...making 99% of $ACEV revenues...

I will add that given their IP & small market cap - they are primed M&A targets long term ala. $AMD / Xilinx.

Intel is also their largest customer...making 99% of $ACEV revenues...

I am yet to do my financial evaluation of them so follow to find out this but from a technical POV as you can see they are uniquely positioned in a hyper growth sector with high barriers to entry, great IP & are one of the few successful FPGA manufacturers in the world.

(END)

(END)

Read on Twitter

Read on Twitter