Honest question:

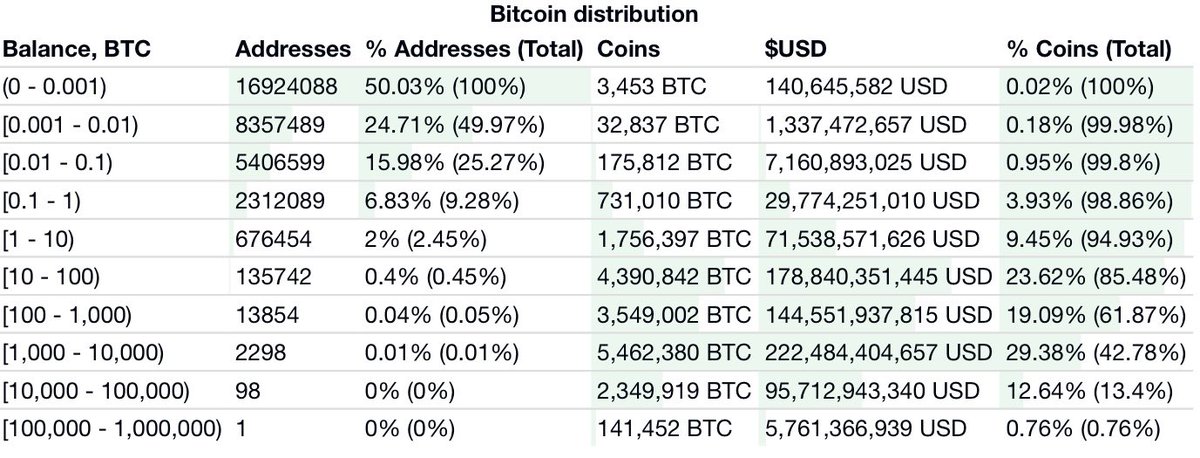

How can Bitcoin possibly be a store of value when 95% of coins are owned by 2% of wallets?

How can Bitcoin possibly be a store of value when 95% of coins are owned by 2% of wallets?

If Bitcoin is to fulfill the role of digital gold, how does $2-10T USD flow into the system?

Assume $2T buys all of the 2.4M BTC left to mine and the 18.6M existing Bitcoin HODLs.

The BTC market cap is (21/2.4 * 2T) = $17.5T

The top 2% are worth $15T?

That seems unlikely.

The BTC market cap is (21/2.4 * 2T) = $17.5T

The top 2% are worth $15T?

That seems unlikely.

Assume the HODLers sell all existing and new BTC to the $2T in new money.

The top 2% net $1.8T in the process?

That’s nuts, too.

The top 2% net $1.8T in the process?

That’s nuts, too.

I want digital, internet native money as much as everyone else.

But how is Bitcoin it?

But how is Bitcoin it?

With this kind of power law distribution, how does Bitcoin take in significant money without making a handful of whales (literally) the richest people in the universe?

For example, what of the the earth-shattering volatility introduced if a single whale decides to sell 100,000 BTC in a day?

What happens to the marginal price (and thus the market cap)?

What happens to the marginal price (and thus the market cap)?

Read on Twitter

Read on Twitter